Stock Market Valuation Concerns: BofA Offers A Soothing Perspective

Table of Contents

BofA's Key Arguments for a Less-Pessimistic Stock Market Valuation

BofA's analysts present a compelling case against extreme pessimism regarding stock market valuations. Their arguments rest on several key pillars:

Addressing Overvaluation Concerns

Many believe the market is significantly overvalued, pointing to high price-to-earnings ratios (P/E ratios) and other valuation metrics. BofA counters this by highlighting several factors:

-

Forward-Looking Metrics: BofA analysts emphasize the importance of using forward-looking P/E ratios, which consider projected earnings, rather than trailing twelve-month earnings. This approach accounts for anticipated future growth, potentially mitigating concerns about current high valuations. They point to robust projected earnings growth in specific sectors as a key justification.

-

Interest Rate Expectations: While rising interest rates impact valuations, BofA acknowledges that these increases are largely anticipated and, to some extent, already priced into the market. The firm's models suggest that current interest rate levels are not excessively punitive for long-term stock market growth.

-

Potential for Market Corrections: BofA doesn't deny the possibility of market corrections. However, they argue that these are a normal part of the market cycle and don't necessarily signal a catastrophic bear market. They suggest that strategically positioned investors can utilize such corrections as opportunities. Keywords like overvalued stocks, market correction, interest rates, and earnings growth are crucial here.

The Role of Long-Term Growth Projections

BofA's valuation analysis heavily incorporates long-term economic growth forecasts. The firm emphasizes:

-

Future Earnings Potential: Instead of focusing solely on current earnings, BofA looks ahead. Their optimistic outlook stems from their projection of continued, albeit moderated, economic growth in key sectors.

-

Sector-Specific Optimism: BofA highlights specific sectors, such as technology and renewable energy, as possessing significant long-term growth potential, thus supporting their overall positive valuation perspective. Using keywords like long-term investment, economic growth, future earnings, and sector performance strengthens SEO.

Addressing Geopolitical and Macroeconomic Risks

BofA acknowledges the significant geopolitical and macroeconomic risks impacting the market:

-

Inflation Mitigation: The firm’s analysis incorporates various scenarios to model the effects of inflation, including different paces of mitigation by central banks. They consider how these various scenarios might impact corporate earnings and overall market valuations.

-

Geopolitical Instability and Supply Chain Disruptions: BofA incorporates these risks into their models, attempting to quantify their potential impact on future earnings. Their approach demonstrates a nuanced understanding of the complexities involved. Keywords like inflation risk, geopolitical risk, supply chain, and macroeconomic factors are critical for proper indexing.

Alternative Perspectives and Criticisms of BofA's Outlook

While BofA offers a reassuring perspective, it's crucial to acknowledge counterarguments. Some analysts argue that:

-

BofA's Models May Be Overly Optimistic: Critics suggest BofA's projections for future earnings growth might be overly optimistic, potentially underestimating the impact of persistent inflation or unforeseen economic downturns.

-

Potential Bias: As a major financial institution, BofA's outlook could be influenced by its own investment strategies and positions. This potential bias needs to be considered when evaluating their analysis.

-

Ignoring Systemic Risks: Some believe BofA’s analysis might not adequately account for broader systemic risks, such as escalating global debt levels or potential financial sector instability. Relevant keywords here include bear market, market analysis, financial experts, and investment strategy.

Practical Implications for Investors

BofA's perspective offers several actionable insights for investors:

Investment Strategies Based on BofA's Perspective

Based on BofA's relatively optimistic outlook, investors might consider:

-

Strategic Sector Rotation: Focusing on sectors with strong long-term growth potential, as identified by BofA's analysis, might be a prudent strategy.

-

Maintaining Diversification: A well-diversified portfolio remains crucial to mitigate risk. BofA’s assessment can inform the allocation of assets across different sectors.

-

Gradual Accumulation: Rather than making large, sudden investments, a gradual accumulation strategy could help to manage risk and capitalize on market corrections. Keywords: diversification, risk management, investment strategies, portfolio allocation.

The Importance of Due Diligence and Independent Research

It's paramount to remember that BofA's analysis is just one perspective. Investors should always conduct their own thorough due diligence:

-

Independent Research: Relying solely on one source, even a reputable one like BofA, is risky. Investors should consult multiple sources and conduct their own in-depth research.

-

Risk Tolerance and Financial Goals: Investment decisions should align with individual risk tolerance levels and long-term financial goals. Keywords: due diligence, independent research, risk tolerance, financial goals.

Conclusion: Making Sense of Stock Market Valuation Concerns – A Balanced Approach

BofA's analysis offers a relatively positive outlook on stock market valuations, highlighting strong projected earnings growth and the potential for long-term gains. However, a balanced approach is essential. Investors should carefully consider alternative perspectives and conduct thorough independent research before making any investment decisions. By understanding BofA's perspective and conducting your own thorough research, you can navigate the complexities of stock market valuation and make informed investment decisions. Remember to continuously monitor the market and adjust your strategy as needed.

Featured Posts

-

Hout Bay Fcs Success The Juergen Klopp Effect

May 22, 2025

Hout Bay Fcs Success The Juergen Klopp Effect

May 22, 2025 -

Second Reintroduced Colorado Gray Wolf Found Dead In Wyoming

May 22, 2025

Second Reintroduced Colorado Gray Wolf Found Dead In Wyoming

May 22, 2025 -

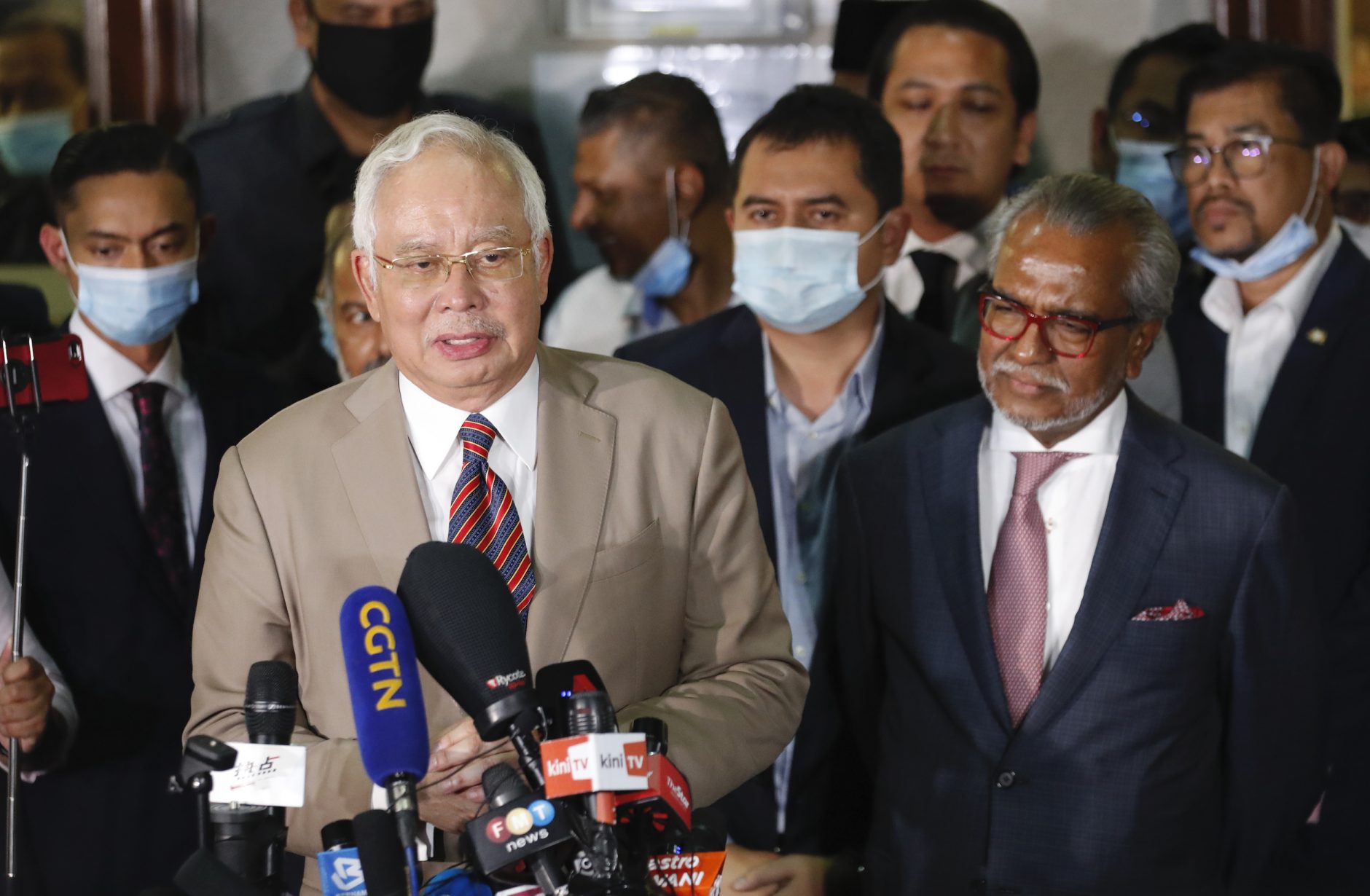

Malaysia Ex Pm Najibs Alleged Role In 2002 French Submarine Bribery Scandal

May 22, 2025

Malaysia Ex Pm Najibs Alleged Role In 2002 French Submarine Bribery Scandal

May 22, 2025 -

Zayava Yevrokomisara Vpliv Na Peregovori Schodo Vstupu Ukrayini Do Nato

May 22, 2025

Zayava Yevrokomisara Vpliv Na Peregovori Schodo Vstupu Ukrayini Do Nato

May 22, 2025 -

Jeremie Frimpong Transfer Saga Deal Done But Liverpool Fc Absent

May 22, 2025

Jeremie Frimpong Transfer Saga Deal Done But Liverpool Fc Absent

May 22, 2025

Latest Posts

-

Blake Lively Separating Fact From Fiction In Recent Reports

May 22, 2025

Blake Lively Separating Fact From Fiction In Recent Reports

May 22, 2025 -

The Blake Lively Allegations Fact Checking And Analysis

May 22, 2025

The Blake Lively Allegations Fact Checking And Analysis

May 22, 2025 -

Blake Livelys Support System Amidst Reported Celebrity Fallout

May 22, 2025

Blake Livelys Support System Amidst Reported Celebrity Fallout

May 22, 2025 -

Addressing The Allegations The Blake Lively Story

May 22, 2025

Addressing The Allegations The Blake Lively Story

May 22, 2025 -

The Blake Lively Taylor Swift Gigi Hadid Drama What We Know So Far

May 22, 2025

The Blake Lively Taylor Swift Gigi Hadid Drama What We Know So Far

May 22, 2025