Thames Water Executive Bonuses: A Case Study In Corporate Governance

Table of Contents

2. The Performance of Thames Water and the Justification for Bonuses

Thames Water's Financial Performance:

Thames Water's financial performance in recent years presents a complex picture. While the company has reported profits, analysts point to high levels of debt and concerns about insufficient investment in critical infrastructure upgrades. Keywords like "Thames Water financial performance," "profitability," "debt," and "infrastructure investment" are key to understanding this duality.

- High Debt Levels: Significant debt burdens impact the company's financial flexibility and ability to invest in future improvements.

- Profitability Concerns: While profits have been reported, the sustainability and ethical implications of these profits amidst ongoing customer service issues and environmental concerns remain a point of contention.

- Inadequate Infrastructure Investment: Reports suggest a lag in investment compared to the needs of a growing population and aging infrastructure, leading to increased incidents of sewage overflows and service disruptions. This directly contradicts the often-cited justifications for executive bonuses.

The contrast between the reported financial performance and the public perception of failing service – marked by leaks, sewage overflows, and persistent complaints – fuels the public anger surrounding Thames Water executive bonuses.

The Argument for Executive Bonuses:

Thames Water’s defense of its executive bonus structure typically centers on "performance-based pay" and the need for strong incentives to attract and retain top talent in a competitive market. Keywords such as "executive compensation," "performance-based pay," and "incentives" are frequently employed in their justifications.

- Meeting Key Performance Indicators (KPIs): Thames Water often points to the achievement of specific, internally set KPIs as justification for bonuses. However, the transparency and relevance of these KPIs are often questioned by the public.

- Attracting and Retaining Talent: The company argues that competitive executive compensation is necessary to attract and retain skilled managers capable of navigating the challenges of the water industry.

- Long-Term Strategic Goals: Justifications sometimes include references to long-term strategic goals achieved through the leadership of the executive team, implying a direct link between executive action and company success.

However, the weakness of these arguments lies in the lack of transparency and the disconnect between claimed success and the widely perceived failures in service delivery and environmental responsibility.

The Role of Regulatory Oversight:

Ofwat, the water regulator, plays a crucial role in overseeing Thames Water's performance and executive compensation. Keywords such as "Ofwat," "water regulation," "corporate accountability," and "regulatory oversight" are crucial in understanding this dynamic. The effectiveness of Ofwat's regulatory power in curbing excessive executive pay remains a subject of ongoing debate.

- Regulatory Framework Limitations: Existing regulations may not be stringent enough to effectively prevent excessive executive bonuses, particularly when these bonuses are linked to internally-set performance indicators.

- Lack of Transparency: Concerns persist regarding the transparency of Ofwat's oversight and the accessibility of information regarding Thames Water’s executive compensation structure.

- Potential for Regulatory Reform: The Thames Water controversy highlights the need for strengthened regulatory frameworks with greater emphasis on corporate social responsibility and environmental performance, beyond mere financial indicators. This includes more robust scrutiny of executive compensation packages.

3. Public Backlash and the Ethical Implications of Thames Water Executive Bonuses

Public Opinion and Media Coverage:

The public reaction to news of Thames Water executive bonuses has been overwhelmingly negative, marked by widespread anger and frustration. Keywords such as "public outrage," "media scrutiny," "negative publicity," and "PR crisis" aptly describe the situation.

- Social Media Outrage: Social media platforms have been flooded with criticism, highlighting the disconnect between executive rewards and the everyday experiences of Thames Water customers.

- Negative Media Coverage: Major news outlets have widely reported on the controversy, fueling public anger and intensifying calls for greater corporate accountability.

- Public Protests: The controversy has led to organized protests and campaigns demanding greater transparency and fairer distribution of resources.

Ethical Considerations and Corporate Social Responsibility:

Awarding substantial bonuses while facing significant criticism for environmental failings, such as repeated sewage overflows, raises serious ethical questions. Keywords like "corporate social responsibility," "environmental performance," "ethical leadership," and "stakeholder interests" are central to this discussion.

- Stakeholder Capitalism Neglect: The Thames Water case exemplifies a failure to adequately consider the interests of all stakeholders – including customers, the environment, and the wider community – in favor of prioritizing shareholder value and executive compensation.

- Environmental Damage Costs: The cost of environmental damage caused by sewage overflows and other issues far outweighs the benefits of executive bonuses, raising concerns about a lack of ethical leadership.

- Brand Reputation Damage: The negative publicity surrounding the executive bonuses has severely damaged Thames Water's brand reputation, impacting customer loyalty and trust.

4. Case Study Comparisons and Lessons Learned

Comparing Thames Water to Other Companies:

The Thames Water case echoes similar controversies surrounding executive pay in other sectors, highlighting a broader pattern of corporate governance failures. Keywords such as "executive pay," "corporate governance failures," "best practices," and "case studies" are useful in comparing and contrasting these instances.

- Financial Sector Scandals: Comparisons can be drawn with scandals in the financial sector, where excessive bonuses contributed to risky behavior and ultimately resulted in widespread economic damage.

- Energy Sector Controversies: Similar controversies in the energy sector illustrate the broader challenge of aligning executive compensation with environmental responsibility and social impact.

- Common Themes: Across these cases, common themes include a lack of transparency in compensation structures, a disconnect between executive rewards and company performance, and inadequate regulatory oversight.

Implications for Corporate Governance Reform:

The Thames Water case underscores the urgent need for meaningful corporate governance reform. Keywords like "corporate governance reform," "executive pay transparency," "shareholder activism," and "regulatory changes" are vital for this discussion.

- Increased Transparency: Mandatory disclosure of executive compensation packages, along with clear justification for bonus payouts, is essential for improving accountability.

- Strengthened Regulatory Oversight: More robust regulatory frameworks are needed to ensure that executive compensation is aligned with overall company performance, including environmental and social considerations.

- Shareholder Activism: Encouraging shareholder activism and promoting engagement with corporate governance issues can create pressure for more responsible compensation practices.

5. Conclusion: The Future of Thames Water Executive Bonuses and Corporate Accountability

The Thames Water executive bonus controversy serves as a stark reminder of the urgent need for robust corporate governance and ethical leadership. The justifications offered by Thames Water, while framed around performance-based pay and attracting talent, fall short when confronted with the company's environmental record and public perception of its service. The outrage surrounding "Thames Water executive bonuses" highlights the disconnect between executive compensation and broader stakeholder interests. We need greater transparency in executive bonus structures and a stronger focus on corporate social responsibility. Contact your representatives and support organizations advocating for corporate governance reform to demand greater accountability from companies like Thames Water and influence the future of executive compensation practices. Only through collective action can we ensure that executive pay reflects genuine company success and ethical conduct, rather than simply rewarding short-sighted profit maximization at the expense of the environment and the public good.

Featured Posts

-

Relx Succes Ai Gedreven Groei Ondanks Zwakke Economie

May 24, 2025

Relx Succes Ai Gedreven Groei Ondanks Zwakke Economie

May 24, 2025 -

The Today Show Dylan Dreyers Close Call And What Happened

May 24, 2025

The Today Show Dylan Dreyers Close Call And What Happened

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

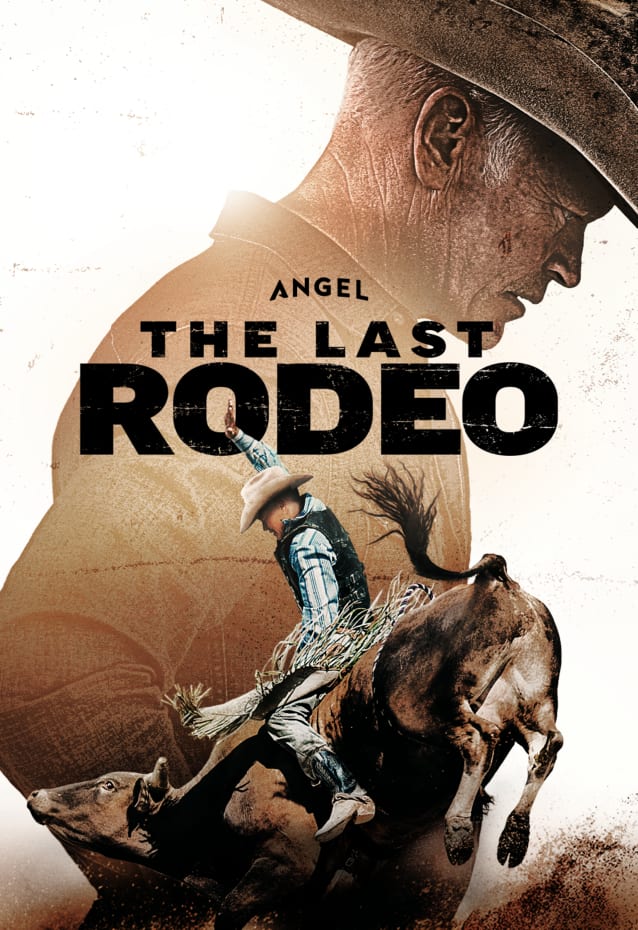

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025 -

Luxus Porsche 911 80 Millio Forintos Extrafelszereltseg

May 24, 2025

Luxus Porsche 911 80 Millio Forintos Extrafelszereltseg

May 24, 2025

Latest Posts

-

How Joe Jonas Dealt With A Couple Fighting About Him

May 24, 2025

How Joe Jonas Dealt With A Couple Fighting About Him

May 24, 2025 -

Joe Jonas How He Handled A Couples Fight Over Him

May 24, 2025

Joe Jonas How He Handled A Couples Fight Over Him

May 24, 2025 -

The Jonas Brothers Couples Argument And Joe Jonass Reaction

May 24, 2025

The Jonas Brothers Couples Argument And Joe Jonass Reaction

May 24, 2025 -

The Jonas Brothers Hilarious Response To Couples Fight

May 24, 2025

The Jonas Brothers Hilarious Response To Couples Fight

May 24, 2025 -

Could Jonathan Groff Make Tony Awards History With Just In Time

May 24, 2025

Could Jonathan Groff Make Tony Awards History With Just In Time

May 24, 2025