Tesla's Response To Shareholder Lawsuits Stemming From Musk's Compensation

Table of Contents

The Structure of Musk's Compensation Package and its Controversies

Elon Musk's compensation package, approved in 2018, is unlike any other seen in corporate history. It centers around the achievement of ambitious performance milestones, granting him stock options contingent upon Tesla reaching specific market capitalization and operational goals. The sheer scale of the potential payout—potentially exceeding $55 billion—immediately sparked controversy. Shareholders argued that the package was excessively generous and lacked sufficient safeguards to ensure alignment with shareholder interests.

- Unusually High Potential Payout: The potential reward vastly surpasses typical executive compensation, raising concerns about excessive risk-taking.

- Lack of Clear Performance Benchmarks: Critics argue that some performance metrics were ambiguously defined, potentially allowing Musk to manipulate results.

- Potential Conflicts of Interest: The structure of the compensation package, tied to Tesla's stock price, potentially incentivizes actions that benefit Musk personally at the expense of long-term shareholder value.

- Allegations of Benefiting Musk Disproportionately: Shareholders argue the compensation package primarily benefits Musk, regardless of overall company performance.

Tesla's Legal Defenses Against Shareholder Lawsuits

Tesla's legal strategy in defending against these lawsuits focuses on demonstrating the value creation under Musk's leadership and the proper processes followed in approving the compensation package. They contend that the package was meticulously designed with performance-based goals, aligning Musk's interests with those of shareholders. Furthermore, Tesla highlights the extensive due diligence and independent board approval processes.

- Arguments about Shareholder Approval: Tesla emphasizes that the compensation package received shareholder approval, albeit with some dissenting votes.

- Claims of Significant Value Creation: Tesla points to the substantial increase in its market capitalization and its technological advancements under Musk's leadership.

- Defense of the Performance-Based Nature: Tesla argues that the compensation structure is intrinsically performance-based, justifying the high potential payout through tangible achievements.

- Highlighting Independent Board Approval Processes: Tesla underlines the involvement of independent directors in the approval process to assure objectivity and protect shareholder interests.

Key Arguments Presented by Shareholders in the Lawsuits

Shareholder lawsuits against Tesla center on allegations of breaches of fiduciary duty, arguing that the compensation package constitutes waste of corporate assets and violates fundamental principles of corporate governance. These lawsuits demand greater corporate transparency and accountability.

- Waste of Corporate Assets: Shareholders argue that the compensation package constitutes an unjustified allocation of company resources.

- Breach of Contract: Some lawsuits allege breaches of the implied covenant of good faith and fair dealing owed to shareholders.

- Violation of Corporate Governance Principles: The lawsuits point to potential conflicts of interest and a lack of appropriate oversight in the approval process.

- Demand for Corporate Transparency: Shareholder lawsuits seek greater transparency into Tesla's decision-making processes regarding executive compensation.

The Outcomes and Ongoing Legal Battles

The Tesla shareholder lawsuits are ongoing, with various stages of litigation and settlements. The outcomes will significantly influence future corporate governance practices and executive compensation structures. The potential financial repercussions for Tesla, including legal fees and potential settlements, remain uncertain.

- Summary of Key Rulings or Settlements (if any): [Insert updates on any court decisions or settlements reached at the time of publication].

- Ongoing Litigation Timeline: [Provide a brief timeline of key legal events and anticipated future milestones].

- Potential Financial Repercussions for Tesla: [Discuss the potential financial impact of ongoing lawsuits on Tesla's balance sheet].

- Impact on Investor Confidence: [Analyze the effect of these lawsuits on investor confidence and Tesla's stock price].

The Broader Implications for Corporate Governance and Executive Compensation

The Tesla case highlights the increasing scrutiny surrounding executive compensation packages, particularly in high-growth technology companies. The legal battles may trigger regulatory changes and influence future corporate governance practices. The implications extend beyond Tesla, impacting how companies structure executive pay and how boards oversee these crucial decisions.

- Increased Scrutiny of Executive Pay Packages: The Tesla case serves as a cautionary tale, increasing the pressure on companies to justify exceptionally high executive compensation.

- Potential for Regulatory Changes: The lawsuits could influence regulatory bodies to introduce stricter guidelines on executive compensation and corporate governance.

- Impact on Shareholder Activism: The Tesla case encourages greater shareholder activism in challenging excessive executive pay packages.

- Changes in Board Composition and Oversight: Companies may respond by diversifying their boards and strengthening independent oversight of executive compensation.

Conclusion: The Future of Tesla and the Debate on Executive Compensation

Tesla's response to shareholder lawsuits stemming from Elon Musk's compensation package has revealed significant complexities surrounding executive compensation and corporate governance. The ongoing legal battles highlight the tension between incentivizing exceptional leadership and ensuring responsible allocation of corporate resources. The key takeaways from this analysis include the unique structure of Musk's compensation, the legal arguments presented by both sides, and the broader implications for corporate governance practices across industries. Stay informed about the ongoing developments in the Tesla shareholder lawsuits and Musk's compensation debate and delve deeper into the critical issues of executive compensation and corporate governance. Further research into these areas is crucial for understanding the evolving landscape of corporate governance in the 21st century.

Featured Posts

-

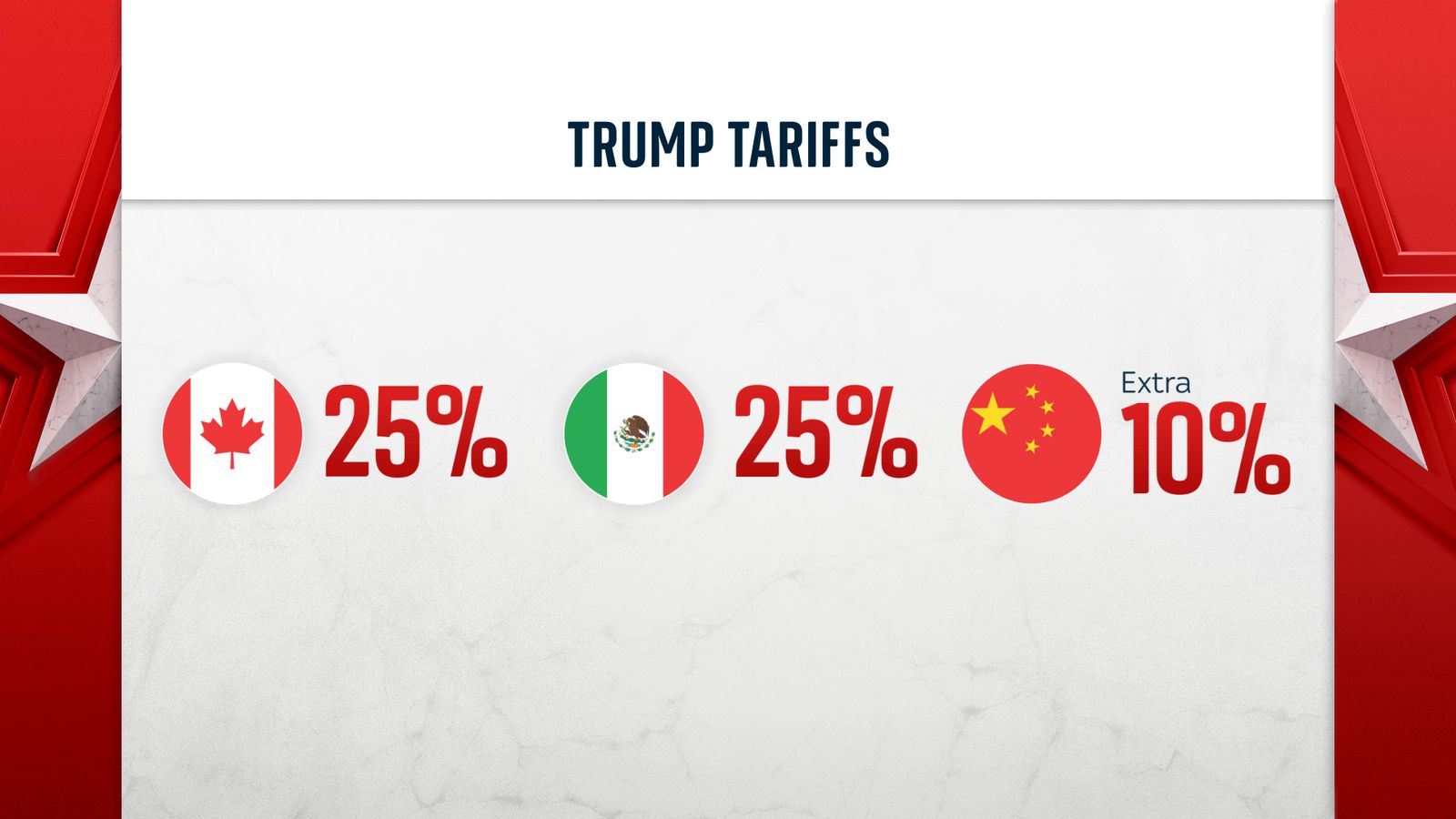

Dutch Public Opinion Opposition To Eu Retaliation Against Trump Tariffs

May 18, 2025

Dutch Public Opinion Opposition To Eu Retaliation Against Trump Tariffs

May 18, 2025 -

Taylor Swifts Reputation Taylors Version A Sneak Peek At Whats To Come

May 18, 2025

Taylor Swifts Reputation Taylors Version A Sneak Peek At Whats To Come

May 18, 2025 -

Amanda Bynes Classmate Claims Tragic School Ritual

May 18, 2025

Amanda Bynes Classmate Claims Tragic School Ritual

May 18, 2025 -

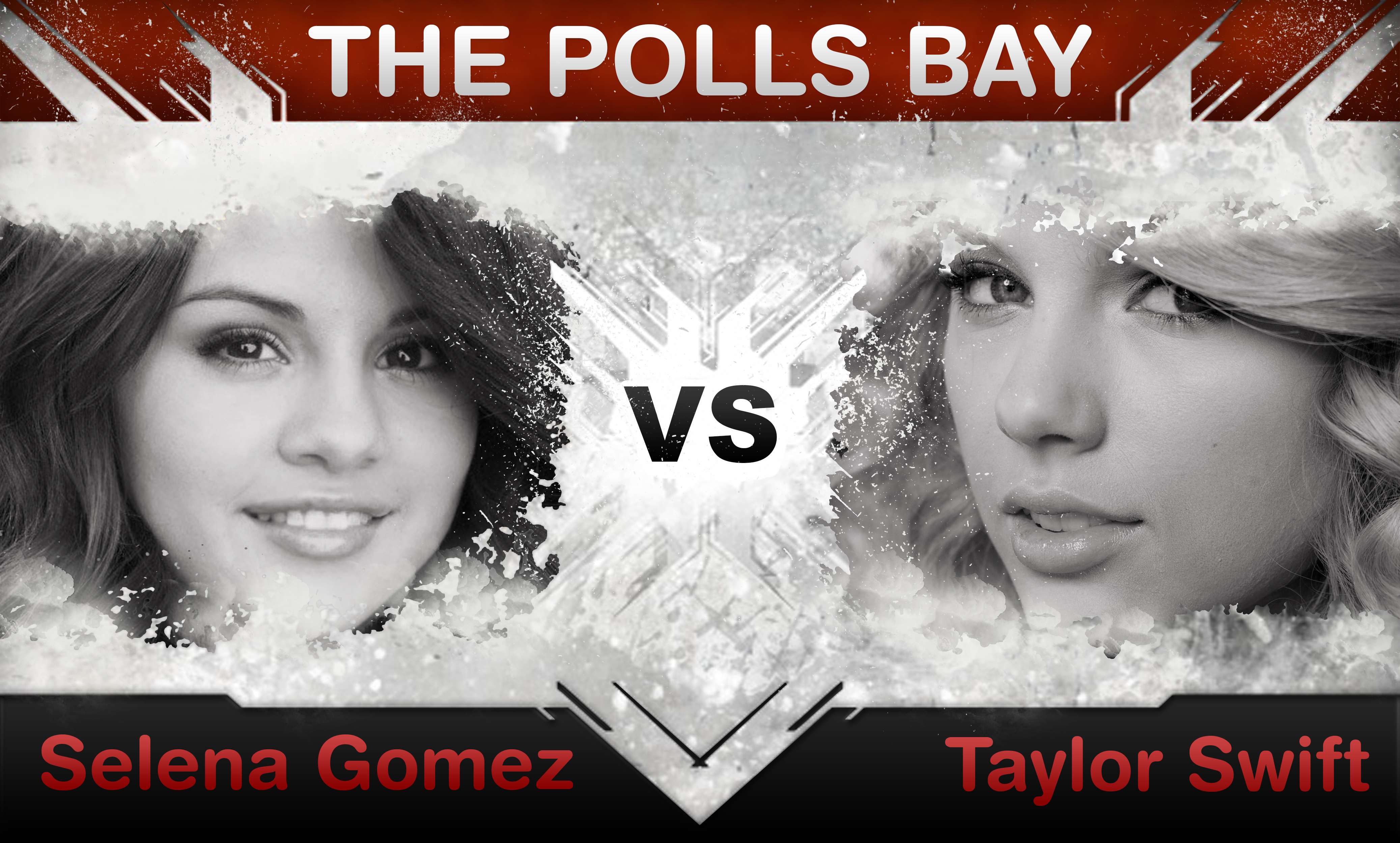

Selena Gomez Vs Taylor Swift A Wake Up Call Over The Blake Lively Situation

May 18, 2025

Selena Gomez Vs Taylor Swift A Wake Up Call Over The Blake Lively Situation

May 18, 2025 -

New Netflix Series The Phone Call That Changed History Bin Laden Capture

May 18, 2025

New Netflix Series The Phone Call That Changed History Bin Laden Capture

May 18, 2025

Latest Posts

-

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025 -

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025 -

Amanda Bynes Spotted After Joining Only Fans

May 18, 2025

Amanda Bynes Spotted After Joining Only Fans

May 18, 2025 -

Amanda Bynes Only Fans Debut A Closer Look At Her Content Policy

May 18, 2025

Amanda Bynes Only Fans Debut A Closer Look At Her Content Policy

May 18, 2025 -

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025