Stock Market Valuation Concerns? BofA Offers Investors A Reason For Calm

Table of Contents

BofA's Bullish Outlook on Stock Market Valuation

BofA maintains a relatively bullish outlook on stock market valuation, despite recent fluctuations. Their analysis considers a variety of factors, leading them to believe that current valuations, while seemingly high, are largely justified.

Analyzing BofA's Rationale

BofA's positive outlook is rooted in several key arguments. They point to a confluence of factors supporting continued market growth, despite valuation concerns.

- Bullet Point 1: BofA cites strong corporate earnings growth as a primary justification. Their reports project continued robust earnings per share (EPS) growth for many companies, exceeding historical averages in several key sectors. This strong earnings performance helps support current Price-to-Earnings (P/E) ratios.

- Bullet Point 2: The firm identifies technology, healthcare, and consumer staples as particularly strong performing sectors, poised for continued growth and contributing significantly to overall market valuation.

- Bullet Point 3: While acknowledging inflationary pressures, BofA believes that current inflation levels are manageable and are already factored into their valuation models. They anticipate inflation to moderate over time, further supporting their positive outlook.

Addressing Valuation Concerns Directly

Many investors express concerns about overvaluation, pointing to seemingly high P/E ratios compared to historical averages. BofA addresses these concerns by:

- Bullet Point 1: Comparing current P/E ratios to historical data, adjusting for factors such as interest rates and economic growth. Their analysis suggests that while valuations are higher than some historical averages, they are not unprecedented, especially considering the current economic environment.

- Bullet Point 2: Utilizing alternative valuation metrics beyond P/E ratios, such as Price-to-Sales (P/S) and Price-to-Book (P/B) ratios, to paint a more complete picture. Their findings from these analyses generally support their positive outlook.

- Bullet Point 3: Explicitly acknowledging potential risks such as rising interest rates or geopolitical uncertainty. However, BofA incorporates these risks into their models and believes the positive factors outweigh the negative ones in the near to mid-term.

Factors Contributing to BofA's Positive Stock Market Valuation Analysis

BofA's positive analysis is built upon several key pillars: strong corporate earnings and the impact of monetary policy.

The Role of Corporate Earnings

Corporate earnings are central to BofA's analysis. Strong earnings growth provides a fundamental justification for higher valuations.

- Bullet Point 1: Specific examples of companies exhibiting strong earnings growth are cited in BofA reports, demonstrating the breadth of the positive trend. This isn't isolated to a few sectors but is a more widespread phenomenon.

- Bullet Point 2: Sustained earnings growth allows companies to reinvest profits, fueling further innovation and growth, ultimately justifying higher stock prices. This positive feedback loop is crucial to BofA’s assessment.

- Bullet Point 3: While acknowledging potential headwinds, such as supply chain disruptions or increased competition, BofA believes these challenges are manageable and are already partially reflected in their valuations.

The Impact of Monetary Policy

BofA's view on monetary policy is crucial to their assessment of stock market valuation. Interest rate movements significantly affect both company profitability and investor behavior.

- Bullet Point 1: BofA's forecast for interest rates plays a critical role in their analysis. Their anticipated trajectory for interest rates influences their projections for corporate profitability and market sentiment.

- Bullet Point 2: Interest rate changes directly impact borrowing costs for companies, influencing investment decisions and ultimately profitability. Lower rates, in BofA’s view, contribute to a more supportive environment for stock valuations.

- Bullet Point 3: BofA carefully considers the overall monetary policy environment, including quantitative easing measures or other interventions by central banks, assessing their influence on stock valuations.

Cautious Optimism: Navigating Stock Market Valuation Risks

While BofA presents a positive outlook, it's crucial to acknowledge the inherent risks within the stock market.

Understanding the Limitations

Even with a positive outlook, inherent risks always exist in stock market investments.

- Bullet Point 1: Market corrections are a normal part of the investment cycle. Understanding the possibility of short-term downturns is essential.

- Bullet Point 2: Diversification across different asset classes and sectors is crucial for risk management. Don't put all your eggs in one basket.

- Bullet Point 3: Adopting a long-term investment strategy helps mitigate the impact of short-term market volatility. Focus on your long-term goals, rather than daily fluctuations.

BofA's Recommendations for Investors

Based on their analysis, BofA offers several recommendations to investors.

- Bullet Point 1: They suggest maintaining a well-diversified portfolio, adjusting allocations based on individual risk tolerance and investment horizons.

- Bullet Point 2: Emphasizing the importance of understanding one's own risk tolerance before making any investment decisions. Don't invest in assets that make you uncomfortable.

- Bullet Point 3: They encourage seeking professional financial advice, especially for those lacking the expertise to navigate the complexities of stock market valuation independently.

Conclusion

BofA's analysis of current stock market valuations offers a reason for relative calm. Their positive outlook is supported by strong corporate earnings, a considered view of monetary policy, and the acknowledgment of potential risks. However, cautious optimism remains key. While strong fundamentals suggest potential for continued growth, market volatility is inherent. Thorough research, a well-diversified portfolio, and perhaps professional financial advice are essential when navigating the complexities of stock market valuation. Don't hesitate to conduct your own in-depth research on stock market valuation before making any investment decisions. Remember to carefully consider your risk tolerance and investment goals when assessing your portfolio's stock market valuation.

Featured Posts

-

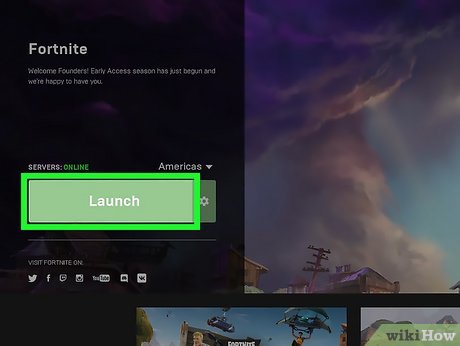

Fortnite Refund Hints At Cosmetic Policy Changes

May 02, 2025

Fortnite Refund Hints At Cosmetic Policy Changes

May 02, 2025 -

Kshmyr Tnazeh Pakstany Fwj Ky Palysy Awr Mstqbl Ky Jngwn Ka Amkan

May 02, 2025

Kshmyr Tnazeh Pakstany Fwj Ky Palysy Awr Mstqbl Ky Jngwn Ka Amkan

May 02, 2025 -

Glastonbury Headliners 2024 The 1975 And Olivia Rodrigo Announced

May 02, 2025

Glastonbury Headliners 2024 The 1975 And Olivia Rodrigo Announced

May 02, 2025 -

Celebrity Traitors Uk Two Stars Quit The Game

May 02, 2025

Celebrity Traitors Uk Two Stars Quit The Game

May 02, 2025 -

Rust A Post Tragedy Analysis Of Alec Baldwins Performance And The Films Impact

May 02, 2025

Rust A Post Tragedy Analysis Of Alec Baldwins Performance And The Films Impact

May 02, 2025

Latest Posts

-

Aedae Aljmahyr Qaymt B 30 Shkhsyt Krt Qdm Mthyrt Lljdl Fy Mwqe Bkra

May 03, 2025

Aedae Aljmahyr Qaymt B 30 Shkhsyt Krt Qdm Mthyrt Lljdl Fy Mwqe Bkra

May 03, 2025 -

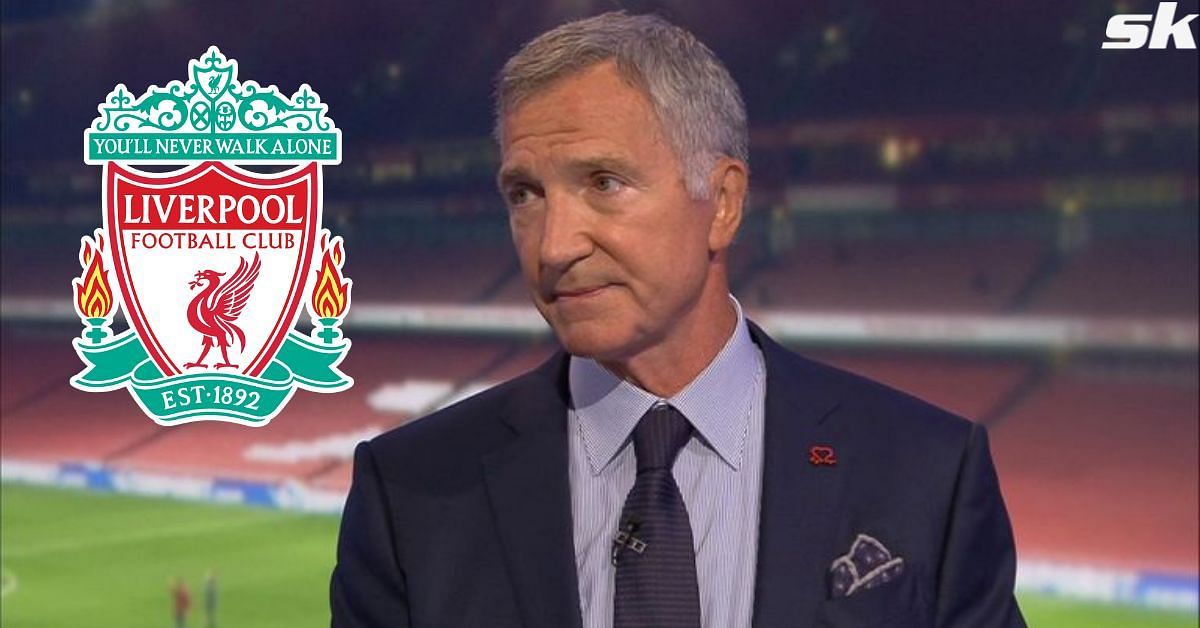

Sounesss Verdict The Critical Role In Arsenals Title Race

May 03, 2025

Sounesss Verdict The Critical Role In Arsenals Title Race

May 03, 2025 -

Mwqe Bkra Akthr 30 Shkhsyt Krwyt Mkrwht Mn Aljmahyr

May 03, 2025

Mwqe Bkra Akthr 30 Shkhsyt Krwyt Mkrwht Mn Aljmahyr

May 03, 2025 -

Liverpools Transfer Plans Frimpong Discussions And Elliotts Status

May 03, 2025

Liverpools Transfer Plans Frimpong Discussions And Elliotts Status

May 03, 2025 -

Why Arsenal Lost The Title Sounesss Analysis

May 03, 2025

Why Arsenal Lost The Title Sounesss Analysis

May 03, 2025