Thailand Inflation Dip: More Rate Cuts Expected

Table of Contents

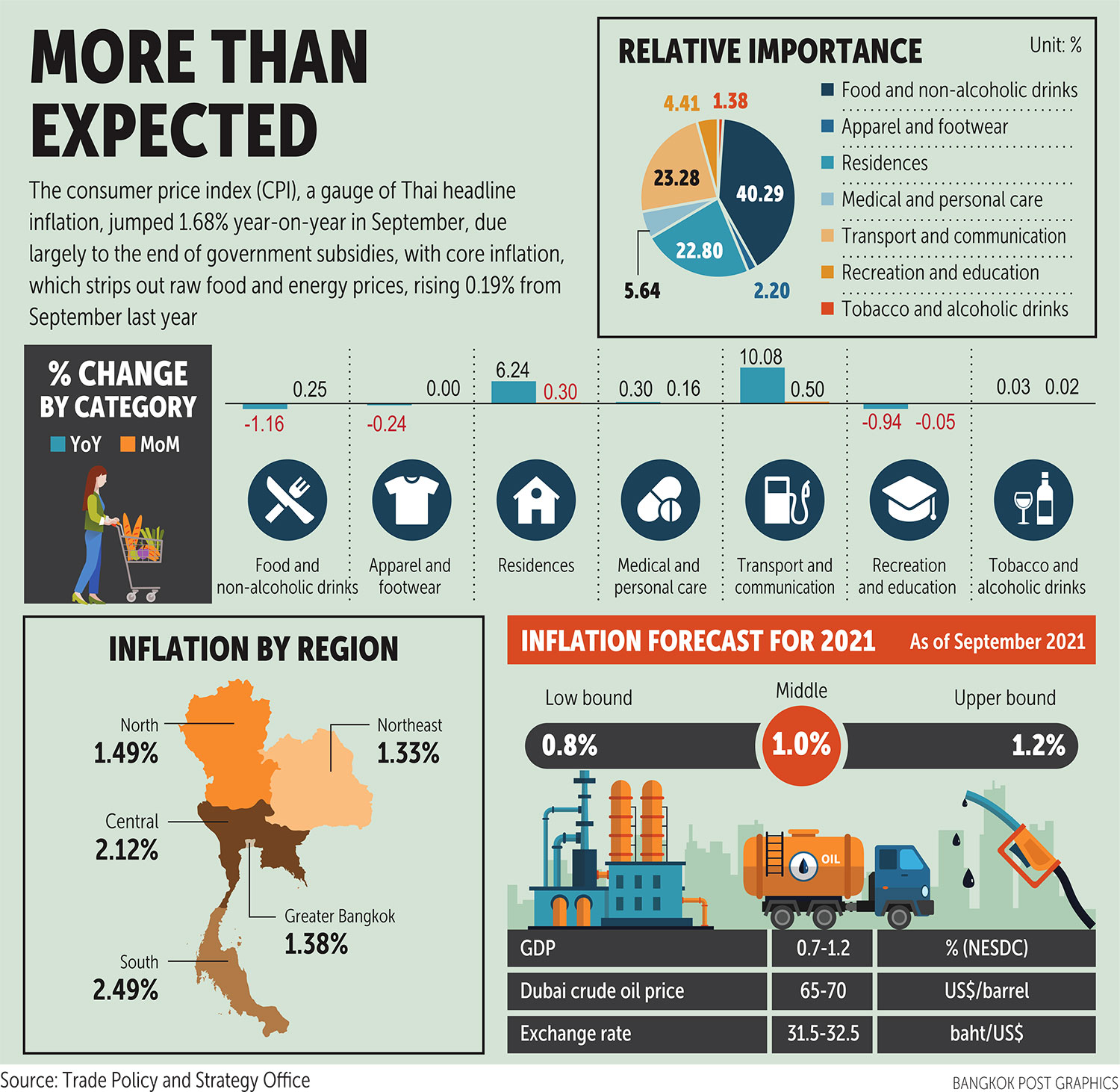

Factors Contributing to the Thailand Inflation Dip

Several key factors have contributed to the recent decline in Thailand's inflation rate, offering a more favorable economic outlook. Understanding these contributing elements is vital for predicting future trends in the Thai economy and the Bank of Thailand's response.

Easing Global Commodity Prices

The softening of global commodity prices has played a significant role in reducing Thailand's inflation rate. Lower global oil prices, for instance, have directly impacted transportation costs and the prices of various goods and services.

- Examples: Reduced prices for crude oil have significantly lowered fuel costs, impacting transportation and manufacturing. Prices of imported agricultural products, such as wheat and corn, have also decreased, affecting food prices.

- Impact on CPI: The decline in commodity prices has directly translated to a lower Consumer Price Index (CPI), a key indicator of inflation. Data from the National Statistical Office (NSO) clearly shows this correlation.

- Global Context: The global economic slowdown and decreased demand for commodities in major economies have contributed to this price easing, creating a more favorable external environment for Thailand.

Stronger Thai Baht

The appreciation of the Thai baht against other major currencies has also helped to curb import inflation. A stronger baht makes imported goods cheaper, reducing inflationary pressures from overseas.

- Baht's Performance: The baht has shown considerable strength against the US dollar and other regional currencies in recent months. This is evidenced by data from the Bank of Thailand and various financial news sources.

- Impact on Import Prices: The stronger baht has directly lowered the cost of imported goods, ranging from consumer electronics to raw materials for manufacturing. This has had a tangible impact on the prices consumers face.

- Influencing Factors: Factors contributing to the baht's strength include increased foreign investment in Thailand and the country's relatively stable economic performance compared to some other nations.

Government Measures to Control Inflation

The Thai government has also implemented several measures aimed at mitigating inflationary pressures. These policies, though varied in their effectiveness, have played a role in curbing inflation.

- Specific Examples: Government subsidies on essential goods, such as energy and food, have helped to keep prices in check for consumers. Targeted fiscal measures have also been introduced to support specific sectors impacted by inflation.

- Effectiveness: While the effectiveness of these measures has been debated, they have undeniably contributed to a softer inflation picture. The long-term impact and potential unintended consequences are subjects of ongoing analysis.

- Potential Drawbacks: Some argue that subsidies can distort markets and create long-term dependency, potentially impacting the efficiency of the overall economy. Careful evaluation of these measures' long-term impact is essential.

Implications of Further Rate Cuts in Thailand

The possibility of further interest rate cuts by the Bank of Thailand has significant implications for the Thai economy, both positive and negative.

Stimulating Economic Growth

Lower interest rates are expected to stimulate economic growth through increased investment and consumption.

- Impact on GDP Growth: Reduced borrowing costs should encourage businesses to invest more, leading to job creation and overall GDP expansion.

- Consumer Spending: Lower interest rates make borrowing more attractive for consumers, potentially boosting spending on durable goods and other items, further driving economic growth.

- Benefiting Sectors: Sectors such as construction, real estate, and consumer durables are expected to benefit most from reduced interest rates.

Risks Associated with Rate Cuts

However, rate cuts also carry inherent risks that need careful consideration.

- Financial Stability Risks: Excessive rate cuts can potentially destabilize the financial system, potentially leading to asset bubbles and increased non-performing loans.

- Currency Impact: Further rate cuts might weaken the baht, potentially increasing import prices and negating some of the benefits of lower interest rates.

- Excessive Borrowing: Easy access to credit due to lower rates could lead to excessive borrowing, creating further risks to financial stability in the long term.

The Bank of Thailand's Stance

The Bank of Thailand’s stance on future monetary policy will be crucial in determining the direction of the Thai economy.

- Recent BOT Statements: Recent statements from the BOT suggest a cautious approach, with a focus on balancing economic growth with price stability. Specific language from their communications should be considered carefully.

- Predictions for Future Rate Adjustments: While no concrete commitments have been made, analysts and economists anticipate further rate cuts, though the timing and magnitude remain uncertain.

- Influencing Factors: The BOT's decisions will be heavily influenced by domestic inflation data, global economic developments, and the performance of the Thai baht.

Conclusion

The recent dip in Thailand inflation, a consequence of easing global commodity prices, a stronger baht, and government initiatives, has fueled expectations for further rate cuts by the Bank of Thailand. While lower interest rates offer the potential to stimulate economic growth and boost consumer spending, the associated risks, including potential asset bubbles and currency fluctuations, must be carefully weighed. The Bank of Thailand's future monetary policy decisions will depend on a delicate balance of these factors. Stay informed about the evolving situation regarding Thailand inflation and the Bank of Thailand’s announcements to make informed decisions about your investments and financial planning in Thailand. Understanding the dynamics of Thailand inflation is crucial for navigating the economic landscape.

Featured Posts

-

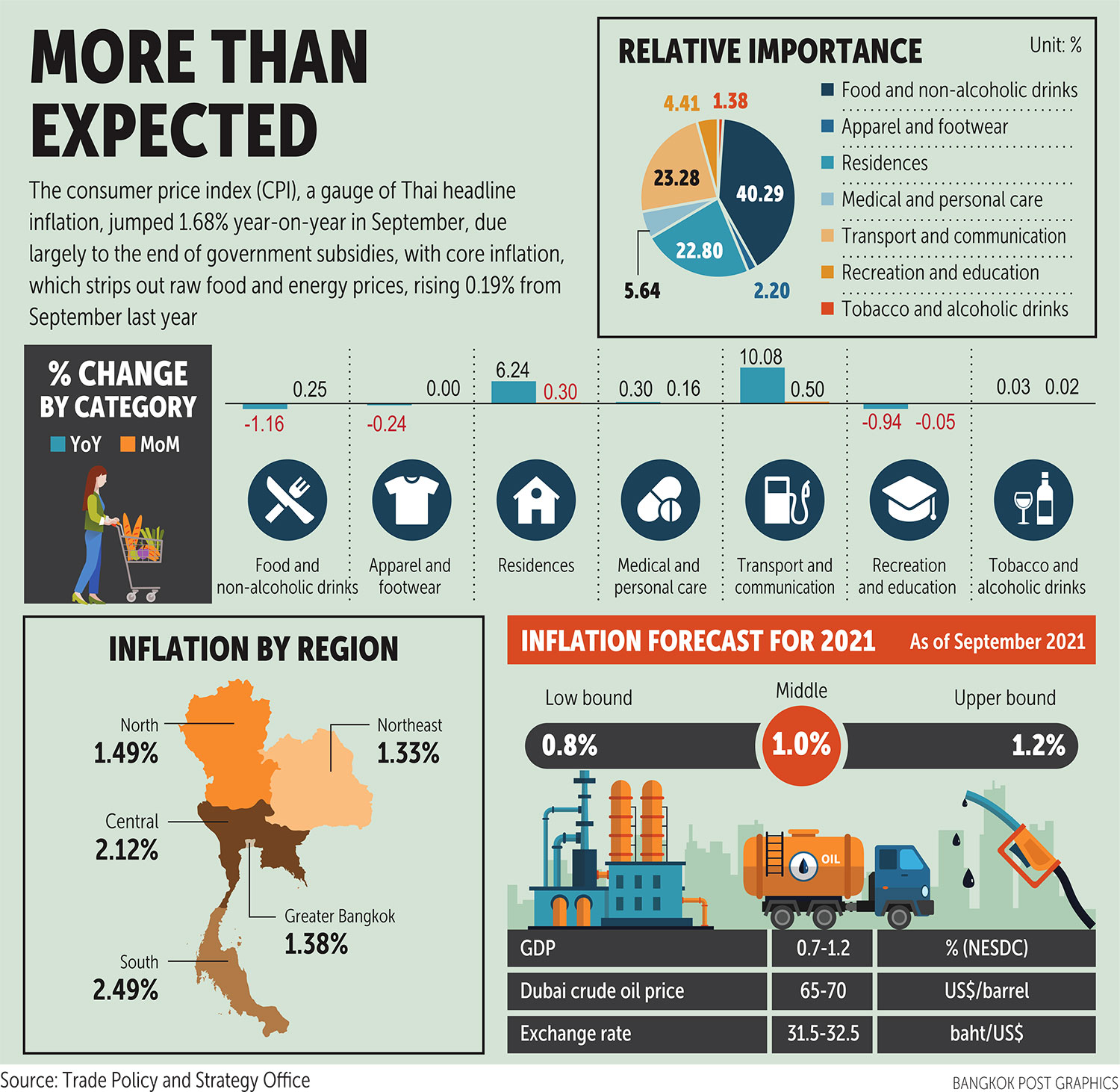

Lingering Effects Toxic Chemical Contamination From Ohio Train Derailment

May 07, 2025

Lingering Effects Toxic Chemical Contamination From Ohio Train Derailment

May 07, 2025 -

Young And Restless Recap Friday March 7 Diane And Kyles Storylines

May 07, 2025

Young And Restless Recap Friday March 7 Diane And Kyles Storylines

May 07, 2025 -

Cem Karaca Bati Ve Anadolu Mueziginin Essiz Bulusmasi

May 07, 2025

Cem Karaca Bati Ve Anadolu Mueziginin Essiz Bulusmasi

May 07, 2025 -

Mideast Titans Retreat From Ai Race Us And China Lead

May 07, 2025

Mideast Titans Retreat From Ai Race Us And China Lead

May 07, 2025 -

Hawkgirl In Superman James Gunn Shares Exciting New Information

May 07, 2025

Hawkgirl In Superman James Gunn Shares Exciting New Information

May 07, 2025

Latest Posts

-

Dame Laura Kenny Welcomes Daughter After Fertility Struggle

May 07, 2025

Dame Laura Kenny Welcomes Daughter After Fertility Struggle

May 07, 2025 -

The Evolution Of Dame Laura Kenny From Olympic Gold To New Leadership Roles

May 07, 2025

The Evolution Of Dame Laura Kenny From Olympic Gold To New Leadership Roles

May 07, 2025 -

Dame Laura Kenny Reflecting On Olympic Triumphs And Shaping The Future

May 07, 2025

Dame Laura Kenny Reflecting On Olympic Triumphs And Shaping The Future

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special How Much Did They Win

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special How Much Did They Win

May 07, 2025 -

Laura Kennys Golden Journey Lessons Learned And New Roles

May 07, 2025

Laura Kennys Golden Journey Lessons Learned And New Roles

May 07, 2025