Stock Market Valuations And Investor Sentiment: BofA's Analysis

Table of Contents

BofA's Valuation Metrics: A Deep Dive

BofA employs a multifaceted approach to assess stock market valuations, incorporating various financial ratios and market indicators. Their analysis goes beyond simple metrics, considering both macroeconomic factors and individual sector dynamics.

Price-to-Earnings Ratio (P/E) Analysis

BofA's P/E analysis provides a crucial perspective on whether the market, or specific sectors, are overvalued or undervalued. Their recent report showed a mixed bag.

- High P/E Sectors: Technology and certain growth sectors showed relatively high P/E ratios, suggesting potentially higher future growth expectations but also increased risk of a correction.

- Low P/E Sectors: Utilities and some defensive sectors exhibited lower P/E ratios, potentially indicating undervaluation or lower growth expectations. This might represent opportunities for value investors.

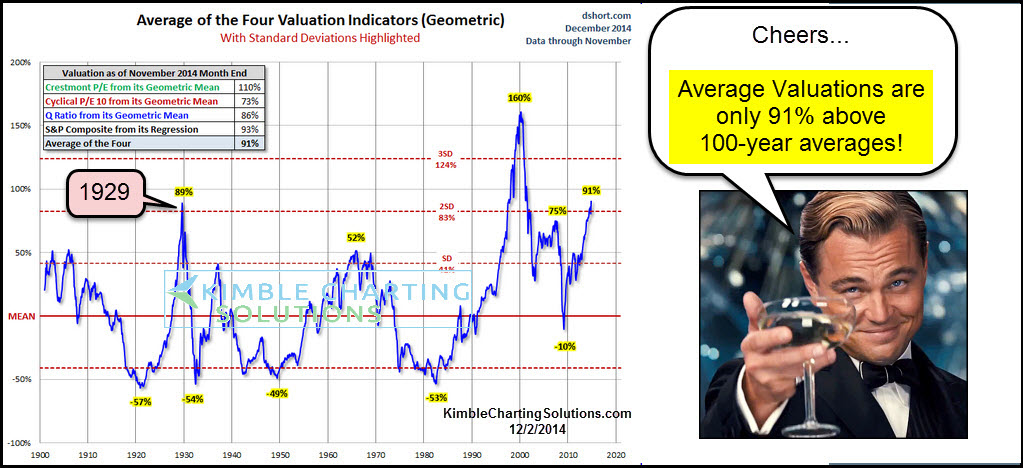

- Comparison to Historical Averages: BofA's analysis compared current P/E ratios to historical averages, highlighting sectors trading significantly above or below their historical norms. This context is crucial for determining whether current valuations are justified.

- Implications for Future Growth: High P/E ratios often signal robust future growth expectations, but carry the risk of a sharp decline if these expectations are not met. Conversely, low P/E ratios might represent undervalued assets with potential for growth.

Cyclical vs. Defensive Sectors

BofA's assessment of cyclical and defensive sectors provides crucial insights into investment opportunities.

- Cyclical Sector Valuations: Technology, consumer discretionary, and industrials, being cyclical sectors, demonstrated varying valuations depending on their specific sub-sectors and growth prospects. BofA highlighted certain areas within these sectors as potentially overvalued, while others appeared more attractively priced.

- Defensive Sector Valuations: Utilities and healthcare, typically considered defensive sectors, displayed more stable valuations. However, BofA also analyzed the impact of rising interest rates on these sectors, potentially affecting their perceived safety and thus, their valuations.

- Potential Investment Opportunities: BofA's analysis pinpointed specific sectors and companies within those sectors presenting compelling investment opportunities based on their valuation relative to their growth potential and risk profiles.

- Risk Assessment: The report provided a comprehensive risk assessment for each sector, highlighting potential downside risks to guide investors in making informed choices.

Market Capitalization and its Significance

BofA's analysis of overall market capitalization provides a broader context for evaluating stock market valuations.

- Market Cap Comparisons to Historical Data: BofA compared the current market capitalization to historical data, helping to identify whether the market is significantly overvalued or undervalued relative to its past performance.

- Potential Overvaluation Concerns: The report discussed potential concerns regarding overvaluation, especially in specific sectors, warning investors about the risks associated with inflated valuations.

- BofA's Outlook: Based on their market capitalization analysis, BofA offered their outlook on the potential for future market growth, possible corrections, and overall market trajectory.

Investor Sentiment Gauges: Reading the Tea Leaves

BofA uses a range of indicators to gauge investor sentiment, providing a crucial perspective alongside its valuation analysis.

Bullish vs. Bearish Indicators

BofA's sentiment analysis considers a variety of factors to determine the prevailing market mood.

- Bullish Indicators: These include strong fund flows into equities, increasing investor confidence surveys, and a rise in trading volume in specific sectors.

- Bearish Indicators: Conversely, bearish indicators might include decreased investor confidence, outflows from equity funds, and increased volatility in specific market segments.

- BofA's Current Assessment of Investor Sentiment: The report summarized BofA's current assessment of investor sentiment, highlighting whether the market is leaning towards bullish or bearish territory.

- Potential Impact on the Market: The analysis explored the potential impact of the prevailing sentiment on market movements, providing insights into potential future trends.

Impact of Geopolitical Events and Economic Data

External factors significantly impact investor sentiment and BofA explicitly incorporates these.

- Specific Events Impacting Sentiment: The report detailed specific geopolitical events (e.g., international conflicts, political instability) and economic data (e.g., inflation rates, interest rate changes) influencing investor sentiment.

- BofA's Assessment of Their Impact: BofA analyzed the impact of these events on market sentiment, explaining their influence on investor behavior and market valuations.

- Implications for Investors: The analysis offered implications for investors, advising on strategies to navigate these external factors and manage risk effectively.

The Role of Volatility and Uncertainty

BofA acknowledged the role of market volatility and uncertainty in shaping investor sentiment and valuations.

- BofA's Perspective on Current Volatility: The report addressed the current market volatility, explaining its drivers and potential implications for investors.

- Strategies for Navigating Uncertain Markets: BofA suggested strategies for navigating periods of uncertainty, emphasizing risk management and diversification.

- Risk Management Suggestions: The report offered specific risk management suggestions, including diversification strategies and hedging techniques to mitigate potential losses in volatile markets.

BofA's Investment Recommendations Based on the Analysis

BofA's analysis culminates in specific investment recommendations for investors.

Sector-Specific Strategies

BofA provided sector-specific investment strategies based on their valuation and sentiment analysis.

- Specific Sectors to Overweight/Underweight: The report suggested specific sectors to overweight or underweight based on their analysis, indicating opportunities and potential risks within each sector.

- Rationale Behind the Recommendations: The report clearly articulated the rationale behind their recommendations, explaining the factors driving their choices.

- Potential Risks and Rewards: For each recommendation, BofA highlighted the potential risks and rewards, helping investors make well-informed decisions.

Portfolio Allocation Suggestions

BofA's analysis provided broader portfolio allocation advice.

- Asset Class Recommendations: The report suggested optimal asset allocation strategies, considering various asset classes such as equities, bonds, and alternatives.

- Diversification Strategies: BofA emphasized the importance of diversification to mitigate risk and optimize returns.

- Risk Tolerance Considerations: The analysis highlighted the importance of aligning investment strategies with individual risk tolerance levels.

Conclusion

BofA's analysis provides a comprehensive overview of current stock market valuations and investor sentiment. Understanding these factors is paramount for making sound investment decisions. Their findings reveal a complex interplay between valuation metrics, investor psychology, and external factors. BofA's sector-specific strategies and portfolio allocation suggestions offer valuable guidance for navigating the current market environment. We strongly encourage you to delve deeper into BofA's full report and utilize this analysis to refine your own investment strategies related to stock market valuations. Further research on keywords like "stock market analysis," "investment strategies," and "market trends" will further enhance your understanding and help you make informed investment decisions.

Featured Posts

-

Regularisations Massives De Charges A Saint Ouen Un Fonds D Aide Pour Les Locataires

May 27, 2025

Regularisations Massives De Charges A Saint Ouen Un Fonds D Aide Pour Les Locataires

May 27, 2025 -

The Growth Of Delivery Alternatives In Response To Canada Post Issues

May 27, 2025

The Growth Of Delivery Alternatives In Response To Canada Post Issues

May 27, 2025 -

Knives Outs Future Is It Entirely Dependent On Daniel Craig

May 27, 2025

Knives Outs Future Is It Entirely Dependent On Daniel Craig

May 27, 2025 -

Wonder Park Ticket Prices Hours And Faqs

May 27, 2025

Wonder Park Ticket Prices Hours And Faqs

May 27, 2025 -

Latest On Victor Osimhen Manchester Uniteds Transfer Hopes Strengthened

May 27, 2025

Latest On Victor Osimhen Manchester Uniteds Transfer Hopes Strengthened

May 27, 2025

Latest Posts

-

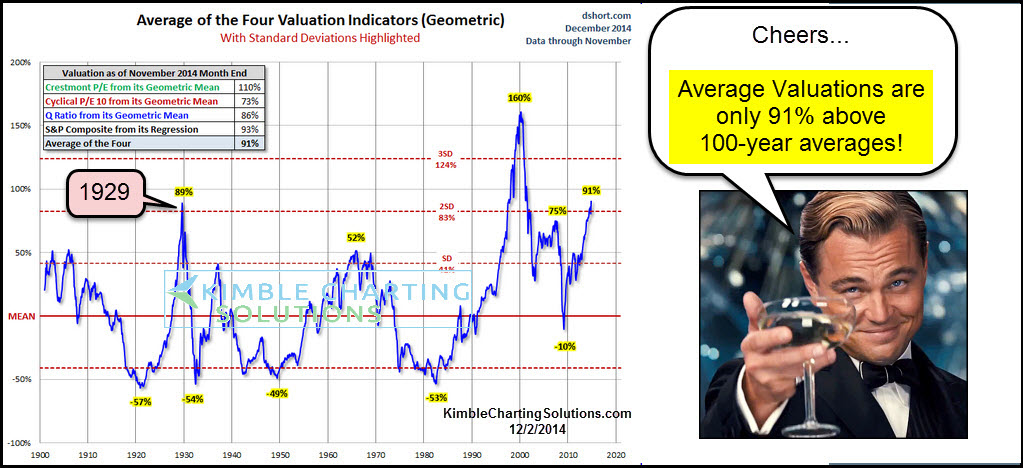

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025