Tesla's Future: The Implications Of Elon Musk's Renewed Assertiveness

Table of Contents

Musk's Leadership Style and its Impact on Tesla's Innovation

Musk's leadership style is characterized by aggressive timelines and a high tolerance for risk. This approach has fueled Tesla's rapid innovation in electric vehicles and autonomous driving, but it also carries significant risks.

Aggressive Timeline and Risk-Taking

Musk's history is filled with ambitious deadlines, some met with spectacular success, others resulting in delays and setbacks.

- Successes: The rapid development and market launch of the Model S and Model 3 demonstrate his ability to push boundaries and achieve seemingly impossible goals.

- Failures: The Cybertruck's delayed launch and ongoing challenges with Full Self-Driving (FSD) technology highlight the inherent risks associated with such an aggressive approach. These delays impact investor confidence and can lead to stock price volatility.

- This approach, while fostering rapid innovation in areas like battery technology and electric motor design, also creates uncertainty for investors who are wary of unrealistic timelines and potential overpromises related to Tesla innovation and product development. The ambitious goals, while inspiring, require meticulous risk management to avoid significant financial repercussions.

Direct Communication and its Double-Edged Sword

Musk's direct and often controversial communication style, primarily through tweets and public statements, significantly influences public perception and Tesla's brand image.

- Market Impacts: His tweets have, on occasion, caused significant market fluctuations in Tesla stock. Announcements about production targets, technological advancements, and even personal opinions can lead to dramatic price swings.

- Transparency vs. Volatility: While some appreciate his transparency, others criticize his impulsive communication, arguing it undermines investor confidence and damages Tesla's PR. The double-edged sword of his directness is a constant balancing act between engaging the public and maintaining a stable market presence.

The Shifting Landscape of the EV Market and Tesla's Competitiveness

Tesla faces a rapidly evolving EV market with increasing competition from both established and new players.

Increased Competition from Established Automakers

Traditional automakers like Ford, GM, and Volkswagen are heavily investing in electric vehicles, posing a significant challenge to Tesla's market dominance.

- Competitive Strategies: These companies leverage existing manufacturing infrastructure, established dealer networks, and brand recognition to compete directly with Tesla. Their strategies often focus on more affordable EVs and a broader range of vehicle types.

- Market Share Impact: The increased competition is likely to impact Tesla's market share in the coming years, necessitating strategic adaptations to maintain its leading position within the electric vehicle market.

Technological Advancements and the Race for Autonomous Driving

Autonomous driving technology is crucial for Tesla's future and its competitiveness.

- Tesla's Progress: Tesla's Autopilot and FSD represent significant advancements, but regulatory hurdles and technological challenges remain. The technology's reliability and safety are subject to intense scrutiny.

- Competitive Landscape: Other automakers and tech companies are aggressively pursuing autonomous driving technology, creating a highly competitive landscape. The race to achieve fully autonomous driving capabilities is fiercely contested, impacting the future of Tesla and the overall automotive industry.

Financial Performance and Investor Sentiment

Tesla's financial performance and investor sentiment are closely tied to Elon Musk's actions and statements.

Stock Price Volatility and its Correlation to Musk's Actions

Tesla's stock price has exhibited significant volatility, often correlated with Musk's public pronouncements and actions.

- Stock Performance Fluctuations: News related to production targets, new product announcements, or even Musk's personal activities can trigger substantial price changes. This volatility reflects the market's sensitivity to Musk's influence on the company.

- Investor Confidence: Maintaining investor confidence is crucial for Tesla's long-term success. Musk's leadership style, while driving innovation, contributes to this volatility and can impact investor sentiment.

Tesla's Long-Term Financial Sustainability

Tesla's long-term financial sustainability depends on various factors, including production capacity, expansion plans, and profitability margins.

- Production Capacity and Expansion: Expanding production capacity to meet growing demand while maintaining profitability is a key challenge. Tesla's ambitious expansion plans, including new Gigafactories, are critical for its long-term growth.

- Profitability Margins: Maintaining healthy profit margins in a competitive market is essential for sustainable growth. Tesla's pricing strategies and cost management will play a vital role in achieving this goal and influencing its future revenue growth.

Tesla's Future: A Look Ahead

In conclusion, Tesla's future is intricately linked to Elon Musk's leadership style and its impact on innovation, market competitiveness, and financial performance. The complex interplay between his assertive approach, the evolving EV market, and investor sentiment will shape Tesla's trajectory in the coming years. Musk's influence is undeniable, but the sustainability of his strategies and their ultimate effect on Tesla's future remains a subject of ongoing debate and scrutiny. What are your predictions for Tesla's future under Elon Musk's continued leadership? Share your thoughts in the comments below!

Featured Posts

-

The Harsh Reality Of Buy And Hold A Long Term Investors Perspective

May 25, 2025

The Harsh Reality Of Buy And Hold A Long Term Investors Perspective

May 25, 2025 -

Canada Post Strike Threat Impact On Customers And Business

May 25, 2025

Canada Post Strike Threat Impact On Customers And Business

May 25, 2025 -

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Kultovoy Kinolenty

May 25, 2025

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Kultovoy Kinolenty

May 25, 2025 -

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025 -

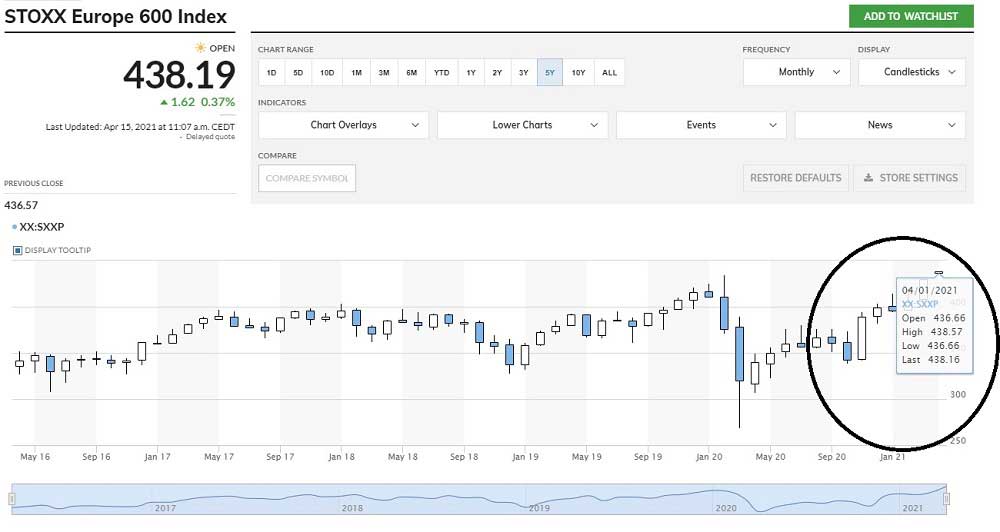

Avrupa Piyasalarinda Duesues Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 25, 2025

Avrupa Piyasalarinda Duesues Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 25, 2025

Latest Posts

-

George L Russell Jr S Passing A Loss For Marylands Legal And Political Communities

May 25, 2025

George L Russell Jr S Passing A Loss For Marylands Legal And Political Communities

May 25, 2025 -

Maryland Mourns The Passing Of Legal Luminary George L Russell Jr

May 25, 2025

Maryland Mourns The Passing Of Legal Luminary George L Russell Jr

May 25, 2025 -

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025 -

Mercedes And George Russell Contract Renewal Hinges On This One Factor

May 25, 2025

Mercedes And George Russell Contract Renewal Hinges On This One Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Future

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Future

May 25, 2025