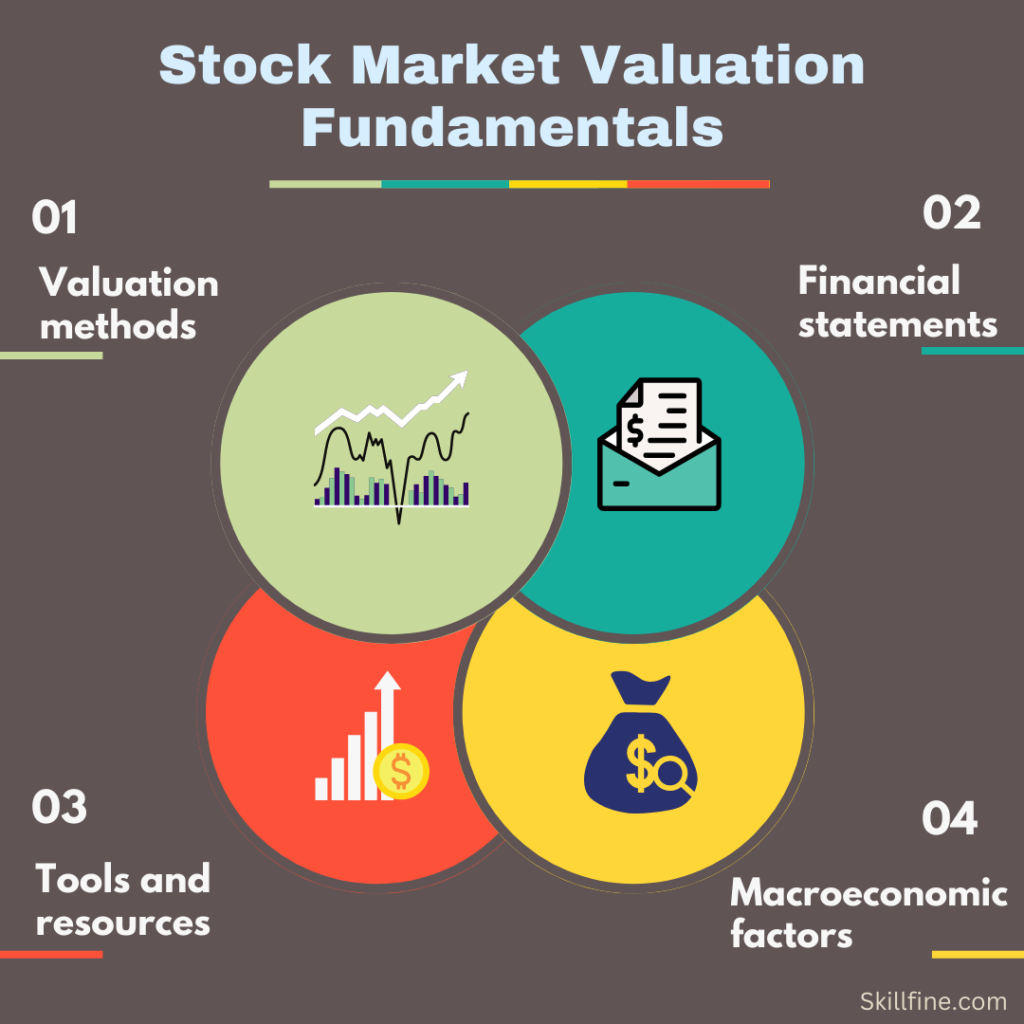

Stock Market Valuation Concerns: BofA's View And Investor Guidance

Table of Contents

BofA's Key Concerns Regarding Stock Market Valuation

BofA's assessment of the current stock market valuation landscape reveals several key concerns impacting investors. These concerns stem from a confluence of factors that require careful consideration.

Overvaluation Concerns

BofA highlights potential overvaluation in specific sectors and the overall market. This concern is largely based on traditional valuation metrics, suggesting a potential disconnect between current prices and intrinsic value.

-

Price-to-Earnings (P/E) Ratios and Their Implications: High P/E ratios across several sectors indicate that investors are paying a premium for current earnings. This suggests that future earnings growth must significantly outperform historical trends to justify current prices. An inflated P/E ratio can be a signal of potential overvaluation.

-

Sectors Flagged as Potentially Overvalued: BofA has specifically pointed to sectors like Technology and Consumer Discretionary as exhibiting potentially high valuations. These sectors have seen substantial growth in recent years, leading to elevated price-to-earnings multiples. Investors should carefully scrutinize individual companies within these sectors, looking beyond aggregated data.

-

Historical P/E Ratio Comparisons: Comparing current P/E ratios to historical averages provides context. If current ratios significantly exceed long-term averages, it strengthens the argument for overvaluation. This comparison highlights the potential for a market correction.

-

Other Valuation Metrics: BofA employs various valuation metrics beyond P/E ratios, including Price-to-Sales (P/S) and Price-to-Book (P/B) ratios. These provide a more comprehensive picture of a company’s valuation and help to identify potential overvaluation across different sectors. Investors should consider using a variety of valuation metrics for a complete picture.

Impact of Interest Rate Hikes

The Federal Reserve's interest rate hikes significantly impact stock market valuation. BofA acknowledges this crucial factor.

-

Inverse Relationship Between Interest Rates and Stock Valuations: Rising interest rates generally lead to lower stock valuations. This is because higher rates increase the discount rate used in discounted cash flow (DCF) models, reducing the present value of future earnings.

-

Impact on Discounted Cash Flow Models: DCF models, used to assess a company's intrinsic value, are highly sensitive to changes in interest rates. Higher rates directly decrease the present value of future cash flows, leading to lower valuations.

-

Potential for Further Interest Rate Increases: The possibility of further interest rate increases adds to the uncertainty surrounding stock market valuation. Investors need to consider the potential for continued downward pressure on stock prices. This uncertainty necessitates cautious investment strategies.

Geopolitical Risks and Their Influence

Geopolitical events significantly influence investor sentiment and market volatility, impacting stock market valuation according to BofA's analysis.

-

Specific Geopolitical Factors: Factors such as inflation, the ongoing war in Ukraine, and persistent supply chain disruptions introduce uncertainty and volatility into the market.

-

Market Volatility and Uncertainty: These factors contribute to increased market volatility and uncertainty, making it challenging to predict future market performance. Investors need to be prepared for sudden price swings.

-

Long-Term Impact Assessment: BofA's assessment considers the potential long-term consequences of these geopolitical factors on the economy and subsequently on stock market valuation. Understanding the long-term impact is critical for long-term investment planning.

Investor Guidance Based on BofA's Analysis

Navigating the current market landscape requires a proactive and informed approach. Here's some investor guidance based on BofA's analysis:

Diversification Strategies

Mitigating risk is paramount. Diversification is a critical component of any robust investment strategy.

-

Diversification Across Asset Classes: Diversify across different asset classes such as stocks, bonds, and real estate to reduce the impact of underperformance in any single asset class.

-

Geographic Diversification: Investing in companies across different geographic regions helps to reduce risk associated with specific country-specific events or economic downturns.

-

Sector Diversification: To avoid overexposure to potentially overvalued sectors, diversify across various sectors. This minimizes the impact of sector-specific downturns.

Defensive Investment Approaches

A defensive approach is prudent during periods of market uncertainty.

-

Value Investing: Focus on identifying undervalued companies with strong fundamentals. This involves thorough due diligence and a focus on intrinsic value.

-

Dividend-Paying Stocks: Consider dividend-paying stocks to generate income, providing a cushion against market fluctuations. Dividend payouts offer a consistent return regardless of price volatility.

-

Long-Term Investment Strategies: Maintain a long-term investment horizon, resisting the urge to react to short-term market fluctuations. Long-term investing smooths out the impact of market volatility.

Monitoring Key Economic Indicators

Staying informed about key economic indicators is crucial for making sound investment decisions.

-

Key Indicators to Track: Closely monitor inflation rates, unemployment rates, and GDP growth to gain insights into the overall economic health.

-

Central Bank Policies: Stay informed about central bank policies and announcements, as these significantly influence interest rates and market sentiment.

-

Reliable Sources: Use reliable and credible sources for economic data and analysis. Thorough research is key to informed decision-making.

Conclusion

BofA's analysis of current stock market valuation presents both challenges and opportunities for investors. Understanding the potential overvaluation in certain sectors, the impact of interest rate hikes, and the influence of geopolitical risks is crucial for developing a robust investment strategy. By implementing diversification strategies, adopting defensive investment approaches, and monitoring key economic indicators, investors can better navigate these concerns. Don't ignore these stock market valuation concerns; proactive planning and informed decision-making are key to achieving your long-term financial goals. Stay informed and continue researching stock market valuation trends for successful investing.

Featured Posts

-

Peppa Pigs Hidden Name A Revelation For Longtime Fans

May 21, 2025

Peppa Pigs Hidden Name A Revelation For Longtime Fans

May 21, 2025 -

Liverpool Raih Liga Inggris 2024 2025 Peran Krusial Para Pelatih

May 21, 2025

Liverpool Raih Liga Inggris 2024 2025 Peran Krusial Para Pelatih

May 21, 2025 -

Penn Relays Allentowns Historic Sub 43 4x100m Relay

May 21, 2025

Penn Relays Allentowns Historic Sub 43 4x100m Relay

May 21, 2025 -

Gangsta Granny Activities And Resources For Young Readers

May 21, 2025

Gangsta Granny Activities And Resources For Young Readers

May 21, 2025 -

Cassis Blackcurrant Cocktails Recipes And Inspiration

May 21, 2025

Cassis Blackcurrant Cocktails Recipes And Inspiration

May 21, 2025

Latest Posts

-

Wwe Raw 5 19 2025 Review Hits And Misses

May 21, 2025

Wwe Raw 5 19 2025 Review Hits And Misses

May 21, 2025 -

Wwe Raw 5 19 2025 3 Things We Loved 3 We Hated

May 21, 2025

Wwe Raw 5 19 2025 3 Things We Loved 3 We Hated

May 21, 2025 -

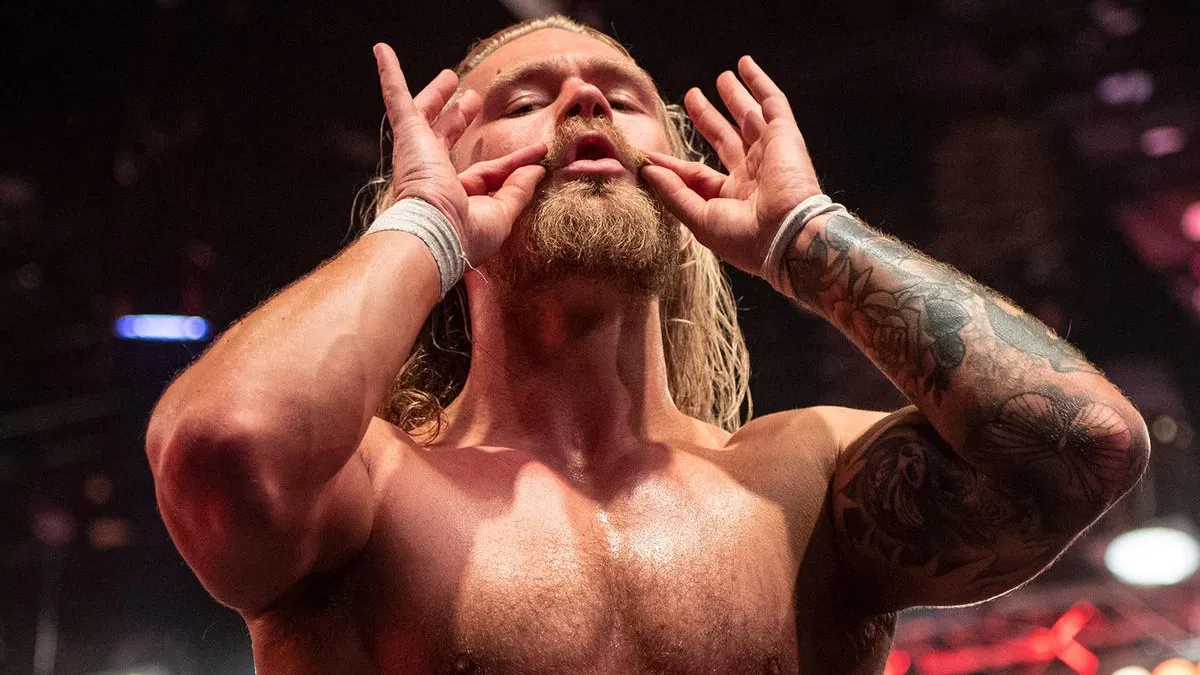

Tyler Bate Back On Wwe Raw What To Expect

May 21, 2025

Tyler Bate Back On Wwe Raw What To Expect

May 21, 2025 -

Ripley And Perezs Road To Money In The Bank Wwe News

May 21, 2025

Ripley And Perezs Road To Money In The Bank Wwe News

May 21, 2025 -

Tyler Bates Wwe Raw Return Reunited With Pete Dunne

May 21, 2025

Tyler Bates Wwe Raw Return Reunited With Pete Dunne

May 21, 2025