TD's Recession Warning: 100,000 Jobs At Risk

Table of Contents

The Severity of TD's Recession Prediction and its Implications

TD's recession prediction isn't based on speculation; it's rooted in a concerning confluence of economic indicators. Understanding these indicators is crucial to grasping the gravity of the situation and the potential for widespread job losses.

Economic Indicators Supporting TD's Concerns:

TD's concerns are supported by several key economic indicators:

- High Inflation: Persistently high inflation erodes purchasing power, dampening consumer spending and impacting business profitability. Data from [cite source on inflation statistics] shows inflation remaining stubbornly above the central bank's target, suggesting a prolonged period of economic uncertainty.

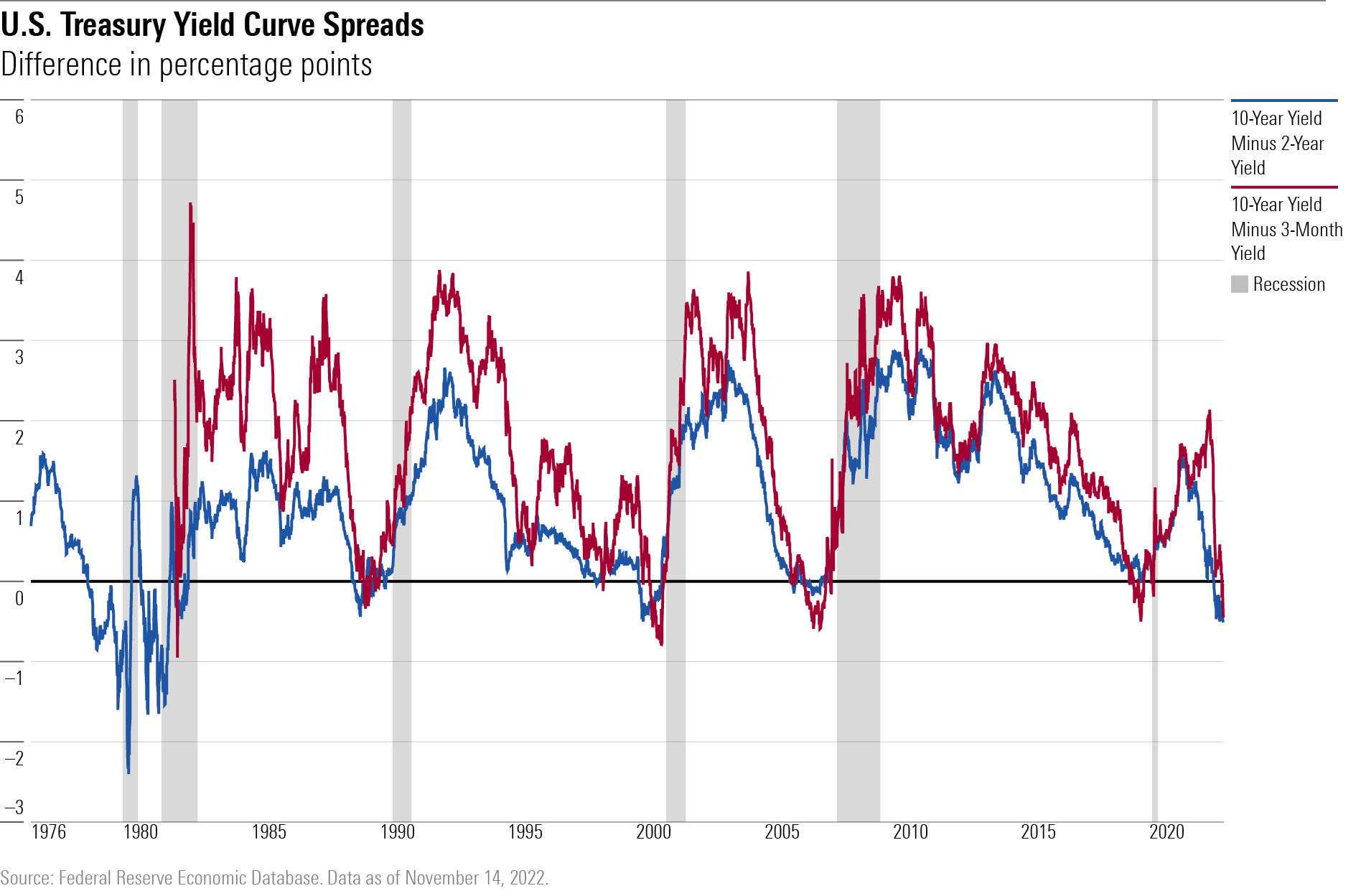

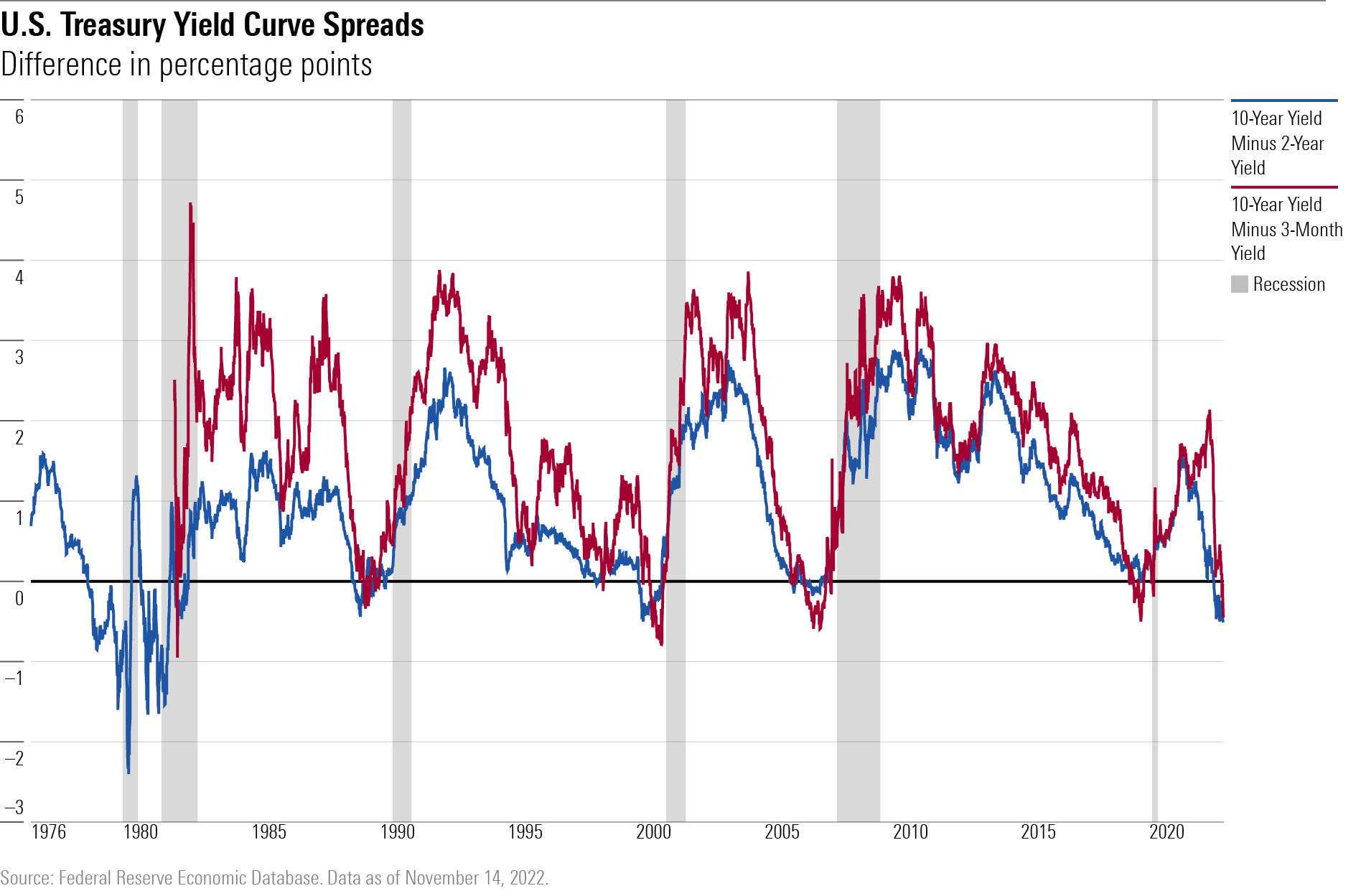

- Rising Interest Rates: Aggressive interest rate hikes by central banks, while intended to combat inflation, also increase borrowing costs for businesses and consumers, potentially triggering a slowdown in investment and economic activity. [Cite source on interest rate hikes].

- Slowing Consumer Spending: As inflation bites and interest rates climb, consumer spending, a key driver of economic growth, is showing signs of weakening. [Cite source on consumer spending data]. This reduced demand translates directly into decreased production and potential layoffs.

- Weakening Housing Market: The real estate sector, a significant contributor to economic activity, is already feeling the pinch of rising interest rates, impacting job creation in construction and related industries. [Cite source on housing market data].

Sectors Most Vulnerable to Job Losses:

Several sectors are particularly vulnerable to job losses during a recession:

- Technology: The tech sector, known for its boom-and-bust cycles, is often among the first to feel the effects of a downturn, with potential for significant layoffs in areas like software development and marketing. Estimates suggest [cite potential job loss estimates if available] job losses in this sector.

- Real Estate: The housing market slowdown, fueled by rising interest rates, directly impacts construction, real estate brokerage, and related industries.

- Manufacturing: Manufacturing sectors heavily reliant on consumer demand are particularly vulnerable to reduced spending.

- Retail: The retail sector often sees significant job cuts during economic downturns as consumer spending contracts.

Geographic Impact of Potential Job Losses:

The impact of potential job losses won't be evenly distributed. Regions heavily reliant on specific vulnerable sectors will likely be disproportionately affected. For instance, [mention specific region and vulnerable industry]. A map visualizing regional vulnerability based on industry concentration and economic diversification would be beneficial here. [Insert map or chart if available; otherwise describe the anticipated regional impacts].

Strategies for Individuals Facing Potential Unemployment

Proactive planning is key to mitigating the impact of potential job losses. Individuals should focus on strengthening their job search skills and ensuring financial stability.

Strengthening Your Resume and Job Search Skills:

- Update your resume: Highlight your most relevant skills and achievements, tailoring it to specific job applications.

- Network strategically: Reconnect with former colleagues and build new professional relationships.

- Enhance your online presence: Optimize your LinkedIn profile and other online platforms to showcase your skills and experience.

- Acquire new skills: Consider taking online courses or workshops to enhance your marketability. Resources like [list relevant resources, e.g., Coursera, LinkedIn Learning] can be beneficial.

Financial Planning and Budgeting for Uncertain Times:

- Create a realistic budget: Track your income and expenses to identify areas where you can cut back.

- Build an emergency fund: Aim to save at least 3-6 months' worth of living expenses.

- Review your debt: Consider strategies to manage or reduce your debt load. Resources like [list relevant financial literacy resources] can offer valuable guidance.

Exploring Alternative Employment Options:

- Freelancing: Explore freelance platforms like Upwork or Fiverr to supplement your income.

- Gig work: Consider driving for ride-sharing services or delivering food.

- Entrepreneurship: If you have a viable business idea, consider starting your own business.

Government and Corporate Responses to the Recession Warning

Both government and corporations will play a vital role in mitigating the impact of a potential recession.

Government Initiatives and Support Programs:

Governments often implement support programs during economic downturns. These may include:

- Job creation programs: Initiatives to stimulate job growth in key sectors.

- Unemployment benefits: Extended unemployment insurance to support individuals who lose their jobs.

- Financial assistance programs: Programs to help individuals and businesses cope with financial hardship. [Link to relevant government websites for details on these programs].

Corporate Strategies for Managing Potential Layoffs:

Corporations will likely adopt various strategies to navigate the economic climate:

- Hiring freezes: A temporary halt to new hiring to manage costs.

- Reduced hours: Cutting employee hours to reduce labor costs.

- Layoffs: Unfortunately, layoffs may become necessary in some cases. Ethical considerations around layoffs, including fair treatment of affected employees, will be paramount.

Conclusion

TD's recession warning underscores the potential for significant job losses – as many as 100,000 jobs at risk – impacting various sectors and regions. The economic indicators supporting this prediction – high inflation, rising interest rates, and slowing consumer spending – highlight the seriousness of the situation. The technology, real estate, manufacturing, and retail sectors appear particularly vulnerable. However, by proactively strengthening your resume, enhancing your financial planning, and exploring alternative employment options, you can mitigate the impact of TD's recession warning and enhance your job security. Don't wait for TD's recession warning to become a reality. Take control of your career and financial future by implementing the strategies outlined above. Prepare for potential job losses and strengthen your resilience in the face of an economic downturn. Remember to stay informed about government initiatives and support programs available to help you navigate these challenging times.

Featured Posts

-

Marlins Defeat Cubs 3 1 Behind Stowers Two Home Runs And Weathers Strong Pitching

May 28, 2025

Marlins Defeat Cubs 3 1 Behind Stowers Two Home Runs And Weathers Strong Pitching

May 28, 2025 -

Dangerous Climate Whiplash Global Cities Face Growing Impacts Report Reveals

May 28, 2025

Dangerous Climate Whiplash Global Cities Face Growing Impacts Report Reveals

May 28, 2025 -

San Diego Padres Begin Extended Road Trip In Pittsburgh

May 28, 2025

San Diego Padres Begin Extended Road Trip In Pittsburgh

May 28, 2025 -

Kapal Pelni Km Lambelu Jadwal Perjalanan Nunukan Makassar Juni 2025

May 28, 2025

Kapal Pelni Km Lambelu Jadwal Perjalanan Nunukan Makassar Juni 2025

May 28, 2025 -

The Last Five Meetings Arsenal And Psv Eindhovens Head To Head

May 28, 2025

The Last Five Meetings Arsenal And Psv Eindhovens Head To Head

May 28, 2025

Latest Posts

-

Is Rob Manfreds Leadership Failing Mlb A Madden Inspired Look

May 30, 2025

Is Rob Manfreds Leadership Failing Mlb A Madden Inspired Look

May 30, 2025 -

Evan Longorias Retirement Reflecting On A Rays Legacy

May 30, 2025

Evan Longorias Retirement Reflecting On A Rays Legacy

May 30, 2025 -

Hkayt Alastqlal Ndal Alajyal Mn Ajl Alhryt

May 30, 2025

Hkayt Alastqlal Ndal Alajyal Mn Ajl Alhryt

May 30, 2025 -

Mlb Commissioner Rob Manfred Faces Ownership Challenges A Madden Angle

May 30, 2025

Mlb Commissioner Rob Manfred Faces Ownership Challenges A Madden Angle

May 30, 2025 -

Mathr Alastqlal Nmadhj Mn Albtwlt Walshjaet

May 30, 2025

Mathr Alastqlal Nmadhj Mn Albtwlt Walshjaet

May 30, 2025