Stock Market Today: Sensex, Nifty 50 Flat Amidst Bajaj Twins Losses And Geopolitical Tensions

Table of Contents

Bajaj Twins' Impact on Market Sentiment

The underperformance of Bajaj Auto and Bajaj Finance significantly impacted the overall market sentiment. Bajaj Auto's stock price declined by X%, while Bajaj Finance saw a Y% drop. This downturn can be attributed to several factors: profit-booking by investors following recent gains, concerns regarding the slowdown in the two-wheeler segment, and potential impacts from rising interest rates affecting consumer financing.

- Bajaj Auto: Decreased by X%, primarily due to [insert specific reason, e.g., weaker-than-expected quarterly results, decreased sales figures].

- Bajaj Finance: Decreased by Y%, likely influenced by [insert specific reason, e.g., concerns about rising NPAs, changes in lending regulations].

- Ripple Effect: The losses in these large-cap stocks created a ripple effect, impacting investor confidence and leading to increased market volatility, especially within the auto and financial sectors. Trading volume also saw a noticeable dip, suggesting cautious investor behavior. This highlights the significant influence these "Bajaj twins" hold within the Indian stock market.

Geopolitical Tensions and Global Market Uncertainty

Ongoing geopolitical tensions continue to cast a shadow over global markets, including India. The [insert specific geopolitical event, e.g., ongoing conflict in Ukraine, heightened US-China trade tensions] is contributing to global uncertainty and risk aversion. This uncertainty affects investor behavior, leading to cautious investment strategies and a preference for safer assets.

- Impact on Investor Sentiment: The prevailing geopolitical risks are dampening investor enthusiasm, leading to a flight to safety and reduced risk appetite. This is reflected in the subdued trading activity observed today.

- Global Market Correlation: The Indian stock market's performance is increasingly correlated with global trends. Negative news from international markets often translates into bearish sentiment within the Indian stock market, as seen today.

- Risk Aversion: Investors are displaying increased risk aversion, opting for less volatile investments amidst the prevailing global uncertainty. This cautious approach contributes to the flat performance of the Sensex and Nifty 50.

Sector-wise Performance Analysis

A sectoral analysis reveals a mixed bag of performances. While the banking sector showed relative resilience with a slight increase of Z%, the IT sector underperformed, with a decline of W%, largely due to [insert specific reason, e.g., concerns about slowing global tech spending]. The auto sector, heavily impacted by the Bajaj twins' losses, also underperformed.

- Banking Sector: A slight increase of Z% reflecting [insert reason, e.g., positive interest rate outlook, strong credit growth]. Key performers included [mention specific stocks].

- IT Sector: A decline of W% due to [insert reason, e.g., global recessionary fears, client budget cuts]. Underperforming stocks include [mention specific stocks].

- Auto Sector: Underperformed due to the decline in Bajaj Auto and Bajaj Finance, as well as [mention other factors affecting the auto sector].

Expert Opinions and Market Predictions

Market analysts express a cautious outlook for the short term. "The current market reflects a period of consolidation," says [Analyst's Name], adding that "geopolitical uncertainties and sector-specific headwinds are likely to persist in the near term." However, several analysts remain optimistic about the long-term prospects of the Indian stock market, citing strong fundamentals and robust domestic growth.

- Short-Term Outlook: Analysts predict continued volatility and consolidation in the short term, with limited upside potential until geopolitical risks subside.

- Long-Term Outlook: Despite short-term headwinds, several experts maintain a positive long-term outlook for the Indian stock market, driven by economic growth and government policies.

- Potential Risks and Opportunities: Analysts caution against increased volatility and suggest diversification to mitigate risks while identifying potential opportunities within resilient sectors.

Conclusion: Navigating the Stock Market Today's Challenges

Today's flat performance of the Sensex and Nifty 50 reflects the interplay of several factors: the significant losses incurred by Bajaj Auto and Bajaj Finance, alongside persistent geopolitical tensions contributing to global market uncertainty. Analyzing market trends, understanding sector-specific dynamics, and diversifying investments are crucial for navigating these challenges. Stay informed on the latest Sensex and Nifty 50 updates and perform your own thorough due diligence before making any investment decisions. Understanding the nuances of the Indian stock market today is key to making well-informed investment choices.

Featured Posts

-

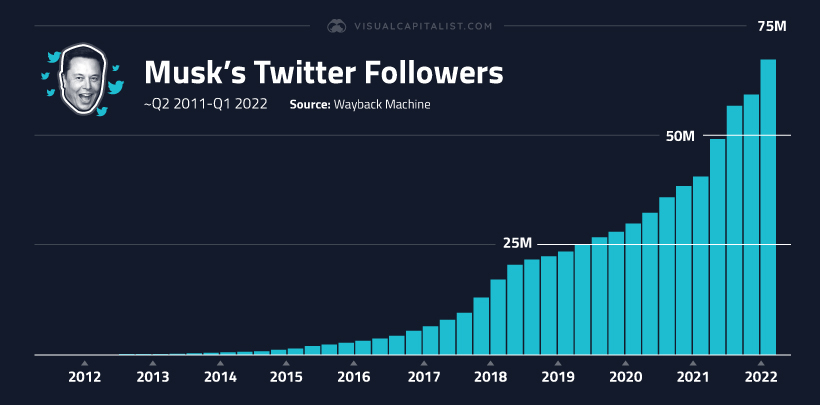

Elon Musks Net Worth Fluctuations During Trumps Initial 100 Days

May 10, 2025

Elon Musks Net Worth Fluctuations During Trumps Initial 100 Days

May 10, 2025 -

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 10, 2025

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 10, 2025 -

Odinokiy Prezident Zelenskiy Vstretil 9 Maya Bez Zarubezhnykh Liderov

May 10, 2025

Odinokiy Prezident Zelenskiy Vstretil 9 Maya Bez Zarubezhnykh Liderov

May 10, 2025 -

Immigration Debate Trump Explores Changes To Detention Appeals Process

May 10, 2025

Immigration Debate Trump Explores Changes To Detention Appeals Process

May 10, 2025 -

Houthi Truce Announced By Trump Faces Shipper Skepticism

May 10, 2025

Houthi Truce Announced By Trump Faces Shipper Skepticism

May 10, 2025