Stock Markets Soar On Renewed U.S.-China Trade Optimism

Table of Contents

Positive Trade Signals Boost Investor Confidence

Recent developments in U.S.-China trade negotiations have ignited a spark of optimism, significantly boosting investor confidence. Positive statements from high-ranking officials in both countries, coupled with reports of progress in resolving key trade disputes, have contributed to a decreased sense of uncertainty in the market. This reduced uncertainty has led to increased risk appetite among investors, prompting them to allocate more capital into equities.

- Increased Risk Appetite: The VIX volatility index, often referred to as the "fear gauge," dropped significantly, indicating a decline in market anxiety and an increase in investor willingness to take on risk.

- Market Surge Data: The Dow Jones Industrial Average saw a gain of X%, the S&P 500 rose by Y%, and the Nasdaq Composite jumped Z%. These figures represent substantial increases and reflect a strong positive market reaction.

- Increased Trading Volume: The increased trading volume observed further underscores the significant impact of this news on investor activity. Higher volumes suggest more active participation and confidence in the market.

These positive signals have effectively calmed investor fears regarding a prolonged trade war, leading to a more favorable market environment. The keywords investor confidence, risk appetite, and market volatility are key indicators of this shift.

Sector-Specific Reactions to the Trade Optimism

The positive news regarding U.S.-China trade relations hasn't impacted all market sectors equally. While the overall market experienced a significant surge, the extent of gains varied depending on sector-specific vulnerabilities and potential benefits from eased trade tensions.

- Technology Sector Gains: Technology stocks, which were particularly hard-hit by previous trade uncertainties, experienced some of the most significant gains. Reduced tariffs and a more stable trade environment are likely to boost profits for technology companies involved in cross-border trade.

- Manufacturing Sector Response: The manufacturing sector also saw positive movement, albeit more moderate than the tech sector. Easing trade tensions should alleviate some of the pressures on manufacturers, leading to improved supply chains and potentially increased production.

- Energy Sector Impact: The energy sector's response is more complex and depends on various factors, including global demand and the specific details of any trade agreement. Potential impacts on energy prices could influence the sector's performance.

Analyzing these sector performance variations offers valuable insights into the nuanced impact of U.S.-China trade optimism on the stock market and the interplay between trade impact and individual stock market sectors.

Economic Implications of Improved U.S.-China Trade Relations

A successful resolution to the U.S.-China trade dispute holds significant positive economic implications globally. Reduced trade barriers should lead to increased global trade, boosting economic growth and fostering greater certainty for businesses.

- Global GDP Growth: A reduction in trade tensions could contribute to increased global GDP growth by facilitating smoother cross-border commerce and investment.

- Reduced Inflation: Eased trade tensions can lead to lower import prices, potentially reducing inflationary pressures in various economies.

- Increased Consumer Spending: Greater economic certainty and lower prices can translate into higher consumer confidence and increased spending, further stimulating economic growth.

However, it is crucial to acknowledge potential downsides. The specific terms of any trade deal are critical, and future disagreements could still arise, potentially impacting the long-term economic benefits. This underscores the need to carefully monitor the economic impact of any trade deal and its effect on global trade and economic growth.

Conclusion: Navigating the Stock Market in the Wake of U.S.-China Trade Optimism

The renewed optimism surrounding U.S.-China trade relations has undeniably had a significant and positive impact on global stock markets, boosting investor sentiment and generating considerable excitement about future economic growth. However, it's crucial to remain vigilant and continue monitoring further developments in these trade relations. The potential for future shifts in the relationship remains, highlighting the need for a cautious and informed approach to investment strategies. To stay informed about the evolving U.S.-China trade relations and their influence on the stock market outlook, subscribe to our newsletter or follow our updates on relevant financial news sources. Understanding the impact of U.S.-China trade relations on your investment strategy is crucial for navigating the market effectively.

Featured Posts

-

Eurojackpot Voitto Suomeen 4 8 Miljoonaa Euroa Naein Se Tapahtui

May 14, 2025

Eurojackpot Voitto Suomeen 4 8 Miljoonaa Euroa Naein Se Tapahtui

May 14, 2025 -

Estonias Absurd Eurovision Performance A Hilarious Italian Twist

May 14, 2025

Estonias Absurd Eurovision Performance A Hilarious Italian Twist

May 14, 2025 -

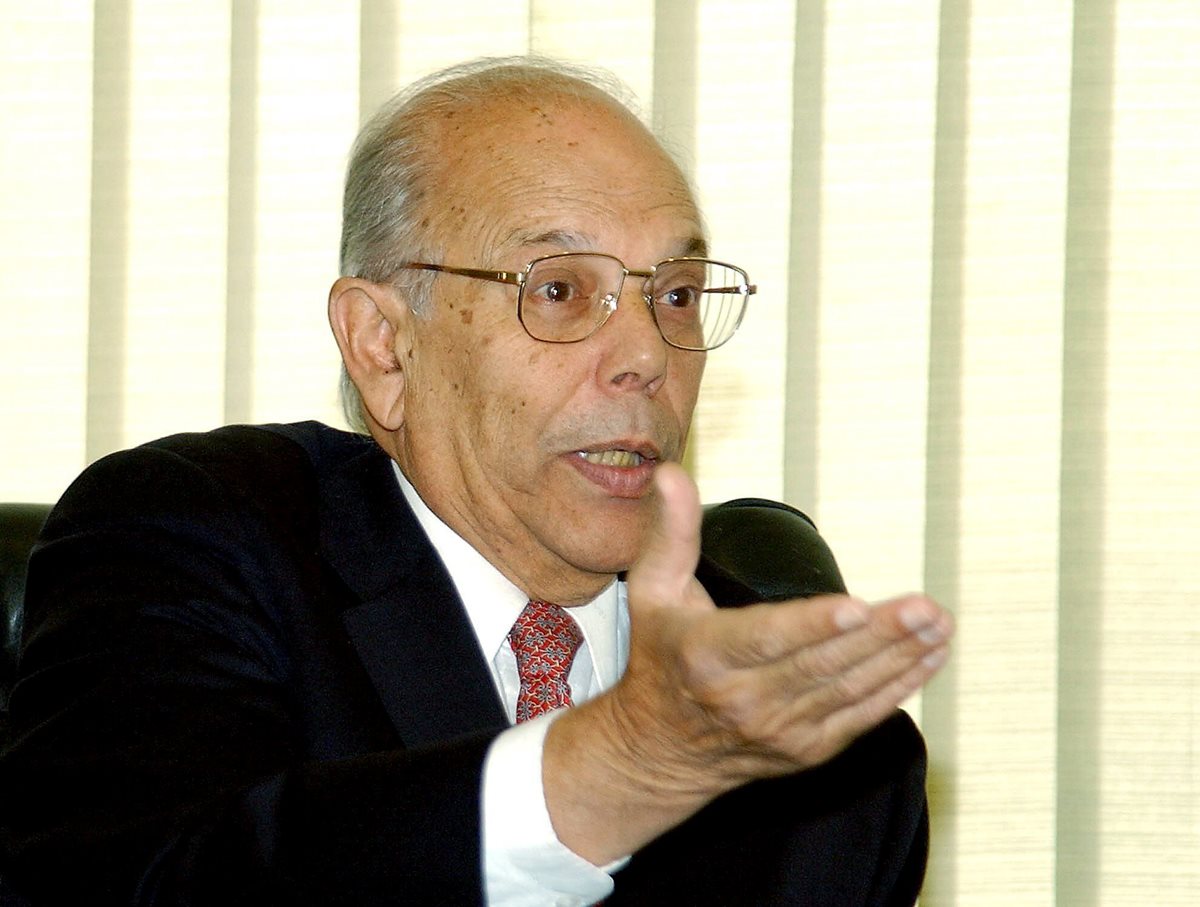

Uruguay Muere El Expresidente Jose Mujica A Los 89 Anos

May 14, 2025

Uruguay Muere El Expresidente Jose Mujica A Los 89 Anos

May 14, 2025 -

Jose Mujica Ex Presidente De Uruguay Muere A Los 89 Anos

May 14, 2025

Jose Mujica Ex Presidente De Uruguay Muere A Los 89 Anos

May 14, 2025 -

Walmart Recall Affects Baby Products Focus On Unstable Dressers

May 14, 2025

Walmart Recall Affects Baby Products Focus On Unstable Dressers

May 14, 2025