Stock Market Update: Strong Earnings Boost Rockwell Automation And Other Big Names

Table of Contents

Rockwell Automation's Stellar Performance

Exceeding Earnings Expectations

Rockwell Automation (ROK), a leading provider of industrial automation and digital transformation solutions, significantly exceeded analysts' expectations in its recent earnings report. The company announced a remarkable [insert percentage]% increase in earnings per share (EPS) compared to estimates and a [insert percentage]% year-over-year jump in revenue. This impressive performance sent shockwaves through the market, demonstrating the company's robust financial health and its ability to navigate current economic challenges. The strong numbers reflect a successful strategy focused on innovation and meeting growing industrial demands.

Growth Drivers

Several key factors contributed to Rockwell Automation's outstanding performance:

- Strong demand in the automotive industry: The resurgence of the automotive sector, driven by electric vehicle production and automation needs, fueled significant demand for Rockwell's automation solutions.

- Successful implementation of new digital solutions: Rockwell's investments in innovative digital technologies, such as cloud-based platforms and industrial IoT solutions, are paying off, attracting new customers and enhancing operational efficiency for existing ones.

- Increased efficiency in supply chain management: The company's efforts to optimize its supply chain, mitigating disruptions and improving delivery times, contributed significantly to its overall profitability. This proactive approach underscores Rockwell's resilience in the face of global supply chain complexities.

Market Reaction & Future Outlook

The market reacted positively to Rockwell Automation's earnings report, with the company's stock price experiencing a [insert percentage]% surge. Trading volume also increased significantly, reflecting strong investor confidence. While future market performance is always subject to uncertainty, analysts generally hold a cautiously optimistic outlook for Rockwell Automation, citing its strong backlog, innovative product pipeline, and strategic position in the growing industrial automation market.

Other Big Winners in the Earnings Season

Identifying Key Players

Several other companies also delivered impressive earnings reports, further boosting market sentiment. Here are a few notable examples:

- Company A (e.g., Microsoft): (Technology Sector) Exceeded software sales targets driven by strong cloud computing demand and growth in its subscription services.

- Company B (e.g., Procter & Gamble): (Consumer Goods Sector) Benefited from robust holiday sales and continued strength in its core product lines, demonstrating resilient consumer spending despite inflationary pressures.

- Company C (e.g., Caterpillar): (Industrial Sector) Reported higher-than-expected earnings, driven by robust demand for construction and mining equipment globally, indicating strong infrastructure spending.

Broader Market Implications

The collective strong earnings from these companies suggest a positive underlying trend within specific sectors, but cautious optimism is warranted before concluding broader economic strength. While these results certainly boost investor confidence and could contribute to market stability, it's crucial to consider other economic factors before drawing definitive conclusions.

Analyzing the Impact of Strong Earnings on the Stock Market

Investor Confidence and Market Sentiment

Positive earnings reports play a crucial role in shaping investor confidence and overall market sentiment. When companies consistently exceed expectations, it reinforces a belief in the underlying strength of the economy and fosters a more positive outlook for future growth. This confidence often translates into increased investment activity and higher stock prices.

Sector-Specific Trends

The strong earnings reports highlight sector-specific trends. The success of companies in the industrial and technology sectors underscores the growing demand for automation, digital transformation, and cloud computing solutions. Meanwhile, the strong performance in the consumer goods sector indicates continued resilience in consumer spending, despite economic headwinds.

Potential Risks and Cautions

It's essential to acknowledge potential risks that could impact future market performance. Inflation, geopolitical instability, and ongoing supply chain disruptions remain significant concerns. These factors could negatively affect corporate profitability and overall market sentiment in the coming months.

Conclusion: Staying Informed on the Stock Market's Ups and Downs

This "Stock Market Update: Strong Earnings Boost Rockwell Automation and Other Big Names" highlights the positive impact of strong earnings reports on specific companies, like Rockwell Automation, and the broader market. While these results are encouraging, it's crucial to maintain a balanced perspective and consider potential risks. Regularly monitoring stock market updates and analyzing earnings reports is vital for making informed investment decisions. Stay informed on the latest news and analysis to capitalize on future investment opportunities. For up-to-date information, visit [link to relevant financial news website]. Keep an eye on future stock market updates to make smart investment choices.

Featured Posts

-

Rfk Jr Calls For End To Routine Covid 19 Vaccination In Children And Pregnant Women

May 17, 2025

Rfk Jr Calls For End To Routine Covid 19 Vaccination In Children And Pregnant Women

May 17, 2025 -

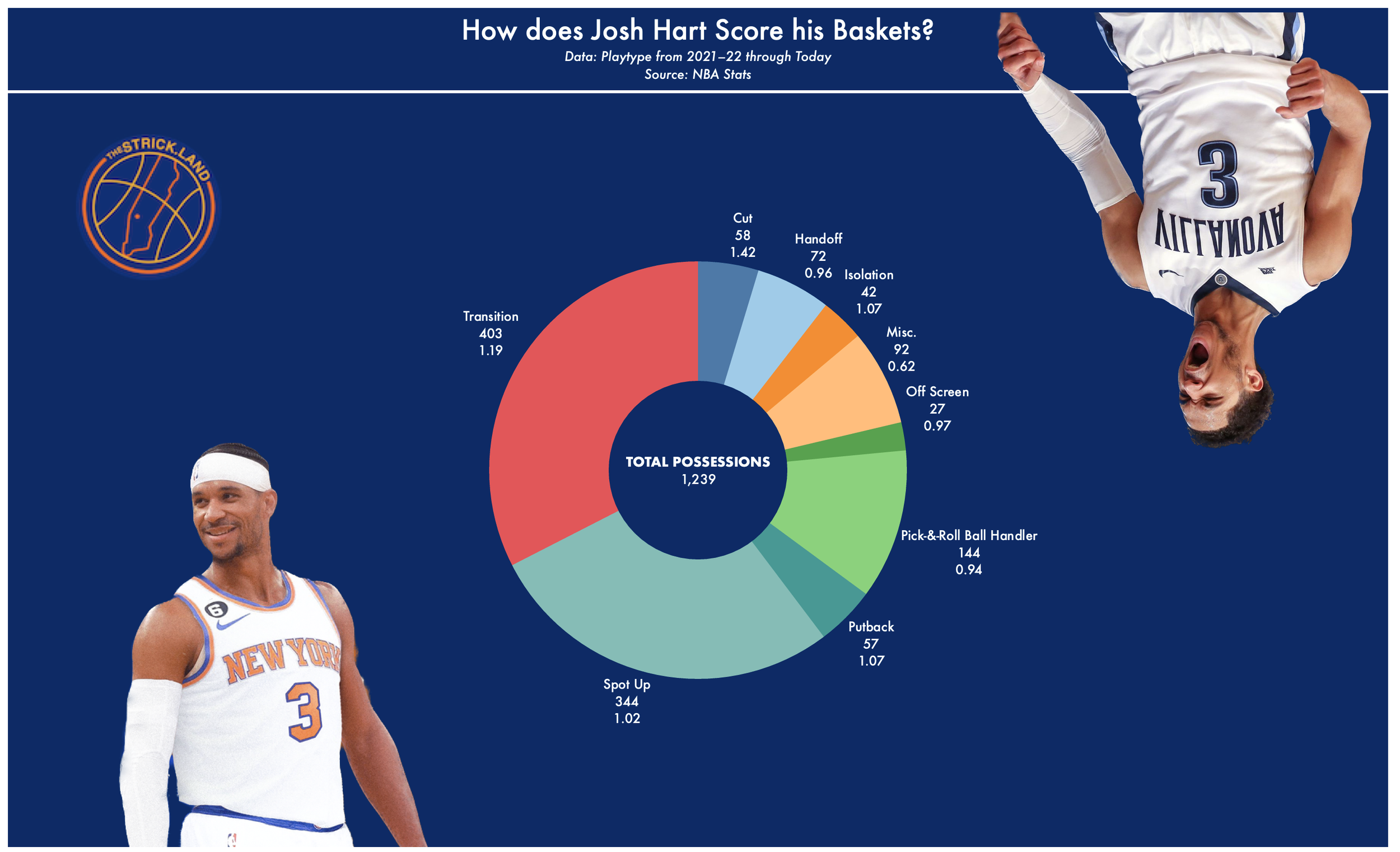

Josh Hart Shatters Knicks Single Season Triple Double Record

May 17, 2025

Josh Hart Shatters Knicks Single Season Triple Double Record

May 17, 2025 -

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025 -

Mariners Bryce Miller Elbow Injury And 15 Day Il Placement

May 17, 2025

Mariners Bryce Miller Elbow Injury And 15 Day Il Placement

May 17, 2025 -

Brunson Injury Highlights Knicks Critical Flaw

May 17, 2025

Brunson Injury Highlights Knicks Critical Flaw

May 17, 2025

Latest Posts

-

Everything La Lakers News Stats And Analysis From Vavel Us

May 17, 2025

Everything La Lakers News Stats And Analysis From Vavel Us

May 17, 2025 -

Tony Gilroys Positive Andor Star Wars Experience A Retrospective

May 17, 2025

Tony Gilroys Positive Andor Star Wars Experience A Retrospective

May 17, 2025 -

Ai Controversy Leads To Cancellation Of Star Wars Andor Book

May 17, 2025

Ai Controversy Leads To Cancellation Of Star Wars Andor Book

May 17, 2025 -

La Lakers Game Recaps Highlights And More Vavel Us

May 17, 2025

La Lakers Game Recaps Highlights And More Vavel Us

May 17, 2025 -

Andor Book Axed The Impact Of Ai On Star Wars Publishing

May 17, 2025

Andor Book Axed The Impact Of Ai On Star Wars Publishing

May 17, 2025