Stock Market Valuations: Addressing Investor Concerns With BofA's Analysis

Table of Contents

BofA's Current Market Valuation Assessment

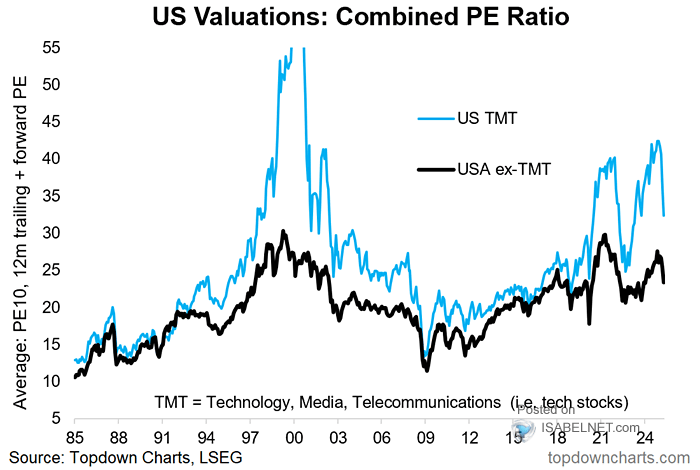

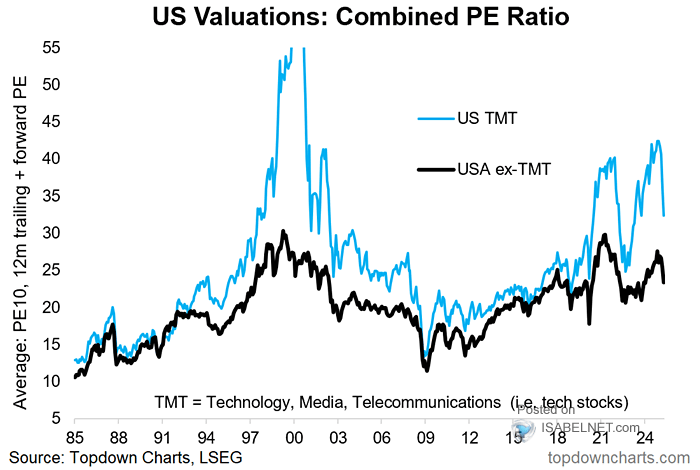

BofA employs a rigorous approach to assessing market valuations, leveraging several key metrics to paint a comprehensive picture.

Key Metrics Used by BofA

BofA utilizes a range of established valuation metrics to gauge market health. These include:

- Price-to-Earnings ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors expect higher future earnings growth.

- Price-to-Sales ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's useful for valuing companies with negative earnings or those in rapidly growing industries.

- Cyclically Adjusted Price-to-Earnings ratio (CAPE): Also known as the Shiller P/E ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable valuation measure.

Specific data points from BofA's report (replace with actual data from a recent BofA report):

- "BofA cites a current P/E ratio of 25 for the S&P 500, indicating a potentially higher valuation compared to historical averages."

- "BofA's CAPE ratio suggests a slightly overvalued market compared to long-term historical trends."

BofA's Overall Assessment of Market Valuation

(Replace with BofA's actual assessment and supporting data) Based on their analysis of the P/E, P/S, and CAPE ratios, as well as other macroeconomic factors, BofA currently assesses the market as (e.g., slightly overvalued). This assessment is primarily due to (e.g., strong corporate earnings growth coupled with rising interest rates).

[Insert chart or graph illustrating BofA's findings here. Source: BofA Securities report (cite the specific report)]

Addressing Investor Concerns Regarding High Valuations

If BofA's analysis suggests a potentially high valuation, several factors contribute to investor concerns.

The Impact of Interest Rates on Stock Valuations

Rising interest rates significantly impact stock valuations. Higher rates increase the attractiveness of bonds, diverting investment capital away from equities. This inverse relationship between bond yields and stock valuations is a key driver of market behavior.

BofA's perspective on interest rate impacts:

- "BofA predicts interest rate hikes will impact valuations by reducing future discounted cash flow estimates."

- "The bank suggests investors consider adjusting their portfolio allocation towards assets less sensitive to interest rate changes."

Inflation's Role in Market Valuation

Inflation erodes corporate earnings and reduces the purchasing power of future cash flows. High inflation can lead to decreased investor confidence and lower stock prices.

Key insights from BofA regarding inflation's impact:

- "BofA anticipates inflation to moderate in the coming year but remain above historical averages."

- "The bank recommends investors carefully consider the impact of inflation on earnings forecasts when making investment decisions."

BofA's Recommendations for Investors

Based on their comprehensive analysis, BofA provides specific recommendations for investors navigating the current market.

Investment Strategies Based on BofA's Analysis

(Replace with BofA's actual recommendations) BofA suggests a diversified approach, emphasizing:

- "BofA suggests focusing on value stocks with strong fundamentals and lower valuations relative to their earnings."

- "The bank advises caution in growth stocks, particularly those with high P/E ratios and limited profitability."

Risk Management Strategies for Investors

Effective risk management is crucial in any market environment, but especially during periods of uncertainty.

BofA's risk management advice:

- "Diversify your portfolio to mitigate risk across different asset classes and sectors."

- "BofA recommends monitoring market trends and adjusting your portfolio accordingly to manage risk exposure."

Understanding Stock Market Valuations – Key Takeaways and Next Steps

BofA's analysis provides a valuable framework for understanding current stock market valuations. The assessment addresses key investor concerns surrounding interest rates and inflation's influence on market pricing. The bank recommends a cautious approach, prioritizing diversification and risk management while focusing on undervalued sectors.

Understanding stock market valuations is an ongoing process. Stay informed about BofA's future analyses and consult with a financial professional to tailor a strategy that aligns with your individual risk tolerance and financial goals. Regularly reviewing and adjusting your approach to stock market valuations will empower you to make informed investment decisions.

Featured Posts

-

Sudamericano Sub 20 En Vivo Uruguay Vs Colombia Minuto A Minuto Online

May 12, 2025

Sudamericano Sub 20 En Vivo Uruguay Vs Colombia Minuto A Minuto Online

May 12, 2025 -

Jessica Simpson And Jeremy Renner A Look At Their Past And Present Interactions

May 12, 2025

Jessica Simpson And Jeremy Renner A Look At Their Past And Present Interactions

May 12, 2025 -

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 12, 2025

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 12, 2025 -

Ufc 315 Betting Odds Your Weekend Lock Mm Amania Com Predictions

May 12, 2025

Ufc 315 Betting Odds Your Weekend Lock Mm Amania Com Predictions

May 12, 2025 -

Dochter Sylvester Stallone Foto Oogst Lof Voor Haar Schoonheid

May 12, 2025

Dochter Sylvester Stallone Foto Oogst Lof Voor Haar Schoonheid

May 12, 2025

Latest Posts

-

Local Obituaries Remembering Our Community Members

May 13, 2025

Local Obituaries Remembering Our Community Members

May 13, 2025 -

Earth Day May Day Parade And Junior League Gala Community Highlights

May 13, 2025

Earth Day May Day Parade And Junior League Gala Community Highlights

May 13, 2025 -

Authentic Greek Cuisine Arrives In Portola Valley A New Taverna Opens

May 13, 2025

Authentic Greek Cuisine Arrives In Portola Valley A New Taverna Opens

May 13, 2025 -

Will Undrafted Player Make Top Draft Picks Redundant

May 13, 2025

Will Undrafted Player Make Top Draft Picks Redundant

May 13, 2025 -

Recent Obituaries Local Residents Who Passed Away

May 13, 2025

Recent Obituaries Local Residents Who Passed Away

May 13, 2025