Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

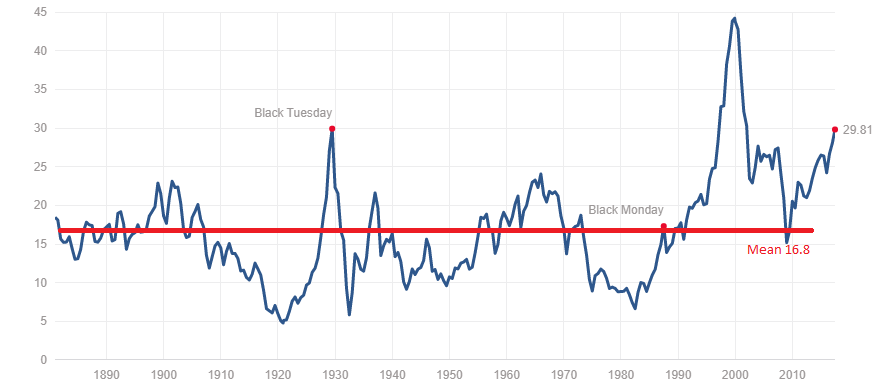

BofA's in-depth stock market analysis provides a nuanced view of current equity valuations. They employed several key equity valuation metrics to reach their conclusions, including the price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield. By comparing these metrics to historical averages, BofA offers a valuable perspective on whether the market is currently overvalued, undervalued, or trading in line with historical norms.

-

BofA's assessment of current P/E ratios: Across various sectors, BofA found that while some sectors show elevated P/E ratios compared to their historical averages, others remain relatively in line with long-term trends. This suggests a more nuanced picture than a blanket statement of market overvaluation.

-

Comparison to historical averages: The analysis compares current valuation metrics to historical data spanning decades, providing a broader context for current market conditions. This long-term perspective helps to mitigate the impact of short-term market volatility on investment decisions.

-

Specific sector analysis: BofA's report likely highlights specific sectors that they deem either undervalued or overvalued, providing investors with actionable intelligence for portfolio adjustments. This granular approach allows investors to make informed choices based on specific investment opportunities.

-

Dividend yield analysis: Dividend yields are considered an important indicator of valuation, especially for income-focused investors. BofA's analysis likely includes insights into dividend yields across different sectors, further informing investors' understanding of relative value.

Addressing Investor Concerns about Market Volatility

Market volatility is a natural part of investing, but it can be especially unnerving during periods of uncertainty. BofA's analysis aims to alleviate some of these concerns by providing a more balanced perspective on current stock market valuations.

-

Contextualizing market fluctuations: BofA's research helps contextualize the current market fluctuations by comparing them to historical trends. This historical perspective can help investors understand that volatility is normal and often temporary.

-

Importance of a long-term investment horizon: BofA likely emphasizes the significance of maintaining a long-term investment strategy. Short-term market movements should not dictate long-term investment decisions.

-

Risk management strategies: The report might suggest diversification as a key risk management strategy. Spreading investments across different asset classes and sectors can help mitigate the impact of market volatility on an individual portfolio.

-

Avoiding impulsive decisions: BofA likely cautions against making impulsive decisions based on short-term market swings. Rational, well-researched investment choices are more likely to achieve long-term financial goals.

BofA's Recommendations for Investors

Based on their detailed valuation analysis, BofA likely offers specific recommendations for investors to adjust their portfolio allocations. These recommendations will likely consider both opportunities and potential risks across different sectors and asset classes.

-

Portfolio adjustments: BofA's suggested adjustments might involve shifting allocations from overvalued sectors to potentially undervalued ones. This strategic reallocation can optimize portfolio performance.

-

Opportunities in undervalued sectors: The report may highlight specific sectors or asset classes that BofA believes are currently undervalued, presenting attractive investment opportunities for those willing to take on moderate risk.

-

Cautionary notes on overvalued sectors: Equally important are warnings about sectors or asset classes that may be overvalued and pose a higher risk of underperformance.

-

Personalized investment strategies: BofA's recommendations should emphasize the importance of tailoring investment strategies to individual risk tolerance and long-term financial goals. A "one size fits all" approach is rarely optimal.

Conclusion

BofA's analysis offers a degree of reassurance to investors concerned about current stock market valuations. By using a range of valuation metrics and comparing them to historical data, BofA paints a picture that is more nuanced than simple pronouncements of overvaluation. Understanding stock market valuations remains crucial for informed investment decisions. Remember, maintaining a long-term perspective and employing effective risk management strategies are key to achieving long-term financial success. We encourage you to delve deeper into BofA's research and to develop a well-informed investment strategy based on a thorough understanding of stock market valuations. Explore additional resources on investment analysis to further enhance your investment knowledge.

Featured Posts

-

Carney Promises Economys Biggest Overhaul In A Generation

May 04, 2025

Carney Promises Economys Biggest Overhaul In A Generation

May 04, 2025 -

Australian Election 2024 Reflecting Global Anti Trump Sentiment

May 04, 2025

Australian Election 2024 Reflecting Global Anti Trump Sentiment

May 04, 2025 -

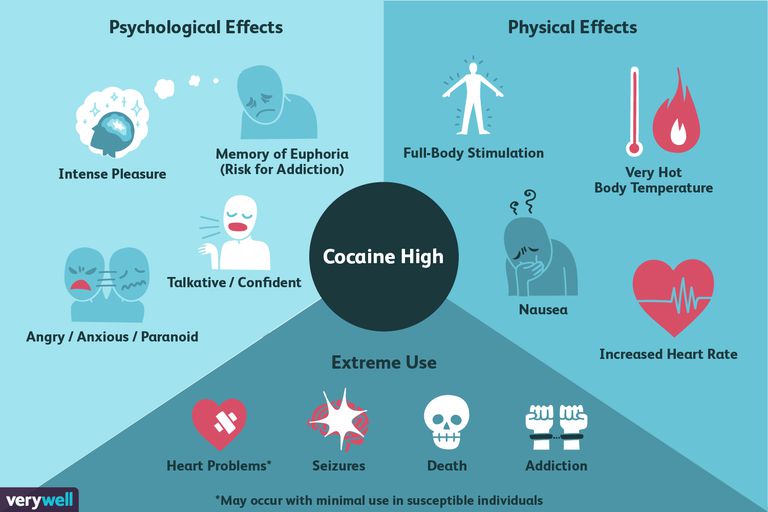

Narco Subs And Enhanced Cocaine Understanding The Drivers Of Global Increase

May 04, 2025

Narco Subs And Enhanced Cocaine Understanding The Drivers Of Global Increase

May 04, 2025 -

Anna Kendricks Silence On Blake Livelys Legal Battle

May 04, 2025

Anna Kendricks Silence On Blake Livelys Legal Battle

May 04, 2025 -

Understanding The First Round Of The Nhl Stanley Cup Playoffs

May 04, 2025

Understanding The First Round Of The Nhl Stanley Cup Playoffs

May 04, 2025

Latest Posts

-

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 04, 2025

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 04, 2025 -

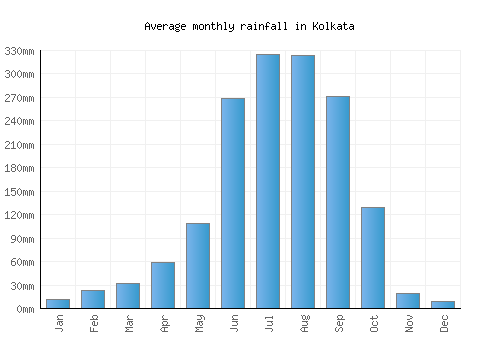

Kolkata To Sizzle March Temperature Forecast Above 30 C

May 04, 2025

Kolkata To Sizzle March Temperature Forecast Above 30 C

May 04, 2025 -

Me T Department Forecasts Thunderstorms In Kolkata And Surrounding Areas

May 04, 2025

Me T Department Forecasts Thunderstorms In Kolkata And Surrounding Areas

May 04, 2025 -

Rain Alert West Bengals North Bengal Region To Expect Heavy Downpour

May 04, 2025

Rain Alert West Bengals North Bengal Region To Expect Heavy Downpour

May 04, 2025 -

Kolkata Weather Update March Temperatures To Exceed 30 Degrees

May 04, 2025

Kolkata Weather Update March Temperatures To Exceed 30 Degrees

May 04, 2025