Stocks Can't Wish Away 'Liberation Day' Tariffs: Market Impact And Analysis

Table of Contents

Understanding the 'Liberation Day' Tariffs

Background and Context

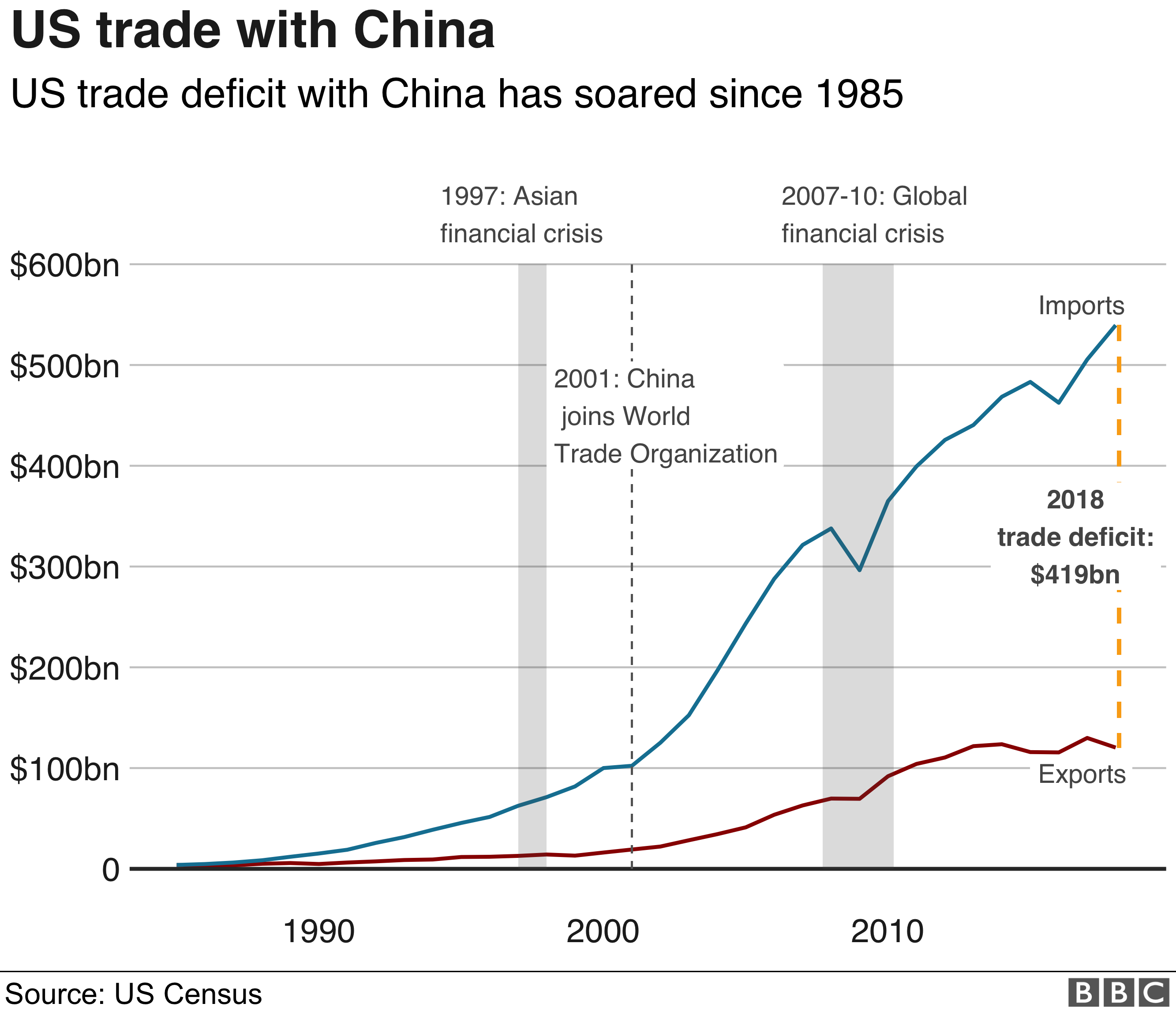

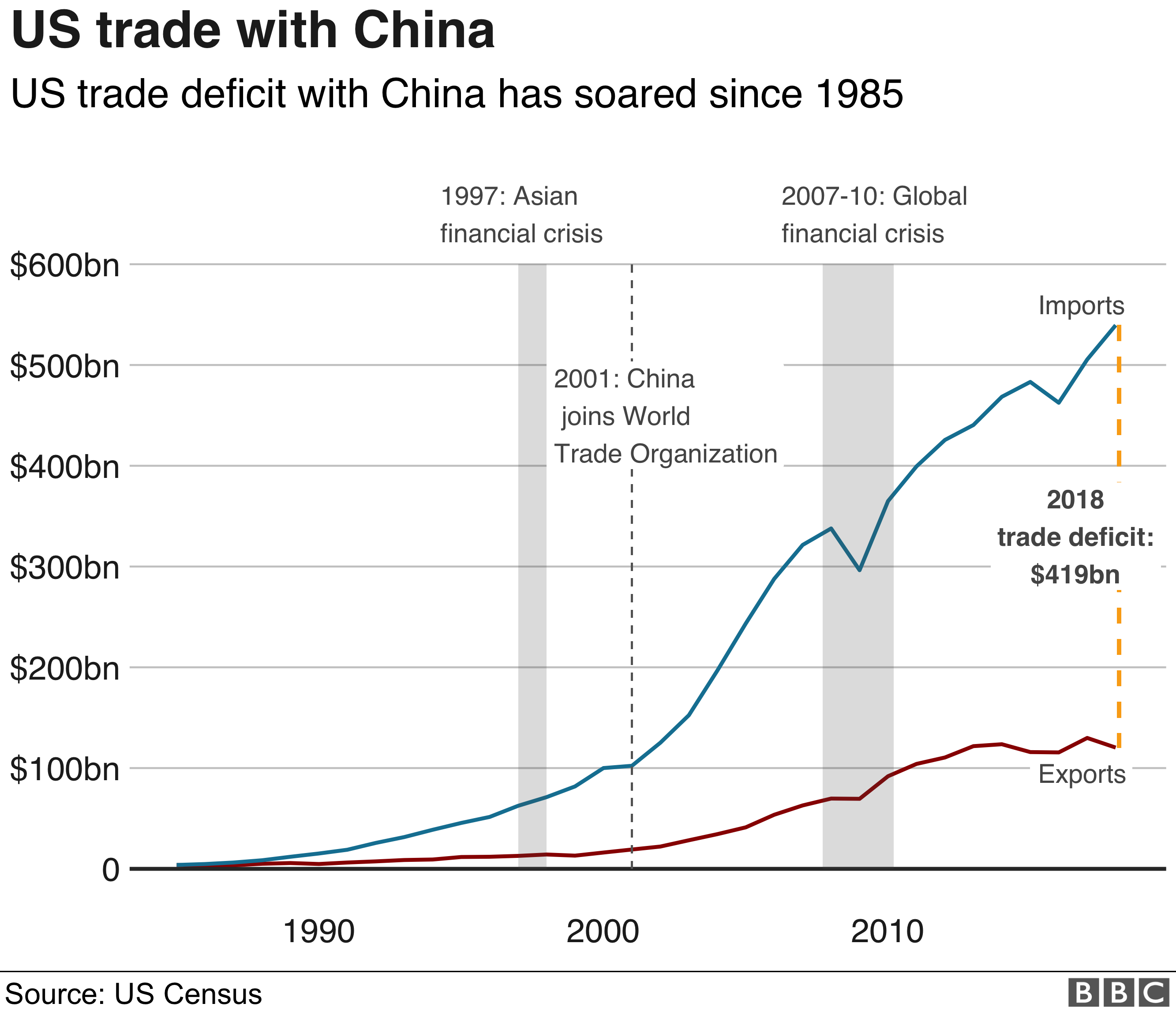

The "Liberation Day" tariffs, implemented on [Insert Date], represent a significant shift in [Country/Region]'s trade policy. The stated purpose is to [State the official reason for the tariffs, e.g., protect domestic industries, retaliate against unfair trade practices]. These tariffs specifically target [List the affected countries] and impact a range of goods, including [List specific examples, e.g., steel, aluminum, agricultural products]. The rationale behind the implementation stems from [Explain the underlying political and economic motivations, e.g., national security concerns, trade imbalances]. While officially presented as a measure to [Reiterate the official purpose], many analysts view it within the broader context of escalating global trade tensions.

- Specific examples of goods affected: Steel, aluminum, agricultural products (e.g., wheat, soybeans), textiles.

- Political and economic context: [Elaborate on the geopolitical factors, e.g., strained relationships with other nations, domestic political pressures].

- Expected duration: The tariffs are currently scheduled to remain in effect for [Duration], although this could change depending on future negotiations and political developments. The uncertainty surrounding their duration further adds to market volatility.

Immediate Market Reaction to the Tariffs

Stock Market Volatility

The announcement of the "Liberation Day" tariffs triggered immediate and widespread market volatility. Major indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq experienced significant fluctuations in the days following the announcement. [Insert data or chart showing the market's immediate reaction – e.g., percentage changes in indices, graphs illustrating volatility]. This initial reaction reflected investors' uncertainty and concern about the potential economic consequences of the increased trade barriers.

Sector-Specific Impacts

The impact of the tariffs wasn't uniform across all sectors. Industries heavily reliant on imported goods or exporting to affected countries felt the brunt of the impact. For instance, the manufacturing sector, particularly companies involved in [Specific examples, e.g., automobile production, consumer electronics], experienced a sharp decline in stock prices. Conversely, some domestic industries producing substitute goods might have seen a temporary boost. [Include examples of companies most affected, both positively and negatively].

- Specific examples of stock price movements: [Provide specific examples, e.g., "Company X's stock fell by 10% after the tariff announcement," "Company Y, a domestic producer of steel, saw a 5% increase"].

- Analysis of investor sentiment: Trading volume surged, indicating heightened investor activity and uncertainty. Options activity also increased, reflecting attempts to hedge against potential losses.

- Significant shifts in market sentiment indicators: The VIX volatility index, a measure of market fear, spiked significantly following the tariff announcement.

Long-Term Implications and Strategic Responses

Economic Forecasting and Modeling

Economists offer varying predictions about the long-term economic effects of the "Liberation Day" tariffs. Some models suggest a significant negative impact on global GDP growth, citing reduced trade and increased inflation. Others argue that the effects will be more localized, primarily affecting the targeted sectors. The ultimate outcome depends on several factors, including the duration of the tariffs, the response of other countries, and the ability of affected industries to adapt. [Mention specific economic forecasts and models used to predict the long-term impacts].

Investment Strategies in a Tariffed Market

Navigating this turbulent market requires a proactive and adaptable investment strategy. Diversification remains crucial, reducing reliance on any single sector or geographical region heavily impacted by these tariffs. Investors should consider:

- Potential scenarios and their likelihood: Develop scenarios considering different tariff durations and potential retaliatory measures. Assess the likelihood of each scenario and adjust your portfolio accordingly.

- Recommendations for adjusting investment portfolios: Increase allocations to sectors less susceptible to the tariffs or those expected to benefit from reduced competition.

- Suggestions for hedging against potential losses: Explore hedging strategies using options or other derivative instruments to mitigate losses in case of further market declines.

Conclusion: Stocks Can't Wish Away 'Liberation Day' Tariffs: Key Takeaways and Next Steps

The "Liberation Day" tariffs represent a significant challenge for global markets. Our analysis reveals a notable immediate impact on stock market indices, with varying effects across sectors. The long-term implications remain uncertain, but they underscore the importance of proactive investment strategies. Diversification, risk management, and a close watch on evolving economic conditions are critical.

Key Takeaways:

- "Liberation Day" tariffs caused immediate market volatility and sector-specific impacts.

- Long-term effects are uncertain but potentially significant, affecting global GDP growth.

- Investors should diversify portfolios, manage risks, and adapt to the changing economic landscape.

Stay informed on the evolving situation surrounding "Liberation Day" tariffs and adapt your investment strategy accordingly. Conduct thorough research and consider consulting a financial advisor to navigate this complex market environment effectively. Understanding the nuances of tariff analysis and its impact on your portfolio is crucial for long-term investment success in this new trade landscape.

Featured Posts

-

Browns Sign Veteran Wide Receiver And Return Specialist Report

May 08, 2025

Browns Sign Veteran Wide Receiver And Return Specialist Report

May 08, 2025 -

Sony Ps 5 Pro Teardown Liquid Metal Cooling Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling Revealed

May 08, 2025 -

Trump Appointees Bold Bitcoin Price Forecast Following Recent Surge

May 08, 2025

Trump Appointees Bold Bitcoin Price Forecast Following Recent Surge

May 08, 2025 -

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Byan

May 08, 2025

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Byan

May 08, 2025 -

Path Of Exile 2 What To Know About Rogue Exiles

May 08, 2025

Path Of Exile 2 What To Know About Rogue Exiles

May 08, 2025