Stock Market Volatility: Analyzing Dow Futures And China's Economic Policies

Table of Contents

Dow Futures as a Leading Indicator of Market Sentiment

Understanding Dow Futures Contracts

Dow futures are financial contracts obligating the buyer to purchase the Dow Jones Industrial Average (DJIA) at a predetermined price on a specific future date. The DJIA, a price-weighted average of 30 large, publicly owned companies, serves as a benchmark for the overall US stock market. Futures contracts allow investors to speculate on the future direction of the DJIA or hedge against potential losses in their stock portfolios. The price of a Dow futures contract is closely tied to the underlying index; an increase in the DJIA typically leads to a rise in futures prices, and vice versa.

- Dow Jones Industrial Average (DJIA): A widely-used index reflecting the performance of 30 major US companies.

- Futures Contracts: Agreements to buy or sell an asset at a specific price on a future date.

- Futures Price & Underlying Index: A strong correlation exists between the price of Dow futures and the actual DJIA value.

Interpreting Price Movements in Dow Futures

Changes in Dow futures prices can act as a powerful predictor of broader market trends. Speculators actively trade futures contracts, anticipating future price movements based on their market outlook. Hedgers, on the other hand, use futures to mitigate risk. Bullish sentiment leads to higher futures prices, reflecting expectations of market growth. Conversely, bearish sentiment results in lower prices, signaling anticipated market declines. News events, economic data releases, and geopolitical factors can significantly influence futures pricing. Technical analysis, using charts and indicators, helps investors identify trends and potential turning points in Dow futures prices.

- Bullish/Bearish Trends: Rising futures prices indicate bullish sentiment, while falling prices suggest bearish sentiment.

- News & Events Impact: Unexpected news, like interest rate changes or political developments, can drastically affect futures prices.

- Technical Analysis: Tools like moving averages, RSI, and MACD aid in interpreting price patterns and predicting future movements.

Dow Futures Volatility and its Implications

Volatility in Dow futures reflects and can amplify wider market instability. High volatility indicates significant uncertainty about the future direction of the market, impacting investor confidence. The Volatility Index (VIX), often referred to as the "fear gauge," measures market volatility and typically rises when uncertainty increases. High volatility in Dow futures necessitates careful risk management strategies, including diversification and hedging techniques.

- Volatility Indicators (e.g., VIX): Metrics that quantify market uncertainty and potential price swings.

- Investor Confidence: High volatility erodes investor confidence, leading to increased caution and potentially reduced trading activity.

- Risk Management: Strategies like hedging and diversification become crucial during periods of high Dow futures volatility.

China's Economic Policies and Global Market Impacts

The Significance of China's Economy

China's economy is a global powerhouse, exerting significant influence on international markets. Its massive size and rapid growth have profound implications for global supply chains, international trade, and commodity prices. Any significant shift in China's economic policies can ripple across the globe, impacting various sectors and markets.

- Supply Chains: China's role as a major manufacturer impacts global supply chain dynamics.

- International Trade: China's participation in global trade is substantial, influencing trade balances and economic growth worldwide.

- Commodity Prices: Chinese demand for raw materials, such as oil and metals, significantly influences their prices.

Analyzing Recent Economic Policy Shifts in China

Recent policy changes in China, such as regulatory crackdowns on technology companies and shifts in infrastructure spending, have had notable impacts on market sentiment. These policies, aimed at controlling debt, promoting technological self-reliance, and addressing inequality, create both opportunities and challenges for investors. The short-term effects might involve market corrections, while long-term impacts could reshape entire industry sectors.

- Regulatory Crackdowns: Increased regulation on certain sectors (e.g., technology) can lead to stock price declines in affected companies.

- Infrastructure Spending: Government investment in infrastructure projects can stimulate economic growth and boost related sectors.

- Impact on Various Sectors: Policies can differentially affect various sectors – for example, real estate policies impact the construction and related industries.

The Correlation Between China's Policies and Dow Futures

Chinese economic news and policy announcements directly impact Dow futures prices. For instance, news regarding trade disputes or regulatory changes in China can cause immediate reactions in Dow futures, reflecting investor concerns about the global economic outlook. The time lag between policy announcements and market reactions varies, but the connection is often observable.

- Trade Disputes: Trade tensions between China and the US can lead to increased volatility in Dow futures.

- Regulatory Changes: Announcements regarding new regulations in China can trigger immediate shifts in investor sentiment and futures prices.

- Time Lag: Market reactions to Chinese policy changes aren't instantaneous; a delay of several hours or days is common.

Managing Portfolio Risk Amidst Volatility

Diversification Strategies

Diversification is crucial for mitigating risks associated with stock market volatility. By spreading investments across various asset classes (stocks, bonds, real estate), geographic regions, and sectors, investors can reduce the impact of negative movements in any single asset. A well-diversified portfolio aims to balance risk and reward.

- Asset Allocation: Distributing investments across different asset classes based on risk tolerance and investment goals.

- International Diversification: Investing in assets from various countries to reduce dependence on a single economy.

- Sector Diversification: Spreading investments across different industry sectors to mitigate sector-specific risks.

Hedging Techniques

Hedging strategies, including the use of Dow futures contracts, help protect portfolios against market downturns. For example, investors holding a significant stock portfolio can use short positions in Dow futures to offset potential losses if the market declines. While hedging can reduce risk, it also limits potential gains.

- Short Selling Dow Futures: Selling futures contracts with the expectation of buying them back at a lower price, offsetting potential stock losses.

- Other Hedging Strategies: Options and other derivative instruments can provide further hedging opportunities.

- Pros & Cons: Hedging reduces downside risk but also caps potential upside returns.

The Role of Fundamental and Technical Analysis

Both fundamental and technical analysis play crucial roles in navigating volatile markets. Fundamental analysis involves evaluating a company's financial health and prospects to determine its intrinsic value. Technical analysis focuses on price charts and indicators to identify trends and patterns. Combining both approaches enables more informed investment decisions.

- Fundamental Analysis: Analyzing a company's financial statements, management, and industry position to assess its long-term value.

- Technical Analysis: Using charts and indicators to identify price trends, support levels, and resistance levels.

- Due Diligence: Thorough research is essential before making any investment decisions, regardless of the analytical approach used.

Conclusion

This article explored the intricate relationship between Dow futures, China's economic policies, and overall stock market volatility. We highlighted how movements in Dow futures often foreshadow broader market trends and how significant policy shifts in China can trigger significant market reactions. Understanding these connections is crucial for effective investment strategy.

Navigating the complexities of stock market volatility requires diligent monitoring of Dow futures and a keen understanding of China's economic policies. Stay informed and develop a robust strategy to manage your investment portfolio effectively. Learn more about analyzing Dow futures and understanding the impact of global economic factors on your investments.

Featured Posts

-

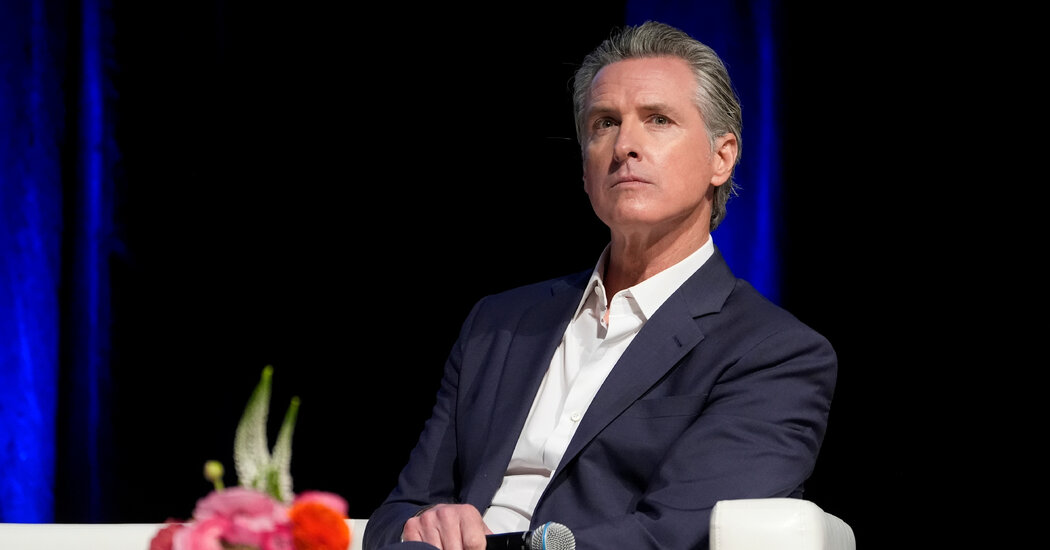

The Deeply Unfair Debate Newsoms Policy On Transgender Participation In Sports

Apr 26, 2025

The Deeply Unfair Debate Newsoms Policy On Transgender Participation In Sports

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two What The Super Bowl Spot Revealed

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two What The Super Bowl Spot Revealed

Apr 26, 2025 -

Macon County Building Permits The Latest Updates

Apr 26, 2025

Macon County Building Permits The Latest Updates

Apr 26, 2025 -

Victor Osimhen Manchester Uniteds Pricey Transfer Target

Apr 26, 2025

Victor Osimhen Manchester Uniteds Pricey Transfer Target

Apr 26, 2025 -

Seven Year Prison Sentence Possible For Ex Rep George Santos In Fraud Case

Apr 26, 2025

Seven Year Prison Sentence Possible For Ex Rep George Santos In Fraud Case

Apr 26, 2025