Tesla Seeks To Block Shareholder Litigation Post-Musk Compensation Deal

Table of Contents

The Heart of the Shareholder Lawsuit Against Tesla

At the core of the shareholder lawsuit against Tesla lies the contention that Elon Musk's compensation package, one of the most lucrative in corporate history, was improperly structured and vastly overvalued. Shareholders argue this represents a significant breach of fiduciary duty by the Tesla board, alleging a failure to act in the best interests of the company and its shareholders. The lawsuit, often framed as a shareholder derivative suit, centers around several key claims:

-

Breach of Fiduciary Duty: The shareholders contend the board failed to adequately negotiate and oversee the Musk compensation package, prioritizing Musk's personal gain over the interests of other shareholders. This alleged breach of their fiduciary duty is a central argument in the lawsuit.

-

Waste of Corporate Assets: The plaintiffs argue that the vast compensation package constitutes a waste of corporate assets, as the valuation of the stock options granted to Musk far exceeds any demonstrable benefit to Tesla.

-

Lack of Independent Board Oversight: A key element of the lawsuit points to the lack of independence and objectivity within the Tesla board during the negotiation and approval process of the Musk compensation deal. This lack of independent board oversight is frequently cited as a major contributing factor to the alleged mismanagement.

The valuation of the compensation package is hotly debated, with shareholders arguing the methods used to assess its worth were flawed and artificially inflated. Understanding the complexities of the "Elon Musk compensation" and its true value is crucial to the lawsuit's success. The arguments around fairness revolve around the lack of a clear link between the granted compensation and demonstrable performance metrics.

Tesla's Defense Strategy to Dismiss Shareholder Litigation

Tesla's defense strategy focuses on a multi-pronged approach aiming to dismiss the shareholder litigation entirely. Their arguments aim to discredit the claims of the shareholders and shield the company from further legal challenges relating to the Musk compensation deal. Key elements of their defense include:

-

Claims of Shareholder Approval: Tesla argues that the compensation package received sufficient shareholder approval, thereby shielding it from legal challenge. They point to voting processes and shareholder resolutions to bolster this claim.

-

Arguments Regarding the Benefit to Tesla and its Shareholders: Tesla's defense emphasizes the purported benefits the Musk compensation package delivered to the company and its shareholders, indirectly linking his leadership to the company's success. This involves highlighting growth and market capitalization during Musk's tenure.

-

Legal Technicalities to Challenge the Lawsuits' Standing: Tesla's legal team is employing various legal technicalities to challenge the standing of the lawsuits, questioning the legitimacy of the plaintiffs’ claims and ability to bring the case forward. This involves scrutinizing procedural aspects of the filings.

Tesla's legal filings, if publicly available, would provide more precise details regarding their arguments. Their overall strategy hinges on showing that the Musk compensation deal was properly approved, beneficial to the company, and legally sound, thereby deflecting the allegations of corporate mismanagement.

Potential Implications of the Outcome of the Shareholder Litigation

The outcome of this shareholder litigation carries significant implications for Tesla, its shareholders, and corporate governance practices broadly. If Tesla succeeds in blocking the litigation, several consequences could arise:

-

Impact on Shareholder Rights and Corporate Governance: A dismissal could weaken shareholder rights and diminish the accountability of corporate boards, setting a concerning precedent for other publicly traded companies. It could embolden other companies to pursue similarly aggressive executive compensation strategies with less fear of repercussions.

-

Effect on Future Executive Compensation Practices: The ruling could influence future executive compensation practices, potentially leading to even more lavish and potentially controversial deals. This impact on executive compensation could ripple through numerous sectors.

-

Potential Legal Precedent Set for Similar Cases: The court’s decision could set a legal precedent for future cases involving similar challenges to executive compensation arrangements. This legal precedent will impact future securities law and corporate accountability.

The broader implications extend to the accountability of publicly traded companies and the protection of shareholder interests. The ruling will significantly influence the landscape of corporate responsibility and securities law.

Expert Opinions on the Tesla Shareholder Lawsuit

Legal experts and financial analysts offer diverse perspectives on the likelihood of Tesla’s success and the overall implications. Some experts believe the evidence supporting the shareholders' claims is substantial, suggesting Tesla’s motion to dismiss could be unsuccessful. Others argue that Tesla has a strong defense based on the technicalities of shareholder approval and the overall benefit to the company. The market reaction, while speculative at this stage, will likely be influenced by the court’s final decision. This legal analysis from multiple experts offers crucial insight into the complex issues at stake.

Conclusion: Analyzing the Tesla Shareholder Litigation and Musk's Compensation

The Tesla shareholder litigation highlights the ongoing debate surrounding executive compensation and corporate governance. Shareholders allege breaches of fiduciary duty, waste of corporate assets, and a lack of independent board oversight in the approval of Elon Musk’s compensation package. Tesla, in its defense, cites shareholder approval, argues for the benefit to the company, and employs legal technicalities to challenge the lawsuits' standing. The court's decision will have significant implications for shareholder rights, future executive compensation practices, and the legal precedent surrounding corporate accountability. Stay informed on the ongoing Tesla shareholder litigation and its impact on future executive compensation deals. Learn more about protecting your rights as a shareholder and understanding the intricacies of corporate governance.

Featured Posts

-

Southeast Texas Municipal Elections May 2025 Candidates And Key Issues

May 18, 2025

Southeast Texas Municipal Elections May 2025 Candidates And Key Issues

May 18, 2025 -

Angels Stars Offseason Tragedy A Look At The Family Health Incidents

May 18, 2025

Angels Stars Offseason Tragedy A Look At The Family Health Incidents

May 18, 2025 -

The End Of Ryujinx Nintendo Intervention And Emulator Shutdown

May 18, 2025

The End Of Ryujinx Nintendo Intervention And Emulator Shutdown

May 18, 2025 -

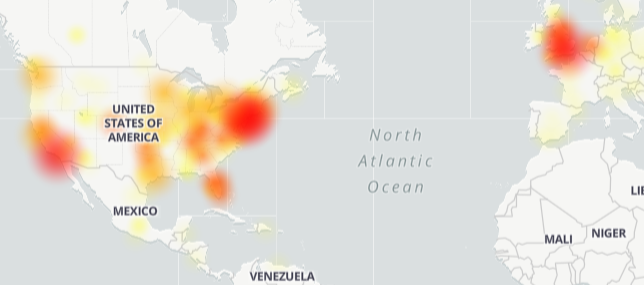

Global Reddit Outage Users Report Issues Accessing The Platform

May 18, 2025

Global Reddit Outage Users Report Issues Accessing The Platform

May 18, 2025 -

Cannes Pre Smartphone Era Hilarious And Unbelievable Images

May 18, 2025

Cannes Pre Smartphone Era Hilarious And Unbelievable Images

May 18, 2025

Latest Posts

-

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025 -

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025 -

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025 -

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025 -

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025