Suncor Production At Record High: Understanding The Sales Volume Dip

Table of Contents

Record-High Suncor Oil Sands Production: A Detailed Look

The surge in Suncor oil sands production is a result of several contributing factors, reflecting both technological advancements and favorable geopolitical circumstances.

Increased Extraction Capabilities

Suncor's impressive output is directly linked to significant improvements in extraction technology and operational efficiency.

- Implementation of enhanced oil recovery techniques: These advanced methods maximize oil extraction from existing reservoirs.

- Expansion of mining operations: Increased mining capacity has led to a greater volume of bitumen being processed.

- Optimized extraction processes: Streamlined processes and automation have boosted overall efficiency.

Suncor's oil sands production has seen a remarkable year-over-year increase of X% (replace X with actual data), resulting in a total of Y barrels produced (replace Y with actual data). This demonstrates a significant leap in production capacity within the Suncor oil sands operations. These improvements in extraction technology, combined with expanded mining operations, have been pivotal to this success.

Favorable Geopolitical Factors

Global events have also played a crucial role in boosting Suncor oil sands production.

- Increased global demand for oil: The global recovery from the pandemic has fueled a surge in energy consumption.

- Reduced OPEC+ production: Decisions by OPEC+ members to constrain oil output have created a tighter global supply, benefiting producers like Suncor.

The increased global oil demand, coupled with the impact of reduced OPEC+ production, has created a favorable environment for Suncor production. These geopolitical risks and opportunities have significantly influenced the company's output. Understanding the dynamics of the energy markets is key to interpreting Suncor's performance.

Declining Suncor Sales Volume: Unpacking the Discrepancy

While Suncor production reached record highs, the company experienced a simultaneous decrease in sales volume. Several interconnected factors explain this seeming contradiction.

Refinery Maintenance and Capacity Constraints

Planned and unplanned refinery maintenance has significantly impacted Suncor's ability to process and sell its oil.

- Scheduled shutdowns: Routine maintenance at various Suncor refineries temporarily reduced refining capacity.

- Unexpected outages: Unforeseen technical issues further hampered refining operations.

These disruptions to downstream operations significantly reduced the volume of refined products available for sale, impacting the overall Suncor sales volume, despite the high levels of Suncor production. The impact on refining capacity was substantial, leading to a notable shortfall in the amount of refined products reaching the market.

Impact of Shifting Global Energy Markets

The fluctuating nature of the global energy landscape also contributed to the decline in Suncor sales volume.

- Oil price volatility: Unpredictable oil price fluctuations affected market demand and pricing strategies.

- Changes in consumer demand: Shifts in consumer preferences and energy consumption patterns also played a role.

- Competition from alternative energy sources: The growing adoption of renewable energy sources has increased competition in the energy sector.

The interplay between oil prices, the energy transition, the rise of renewable energy, and increased market competition has presented challenges to Suncor's sales, despite its record Suncor production.

Inventory Management and Strategic Stockpiling

Suncor's inventory management strategies also played a role in the sales volume dip.

- Strategic stockpiling: The company may have increased its oil inventory in anticipation of future market fluctuations.

- Supply chain management: Optimizing supply chain management may have resulted in a temporary reduction in sales to manage inventory levels effectively.

Analyzing oil inventory levels and understanding Suncor's approach to strategic stockpiling is crucial to fully understanding the sales figures. Effective supply chain management is essential in navigating the complexities of the energy market.

Analyzing Suncor's Financial Performance in Light of the Discrepancy

The gap between record Suncor production and lower sales volume has had a significant impact on the company's financial performance.

Impact on Revenue and Profitability

The lower sales volume directly affected Suncor's financial outcomes.

- Reduced revenue: Lower sales translated to lower overall revenue despite high production.

- Affected profit margins: The production-sales gap impacted profit margins, potentially leading to lower profitability.

- Impact on shareholder value: This discrepancy could affect investor confidence and overall shareholder value.

Analyzing Suncor revenue, profit margins, and the overall financial performance is crucial in understanding the full scope of this discrepancy. The impact on shareholder value needs careful consideration.

Future Outlook and Strategic Adjustments

Suncor will likely need to implement strategic adjustments to address this imbalance.

- Refining capacity improvements: Investing in and improving refining capacity to process and sell higher volumes.

- Enhanced marketing and sales strategies: Developing more effective strategies to increase sales in a competitive market.

- Diversification of energy portfolio: Expanding into renewable energy sources to mitigate risks associated with oil price volatility.

These strategic adjustments will be crucial for Suncor's long-term growth and demonstrate the company's commitment to navigating the evolving energy markets. The future outlook depends on Suncor's ability to execute these strategies successfully.

Conclusion: Suncor Production: Reconciling Record Output with Sales Volume

The discrepancy between record Suncor production and lower sales volume is a complex issue stemming from a combination of refinery maintenance, fluctuating global energy markets, and strategic inventory management. Understanding these factors is vital for accurately assessing Suncor's financial performance and future prospects.

Key takeaways include the significant impact of refinery maintenance on sales, the influence of global energy market dynamics, and the role of strategic inventory management in shaping sales figures. These factors highlight the challenges faced by energy companies in navigating a volatile market.

To stay informed on how Suncor addresses this discrepancy and continues to adapt to the changing energy landscape, continue to follow developments in Suncor oil production, Suncor energy production, and Suncor sales volume. Understanding these trends is key to gaining a comprehensive understanding of the future of energy.

Featured Posts

-

Podpisanie Oboronnogo Soglasheniya Makronom I Tuskom 9 Maya Klyuchevye Momenty

May 09, 2025

Podpisanie Oboronnogo Soglasheniya Makronom I Tuskom 9 Maya Klyuchevye Momenty

May 09, 2025 -

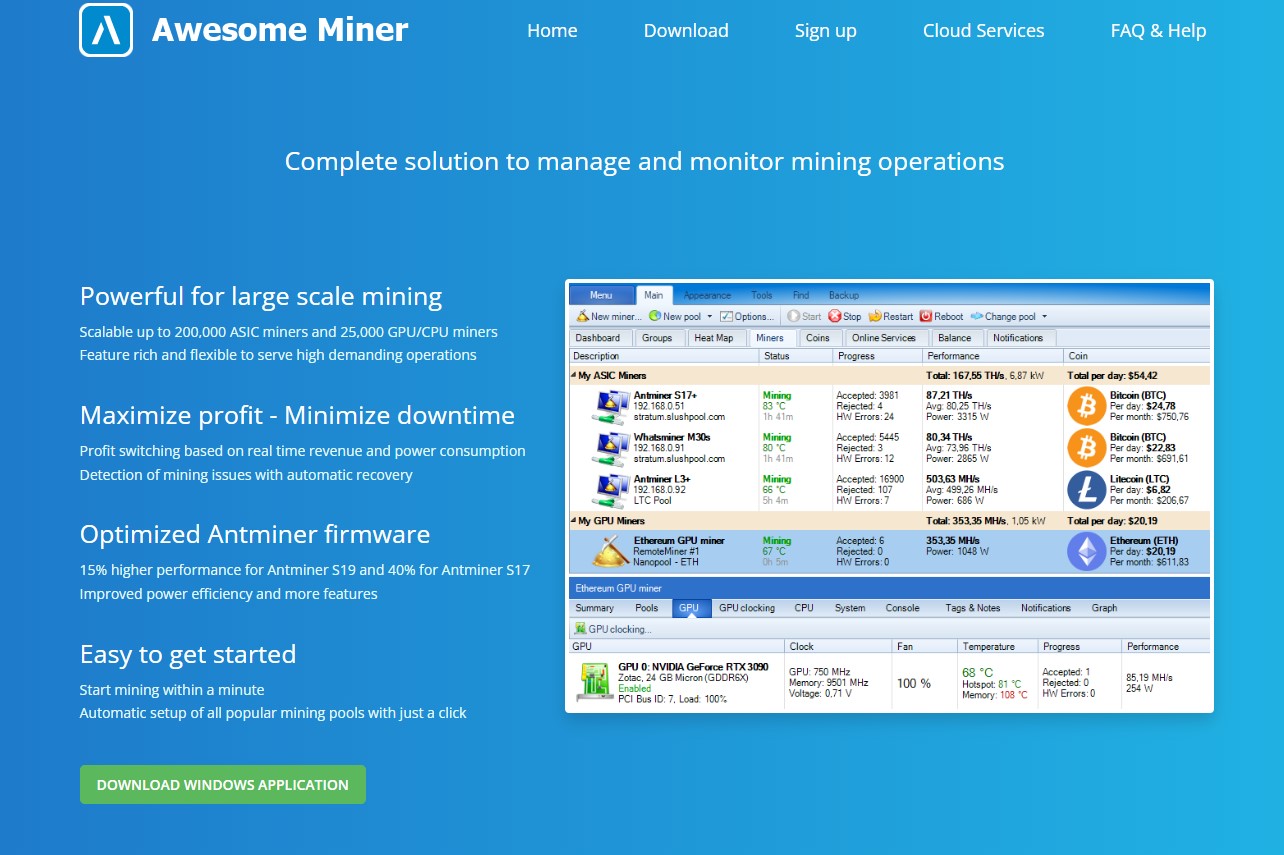

Bitcoin Madenciligi Karlilik Duesuesuenuen Ardindaki Sebepler

May 09, 2025

Bitcoin Madenciligi Karlilik Duesuesuenuen Ardindaki Sebepler

May 09, 2025 -

Vegas Golden Knights Defeat Columbus Blue Jackets 4 0 Hills Stellar Goaltending Leads The Way

May 09, 2025

Vegas Golden Knights Defeat Columbus Blue Jackets 4 0 Hills Stellar Goaltending Leads The Way

May 09, 2025 -

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025 -

Remaining Nhl Season 2024 25 Top Storylines To Follow

May 09, 2025

Remaining Nhl Season 2024 25 Top Storylines To Follow

May 09, 2025