Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Methodology and Key Findings

BofA's valuation assessment employs a combination of established methods, including discounted cash flow (DCF) analysis and price-to-earnings ratio (P/E) comparisons across various sectors. They also incorporate macroeconomic factors such as interest rates, inflation expectations, and projected earnings growth into their models. This holistic approach allows for a more nuanced understanding of current stock market valuations than simpler metrics alone.

The report's key findings paint a relatively positive picture:

-

Historically Moderate Valuations: Current valuations, while elevated compared to pre-pandemic levels, are not excessively high when considered against historical averages, especially when factoring in current interest rates and projected earnings growth. BofA's analysis suggests that the market is pricing in much of the anticipated economic slowdown.

-

Undervalued Sectors Identified: The report identifies specific sectors, such as [insert example sectors identified by BofA, e.g., energy, certain technology sub-sectors], as being potentially undervalued and poised for future growth. This sector analysis provides targeted investment opportunities.

-

Positive Future Market Performance Predictions: Based on their comprehensive analysis, BofA predicts [insert BofA's prediction, e.g., moderate, yet positive, market growth] over the next [insert timeframe, e.g., 12-18 months], citing improving corporate earnings and a gradual easing of inflationary pressures. This prediction is, of course, subject to the usual market uncertainties. Using valuation metrics like the P/E ratio in conjunction with their DCF models supports this prediction.

These findings, supported by detailed valuation metrics and sector analysis, provide a compelling counterpoint to the prevailing negative sentiment in some market circles.

Addressing Investor Concerns About High Inflation and Interest Rates

High inflation and aggressive interest rate hikes are major concerns for investors. BofA directly addresses these anxieties in their report. They argue that much of the negative impact of these factors is already priced into the market.

BofA's reasoning includes:

-

Moderating Inflation: The report suggests that inflation is expected to moderate gradually over the coming year, easing pressure on corporate profit margins and consumer spending. Their projections are based on [mention source of inflation predictions, e.g., analysis of supply chain improvements, softening demand, and central bank actions].

-

Sector-Specific Impact of Interest Rate Hikes: BofA acknowledges the negative impact of higher interest rates on certain sectors, particularly those with high debt burdens. However, they also highlight sectors that are relatively less sensitive to interest rate changes, providing opportunities for strategic allocation.

-

Resilient Market: The report presents evidence suggesting that the market has demonstrated resilience to economic headwinds in the past, and that this resilience, combined with underlying corporate strength, will continue to provide support. This assessment considers factors beyond simple valuation metrics.

These counterarguments provide a more balanced perspective, suggesting that the market's current valuation is not solely determined by inflation and interest rate concerns.

Identifying Opportunities and Investment Strategies Based on BofA's Analysis

BofA's analysis translates into concrete investment opportunities and strategies:

-

Focus on Undervalued Sectors: Investors should consider allocating a portion of their portfolio to the undervalued sectors identified in the BofA report. This requires careful due diligence and consideration of individual risk tolerance.

-

Diversification Across Asset Classes: Maintaining a diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) remains a crucial risk management strategy. This helps mitigate the impact of market fluctuations in any single sector.

-

Defensive Investment Options: While focusing on growth opportunities, it's prudent to incorporate defensive investment options into the portfolio to protect against unforeseen economic downturns.

-

Long-Term Investment Horizon: BofA's analysis suggests that a long-term investment horizon is essential to navigate market volatility and benefit from potential growth opportunities over time.

By adopting these strategies, informed by BofA's analysis, investors can aim to build a robust and resilient portfolio.

Conclusion: Stock Market Valuations and Your Investment Plan

BofA's report offers a reassuring perspective on current stock market valuations, suggesting that concerns about inflation and interest rates are, to a large extent, already reflected in current prices. Their analysis highlights specific undervalued sectors and suggests a long-term investment strategy as a key to weathering market fluctuations. Remember, while BofA's analysis provides valuable insights, it's crucial to conduct your own thorough research and assessment of your risk tolerance before making any investment decisions. Understanding stock market valuations is key to effective investing. Learn more about stock market valuations and develop a well-informed investment strategy that aligns with your financial goals. [Insert link to BofA's report or other relevant resources here].

Featured Posts

-

Dragons Den A Guide To Success On The Show

May 01, 2025

Dragons Den A Guide To Success On The Show

May 01, 2025 -

Omni Secures Dragons Den Funding Plant Based Dog Food Takes Center Stage

May 01, 2025

Omni Secures Dragons Den Funding Plant Based Dog Food Takes Center Stage

May 01, 2025 -

Oplossing Gezocht Aanpakken Van De Lange Wachttijden In Tbs Klinieken

May 01, 2025

Oplossing Gezocht Aanpakken Van De Lange Wachttijden In Tbs Klinieken

May 01, 2025 -

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala

May 01, 2025

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala

May 01, 2025 -

Mining Meaning From Mundane Data An Ai Approach To Creating A Poop Podcast

May 01, 2025

Mining Meaning From Mundane Data An Ai Approach To Creating A Poop Podcast

May 01, 2025

Latest Posts

-

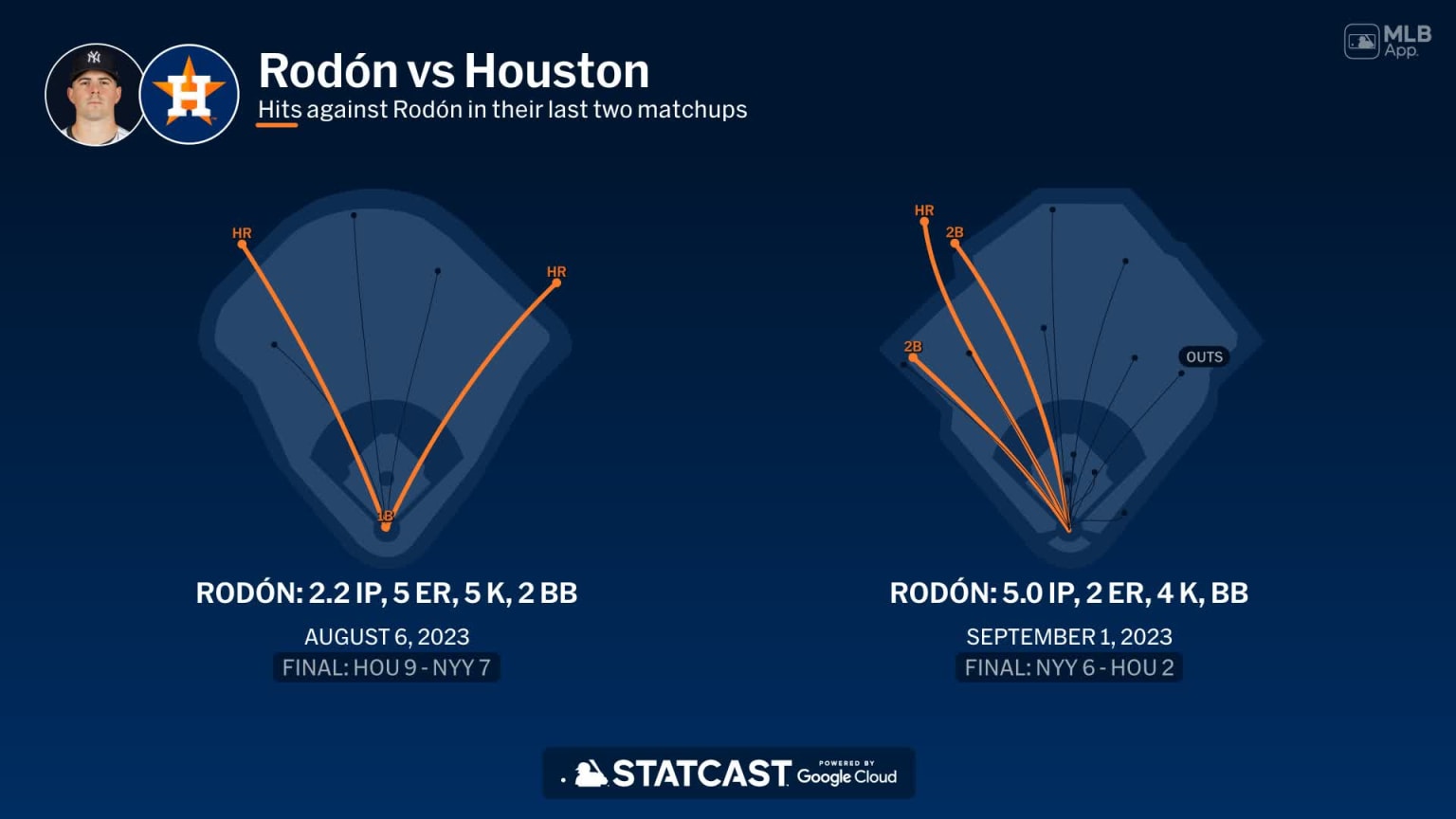

Yankees Salvage Series Finale Rodons Dominant Performance Against Guardians

May 01, 2025

Yankees Salvage Series Finale Rodons Dominant Performance Against Guardians

May 01, 2025 -

Yankees Salvage Series Finale Rodons Gem Fuels 5 1 Win Over Guardians

May 01, 2025

Yankees Salvage Series Finale Rodons Gem Fuels 5 1 Win Over Guardians

May 01, 2025 -

New York Yankees Rodon Silences Guardians In 5 1 Win

May 01, 2025

New York Yankees Rodon Silences Guardians In 5 1 Win

May 01, 2025 -

Rodon Shines Yankees Defeat Guardians 5 1 To Avoid Sweep

May 01, 2025

Rodon Shines Yankees Defeat Guardians 5 1 To Avoid Sweep

May 01, 2025 -

Yankees Beat Guardians 5 1 Rodon Dominates In Series Finale

May 01, 2025

Yankees Beat Guardians 5 1 Rodon Dominates In Series Finale

May 01, 2025