Stock Market Valuation Concerns? BofA Offers Reassurance To Investors

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA presents a compelling case against the widespread narrative of market overvaluation. Their analysis suggests that several key factors justify current valuations, mitigating investor anxieties.

-

Historically Low Interest Rates: BofA points to historically low interest rates as a significant factor supporting current valuations. These low rates directly impact the cost of capital, allowing companies to borrow more cheaply and invest in growth. This, in turn, supports higher price-to-earnings (P/E) ratios. For instance, BofA's research suggests that a 1% decrease in interest rates can lead to a 15-20% increase in equity valuations, all else being equal.

-

Robust Corporate Earnings Growth: BofA highlights robust corporate earnings growth projections, suggesting that current valuations are supported by strong fundamental performance. Many companies are exceeding expectations, demonstrating resilience and adaptability in a dynamic economic environment. The report cites examples of specific sectors showing exceptional earnings growth, further supporting their argument. This strong earnings growth helps justify higher valuations, as investors are willing to pay a premium for companies demonstrating consistent profitability.

-

Technological Innovation and Disruption: The report emphasizes the transformative impact of technology, arguing that innovative companies justify premium valuations due to their growth potential. Disruptive technologies are reshaping industries, creating new opportunities and driving significant value creation. BofA specifically mentions the technology and renewable energy sectors as examples of areas where innovation is supporting higher valuations. These companies, with their potential for exponential growth, often command higher P/E multiples than more established, slower-growing businesses.

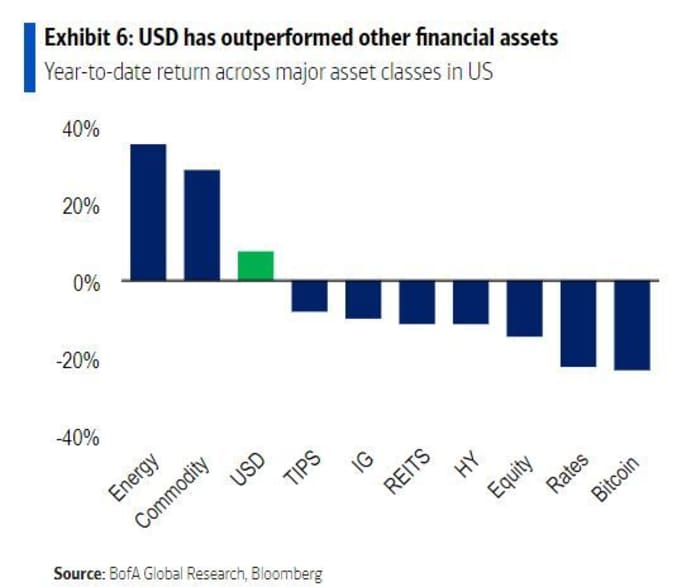

Addressing Specific Valuation Metrics

BofA's analysis extends beyond a simple assessment of overall market valuation, delving into specific metrics to provide a more nuanced perspective.

-

Price-to-Earnings (P/E) Ratio: BofA analyzes the current P/E ratio in comparison to historical averages and industry benchmarks. While acknowledging that current P/E ratios are elevated compared to historical norms, they conclude that this is not necessarily indicative of an imminent market crash. Their analysis considers factors like low interest rates and strong earnings growth, which justify higher valuations. They also point to significant variation in P/E ratios across different sectors, emphasizing the need for a sector-specific approach to valuation.

-

Price-to-Sales (P/S) and Price-to-Book (P/B) Ratios: BofA's analysis extends to other key metrics, showing that while P/E ratios are high, P/S and P/B ratios are more aligned with historical averages, providing a more nuanced picture. This suggests that while the market might appear expensive based on earnings, other valuation measures indicate a more reasonable assessment. This multi-metric approach highlights the importance of considering a range of valuation tools before reaching any conclusions about market overvaluation.

BofA's Investment Recommendations for Investors

Based on their comprehensive analysis, BofA offers practical investment recommendations for investors concerned about stock market valuations.

-

Long-Term Perspective: BofA advises investors to maintain a long-term perspective, emphasizing that market fluctuations are normal and that a diversified portfolio can mitigate risk. They discourage short-term reactive trading based solely on valuation concerns. Instead, they suggest focusing on a well-diversified portfolio that aligns with long-term financial goals.

-

Sector-Specific Opportunities: The report highlights the potential of sectors like technology and renewable energy, while suggesting a cautious approach to highly speculative investments. They advise investors to carefully research and analyze individual companies within these sectors, rather than making broad-based bets. This approach allows for taking advantage of growth opportunities while mitigating specific risks.

-

Active Portfolio Management: BofA forecasts continued moderate growth, encouraging investors to remain invested but to actively manage their portfolios. This involves regular monitoring, rebalancing, and adjusting the portfolio based on evolving market conditions and economic factors. They suggest utilizing their research and insights to inform these investment decisions.

Navigating Stock Market Valuation Concerns with BofA's Insights

In conclusion, BofA's analysis offers a reassuring perspective for investors grappling with stock market valuation concerns. Their key arguments highlight the influence of low interest rates, strong corporate earnings growth, and technological innovation in shaping current valuations. By considering a range of valuation metrics and maintaining a long-term perspective, investors can navigate market uncertainty more effectively. BofA's recommendations emphasize the importance of diversification, sector-specific analysis, and active portfolio management. Don't let stock market valuation concerns paralyze your investment decisions. Consult BofA's analysis for a more informed approach to managing your portfolio and navigating these uncertain times. Learn more about BofA's insights on stock market valuations today!

Featured Posts

-

Can Sinner Hit Top Gear In Time For The French Open Following Doping Suspension

May 28, 2025

Can Sinner Hit Top Gear In Time For The French Open Following Doping Suspension

May 28, 2025 -

Angels Secure Fourth Straight Win Against A

May 28, 2025

Angels Secure Fourth Straight Win Against A

May 28, 2025 -

Life In Germany Vs The Us One Expats Story Of Regret

May 28, 2025

Life In Germany Vs The Us One Expats Story Of Regret

May 28, 2025 -

Balita Jadi Korban Tenggelam Di Drainase Batu Ampar Balikpapan Update Terbaru

May 28, 2025

Balita Jadi Korban Tenggelam Di Drainase Batu Ampar Balikpapan Update Terbaru

May 28, 2025 -

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025

Latest Posts

-

Pursuing The Good Life A Holistic Approach

May 31, 2025

Pursuing The Good Life A Holistic Approach

May 31, 2025 -

What Is The Good Life Exploring Personal Definitions And Paths

May 31, 2025

What Is The Good Life Exploring Personal Definitions And Paths

May 31, 2025 -

Choosing The Best Rosemary And Thyme A Buyers Guide

May 31, 2025

Choosing The Best Rosemary And Thyme A Buyers Guide

May 31, 2025 -

Creating The Good Life Practical Tips For A More Fulfilling Life

May 31, 2025

Creating The Good Life Practical Tips For A More Fulfilling Life

May 31, 2025 -

Understanding And Creating Your Good Life

May 31, 2025

Understanding And Creating Your Good Life

May 31, 2025