Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

BofA's Perspective on Current Stock Market Valuations

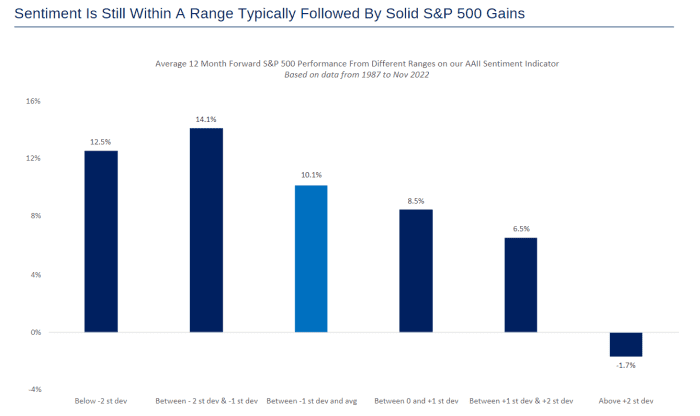

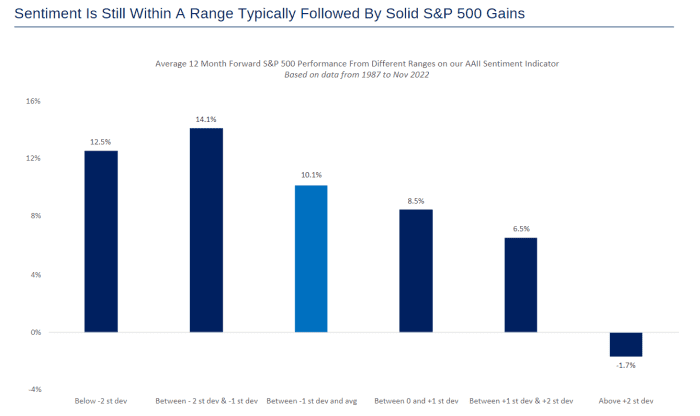

BofA's overall stance on current stock market valuations is that while they are elevated, they are not excessively so, at least not yet cause for widespread panic. Their analysis often references key metrics like the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), comparing them to historical averages and considering the current economic context.

-

Key Arguments: BofA often argues that current valuations are justifiable given the low interest rate environment, projected future earnings growth, and ongoing technological innovation driving corporate profitability. They emphasize the importance of considering these factors in conjunction with valuation metrics.

-

Attractive Sectors: BofA's reports frequently highlight specific sectors, such as technology and healthcare, as potentially attractive investment areas, given their robust growth prospects and resilience to economic downturns. They also may point to specific companies within those sectors that represent undervalued opportunities.

-

Supporting Data: While specific data points change with market fluctuations, BofA typically supports its claims with detailed research and analysis from its equity research teams. (Note: Due to the dynamic nature of financial markets, links to specific BofA reports cannot be provided here. Refer to BofA's official website for the most up-to-date information.) Look for reports focusing on market strategy and equity outlook.

Understanding the Factors Influencing Valuations

Several interconnected factors influence stock market valuations. Understanding these dynamics is crucial for interpreting valuation metrics and making informed investment decisions.

Interest Rates and Their Impact

Interest rates and stock valuations share an inverse relationship.

-

Inverse Relationship: When interest rates rise, borrowing becomes more expensive for businesses, reducing investment and potentially slowing economic growth. This can lead to lower corporate profits and subsequently, lower stock prices. Conversely, lower interest rates stimulate borrowing and investment, often boosting stock valuations.

-

Current Interest Rate Environment: The current interest rate environment significantly impacts stock valuations. The Federal Reserve's monetary policy decisions directly influence interest rates.

-

Federal Reserve's Role: The Federal Reserve's projections for future interest rate movements are closely watched by investors. Predictions of interest rate hikes generally lead to decreased valuations, while expectations of rate cuts or stability usually support higher valuations.

Inflation and its Effects on Stock Market Valuations

Inflation, the rate at which prices rise, also plays a significant role in stock market valuations.

-

Erosion of Purchasing Power: High inflation erodes the purchasing power of money, impacting both consumer spending and corporate profits. This can put downward pressure on stock prices.

-

Market Adjustments: The market generally adjusts to inflationary pressures by factoring anticipated inflation into future earnings expectations. Higher inflation often leads to higher interest rates, further influencing valuations.

-

BofA's Inflation Perspective: BofA's analysis of inflation incorporates various economic indicators to project its trajectory and assess its likely impact on corporate earnings and stock valuations. Their forecasts are often included in their macroeconomic outlook reports.

Economic Growth and its Correlation with Stock Prices

Economic growth and stock market performance are closely correlated.

-

Growth and Valuations: Strong economic growth generally supports higher stock valuations, as businesses thrive and corporate profits increase. This positive feedback loop can fuel further investment and market appreciation.

-

BofA's Growth Predictions: BofA’s economists provide forecasts for future economic growth, considering various factors like consumer spending, business investment, and government policy. These forecasts are integral to their valuation assessments.

-

Risks to Growth: BofA’s analysis also identifies potential risks to economic growth, such as geopolitical instability or supply chain disruptions, which could negatively impact stock market valuations. Understanding these risks is vital for informed investment strategies.

Why Investors Shouldn't Panic (Yet): A Balanced Perspective

While stock market valuations may seem high to some, BofA's analysis suggests a nuanced perspective.

-

Reiteration of Key Arguments: BofA emphasizes the importance of considering the broader economic context, including interest rate projections, inflation expectations, and projected economic growth, when evaluating stock market valuations.

-

Long-Term Investing: A long-term investment strategy is crucial. Short-term market fluctuations are normal and shouldn't dictate long-term investment decisions.

-

Diversification and Risk Management: Diversifying your investment portfolio across different asset classes and sectors helps mitigate risk and reduce the impact of market volatility.

-

Opportunities: BofA's analysis frequently highlights specific opportunities within the market, particularly in sectors poised for growth, despite overall high valuations.

Conclusion

BofA's analysis of current stock market valuations suggests that while valuations may appear high, a less alarming outlook is warranted. This perspective considers factors such as interest rate projections, inflation expectations, and forecasts for economic growth. While remaining vigilant and employing sound risk management, investors should not necessarily panic. Don't let concerns about high stock market valuations deter you from investing wisely. Understand the nuances, consider BofA's perspective, and develop a robust long-term investment strategy to navigate the complexities of stock market valuations. Learn more about [link to BofA's relevant reports or website – replace bracketed information with actual link] to make informed decisions about your investments.

Featured Posts

-

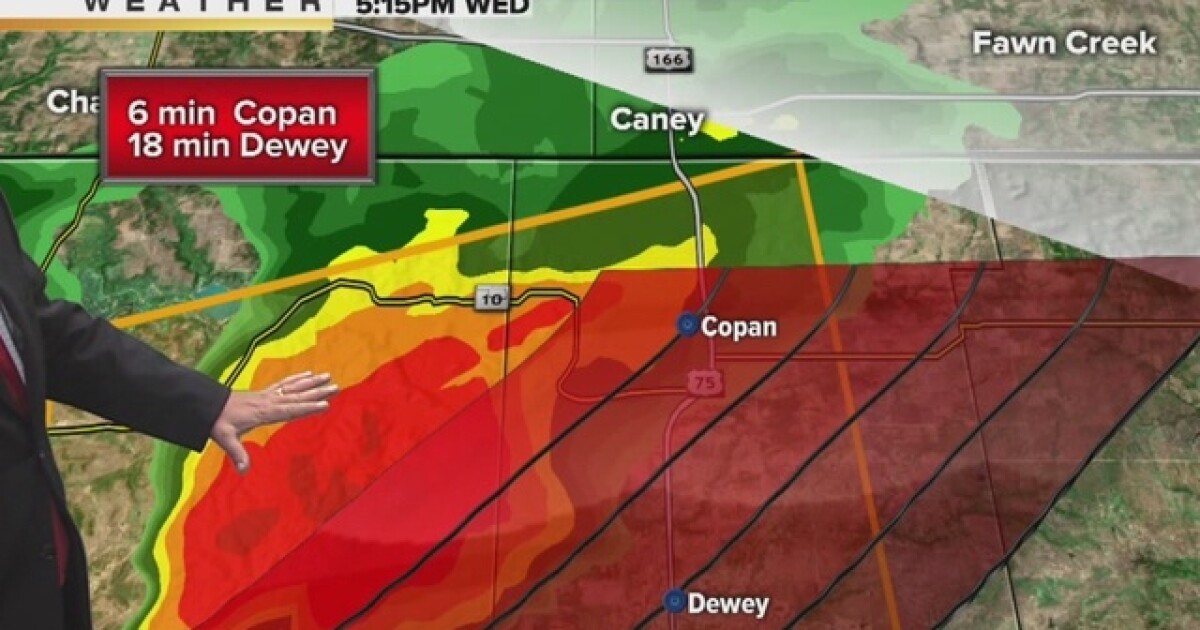

Severe Weather Tulsa Public Schools Closed Wednesday

May 03, 2025

Severe Weather Tulsa Public Schools Closed Wednesday

May 03, 2025 -

Joseph Tf 1 Analyse De La Serie Policiere La Creme De La Crim

May 03, 2025

Joseph Tf 1 Analyse De La Serie Policiere La Creme De La Crim

May 03, 2025 -

Christina Aguileras New Photos Is Too Much Photoshop Changing Her Look

May 03, 2025

Christina Aguileras New Photos Is Too Much Photoshop Changing Her Look

May 03, 2025 -

Alhsar Ela Ghzt Hjwm Israyyly Ysthdf Sfynt Astwl Alhryt

May 03, 2025

Alhsar Ela Ghzt Hjwm Israyyly Ysthdf Sfynt Astwl Alhryt

May 03, 2025 -

Oil Supply Shocks How The Airline Industry Is Feeling The Heat

May 03, 2025

Oil Supply Shocks How The Airline Industry Is Feeling The Heat

May 03, 2025

Latest Posts

-

The Cusma Negotiations Carneys Meeting With Trump And Whats At Stake

May 04, 2025

The Cusma Negotiations Carneys Meeting With Trump And Whats At Stake

May 04, 2025 -

Trump Carney Meeting Crucial For Cusmas Future

May 04, 2025

Trump Carney Meeting Crucial For Cusmas Future

May 04, 2025 -

Predicting The Stanley Cup Winner A Breakdown Of The Nhl Playoff Bracket

May 04, 2025

Predicting The Stanley Cup Winner A Breakdown Of The Nhl Playoff Bracket

May 04, 2025 -

Stanley Cup Playoffs Analyzing The Matchups And Top Contenders

May 04, 2025

Stanley Cup Playoffs Analyzing The Matchups And Top Contenders

May 04, 2025 -

Googles Advertising Business Under Threat Of U S Government Breakup

May 04, 2025

Googles Advertising Business Under Threat Of U S Government Breakup

May 04, 2025