Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Bullish Stance on Current Stock Market Valuations

BofA maintains a relatively bullish stance on current stock market valuations, citing several key factors that support their optimism. Their analysis suggests that while challenges exist, the overall picture isn't as bleak as some predict.

Earnings Growth Expectations

BofA analysts believe that robust corporate earnings growth will justify current valuations, even in the face of macroeconomic uncertainty. Their projections are based on several key observations:

-

Stronger-than-expected Q3 2023 earnings reports: Many companies across various sectors reported earnings that exceeded analysts' expectations in the third quarter of 2023. This suggests underlying strength in the economy and corporate profitability, defying some pessimistic forecasts. Data from BofA's research indicates a significant percentage of companies outperformed projections, bolstering their confidence in future growth.

-

Positive forecasts for future earnings based on strong consumer spending and business investment: Despite inflationary pressures, consumer spending remains relatively resilient, and businesses continue to invest, indicating continued economic activity. These factors are expected to drive future earnings growth, justifying current market valuations. BofA's models incorporate these projections to support their positive outlook.

-

Technology and Healthcare sectors driving earnings growth: While some sectors are experiencing headwinds, others are experiencing robust growth. BofA highlights the technology and healthcare sectors as key drivers of earnings growth, pointing to specific companies and technological advancements contributing to this positive trend. For example, advancements in AI and continued growth in the aging population are cited as positive indicators.

Interest Rate Hike Impact

The Federal Reserve's monetary policy, particularly its interest rate hikes, is a major factor influencing stock market valuations. BofA acknowledges the impact but assesses it differently than some market analysts.

-

Analysis of the Federal Reserve's monetary policy and its potential effects on market performance: BofA carefully analyzes the Fed's actions and their potential impact on inflation, economic growth, and market sentiment. They factor in the potential lag effects of interest rate changes and consider the overall economic context.

-

Explanation of how higher interest rates might affect company profitability and investor sentiment: Higher interest rates increase borrowing costs for companies, potentially impacting profitability. Simultaneously, they can influence investor sentiment, causing a shift in investment preferences. BofA's analysis considers both these aspects, aiming to predict the net effect on stock valuations.

-

BofA's prediction of the peak interest rate and its long-term implications for stock valuations: BofA provides its prediction for the peak interest rate, considering various economic indicators. Their analysis further projects the long-term impact of this peak rate on stock valuations, offering a more nuanced perspective than simple, short-term predictions.

Addressing Key Valuation Concerns

Despite their bullish outlook, BofA acknowledges key valuation concerns that often fuel investor anxiety.

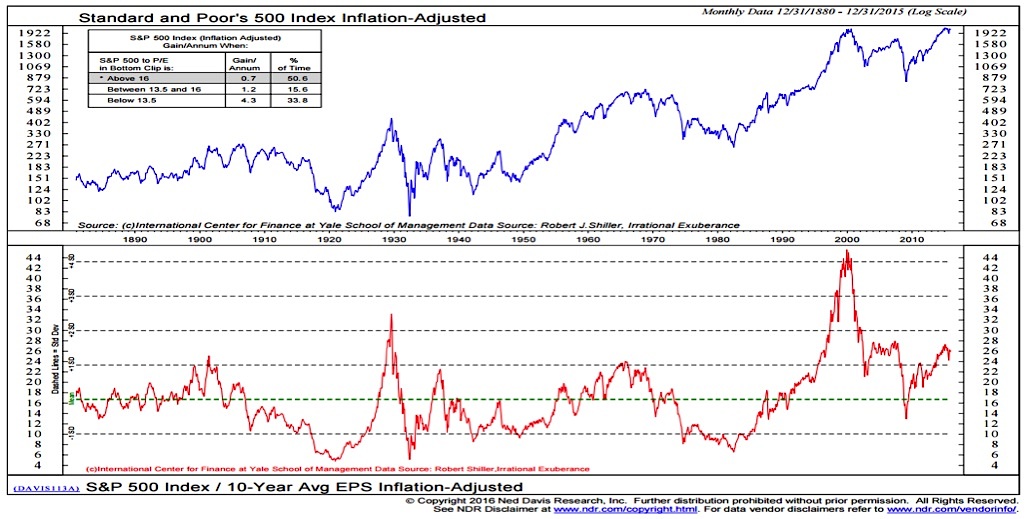

High Price-to-Earnings Ratios (P/E)

High P/E ratios in certain sectors are a frequent cause for concern among investors. BofA addresses this by providing context and perspective.

-

Explanation of factors contributing to high P/E ratios (e.g., growth potential, low interest rates): High P/E ratios are not always a negative indicator. They can reflect high growth potential, particularly in innovative sectors. Low interest rates historically tend to inflate valuations, making high P/E ratios less concerning.

-

Comparison of current P/E ratios to historical averages and other market indicators: BofA provides a comparative analysis of current P/E ratios against historical averages and other relevant market indicators. This helps put current valuations into perspective and assess whether they are truly excessive or within a reasonable range given the current economic climate.

-

BofA's argument for why these high P/E ratios are not necessarily unsustainable: BofA argues that, in some cases, the high P/E ratios are justified by strong growth prospects and are not necessarily unsustainable in the long term. They provide sector-specific analysis to support this claim.

Inflationary Pressures

Inflation significantly impacts stock market valuations by affecting corporate margins and profitability.

-

Analysis of inflation's effect on corporate margins and profitability: BofA analyzes how inflation affects companies' ability to maintain profit margins by increasing their input costs. This analysis helps determine how much of the inflationary pressures companies can successfully pass on to consumers.

-

BofA's assessment of the effectiveness of measures to combat inflation: BofA assesses the effectiveness of government measures and the Federal Reserve's monetary policy in controlling inflation. This evaluation impacts their prediction for future inflation and its influence on earnings and valuations.

-

Discussion of how inflation might influence future earnings forecasts and stock valuations: BofA integrates their inflation projections into their earnings forecasts, providing a comprehensive view of how inflation could influence stock valuations over the coming periods.

Long-Term Outlook and Investment Strategies

BofA offers a long-term perspective and provides actionable investment strategies.

Sector-Specific Opportunities

BofA identifies sectors poised for growth, offering investors potential opportunities.

-

Detailed explanation of why these sectors are attractive investment options: BofA provides in-depth analysis of the selected sectors, outlining their growth drivers, competitive landscapes, and potential risks. This analysis helps investors make informed decisions.

-

Specific examples of companies within those sectors with strong growth potential: They highlight specific companies within these sectors that are believed to have robust growth potential, providing investors with concrete investment ideas.

-

Risk assessment for each highlighted sector: BofA acknowledges the inherent risks associated with each sector, providing a balanced perspective to help investors evaluate potential opportunities and mitigate risks.

Diversification and Risk Management

BofA emphasizes the importance of diversification and risk management in navigating market uncertainty.

-

Importance of diversification across different asset classes: They advocate for diversifying investments across various asset classes to reduce overall portfolio risk. This reduces the impact of poor performance in any single sector or asset class.

-

Strategies for managing risk and protecting investment portfolios: They suggest risk management strategies such as hedging and stop-loss orders to protect investment portfolios from significant losses.

-

Advice on adjusting investment strategies based on market conditions and personal risk tolerance: BofA emphasizes the importance of tailoring investment strategies to individual risk tolerance and adjusting them based on changing market conditions.

Conclusion

BofA's analysis of current stock market valuations offers investors a reason for measured optimism. While acknowledging existing challenges like inflation and interest rate hikes, their focus on robust earnings growth and a long-term perspective provides a compelling counterpoint to prevailing anxieties. By carefully considering BofA's insights and adopting a diversified, risk-managed approach, investors can navigate the complexities of the market and potentially capitalize on opportunities. Remember to conduct your own thorough research and seek professional financial advice before making any investment decisions related to stock market valuations. Understanding stock market valuations is crucial for successful long-term investing.

Featured Posts

-

Draisaitl Hellebuyck And Kucherov Vie For Hart Trophy

May 10, 2025

Draisaitl Hellebuyck And Kucherov Vie For Hart Trophy

May 10, 2025 -

Palantir Stock Performance In Q1 Examining Government And Commercial Revenue Streams

May 10, 2025

Palantir Stock Performance In Q1 Examining Government And Commercial Revenue Streams

May 10, 2025 -

Bangkok Post Highlights Urgent Need For Transgender Equality Legislation

May 10, 2025

Bangkok Post Highlights Urgent Need For Transgender Equality Legislation

May 10, 2025 -

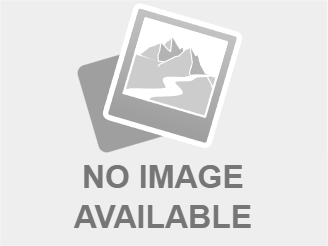

Mapping The Nations Newest Business Hotspots

May 10, 2025

Mapping The Nations Newest Business Hotspots

May 10, 2025 -

Nl Federal Election 202 Year Candidate Profiles And Platforms

May 10, 2025

Nl Federal Election 202 Year Candidate Profiles And Platforms

May 10, 2025