Suncor Hits Record Production, But Sales Growth Lags Behind

Table of Contents

Record Production: A Closer Look at Suncor's Output

Suncor's recent announcement highlighted a substantial increase in oil production, exceeding previous records. This success speaks volumes about the company's upstream operations and their enhanced efficiency. Let's break down the key contributors:

-

Specific figures: Suncor reported a [insert specific percentage or numerical increase] rise in oil production compared to [specify time period, e.g., the same period last year or the previous quarter]. This translates to [insert specific volume of oil produced].

-

Operational Efficiency Improvements: The company has implemented several strategies to boost operational efficiency, including [mention specific examples like technological upgrades, streamlined processes, or improved workforce management]. These improvements have directly contributed to the higher production capacity.

-

New Projects and Technologies: The contribution of new projects and technological advancements to the production boost cannot be ignored. [Mention specific projects or technologies if available, providing details about their impact on production]. This demonstrates Suncor's commitment to innovation within the petroleum production sector.

-

Upstream Operations' Success: Suncor's robust upstream operations are the cornerstone of this achievement. Their focus on [mention specific areas like exploration, extraction, and resource management] has yielded significant positive results, showcasing their expertise in the Canadian energy landscape.

Sales Growth Lag: Why Revenue Isn't Keeping Pace

Despite record-breaking Suncor production, sales growth hasn't mirrored this success. This discrepancy raises important questions regarding the company's downstream operations and market dynamics.

-

Production vs. Revenue Gap: While production has soared, the corresponding increase in revenue has been significantly less. This gap needs further analysis to determine the underlying causes, likely a combination of several factors.

-

Impact of Fluctuating Oil Prices: Oil price volatility plays a significant role. Even with increased production, lower oil prices directly impact the overall revenue generated from sales. [Mention specific price fluctuations and their impact on Suncor's revenue].

-

Refining Margins and Downstream Profitability: Suncor's downstream operations, particularly refining, are crucial. Lower refining margins, influenced by factors such as global demand and competitor actions, significantly affect downstream profitability. This contributes to the sales growth lag, even with high production volumes.

-

Market Demand and Sales: Market demand for refined petroleum products also needs to be considered. Even with increased production, if the market demand is lower or if there's increased competition, sales may not reflect the production increase.

The Role of Refining Margins and Downstream Challenges

Analyzing Suncor's refining margins is critical to understanding the sales growth lag.

-

Refining Operations and Profitability: Suncor's refining capacity and its efficiency directly impact their downstream profitability. A detailed analysis of their refining operations and the associated costs is necessary to fully assess the situation.

-

Crude Oil Prices and Refining Margins: There's a complex relationship between crude oil prices and refining margins. Fluctuations in crude oil prices can significantly impact the profitability of refining operations.

-

Factors Affecting Product Demand and Pricing: Global and regional demand for refined petroleum products influences pricing and, consequently, Suncor's sales revenue. Factors such as economic growth, transportation fuel consumption, and seasonal variations play a part.

-

Improving Downstream Profitability: Suncor needs to explore strategic initiatives to enhance downstream profitability, such as optimizing refining processes, investing in new technologies, and diversifying product offerings.

Financial Implications and Future Outlook for Suncor

The discrepancy between Suncor production and sales growth has significant financial implications.

-

Impact on Overall Financial Performance: The reduced revenue growth, despite record production, will undoubtedly impact Suncor's overall financial performance. This may affect profitability, shareholder returns, and investment decisions.

-

Suncor Stock Performance: The market's reaction to Suncor's financial results will be reflected in its stock performance. Investors will likely scrutinize these results, potentially impacting the company's stock valuation.

-

Expert Opinions and Future Projections: Analysts' opinions and market forecasts regarding Suncor's future performance will depend on the company's ability to address the production-sales imbalance.

-

Strategies to Improve Sales Growth: Suncor may need to implement strategies such as improving downstream operations, exploring new markets, or diversifying its energy portfolio to improve sales growth.

-

Broader Energy Market Trends: The overall energy market trends, including the transition to renewable energy sources and global geopolitical factors, will also significantly influence Suncor's future outlook.

Conclusion

Suncor's record oil production is a notable achievement, but the lagging sales growth reveals a complex situation. Fluctuating oil prices, challenges in downstream operations, and refining margins all contribute to this discrepancy. The financial implications are significant and require strategic action from Suncor. This analysis highlights the importance of understanding the interplay between production and sales in the dynamic oil and gas market. Stay informed on the evolving dynamics of the energy sector and Suncor's strategic responses by following our future updates on Suncor Energy, its production levels, and its sales growth trajectory. Understanding the interplay between production and sales is crucial for navigating the complexities of the oil and gas market.

Featured Posts

-

King Pro Maska Ta Trampa Zrada Ta Pidtrimka Putina

May 10, 2025

King Pro Maska Ta Trampa Zrada Ta Pidtrimka Putina

May 10, 2025 -

Current Petrol Prices In Nigeria The Roles Of Dangote And Nnpc

May 10, 2025

Current Petrol Prices In Nigeria The Roles Of Dangote And Nnpc

May 10, 2025 -

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 10, 2025

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 10, 2025 -

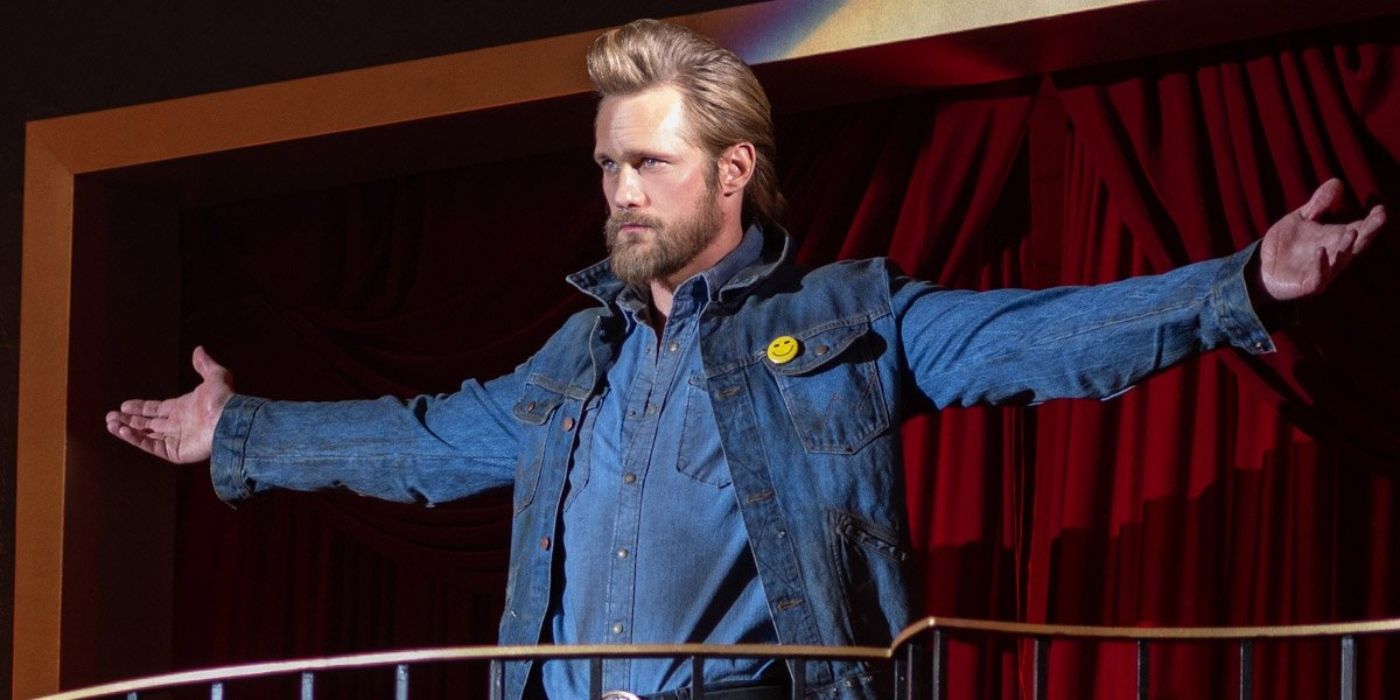

Rethinking Stephen King 4 Unexpected Randall Flagg Theories

May 10, 2025

Rethinking Stephen King 4 Unexpected Randall Flagg Theories

May 10, 2025 -

A European Champions Unlikely Path Rejected By Wolves

May 10, 2025

A European Champions Unlikely Path Rejected By Wolves

May 10, 2025