Strong Earnings Reports Boost Stock Prices: Rockwell Automation And Others

Table of Contents

Rockwell Automation's Stellar Performance and Market Reaction

Rockwell Automation, a leading provider of industrial automation and digital transformation solutions, recently announced exceptionally strong earnings, sending its stock price soaring. This positive performance underscores the significant impact that exceeding expectations can have on investor sentiment and market valuation.

- Revenue Growth: Rockwell Automation reported a substantial year-over-year revenue increase of 15%, significantly surpassing analysts' projections.

- Profit Margins: Their profit margins also expanded, reaching a record high, demonstrating efficient operations and strong pricing power.

- Positive Outlook: Management expressed confidence in future growth, citing robust demand across key industrial sectors and a strong order backlog.

- Market Reaction: Following the earnings release, Rockwell Automation's stock price jumped by over 10% in a single trading session, reflecting investor enthusiasm for the company's performance.

- Factors Contributing to Success: Rockwell Automation's success can be attributed to several factors, including strategic acquisitions, innovative product offerings, and a growing focus on digital solutions catering to the increasing demand for automation in various industries.

Other Companies Showing Strong Earnings Growth

Rockwell Automation isn't alone in experiencing a surge in its stock price following a strong earnings report. Several other publicly traded companies have also seen significant gains due to positive financial results.

-

Company A (Example: A technology company): This company, operating in the rapidly expanding software-as-a-service (SaaS) sector, reported impressive revenue growth driven by increased customer subscriptions and strong international expansion. Their earnings exceeded analyst forecasts, resulting in a double-digit percentage increase in their stock price.

-

Company B (Example: A consumer goods company): A leading producer of consumer staples reported solid earnings growth, driven by strong sales volume and effective cost management. Despite slight inflationary pressures, the company’s ability to maintain profit margins impressed investors, leading to a modest but consistent increase in its share price.

Understanding the Investor Psychology Behind the Price Surge

The surge in stock prices following strong earnings reports is a direct consequence of improved investor confidence. When a company exceeds expectations, it signals financial health and potential for future growth.

- Investor Sentiment: Positive earnings reports significantly improve investor sentiment, creating a wave of optimism and encouraging further investment.

- Market Expectations: Exceeding market expectations is critical. If a company meets or slightly surpasses forecasts, the impact is less dramatic than when it significantly outperforms projections.

- Analyst Ratings: Analysts often adjust their ratings and price targets following strong earnings reports, influencing investor decisions and further boosting the stock price.

Analyzing the Long-Term Implications of Strong Earnings

While the immediate stock price increase is noticeable, the long-term implications of strong earnings reports are equally significant.

- Future Growth: Companies that consistently deliver strong earnings are better positioned for future expansion, enabling them to invest in research and development, acquire complementary businesses, and penetrate new markets.

- Investor Interest: Sustained positive performance attracts increased investor interest, leading to greater capital inflows and potentially higher valuations.

- Enhanced Reputation: Strong earnings reports enhance a company's reputation and brand value, boosting its competitive advantage.

- Future Earnings Expectations: Positive results often lead to increased expectations for future earnings, further supporting the stock price.

Risks and Considerations for Investors

While strong earnings reports are generally positive, investors should not rely solely on them when making investment decisions.

- Fundamental Analysis: It's essential to conduct thorough fundamental analysis, considering factors beyond just the most recent earnings report.

- Short-Term Fluctuations: Stock prices can be volatile, and short-term fluctuations are possible even after a strong earnings report.

- Overvaluation: The market can sometimes overreact to positive news, leading to overvaluation and subsequent price corrections.

- External Factors: Macroeconomic conditions, industry trends, and geopolitical events can also impact stock prices, regardless of a company's performance.

Conclusion

Strong earnings reports are a significant driver of stock price appreciation. Companies like Rockwell Automation exemplify the positive correlation between exceeding financial expectations and market rewards. However, it's crucial for investors to conduct comprehensive due diligence, considering both the immediate impact and the long-term implications of strong earnings reports. Don't base your investment decisions solely on one earnings report; always consider fundamental analysis, market conditions, and potential risks. Stay informed about company earnings reports and use this information, alongside sound financial analysis, to make informed investment decisions based on strong earnings reports and a well-diversified portfolio. Further research into the companies mentioned and related sectors is highly recommended.

Featured Posts

-

Warner Bros Unveils 2025 Slate At Cinema Con

May 17, 2025

Warner Bros Unveils 2025 Slate At Cinema Con

May 17, 2025 -

Mikal Bridges On Knicks Starters Minutes A Request To Coach Thibodeau

May 17, 2025

Mikal Bridges On Knicks Starters Minutes A Request To Coach Thibodeau

May 17, 2025 -

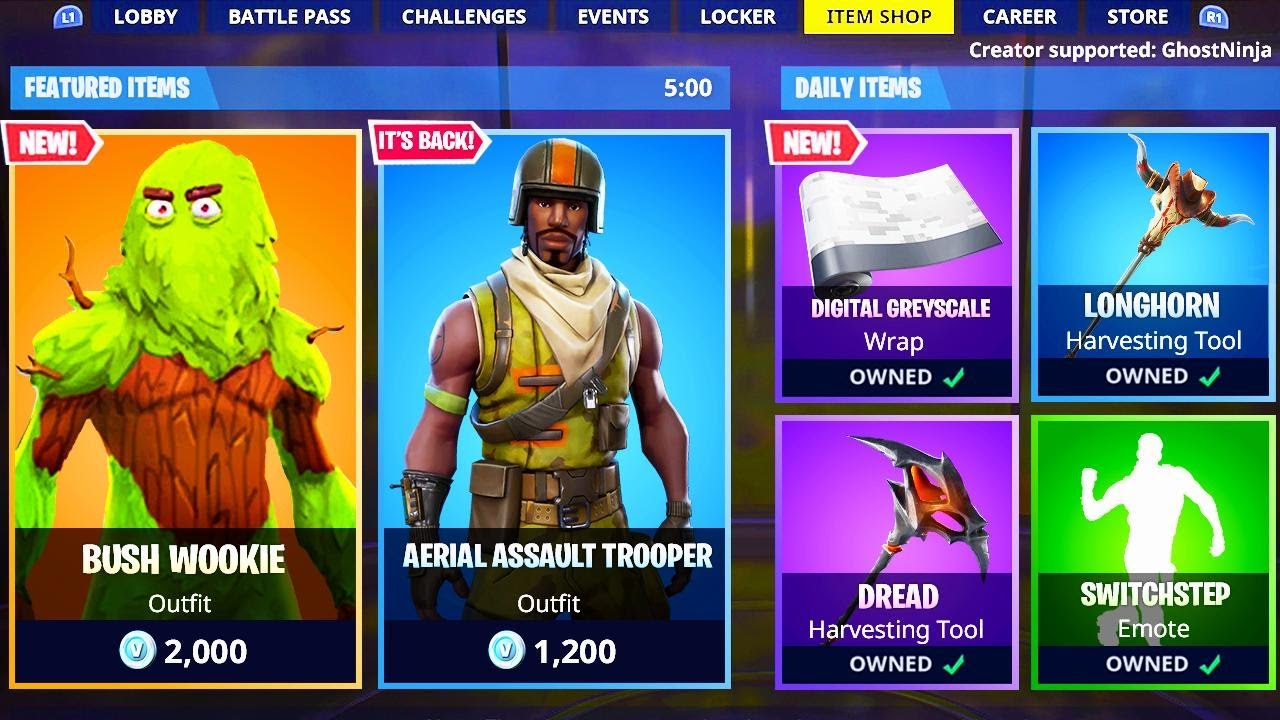

Highly Requested Fortnite Skins Return To Item Shop

May 17, 2025

Highly Requested Fortnite Skins Return To Item Shop

May 17, 2025 -

Thibodeaus Transformation Overcoming Past Flaws To Resurrect The Knicks

May 17, 2025

Thibodeaus Transformation Overcoming Past Flaws To Resurrect The Knicks

May 17, 2025 -

Univision Noticias El Gobierno Persigue El Pago De Prestamos Estudiantiles

May 17, 2025

Univision Noticias El Gobierno Persigue El Pago De Prestamos Estudiantiles

May 17, 2025

Latest Posts

-

Never Before Seen Fortnite Skins Myth Or Reality

May 17, 2025

Never Before Seen Fortnite Skins Myth Or Reality

May 17, 2025 -

El Triunfo De Alcaraz En Montecarlo Alegria Y Dominio

May 17, 2025

El Triunfo De Alcaraz En Montecarlo Alegria Y Dominio

May 17, 2025 -

Nhanh Dau Kich Tinh Miami Open 2025 Djokovic Doi Dau Alcaraz

May 17, 2025

Nhanh Dau Kich Tinh Miami Open 2025 Djokovic Doi Dau Alcaraz

May 17, 2025 -

Fortnite Skins That Disappeared From The Item Shop

May 17, 2025

Fortnite Skins That Disappeared From The Item Shop

May 17, 2025 -

Tenis In Efsanesi Djokovic Kortlarda Zirveye Geri Doenues

May 17, 2025

Tenis In Efsanesi Djokovic Kortlarda Zirveye Geri Doenues

May 17, 2025