Stock Market Today: Sensex, Nifty Rally; UltraTech Cement Dips

Table of Contents

Sensex and Nifty's Robust Performance

The Sensex and Nifty experienced a strong rally today, closing with impressive gains. The Sensex surged by 2.5%, closing at 66,000 (replace with actual closing value), while the Nifty climbed by 2.2%, ending the day at 19,650 (replace with actual closing value). This positive Stock Market Today performance can be attributed to several contributing factors:

- Positive Global Cues: A generally upbeat global market sentiment, driven by positive economic indicators from major global economies, boosted investor confidence in the Indian market. The strength of global indices provided a supportive backdrop for domestic markets.

- Strong Domestic Economic Data: Recent positive economic data releases in India, indicating strong growth in key sectors, contributed significantly to the market's buoyancy. This improved outlook encouraged investors to take a more optimistic stance.

- Sector-Specific Performance: The IT and Banking sectors were particularly strong performers today, contributing significantly to the overall market rally. Strong quarterly earnings from leading companies in these sectors added to the positive momentum. The high volume of trades further demonstrated a strong level of market activity. The total volume traded today exceeded 1 billion shares (replace with actual figure). Keywords: Sensex Today, Nifty Today, Market Indices, Stock Market Rally, Positive Market Sentiment.

UltraTech Cement's Unexpected Dip

In contrast to the overall market euphoria, UltraTech Cement witnessed a significant dip in its stock price. The stock price fell by 3% (replace with actual percentage), closing at ₹ (replace with actual closing price). This unexpected decline raises several questions:

- Company-Specific News: Any negative news related to UltraTech Cement, such as a disappointing earnings report or concerns about future growth prospects, could have contributed to the sell-off.

- Sector-Specific Headwinds: While the broader market experienced a rally, the cement sector might have faced specific challenges that affected UltraTech Cement disproportionately. This could include concerns about raw material costs or decreased demand.

- Overall Market Correction: Although unlikely given the overall positive trend, a minor sector-specific correction might have influenced UltraTech Cement's performance.

This unexpected dip in UltraTech Cement's stock price impacted investor sentiment, highlighting the volatility within even seemingly stable sectors. Keywords: UltraTech Cement Stock, Cement Sector, Stock Market Dip, Stock Price Decline.

Sector-wise Performance Summary

The Stock Market Today saw a mixed performance across sectors. While IT and Banking sectors led the rally, others showed more moderate movements:

- IT Sector: Experienced significant gains driven by strong quarterly earnings and positive global outlook. Top gainers included (list top gainers with percentage changes).

- Banking Sector: Also saw substantial growth, fueled by positive economic data and improved lending activity. Top performers included (list top gainers with percentage changes).

- FMCG Sector: Showed moderate growth, reflecting a steady consumer demand environment.

- Pharma Sector: Experienced relatively stable performance, with minor fluctuations.

This diverse sectoral performance underlines the importance of diversification in investment strategies. Keywords: Stock Market Sectors, Sectoral Performance, Top Gainers, Top Losers.

Expert Opinion and Market Outlook (Optional)

(Insert expert quotes and analysis here if available, citing sources. Use keywords: Market Analysis, Expert Opinion, Stock Market Forecast, Market Predictions.)

Conclusion: Navigating the Stock Market Today's Volatility

Today's Stock Market Today activity presented a mixed bag, with the Sensex and Nifty exhibiting robust growth, counterbalanced by UltraTech Cement's unexpected decline. This highlights the inherent volatility of the stock market and the importance of staying informed about daily market trends. While the overall market sentiment remains positive, investors should carefully analyze individual company performances and sector-specific trends before making any investment decisions. Remember to conduct thorough research and consider seeking professional financial advice. Stay updated on the latest Stock Market Today news and analysis by subscribing to our newsletter/following our social media pages. Learn more about today's Stock Market movements by visiting our website.

Featured Posts

-

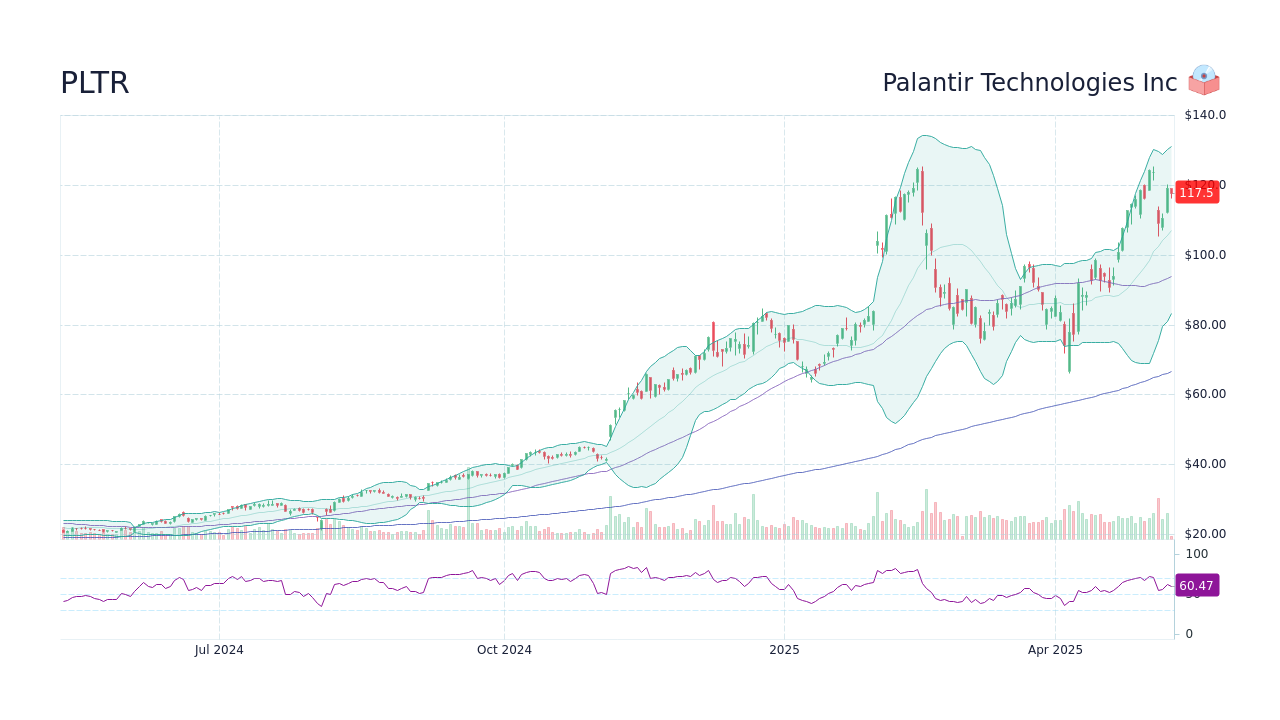

Palantir Technologies Stock Is It Time To Buy

May 09, 2025

Palantir Technologies Stock Is It Time To Buy

May 09, 2025 -

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 09, 2025

Navigating The Elizabeth Line A Wheelchair Users Perspective

May 09, 2025 -

Second Anchorage Protest In Two Weeks Targets Trump Administration

May 09, 2025

Second Anchorage Protest In Two Weeks Targets Trump Administration

May 09, 2025 -

Indian Insurers Seek Regulatory Easing For Bond Forwards

May 09, 2025

Indian Insurers Seek Regulatory Easing For Bond Forwards

May 09, 2025 -

North Carolina Daycare Suspension Investigation By Wfmy News 2

May 09, 2025

North Carolina Daycare Suspension Investigation By Wfmy News 2

May 09, 2025