Student Loan Debt: Understanding The Government's Increased Enforcement

Table of Contents

Increased Collection Activities by the Department of Education

The Department of Education (ED) plays a central role in managing the federal student loan program and is stepping up its collection efforts significantly. This intensified focus translates into several aggressive new strategies for recovering outstanding student loan debt.

-

Increased Wage Garnishment: The ED is increasingly resorting to wage garnishment, where a portion of a borrower's paycheck is automatically deducted to repay their loans. This can severely impact a borrower's monthly budget and financial stability. The process typically involves a legal notice and can result in significant financial hardship if not addressed promptly.

-

More Aggressive Tax Refund Offset: The government now more aggressively uses tax refund offset programs to recover outstanding student loan debt. This means that a borrower's federal tax refund can be entirely or partially seized to repay their loans. This can leave borrowers with little to no financial resources after tax season.

-

Heightened Use of Private Collection Agencies: The ED is increasingly contracting with private collection agencies to pursue borrowers with delinquent student loans. These agencies employ aggressive collection tactics, which can include repeated calls, letters, and even legal action. Borrowers should be aware of their rights when dealing with these agencies and document all communications.

-

Expansion of Credit Reporting for Defaulted Loans: The consequences of defaulting on student loans are more severe than ever. The ED now reports defaulted loans to credit bureaus, negatively impacting borrowers' credit scores and making it harder to secure loans, mortgages, or even rent an apartment in the future. This can have long-term repercussions on financial stability.

Statistics from the Department of Education show a significant increase in the use of all these collection methods over the past few years, highlighting the government's determined approach to recovering student loan debt.

New Regulations and Legislation Impacting Student Loan Borrowers

Recent legislative changes and new regulations have significantly altered the landscape of student loan repayment for borrowers. These changes are designed to improve repayment and reduce defaults but can also create challenges for borrowers.

-

Changes in Income-Driven Repayment Plans: While income-driven repayment plans aim to make monthly payments more manageable based on income, recent changes have often led to higher overall loan costs due to extended repayment periods and increased interest accrual. Understanding the nuances of these plans is crucial.

-

Increased Scrutiny of Loan Forgiveness Programs: Programs offering student loan forgiveness, such as Public Service Loan Forgiveness (PSLF), now face stricter eligibility requirements and more rigorous documentation processes. This makes it harder for borrowers to qualify for these valuable programs.

-

New Rules Regarding Loan Consolidation: Consolidating multiple student loans into a single loan can simplify repayment, but new regulations have introduced complexities. It's essential to carefully weigh the pros and cons before consolidating, ensuring that it's the best strategy for your individual circumstances.

These regulatory changes impact borrowers' ability to manage their student loan debt effectively. Careful planning and understanding of these changes are vital.

The Impact on Borrowers: Understanding Your Rights and Options

Facing aggressive student loan debt collection can be overwhelming, but understanding your rights and available options is crucial. Don't panic; there are resources available to help.

-

Contacting the Student Loan Servicer: Maintaining open and proactive communication with your student loan servicer is paramount. They can provide information on repayment plans, address concerns, and potentially help you avoid default.

-

Exploring Income-Driven Repayment Plans: Income-driven repayment plans can significantly lower monthly payments, making repayment more manageable. However, eligibility criteria vary, so it's important to carefully review your options.

-

Seeking Loan Rehabilitation or Consolidation: Loan rehabilitation can help restore your credit standing after default, while consolidation can simplify repayment. Understand the requirements and implications of each before proceeding.

-

Considering Options Like Bankruptcy (Limited Applicability): While bankruptcy rarely discharges federal student loans, there are very limited exceptions. Consult with a legal professional to explore this option, only if you meet extremely strict criteria.

Navigating the complexities of student loan repayment: Effective student loan management requires careful budgeting and financial planning. Track your expenses, create a realistic repayment plan, and prioritize paying down your debt. Seek professional financial advice if needed. Numerous government websites offer valuable resources and information on managing student loan debt.

Conclusion: Taking Control of Your Student Loan Debt

The government's increased enforcement of student loan debt is undeniable. New collection activities, stricter regulations, and altered repayment plans create significant challenges for borrowers. However, understanding your rights, exploring available options, and proactively managing your debt are crucial steps in mitigating the impact. Don't let student loan debt overwhelm you. Take control by researching available resources, contacting your servicers, and exploring your repayment options today. Effective student loan management, coupled with a clear understanding of the government's approach to student loan repayment, is key to achieving financial stability. Remember to utilize all available resources – including government websites dedicated to student loan forgiveness and student loan management – to navigate this complex landscape.

Featured Posts

-

The Closure Of Anchor Brewing Company Whats Next

May 17, 2025

The Closure Of Anchor Brewing Company Whats Next

May 17, 2025 -

Floridas Generation Next Strengthening School Security And Lockdown Response

May 17, 2025

Floridas Generation Next Strengthening School Security And Lockdown Response

May 17, 2025 -

Mc Collums Transition From Drake To Iowa A New Chapter

May 17, 2025

Mc Collums Transition From Drake To Iowa A New Chapter

May 17, 2025 -

The Impact Of Us Tariffs On Hondas Production And Canadian Export Potential

May 17, 2025

The Impact Of Us Tariffs On Hondas Production And Canadian Export Potential

May 17, 2025 -

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025

Latest Posts

-

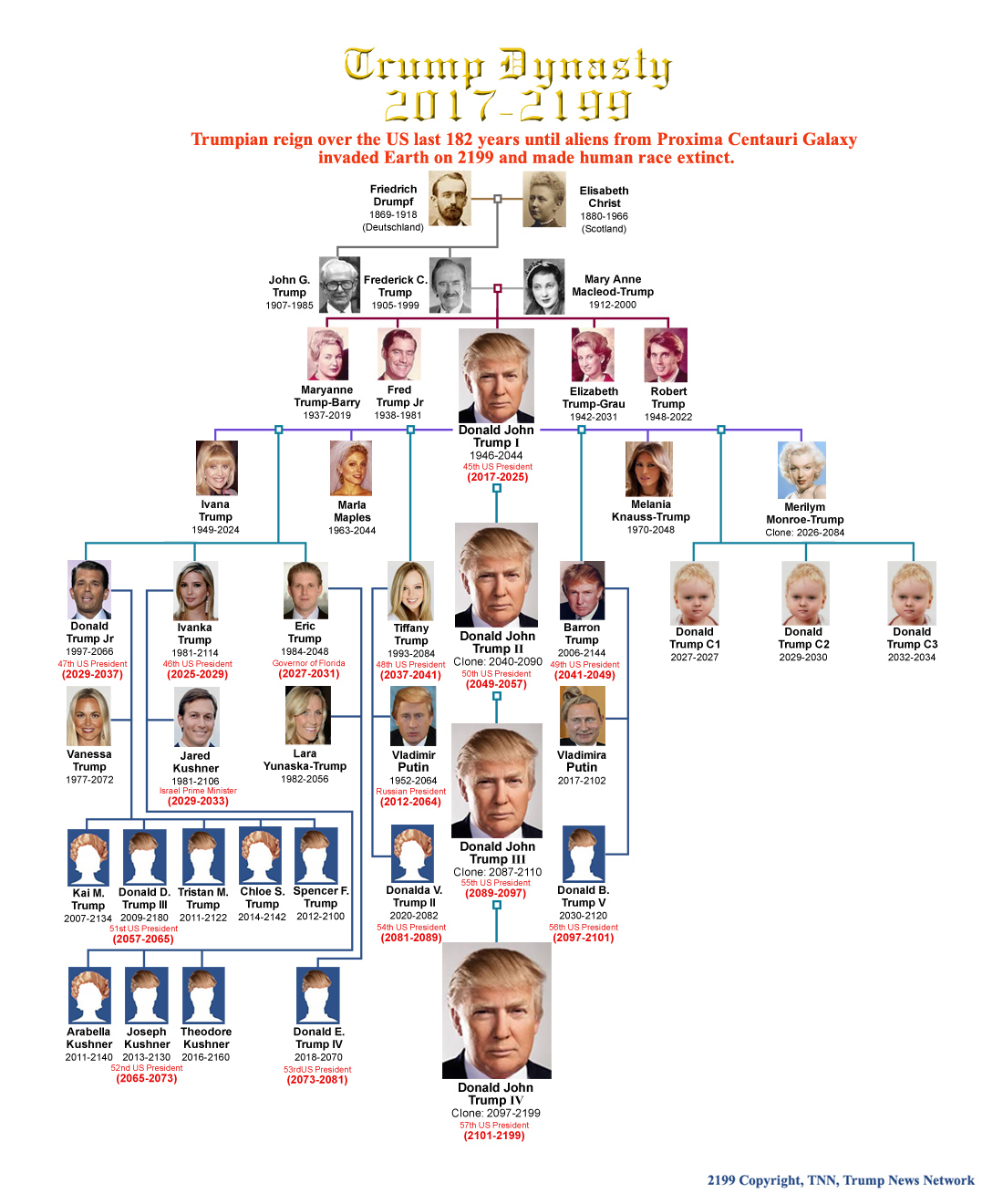

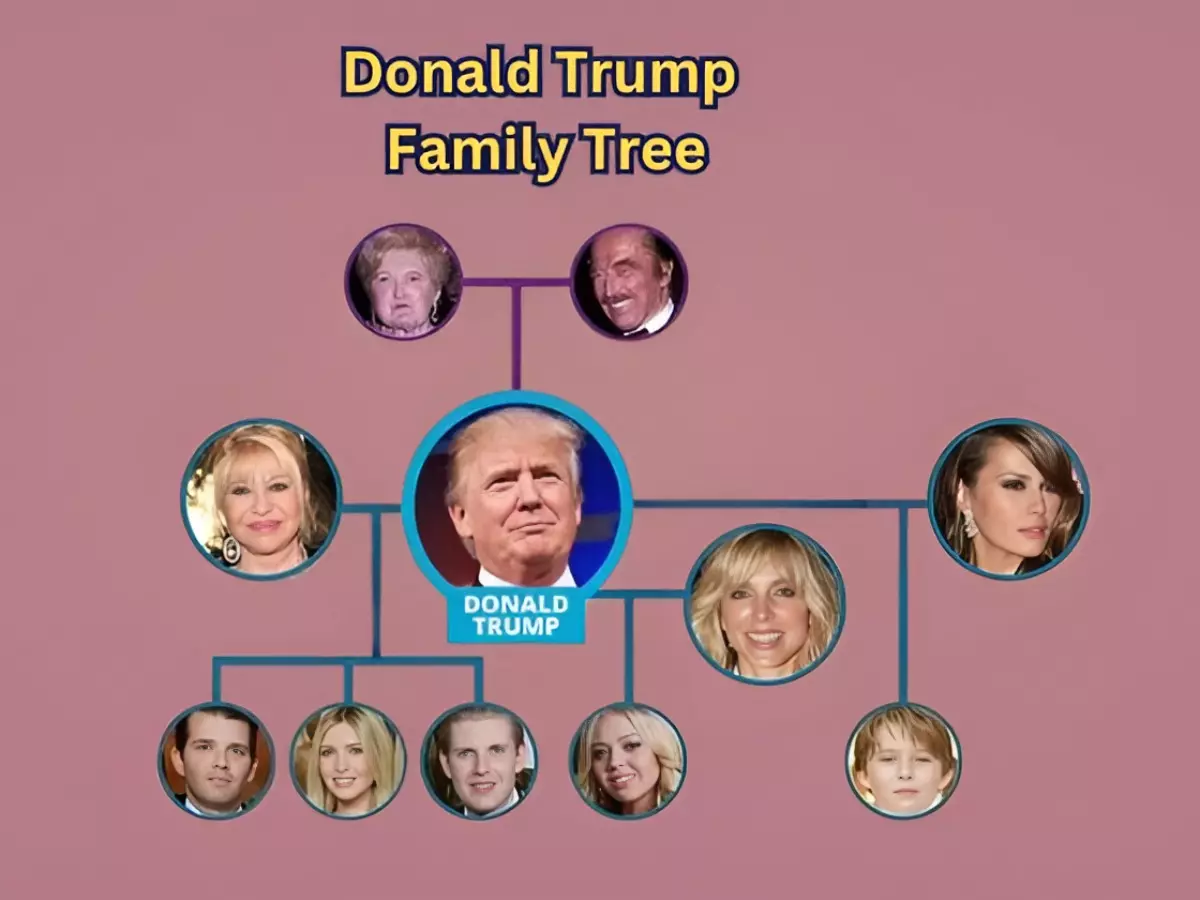

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025 -

A Look At The Trump Family Tree New Addition Alexander Arrives

May 17, 2025

A Look At The Trump Family Tree New Addition Alexander Arrives

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025 -

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025 -

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025