Tech Billionaires' $194 Billion Loss: A 100-Day Analysis Of Trump Inauguration Donors

Table of Contents

The Impact of Trump's Early Policies on Tech Stocks

The early policies enacted by the Trump administration had a profound and multifaceted impact on the tech sector, contributing significantly to the Tech Billionaires' $194 billion loss. Several key areas contributed to this downturn.

Increased Regulatory Scrutiny

Increased antitrust investigations and regulations targeted several tech giants, impacting their valuations. The intensified regulatory scrutiny created uncertainty and fear among investors.

- Google: Faced increased antitrust scrutiny related to its search dominance and advertising practices.

- Facebook: Faced investigations concerning data privacy and its market power.

- Amazon: Faced antitrust concerns regarding its dominance in e-commerce and cloud computing.

[Insert chart showing decline in stock prices of Google, Facebook, and Amazon in the 100 days following the Trump inauguration].

Immigration Policies and their Ripple Effects

Stricter immigration policies implemented by the Trump administration significantly impacted the tech industry's access to skilled foreign workers.

- H-1B Visa Restrictions: The tightening of H-1B visa regulations made it more difficult for tech companies to hire foreign talent, potentially leading to talent shortages.

- Impact on Innovation: The reduced availability of skilled workers hindered innovation and growth within the sector.

[Insert statistic showing the percentage decrease in H-1B visas issued compared to the previous year].

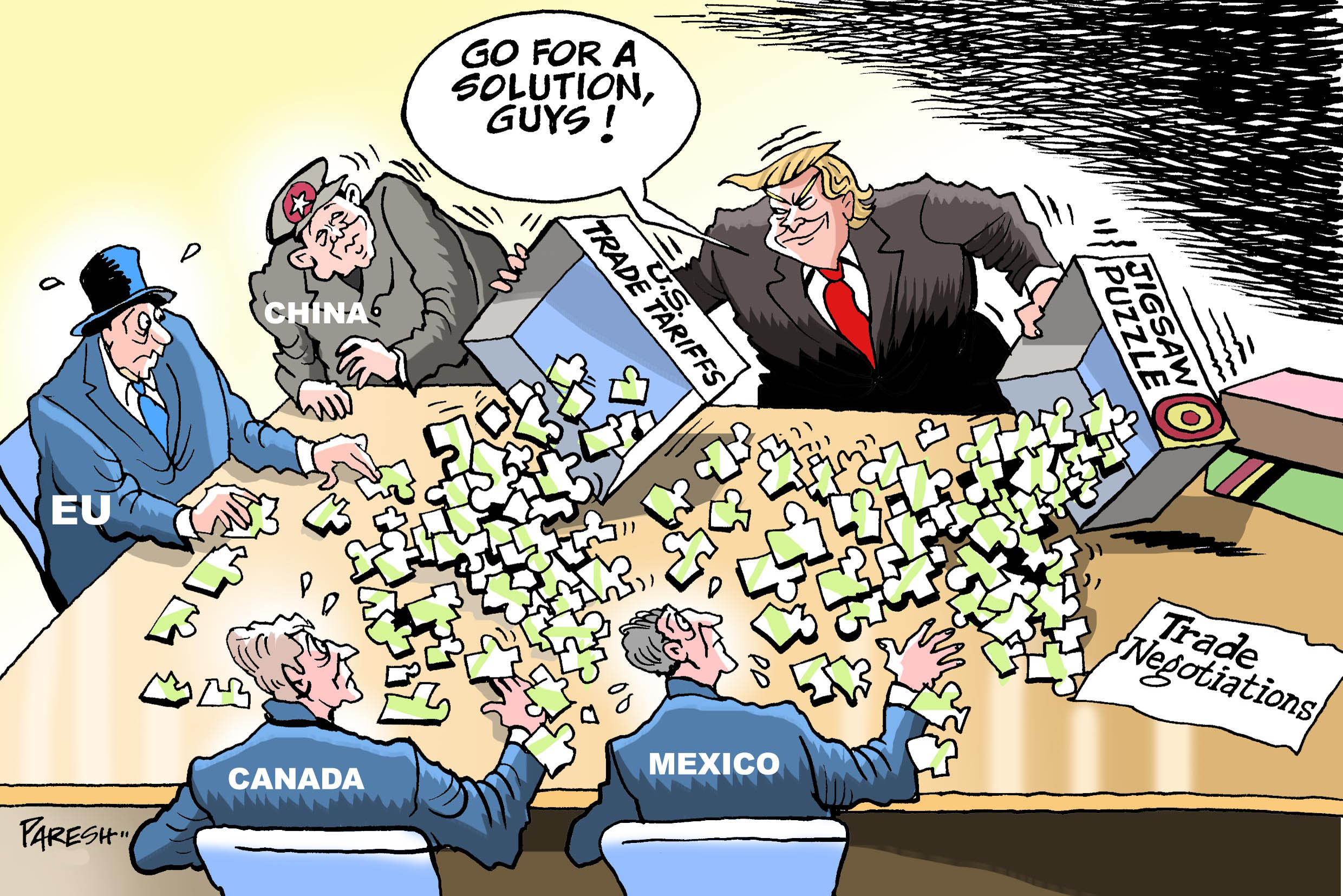

Trade Wars and Global Market Uncertainty

The initiation of trade wars and the imposition of tariffs created global market uncertainty, impacting tech companies' international operations and profitability.

- Tariffs on Tech Products: Tariffs on various tech products disrupted supply chains and increased costs for companies.

- Impact on Global Trade: The trade disputes negatively impacted international trade in the tech sector, reducing revenue and profits.

[Insert chart illustrating the decline in international tech trade during the period].

Shifting Public Perception and Brand Reputation

Beyond direct policy impacts, the shift in public perception and brand reputation played a critical role in the Tech Billionaires' $194 billion loss.

Controversies and Backlash

Controversies surrounding the Trump administration negatively impacted the public's view of tech companies and their leadership, especially those perceived as closely aligned with the administration.

- Association with the Trump Administration: Companies perceived as being supportive of the administration faced public backlash and boycotts.

- Damage to Brand Image: Negative publicity and controversies damaged the brand image of several tech companies.

[Insert data from public opinion polls showing a decline in public favorability towards certain tech companies].

ESG Investing and Socially Responsible Business

The growing importance of Environmental, Social, and Governance (ESG) investing influenced investor decisions. Investors increasingly favored companies with strong ESG profiles, leading to divestment from companies associated with the Trump administration.

- ESG Investing Growth: The rapid growth of ESG investing created pressure on companies to improve their environmental and social performance.

- Divestment from Socially Irresponsible Companies: Investors actively divested from companies deemed socially irresponsible, impacting their valuations.

[Insert data showcasing the growth of ESG investing and its impact on market valuations].

Market Volatility and Economic Uncertainty

While policy changes and public perception played a significant role, broader market trends and economic uncertainty also contributed to the decline in tech valuations.

Broader Market Trends

Several macroeconomic factors influenced the overall decline in tech valuations, independent of political considerations.

- Global Economic Slowdown: Concerns about a global economic slowdown affected investor sentiment.

- Interest Rate Hikes: Interest rate increases by central banks impacted investment valuations.

[Insert data from relevant stock market indices and economic indicators].

Investor Sentiment and Risk Aversion

Following the inauguration, investor sentiment shifted towards risk aversion, disproportionately impacting tech stocks.

- Risk-On/Risk-Off Strategy: Investors adopted risk-off strategies, moving away from higher-risk investments like tech stocks.

- Flight to Safety: Investors moved their capital into safer assets, reducing investment in the tech sector.

[Insert data showing shifts in investor confidence indices and flight-to-safety trends].

Conclusion: Understanding the Complexities of Tech Billionaires' $194 Billion Loss

The Tech Billionaires' $194 billion loss wasn't solely a result of political decisions but rather a complex interplay of factors. Increased regulatory scrutiny, restrictive immigration policies, trade wars, shifting public perception, ESG investing trends, and broader market volatility all contributed to this significant decline. Understanding these interwoven elements is crucial to fully grasping the financial impact. Understanding the intricate relationship between political contributions and market performance is crucial. Continue your research into the long-term effects of Tech Billionaires' $194 billion loss and the impact of political decisions on the tech industry.

Featured Posts

-

Solve The Nyt Spelling Bee April 1st 2025 Complete Guide

May 10, 2025

Solve The Nyt Spelling Bee April 1st 2025 Complete Guide

May 10, 2025 -

Understanding Trumps Nomination Of Casey Means As Surgeon General

May 10, 2025

Understanding Trumps Nomination Of Casey Means As Surgeon General

May 10, 2025 -

Edmonton Nordic Spa Development Rezoning Green Light

May 10, 2025

Edmonton Nordic Spa Development Rezoning Green Light

May 10, 2025 -

Trumps Tariffs A Weapon Not A Negotiation Tool Says Warner

May 10, 2025

Trumps Tariffs A Weapon Not A Negotiation Tool Says Warner

May 10, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed To Chair

May 10, 2025

Nottingham Attacks Inquiry Retired Judge Appointed To Chair

May 10, 2025