Student Loan Crisis: Economic Consequences And Potential Solutions

Table of Contents

The Crushing Weight of Student Loan Debt: Economic Consequences for Individuals

The burden of student loan debt extends far beyond monthly payments; it fundamentally alters the financial trajectory of individuals and families.

Delayed Major Life Milestones

Student loan debt significantly delays major life milestones for many borrowers. The crippling weight of repayments often pushes back crucial life decisions:

- Homeownership: The high cost of student loans makes saving for a down payment incredibly challenging, pushing back homeownership by several years, if not indefinitely. Studies show that student loan debt is a primary reason for delayed homeownership among millennials and Gen Z.

- Marriage and Family: The financial strain of student loan repayments can postpone marriage and starting a family, impacting demographic trends and societal structures.

- Retirement Planning: With a large portion of income allocated to student loan payments, individuals struggle to save adequately for retirement, potentially facing financial insecurity in their later years. This leads to a potential shortfall in retirement savings and increased reliance on social security.

Reduced Spending and Economic Growth

The substantial student loan payments restrict consumer spending, acting as a drag on economic growth. This ripple effect impacts various sectors:

- Retail Sales: Reduced disposable income means less money available for non-essential purchases, impacting retail sales and potentially leading to job losses in the retail sector.

- Housing Market: Delayed homeownership and reduced consumer spending weaken the housing market, impacting construction and related industries.

- Overall Economic Growth: The suppressed consumer demand stemming from high student loan debt contributes to slower overall economic growth.

Increased Financial Stress and Mental Health Issues

The constant pressure of student loan debt takes a significant psychological toll:

- Anxiety and Depression: Studies consistently link high levels of student loan debt to increased rates of anxiety, depression, and other mental health issues.

- Relationship Strain: Financial stress related to student loan debt can significantly strain personal relationships and contribute to family conflict.

- Reduced Well-being: The overall impact on mental and emotional well-being can negatively impact productivity and overall quality of life.

Broader Economic Ramifications of the Student Loan Crisis

The student loan crisis doesn't just affect individuals; it creates systemic issues with wider economic consequences.

Impact on the Labor Market

Student loan debt influences career choices and entrepreneurial activity:

- Career Choices: Many graduates choose lower-paying, stable jobs to manage their debt, potentially hindering career progression and overall economic productivity.

- Entrepreneurial Activity: The financial constraints imposed by student loan debt discourage many from pursuing entrepreneurial ventures, reducing innovation and job creation.

- Brain Drain: Highly skilled individuals may choose to emigrate to countries with more favorable repayment options, creating a potential "brain drain" for the US economy.

Strain on Public Resources

Loan defaults and the costs of loan forgiveness programs strain public resources:

- Government Spending: The costs associated with administering loan forgiveness programs and managing defaults place a significant burden on taxpayers.

- Fiscal Policy Implications: The increasing cost of managing the student loan crisis necessitates difficult fiscal policy decisions, potentially impacting other crucial government programs.

- Long-term Economic Stability: The accumulation of student loan debt poses a significant threat to long-term economic stability and sustainable growth.

Intergenerational Effects of Student Debt

The student loan crisis creates a cycle of debt that impacts future generations:

- Decreased Upward Mobility: The burden of student loan debt can restrict upward mobility, perpetuating economic inequality across generations.

- Family Financial Strain: The financial burden of student loans can extend to families, impacting their ability to support their children and contribute to their future success.

- Long-Term Economic Inequality: The ongoing student loan crisis may exacerbate existing economic inequalities, creating a significant societal challenge.

Potential Solutions and Policy Recommendations to Address the Student Loan Crisis

Addressing the student loan crisis requires a multi-pronged approach focusing on both immediate relief and long-term solutions.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) adjust monthly payments based on income, but they have limitations:

- Extended Repayment Periods: IDRs often extend repayment periods, resulting in higher total interest paid over the life of the loan.

- Forgiveness After 20-25 Years: While some IDR plans offer loan forgiveness after 20-25 years, the process can be complex and eligibility requirements are stringent.

- Limited Awareness: Many borrowers are unaware of the availability and benefits of various IDR plans.

Loan Forgiveness Programs

Targeted loan forgiveness initiatives can provide immediate relief, but they have drawbacks:

- Cost to Taxpayers: Large-scale loan forgiveness programs would require substantial government spending, raising concerns about the fiscal impact.

- Equity Concerns: Some argue that loan forgiveness disproportionately benefits higher earners, while others believe it's a necessary step to address systemic inequality.

- Moral Hazard: Critics argue that loan forgiveness could create a moral hazard, encouraging future borrowers to take on excessive debt.

Investing in Affordable Higher Education

Making higher education more affordable is crucial for long-term solutions:

- Increased Funding for Grants and Scholarships: Expanding access to need-based grants and merit-based scholarships would reduce the reliance on student loans.

- Tuition Reform: Implementing policies to control tuition increases and promote transparency in college pricing would help make higher education more accessible.

- Investment in Community Colleges: Investing in community colleges and vocational training programs offers more affordable pathways to employment and skills development.

Financial Literacy Programs

Improving financial literacy among students is essential:

- Incorporating Financial Literacy into Curricula: Integrating financial literacy education into high school and college curricula would equip students with the knowledge and skills to manage their finances responsibly.

- Access to Financial Counseling: Providing access to affordable and accessible financial counseling services would support students in making informed decisions about their finances.

- Early Intervention: Early intervention programs that educate students about borrowing responsibly could prevent future financial difficulties.

Conclusion: Finding a Path Forward: Addressing the Student Loan Crisis for a Stronger Economy

The student loan crisis presents significant economic consequences, impacting individuals, the labor market, and the broader economy. Delayed life milestones, reduced spending, increased financial stress, and strain on public resources are all serious repercussions. Addressing this crisis requires a comprehensive approach incorporating income-driven repayment plans, carefully considered loan forgiveness programs, investment in affordable higher education, and improved financial literacy programs. Take control of your student loan debt today by exploring available options and advocating for policy changes that promote a more sustainable and equitable future. Learn more about the student debt crisis and its impact and advocate for solutions to the student loan crisis to build a stronger economy for all.

Featured Posts

-

Ajax Six Point Lead Diminished Analysis Of The Costly Refereeing Error For Az

May 28, 2025

Ajax Six Point Lead Diminished Analysis Of The Costly Refereeing Error For Az

May 28, 2025 -

M 5 15

May 28, 2025

M 5 15

May 28, 2025 -

Arsenal Transfer News Agbonlahor Tips Gunners For Premier League Star

May 28, 2025

Arsenal Transfer News Agbonlahor Tips Gunners For Premier League Star

May 28, 2025 -

The 99th Minute Ajaxs Nine Point Disaster And Lost Championship

May 28, 2025

The 99th Minute Ajaxs Nine Point Disaster And Lost Championship

May 28, 2025 -

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025

Latest Posts

-

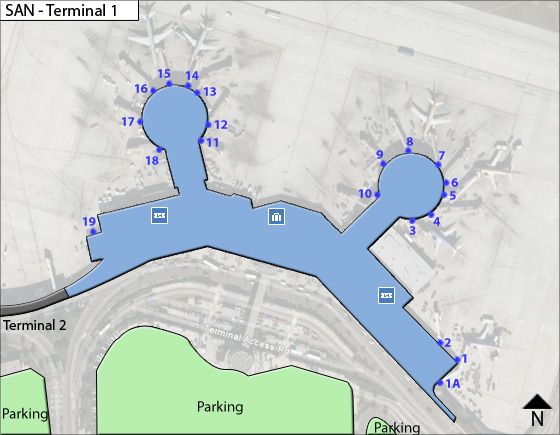

San Diego Airport San Flight Delay Information And Resources

May 30, 2025

San Diego Airport San Flight Delay Information And Resources

May 30, 2025 -

Avoiding San Diego International Airport Flight Delays Tips And Tricks

May 30, 2025

Avoiding San Diego International Airport Flight Delays Tips And Tricks

May 30, 2025 -

San Diego International Airport Flight Delays What You Need To Know

May 30, 2025

San Diego International Airport Flight Delays What You Need To Know

May 30, 2025 -

Enjoy Four Days Of Sunshine San Diego Weather Forecast

May 30, 2025

Enjoy Four Days Of Sunshine San Diego Weather Forecast

May 30, 2025 -

Schools Closed Again Winter Weather Impacts Continue

May 30, 2025

Schools Closed Again Winter Weather Impacts Continue

May 30, 2025