Swissquote Bank On Recent Developments In Sovereign Bond Markets

Table of Contents

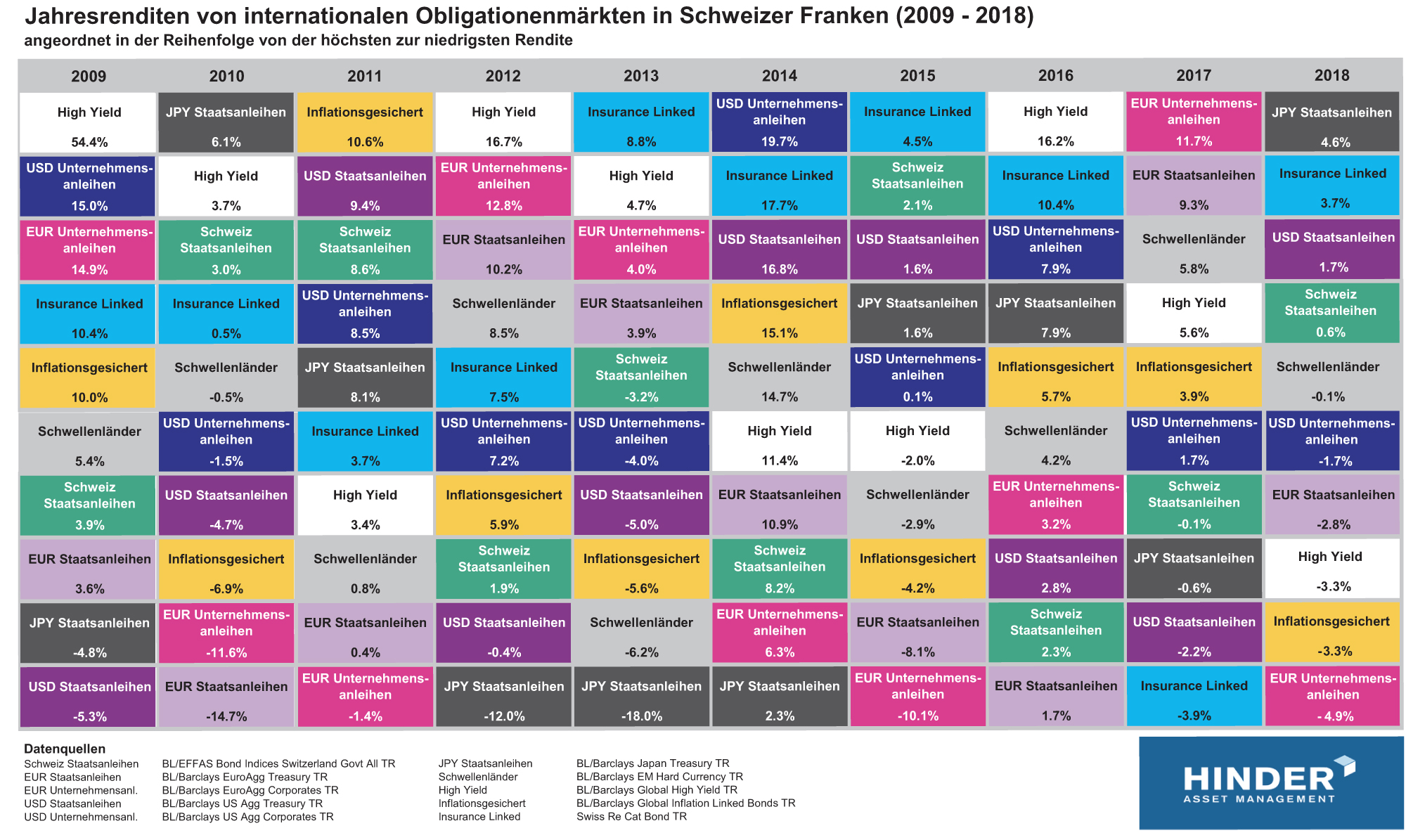

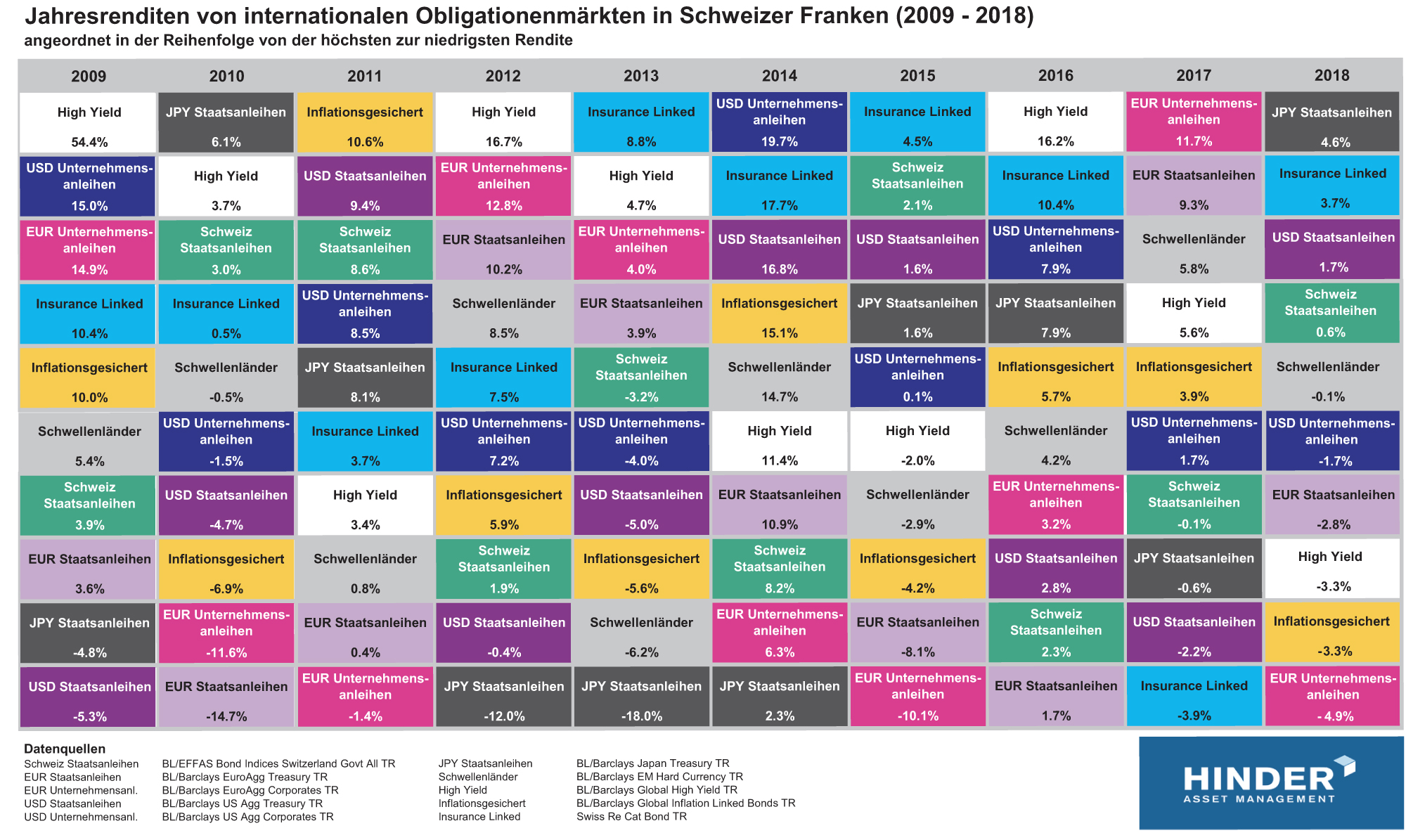

Rising Interest Rates and Their Impact on Sovereign Bond Yields

The relationship between interest rate hikes and sovereign bond yields is inverse. As central banks raise interest rates to combat inflation, the yields on existing sovereign bonds tend to rise to reflect the increased opportunity cost of holding lower-yielding bonds. This is because investors demand higher returns to compensate for the higher returns available from new, higher-yielding bonds. This impact varies depending on several factors, expertly analyzed by Swissquote Bank.

- Impact on different maturity bonds: Short-term bonds are generally more sensitive to interest rate changes than long-term bonds. Swissquote Bank's analysis provides detailed breakdowns of this sensitivity across different maturities.

- The role of central bank policy: Central bank policies significantly influence sovereign bond yields. Swissquote Bank closely monitors announcements and actions from central banks globally to predict their impact on the market.

- Geographic variations in yield responses: The response of sovereign bond yields to interest rate hikes varies across countries based on factors like economic strength, political stability, and debt levels. Swissquote Bank offers detailed country-specific analyses to help you understand these variations.

- Swissquote Bank's analysis: Swissquote Bank provides comprehensive yield curve analysis, providing insights into the expected future path of interest rates and their implications for sovereign bond investments. This allows investors to make informed decisions based on their risk tolerance and investment horizon.

(Insert a chart or graph here illustrating yield curves from Swissquote Bank reports)

Inflationary Pressures and Sovereign Debt Sustainability

Inflation erodes the real value of fixed-income investments like sovereign bonds. High inflation leads to higher interest rates, increasing borrowing costs for governments and potentially impacting their ability to service their debt. Swissquote Bank's analysis helps investors assess this crucial risk.

- The correlation between inflation and interest rates: As inflation rises, central banks typically raise interest rates, impacting sovereign bond yields as discussed above. Swissquote Bank provides in-depth analysis of this correlation, helping investors predict market movements.

- Analysis of specific countries: Swissquote Bank assesses the debt sustainability of various countries, highlighting those facing significant challenges due to high inflation and debt burdens. This includes assessing debt-to-GDP ratios and other key indicators.

- Swissquote Bank's creditworthiness assessment: Swissquote Bank employs rigorous methodologies to assess the creditworthiness of sovereign debt, helping investors identify potentially risky investments.

- Investment strategies for managing inflation risk: Swissquote Bank offers recommendations for managing inflation risk, including strategies like investing in inflation-linked bonds or diversifying across different asset classes.

Geopolitical Risks and Their Influence on Sovereign Bond Markets

Geopolitical events, such as wars, political instability, or sanctions, can significantly impact sovereign bond prices. These events often create uncertainty and risk aversion, leading investors to seek safety in less volatile assets, thus impacting sovereign bond markets. Swissquote Bank provides expert analysis of these risks.

- Examples of recent geopolitical events and their market impact: Swissquote Bank's analysts closely monitor and analyze the impact of events like the war in Ukraine, political tensions in other regions, and trade disputes, assessing their influence on various sovereign bond markets.

- Swissquote Bank's geopolitical risk assessment: Swissquote Bank incorporates geopolitical risks into its analysis, providing investors with a comprehensive understanding of the potential impact of these events on their investments.

- Diversification strategies for mitigating geopolitical risk: Swissquote Bank advises on diversification strategies to reduce exposure to specific geopolitical risks. This includes diversifying across different countries and regions.

- Specific sovereign bonds more susceptible to geopolitical risk: Swissquote Bank identifies sovereign bonds from countries deemed more vulnerable to geopolitical risks, allowing investors to make informed decisions.

Opportunities and Challenges for Investors in Sovereign Bond Markets

The current environment presents both opportunities and challenges for sovereign bond investors. While rising interest rates offer potential for higher returns, investors need to carefully manage the associated risks. Swissquote Bank provides crucial insights to help investors navigate this landscape.

- Potential for higher returns in a rising-rate environment: Swissquote Bank highlights opportunities to earn higher returns by strategically investing in sovereign bonds in a rising-rate environment.

- Risks associated with investing in sovereign bonds from emerging markets: Swissquote Bank analyzes the risks associated with investing in sovereign bonds from emerging markets, considering factors like political stability, economic growth, and currency fluctuations.

- The role of diversification in managing risk: Swissquote Bank emphasizes the importance of diversification to manage risk effectively in the sovereign bond market.

- Swissquote Bank's recommendations for investors: Swissquote Bank provides specific investment recommendations tailored to different risk tolerances and investment objectives, leveraging its platform and insights.

Conclusion: Navigating the Sovereign Bond Market with Swissquote Bank

The sovereign bond market is dynamic and influenced by several factors, including rising interest rates, inflation, and geopolitical risks. These factors present both opportunities and challenges for investors. Swissquote Bank's expert analysis and comprehensive resources provide crucial support for investors seeking to navigate this complex market effectively. Swissquote Bank's sovereign bond market expertise allows investors to make informed decisions, manage risk, and potentially achieve their investment goals. Learn more about navigating the complexities of sovereign bond markets with Swissquote Bank's expert analysis and trading platform. Visit [link to relevant Swissquote Bank page] today to explore your investment options and unlock the potential of sovereign bond investing with Swissquote Bank.

Featured Posts

-

Dalfsen Amber Alert Leads To Arrest Of Biological Parents

May 19, 2025

Dalfsen Amber Alert Leads To Arrest Of Biological Parents

May 19, 2025 -

Eurovision 2025 Az Rbaycani S Fur T Msil Ed C K

May 19, 2025

Eurovision 2025 Az Rbaycani S Fur T Msil Ed C K

May 19, 2025 -

Ufc 313 Star Concedes Opponent Deserved Victory Amidst Robbery Claims

May 19, 2025

Ufc 313 Star Concedes Opponent Deserved Victory Amidst Robbery Claims

May 19, 2025 -

The Importance Of Interdisciplinary And Transdisciplinary Research

May 19, 2025

The Importance Of Interdisciplinary And Transdisciplinary Research

May 19, 2025 -

Finalen I Melodifestivalen 2025 Artister Startordning Och Allt Du Behoever Veta

May 19, 2025

Finalen I Melodifestivalen 2025 Artister Startordning Och Allt Du Behoever Veta

May 19, 2025

Latest Posts

-

The Scale Of Russias Latest Drone Assault On Ukraine

May 19, 2025

The Scale Of Russias Latest Drone Assault On Ukraine

May 19, 2025 -

Analysis Russias Largest Drone Strike Against Ukraine And Its Implications

May 19, 2025

Analysis Russias Largest Drone Strike Against Ukraine And Its Implications

May 19, 2025 -

Improving Code Efficiency With Chat Gpts Ai Coding Agent

May 19, 2025

Improving Code Efficiency With Chat Gpts Ai Coding Agent

May 19, 2025 -

Ai Coding Assistance Chat Gpts Latest Update

May 19, 2025

Ai Coding Assistance Chat Gpts Latest Update

May 19, 2025 -

Russias Intensified Drone Warfare Major Attack On Ukraine

May 19, 2025

Russias Intensified Drone Warfare Major Attack On Ukraine

May 19, 2025