Swissquote Bank: Euro And European Futures Rise, US Futures Fall

Table of Contents

Euro and European Futures Surge: Understanding the Reasons

The recent strength of the Euro and the rise in European futures contracts signal a positive outlook for the European economy. Several factors contribute to this upward trajectory:

-

Positive Economic Indicators from the Eurozone: Recent data releases, including stronger-than-expected GDP growth and robust employment figures, point to a resilient Eurozone economy. This positive economic sentiment fuels investor confidence, driving demand for the Euro and related futures.

-

Changes in the European Central Bank's (ECB) Monetary Policy: The ECB's measured approach to interest rate adjustments, balancing inflation concerns with economic growth, has instilled a degree of stability in the market. This predictability contributes to the Euro's strength.

-

Increased Investor Confidence in the European Market: Growing confidence in the European Union's economic stability and its response to global challenges is attracting significant foreign investment, further boosting the Euro.

-

Geopolitical Factors Influencing the Euro's Value: While geopolitical risks remain globally, the Eurozone's relative stability compared to other regions has made it a safe haven for some investors, positively impacting its value.

-

Swissquote Trading Platform Advantage: Swissquote Bank's advanced trading platform offers seamless access to Euro and European futures contracts, allowing traders to capitalize on these market trends effectively. Its intuitive interface, combined with real-time market data and sophisticated charting tools, facilitates informed decision-making.

US Futures Dip: Identifying Contributing Factors

In contrast to the European market's buoyancy, US futures have experienced a decline, indicating potential concerns within the US economy:

-

Concerns about US Inflation and the Federal Reserve's Response: Persistent inflationary pressures and the Federal Reserve's aggressive interest rate hikes to combat them are weighing heavily on investor sentiment. The uncertainty surrounding the effectiveness of these measures contributes to market volatility.

-

Slowdown in US Economic Growth: Signs of slowing economic growth in the US, coupled with potential recessionary risks, are causing investors to adopt a more cautious approach, leading to a decline in futures contracts.

-

Geopolitical Uncertainties Impacting the US Market: Global geopolitical events can impact investor confidence and market stability. These uncertainties contribute to the overall decline in US futures.

-

Key Economic Data Releases: Specific negative economic data releases, such as lower-than-expected manufacturing indices or consumer confidence reports, can exacerbate market anxieties and push US futures downwards.

-

Swissquote Forex Trading and Risk Management: Swissquote Bank offers a robust range of tools and resources to help traders navigate the volatility in the US market. Access to real-time analysis, educational materials, and risk management tools is crucial for mitigating potential losses during periods of market uncertainty. Its forex trading capabilities provide the flexibility to adapt to changing market conditions.

Trading Implications and Strategies with Swissquote Bank

The contrasting market trends highlighted by Swissquote Bank present both opportunities and challenges for traders:

-

Strategies for Profiting from the Rising Euro and European Futures: Adopting long positions on Euro and European futures contracts could be a viable strategy for traders who believe the current upward trend will continue. However, risk management remains crucial.

-

Strategies for Mitigating Risk in the Falling US Futures Market: Hedging strategies, short positions, or carefully selecting less volatile assets are potential approaches to mitigate risk in the declining US futures market.

-

Swissquote Bank's Resources for Informed Trading: Swissquote Bank's platform provides a wealth of resources, including advanced charting tools, in-depth market analysis reports, and educational materials to support traders in making informed decisions. These tools are crucial for understanding market dynamics and implementing effective strategies.

-

Risk Management is Paramount: Regardless of the chosen trading strategy, effective risk management is paramount. Traders should always define clear stop-loss orders and diversify their portfolios to limit potential losses.

Conclusion

Swissquote Bank's market analysis reveals a significant divergence between European and US futures markets. The Euro and European futures are experiencing a surge driven by positive economic indicators, while US futures are declining due to concerns about inflation and economic slowdown. Understanding these contrasting trends is critical for making informed trading decisions. Leverage Swissquote Bank's platform and resources, including its advanced trading tools and insightful market analysis, to navigate this dynamic market environment effectively. Open a Swissquote Bank account today and start trading the Euro and other futures contracts, capitalizing on the current market opportunities. Visit Swissquote Bank to explore trading opportunities in the dynamic global markets.

Featured Posts

-

Fani Eurowizji Werdykt Dla Steczkowskiej Powod Do Radosci

May 19, 2025

Fani Eurowizji Werdykt Dla Steczkowskiej Powod Do Radosci

May 19, 2025 -

Alfonso Arus Critica A Melody En Arusero Tras Su Eleccion Para Eurovision 2025

May 19, 2025

Alfonso Arus Critica A Melody En Arusero Tras Su Eleccion Para Eurovision 2025

May 19, 2025 -

Cursus Universitaire En Archives A Poitiers

May 19, 2025

Cursus Universitaire En Archives A Poitiers

May 19, 2025 -

Filistinli Muelteciler Gazze Deki Varolus Muecadelesi

May 19, 2025

Filistinli Muelteciler Gazze Deki Varolus Muecadelesi

May 19, 2025 -

El Cne Y Las Elecciones Primarias De 2025 Un Analisis Del Proceso

May 19, 2025

El Cne Y Las Elecciones Primarias De 2025 Un Analisis Del Proceso

May 19, 2025

Latest Posts

-

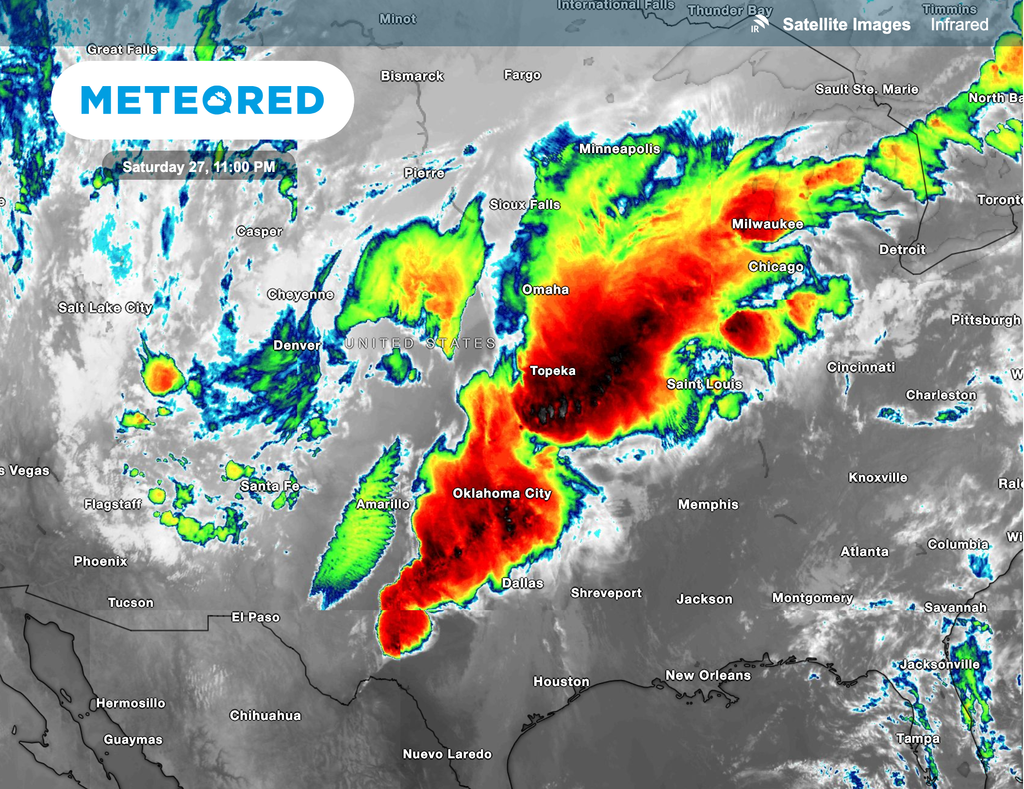

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025 -

25 Killed As Powerful Tornadoes Slam Central Us Causing Catastrophic Damage

May 19, 2025

25 Killed As Powerful Tornadoes Slam Central Us Causing Catastrophic Damage

May 19, 2025 -

Central Us Tornadoes Death Toll Rises To 25 Significant Damage Reported

May 19, 2025

Central Us Tornadoes Death Toll Rises To 25 Significant Damage Reported

May 19, 2025 -

Devastating Tornadoes Claim 25 Lives Leave Trail Of Destruction Across Two States

May 19, 2025

Devastating Tornadoes Claim 25 Lives Leave Trail Of Destruction Across Two States

May 19, 2025 -

Tornado Outbreak 25 Dead Widespread Destruction Across Central Us

May 19, 2025

Tornado Outbreak 25 Dead Widespread Destruction Across Central Us

May 19, 2025