Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Key Arguments Against Panic Selling

BofA's stance against knee-jerk reactions in the face of market fluctuations rests on several key pillars. Their arguments emphasize the importance of a long-term perspective, careful valuation analysis, the identification of undervalued opportunities, and the crucial role of diversification.

Long-Term Perspective on Stock Market Valuations

BofA stresses the significance of long-term investment strategies when assessing stock market valuations. They argue that short-term market noise, while unsettling, often obscures the larger, upward trend of the market over time. Focusing solely on short-term fluctuations can lead to poor investment decisions.

- Historical Context: Market corrections are a normal part of the economic cycle. History provides ample evidence of significant market downturns followed by periods of substantial growth.

- The Dot-com bubble of the late 1990s, followed by a period of recovery.

- The 2008 financial crisis, which was eventually overcome by market resurgence.

- Separating Noise from Trend: It's vital to differentiate between temporary setbacks and underlying long-term growth trends. A long-term perspective helps investors weather short-term storms and capitalize on eventual market recovery.

- Keywords: long-term investment, market correction, historical performance, stock market recovery

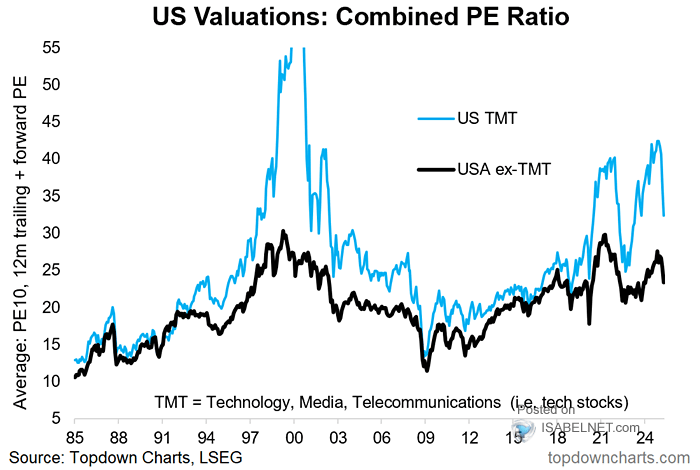

Analyzing Current Market Valuations

BofA likely employs various valuation metrics to assess the current market. These metrics provide insights into whether the market is overvalued, undervalued, or fairly priced. While specific data and methodologies may vary, common approaches include:

- Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share. A high P/E ratio might suggest overvaluation, while a low P/E ratio could indicate undervaluation.

- Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over time, providing a more stable valuation indicator.

- Other Factors: Interest rates, inflation, economic growth rates, and geopolitical events significantly influence stock market valuations. A rise in interest rates, for instance, might lead to lower valuations as investors seek higher returns in fixed-income investments.

- Keywords: price-to-earnings ratio (P/E), Shiller PE, valuation metrics, market indicators, economic factors

Identifying Undervalued Opportunities

Within a volatile market, BofA likely identifies sectors or individual stocks that appear undervalued relative to their intrinsic worth. This involves careful analysis of financial statements, industry trends, and future growth prospects.

- Rationale: Undervalued assets present potentially attractive investment opportunities for long-term investors willing to tolerate short-term risks.

- Examples: (Disclaimer: This is not financial advice. Thorough due diligence is crucial before making any investment decisions.) BofA might highlight specific sectors, such as [mention a potential sector, e.g., renewable energy or technology], showing promising long-term growth despite current market headwinds.

- Due Diligence: Investors should conduct comprehensive research and analysis before acting on any perceived undervaluation.

- Keywords: undervalued stocks, investment opportunities, due diligence, stock picking, sector analysis

The Importance of Diversification

BofA almost certainly emphasizes the importance of diversification as a cornerstone of effective risk management. Diversification reduces the impact of market volatility on an individual portfolio.

- Strategies: Diversification can involve investing across different asset classes (stocks, bonds, real estate), geographic regions, and industry sectors.

- Reduced Volatility: By spreading investments across various assets, investors mitigate the risk of significant losses due to downturns in a single sector or market.

- Keywords: diversification, risk management, portfolio diversification, asset allocation

Conclusion: Maintaining a Calm Approach to Stock Market Valuations

BofA's message is clear: Avoid panic selling. A thorough understanding of stock market valuations, coupled with a long-term investment strategy, allows investors to navigate market fluctuations effectively. By analyzing valuation metrics, identifying potentially undervalued opportunities, and employing a diversified portfolio, investors can position themselves for long-term success. Remember to conduct thorough due diligence and, if needed, seek professional financial advice before making any significant investment decisions. Understand your stock market valuations and make informed decisions based on a long-term perspective. Don't let market fluctuations cause unnecessary panic.

Featured Posts

-

Rock 101 Deconstructed Big Rig Rock Report 3 12 Analysis

May 23, 2025

Rock 101 Deconstructed Big Rig Rock Report 3 12 Analysis

May 23, 2025 -

Previa Instituto Lanus Analisis De La Lista De Convocados Y El Posible 11

May 23, 2025

Previa Instituto Lanus Analisis De La Lista De Convocados Y El Posible 11

May 23, 2025 -

Disney Confirms April Release Date For A Real Pain

May 23, 2025

Disney Confirms April Release Date For A Real Pain

May 23, 2025 -

6 000 For Cannes Access Investigating The Pure Auteur Fuel Black Market

May 23, 2025

6 000 For Cannes Access Investigating The Pure Auteur Fuel Black Market

May 23, 2025 -

First Test Triumph For Zimbabwe Muzarabanis Stellar Bowling Performance Against Bangladesh

May 23, 2025

First Test Triumph For Zimbabwe Muzarabanis Stellar Bowling Performance Against Bangladesh

May 23, 2025

Latest Posts

-

Is The Last Rodeo Worth Watching A Honest Review

May 23, 2025

Is The Last Rodeo Worth Watching A Honest Review

May 23, 2025 -

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025 -

The Last Rodeo A Critical Review Of The Film

May 23, 2025

The Last Rodeo A Critical Review Of The Film

May 23, 2025 -

Review The Last Rodeo A Heartfelt Bull Riding Tale

May 23, 2025

Review The Last Rodeo A Heartfelt Bull Riding Tale

May 23, 2025 -

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025