Strategy's $555.8 Million Bitcoin Acquisition: Key Details And Implications

Table of Contents

The Acquisition Details: Understanding Strategy's Bitcoin Investment

The Size and Significance of the Investment

Strategy's $555.8 million Bitcoin investment represents a substantial commitment to the cryptocurrency market. This figure is not only significant in terms of Strategy's overall portfolio but also places it among the largest institutional Bitcoin investments to date.

- Specific amount invested: $555.8 million USD (or equivalent in BTC at the time of purchase, specify the amount).

- Percentage of portfolio allocated to Bitcoin: [Insert Percentage, if available. Otherwise, state "Percentage undisclosed, but represents a significant portion of their overall portfolio"].

- Comparison to other institutional Bitcoin investments: [Compare the size of Strategy's investment to other notable institutional investments, such as those by MicroStrategy, Tesla, etc. Provide quantifiable data for comparison.]

- Date of acquisition and market conditions at the time: [Insert date and contextualize the market conditions – was Bitcoin experiencing a bull run, bear market, or period of consolidation? Mention any relevant market events at the time.]

Strategy's Rationale Behind the Bitcoin Purchase

While the exact reasons behind Strategy's decision may not be fully public, several factors likely contributed to this significant purchase.

- Diversification of assets: Investing in Bitcoin allows Strategy to diversify its portfolio beyond traditional assets, potentially mitigating risk and enhancing returns.

- Hedge against inflation: Bitcoin's limited supply and decentralized nature are often viewed as a hedge against inflation and potential currency devaluation.

- Exposure to the growing cryptocurrency market: The investment grants Strategy exposure to the rapidly expanding cryptocurrency market, offering potential for significant long-term growth.

- Long-term investment strategy: This acquisition suggests a long-term strategic view of Bitcoin's potential as a store of value and a medium of exchange.

Market Impact and Implications of Strategy's Bitcoin Acquisition

Price Movements and Market Sentiment

The announcement of Strategy's $555.8 million Bitcoin investment undoubtedly had a ripple effect on the cryptocurrency market.

- Short-term price fluctuations: [Describe the immediate impact on Bitcoin's price – did it rise, fall, or experience significant volatility? Provide data to support your claims.]

- Long-term price predictions: [Discuss potential long-term effects on Bitcoin's price. This should be speculative and based on market analysis, not financial advice.]

- Impact on investor confidence: The investment likely boosted investor confidence in Bitcoin, signaling its increasing acceptance among major financial players.

- Influence on other institutional investors: This could encourage other large institutions to consider similar investments, further fueling the growth of the cryptocurrency market.

Implications for Institutional Adoption of Bitcoin

Strategy's move is a powerful testament to the growing acceptance of Bitcoin within the institutional investment sphere.

- Increased legitimacy and credibility for Bitcoin: The investment adds to Bitcoin's credibility, lending it legitimacy in the eyes of traditional financial institutions.

- Potential for future institutional investments: It could trigger a wave of similar investments from other large corporations and investment firms.

- The role of regulatory frameworks: The regulatory landscape surrounding cryptocurrencies will play a crucial role in shaping the future of institutional adoption.

- Long-term implications for the cryptocurrency market: This investment could significantly accelerate the maturation and mainstream adoption of Bitcoin and other cryptocurrencies.

Risks and Challenges Associated with Strategy's Bitcoin Investment

Volatility and Market Risk

Despite the potential for significant returns, investing in Bitcoin also carries substantial risks.

- Price fluctuations and potential for losses: Bitcoin's price is notoriously volatile, making it susceptible to sharp price swings and potential for substantial losses.

- Regulatory uncertainty and potential changes in policy: Changes in regulatory frameworks could negatively impact Bitcoin's value and investment prospects.

- Security risks and potential for hacks or theft: The risk of hacking or theft remains a concern for cryptocurrency investments, although robust security measures can mitigate this risk.

Long-Term Strategy and Sustainability

The success of Strategy's $555.8 million Bitcoin investment hinges on a well-defined long-term strategy.

- Holding period and exit strategy: Strategy needs a clear plan for how long it intends to hold its Bitcoin investment and what trigger points will dictate its eventual sale or disposition.

- Potential for long-term gains or losses: The long-term outlook depends on various factors, including regulatory developments, market sentiment, and technological advancements.

- Integration into overall financial strategy: The investment needs to be seamlessly integrated into Strategy's overall financial strategy, ensuring alignment with broader business objectives.

Conclusion: Analyzing the Long-Term Effects of Strategy's $555.8 Million Bitcoin Acquisition

Strategy's $555.8 million Bitcoin acquisition is a landmark event in the cryptocurrency world. This significant investment signals a growing acceptance of Bitcoin as a viable asset class among institutional investors, impacting market sentiment and potentially accelerating broader adoption. While the investment carries inherent risks associated with Bitcoin's volatility and regulatory uncertainty, the potential for long-term gains is significant. The long-term success will depend on a well-defined investment strategy, careful risk management, and the evolving cryptocurrency regulatory landscape. We encourage you to share your thoughts on Strategy's bold move and stay informed about the constantly evolving cryptocurrency landscape. Subscribe to our newsletter and follow us on social media for further insights into Bitcoin investment strategies and institutional adoption of cryptocurrencies.

Featured Posts

-

Nba Icons Connection To Ru Pauls Drag Race Godfather Reveal

Apr 30, 2025

Nba Icons Connection To Ru Pauls Drag Race Godfather Reveal

Apr 30, 2025 -

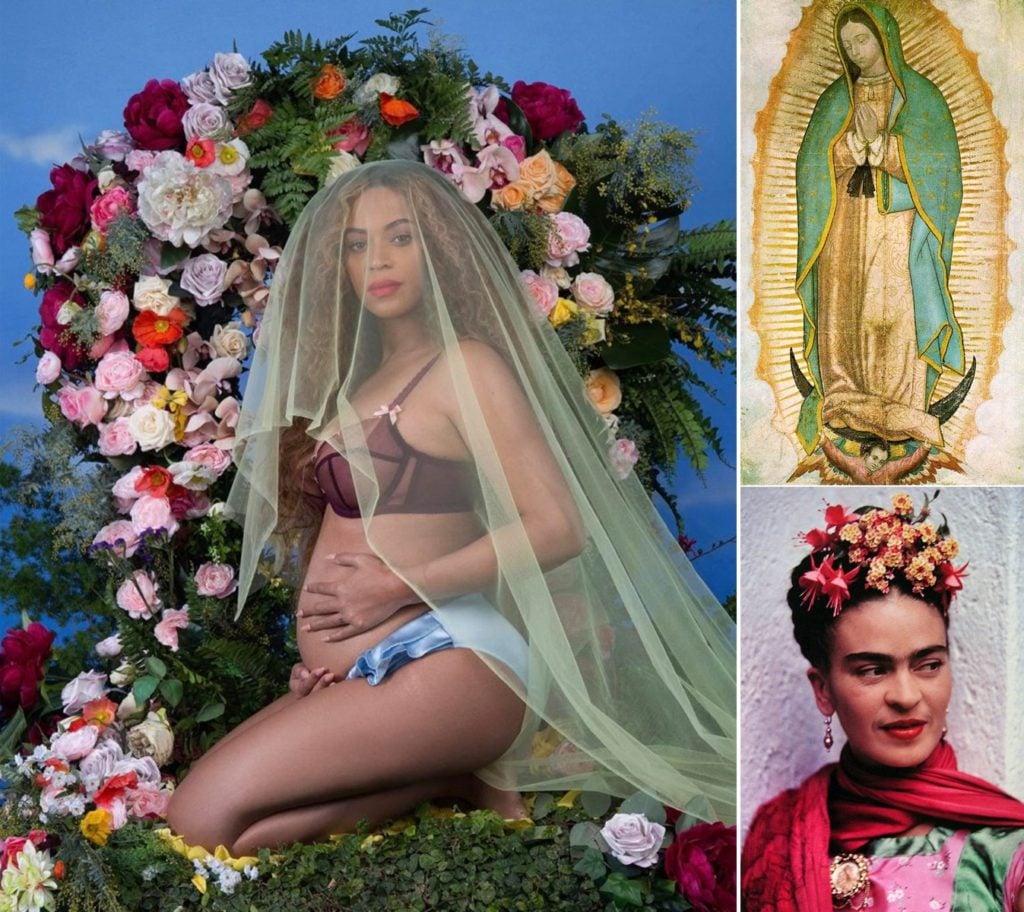

Mpigionse I Kayti Emfanisi Me Tzin Sortsaki Poy Syziteitai

Apr 30, 2025

Mpigionse I Kayti Emfanisi Me Tzin Sortsaki Poy Syziteitai

Apr 30, 2025 -

Super Bowl Family Fun See Jay Z With Blue Ivy And Rumi Carter

Apr 30, 2025

Super Bowl Family Fun See Jay Z With Blue Ivy And Rumi Carter

Apr 30, 2025 -

73

Apr 30, 2025

73

Apr 30, 2025 -

Arkema Analyse Du Document Amf Cp 2025 E1027752

Apr 30, 2025

Arkema Analyse Du Document Amf Cp 2025 E1027752

Apr 30, 2025

Latest Posts

-

Situatsiya S Rakom U Materi Beyonse

Apr 30, 2025

Situatsiya S Rakom U Materi Beyonse

Apr 30, 2025 -

Semya Beyonse Borba S Rakom

Apr 30, 2025

Semya Beyonse Borba S Rakom

Apr 30, 2025 -

Zdorove Materi Beyonse Poslednie Dannye

Apr 30, 2025

Zdorove Materi Beyonse Poslednie Dannye

Apr 30, 2025 -

Novoe O Bolezni Materi Beyonse

Apr 30, 2025

Novoe O Bolezni Materi Beyonse

Apr 30, 2025 -

Beyonse Trevozhnye Novosti O Bolezni Materi

Apr 30, 2025

Beyonse Trevozhnye Novosti O Bolezni Materi

Apr 30, 2025