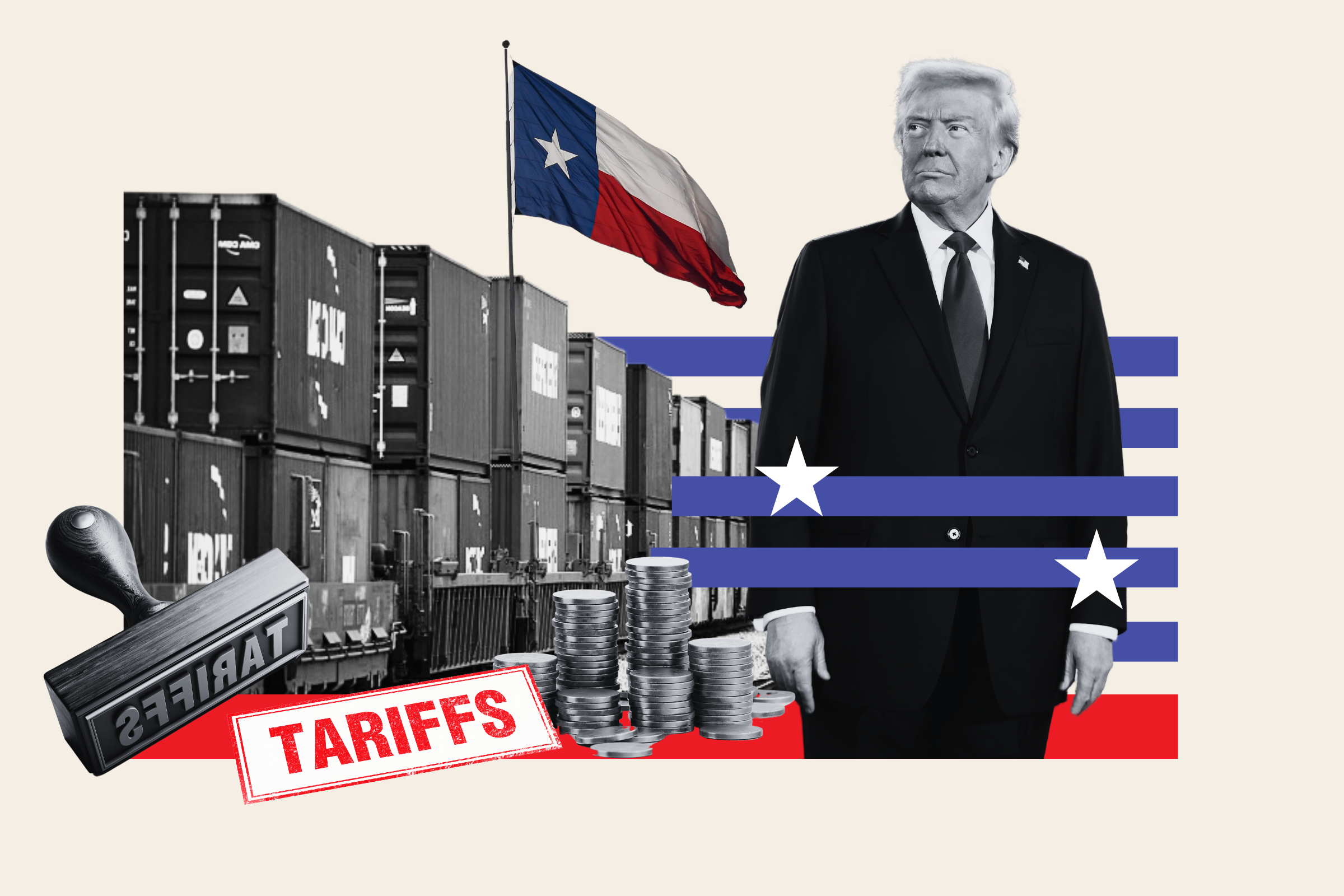

Stock Market Today: Trump's Tariff Threat & UK Trade Deal Impact

Table of Contents

Trump's Tariff Threats: A Looming Shadow on Global Trade

The legacy of Trump's trade policies continues to cast a long shadow over global commerce. His administration's aggressive use of tariffs, particularly in its trade war with China, created significant uncertainty and continues to impact businesses and investor confidence. Understanding this impact is crucial for navigating the "stock market today."

Impact on Specific Sectors

The effects of tariffs are far-reaching, disproportionately affecting certain sectors. The "tariff impact" varies significantly across industries.

-

Manufacturing: Increased import costs for raw materials and components have squeezed profit margins and hampered production for many manufacturers. This leads to reduced competitiveness and potential job losses. The keywords "trade war" and "global trade uncertainty" accurately reflect this sector's challenges.

-

Agriculture: Farmers have been particularly hard hit by retaliatory tariffs imposed by other countries, leading to reduced export opportunities and lower farm incomes.

-

Technology: The tech sector faces challenges from both tariffs and geopolitical tensions, impacting the supply chains of crucial components and potentially slowing innovation.

-

Increased import costs for manufacturers.

-

Reduced consumer purchasing power due to higher prices.

-

Supply chain disruptions and delays.

Geopolitical Implications

Trump's tariff strategies have strained relationships with key trading partners, creating significant geopolitical risks. Analyzing "US trade policy" reveals a pattern of unilateralism that jeopardizes established international trade agreements.

- Increased tensions with China: The trade war significantly damaged US-China relations, impacting various aspects of global cooperation.

- Uncertainty in global trade agreements: The unpredictability of US trade policy has undermined trust in multilateral trade agreements and increased uncertainty for businesses.

- Potential for retaliatory tariffs: Other countries have responded to US tariffs with their own, escalating trade disputes and creating further market instability.

Investor Sentiment and Market Volatility

Tariff threats contribute significantly to "market volatility" and undermine "investor confidence." The uncertainty surrounding trade policies makes it difficult for investors to predict future returns.

- Increased market fluctuations: News regarding tariffs often triggers sharp price swings in the stock market.

- Shift in investor strategies: Investors are increasingly adopting more cautious strategies, seeking "safe-haven assets" like gold or government bonds.

- Increased demand for safe-haven assets: Investors are seeking refuge in less volatile assets during periods of heightened uncertainty.

UK Trade Deal: Navigating a New Economic Landscape

The UK's post-Brexit trade deal has created a new economic landscape with both opportunities and challenges. Understanding its impact on the "stock market today" is crucial for investors.

Impact on UK and EU Economies

The "Brexit trade deal" has significantly altered the trading relationship between the UK and the EU, leading to new trade barriers and adjustments for businesses. Both the "UK economy" and the "EU economy" have experienced shifts in their trade patterns.

- Changes in import/export regulations: New customs procedures and regulatory hurdles have added complexity and costs to cross-border trade.

- Impact on supply chains: Disruptions to established supply chains have affected various sectors in both the UK and the EU.

- New trade barriers: Tariffs and non-tariff barriers have increased the cost of goods traded between the UK and the EU.

Global Implications of the UK Trade Deal

The UK's new trade arrangements have broader global repercussions, influencing "global trade" and "international trade agreements."

- Potential for new trade partnerships: The UK is actively seeking new trade agreements with countries outside the EU.

- Shift in global trade dynamics: The UK's departure from the EU has altered the balance of power in global trade.

- Impact on multinational corporations: Multinational corporations are adapting their strategies to accommodate the new trade landscape.

Market Response to the UK Trade Deal

The "market reaction" to the UK trade deal has been mixed, with some sectors experiencing gains and others facing losses. Analyzing "stock market performance" reveals sector-specific impacts.

- Initial market response (positive or negative): The initial market reaction often reflected short-term optimism or pessimism.

- Long-term implications for investors: The long-term effects on various sectors are still unfolding.

- Sector-specific gains or losses: Some sectors have benefitted from the deal while others have faced challenges.

Strategies for Navigating Current Market Conditions

The current environment necessitates a cautious and strategic approach to investing. Understanding the "stock market today" requires adopting a proactive risk management strategy.

Diversification

A well-diversified investment portfolio is crucial to mitigate risks associated with market volatility. Diversification spreads your investments across various asset classes and sectors, reducing your overall exposure to any single risk.

Risk Management

Effective "risk management" is paramount. This involves careful assessment of your investment goals, tolerance for risk, and the potential impact of geopolitical events.

Long-Term Investing

Focus on a "long-term investing" strategy rather than short-term speculation. This approach helps weather market fluctuations and allows your investments to grow over time. This is particularly important in navigating the uncertainties of the "stock market today."

Conclusion

The "stock market today" is a dynamic reflection of global economic and geopolitical forces. Understanding the impact of Trump's tariff threats and the UK trade deal is essential for investors. By acknowledging the complexities of the current market conditions, diversifying your portfolio, employing effective risk management strategies, and adopting a long-term perspective, you can better position yourself for success. Stay informed on developments related to the stock market today and adapt your investment strategy accordingly. Keep a close watch on the "stock market today" and its global influences.

Featured Posts

-

Aaron Judges Hot Start A Look At The Braves Slow Beginning

May 11, 2025

Aaron Judges Hot Start A Look At The Braves Slow Beginning

May 11, 2025 -

Lily Collins A Glimpse Into Motherhood

May 11, 2025

Lily Collins A Glimpse Into Motherhood

May 11, 2025 -

Lily Collins Stars In Sexy Calvin Klein Campaign See The Photos

May 11, 2025

Lily Collins Stars In Sexy Calvin Klein Campaign See The Photos

May 11, 2025 -

Mtv Cribs A Glimpse Into The World Of Extravagant Real Estate

May 11, 2025

Mtv Cribs A Glimpse Into The World Of Extravagant Real Estate

May 11, 2025 -

Henry Cavills Night Hunter A Surprise Streaming Hit

May 11, 2025

Henry Cavills Night Hunter A Surprise Streaming Hit

May 11, 2025