Student Loan Debt: Expert Advice From A Financial Planner

Table of Contents

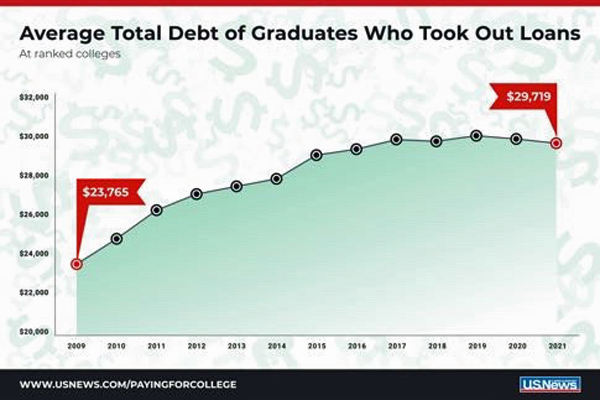

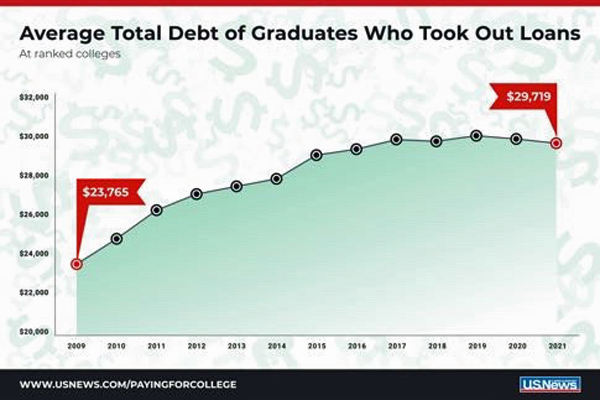

Understanding Your Student Loan Debt

Before you can effectively manage your student loan debt, you need a clear understanding of what you owe. This involves identifying the different types of loans and calculating your total debt.

Types of Student Loans

Understanding the distinctions between different types of student loans is paramount for effective repayment planning. Federal student loans, offered by the government, generally offer more flexible repayment options and protections compared to private student loans, which are provided by banks and credit unions. Furthermore, subsidized loans don't accrue interest while you're in school (under certain conditions), unlike unsubsidized loans.

- Federal Subsidized Loans: Interest isn't charged while you're enrolled at least half-time.

- Federal Unsubsidized Loans: Interest accrues from the time the loan is disbursed.

- Federal PLUS Loans: Loans for graduate students and parents of undergraduate students.

- Private Student Loans: Offered by private lenders; interest rates and terms vary widely.

These differences significantly impact your long-term repayment costs. Higher interest rates translate to higher overall payments, potentially extending the repayment period considerably.

Calculating Your Total Debt

Accurately calculating your total student loan debt is the first step towards effective management. This involves gathering all your loan documents, including statements showing the principal balance, interest rate, and any accumulated fees.

- Gather all loan documents: This includes promissory notes, loan agreements, and monthly statements.

- Use online calculators or spreadsheets: Many online tools can help you calculate your total debt, including both principal and accumulated interest.

- Account for all fees: Include origination fees, late payment fees, and any other associated charges.

Knowing the precise amount you owe allows you to develop a realistic repayment strategy and track your progress effectively.

Creating a Realistic Budget and Repayment Plan

Once you understand your student loan debt, the next crucial step is creating a realistic budget and a viable repayment plan. This process requires careful planning and discipline.

Budgeting for Loan Repayment

Creating a realistic budget that incorporates your student loan payments is vital. This involves carefully tracking your income and expenses to identify areas where you can cut back.

- Use budgeting apps: Many apps are available to track income and expenses automatically.

- Track expenses manually: If you prefer, you can track expenses using a spreadsheet or notebook.

- Identify unnecessary spending: Look for areas where you can reduce spending without sacrificing your quality of life (e.g., eating out less, cutting back on entertainment).

By meticulously tracking your expenses and income, you can create a budget that not only allows you to meet your loan obligations but also leaves room for savings and other financial goals.

Exploring Repayment Options

Several repayment plans are available for federal student loans, each with its own advantages and disadvantages. Understanding these options is crucial for choosing the best plan to suit your individual financial circumstances.

- Standard Repayment: Fixed monthly payments over 10 years.

- Extended Repayment: Fixed monthly payments over a longer period (up to 25 years).

- Income-Driven Repayment (IDR): Payments are based on your income and family size.

- Graduated Repayment: Payments start low and gradually increase over time.

Each plan has different implications for your total interest paid and the length of your repayment period. Carefully consider these factors when selecting a repayment plan.

Strategies for Managing and Reducing Student Loan Debt

Several strategies can help you manage and potentially reduce your student loan debt. These strategies include debt consolidation, refinancing, and seeking professional guidance.

Debt Consolidation

Debt consolidation involves combining multiple student loans into a single loan, potentially simplifying repayment and potentially lowering your interest rate (depending on your credit score and the lender).

- Pros: Simplifies repayment, potentially lower interest rates.

- Cons: May extend the repayment period, impacting credit score if not managed properly.

- Finding reputable lenders: Research and compare offers from different lenders to find the best terms.

Remember to carefully assess the terms and conditions of any consolidation loan before proceeding.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate.

- Factors affecting eligibility: Credit score, debt-to-income ratio, loan type.

- Comparison of refinancing offers: Shop around and compare offers from multiple lenders.

- Implications for credit score: The refinancing process may temporarily impact your credit score.

Refinancing can significantly reduce your overall repayment costs but requires careful consideration of the terms and conditions.

Seeking Professional Financial Advice

Consulting a financial advisor provides invaluable personalized guidance and support in navigating your student loan debt.

- Benefits of professional financial planning: Personalized strategies, unbiased advice, long-term financial planning.

- Questions to ask a financial advisor: Repayment strategies, debt management techniques, long-term financial goals.

- Finding a qualified advisor: Seek referrals from trusted sources, check credentials and experience.

A financial advisor can help create a comprehensive financial plan, encompassing not only student loan repayment but also other important financial goals such as saving for retirement and buying a home.

Conclusion

Effectively managing student loan debt requires a multi-pronged approach: understanding your debt, creating a realistic budget, exploring repayment options, and considering professional financial advice. Proactive planning is key to minimizing the long-term impact of student loans. Don't let student loan debt overwhelm you. Start planning your student loan repayment strategy now. Find a financial advisor who can help you navigate your student loan debt and achieve financial freedom.

Featured Posts

-

Comparing The Top Australian Crypto Casino Sites For 2025

May 17, 2025

Comparing The Top Australian Crypto Casino Sites For 2025

May 17, 2025 -

Singapore Airlines Announces Over Seven Months Bonus For Employees

May 17, 2025

Singapore Airlines Announces Over Seven Months Bonus For Employees

May 17, 2025 -

Valerio Therapeutics S A Delay In 2024 Annual Financial Report Publication

May 17, 2025

Valerio Therapeutics S A Delay In 2024 Annual Financial Report Publication

May 17, 2025 -

La Olimpiada Nacional Conociendo Al Representante De Reynosa David Del Valle Uribe

May 17, 2025

La Olimpiada Nacional Conociendo Al Representante De Reynosa David Del Valle Uribe

May 17, 2025 -

Giants Vs Mariners Series Injured List Update April 4 6

May 17, 2025

Giants Vs Mariners Series Injured List Update April 4 6

May 17, 2025

Latest Posts

-

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025 -

Recession Proof Stocks Is Uber One Of Them

May 17, 2025

Recession Proof Stocks Is Uber One Of Them

May 17, 2025 -

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025 -

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025 -

Real Money Online Casinos In New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos In New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025