The 2025 Fall Of BigBear.ai (BBAI): Factors Contributing To The Decline

Table of Contents

H2: Overreliance on Government Contracts

BigBear.ai's (BBAI) heavy dependence on government contracts proved to be its Achilles' heel. While initially providing a stable revenue stream, this business model inherently carries significant risks. This overreliance created several vulnerabilities:

- Limited Diversification of Revenue Streams: The company's excessive focus on government contracts left it highly susceptible to fluctuations in government spending. A lack of robust private sector clients meant a single downturn in government funding could trigger a catastrophic financial crisis.

- Vulnerability to Changes in Government Spending and Priorities: Changes in political administrations or shifts in national priorities could lead to contract cancellations or delays, dramatically impacting BBAI's revenue projections. Hypothetically, in 2025, a budget realignment could have drastically reduced funding for BBAI's key projects.

- Potential for Contract Delays or Cancellations: The complex nature of government procurement processes often leads to delays and unexpected cancellations. In our hypothetical scenario, several key contracts were delayed, triggering a domino effect on the company's financial stability.

- Increased Competition for Government Contracts: The competitive landscape for government contracts is fiercely competitive. Hypothetically, in 2025, more agile and technologically advanced competitors outbid BBAI for crucial projects, further squeezing its revenue.

H2: Aggressive Expansion and Unsustainable Growth

BBAI's rapid expansion, driven by the initial success of its government contracts, proved unsustainable. The company's aggressive pursuit of growth led to several critical problems:

- Overextension into New Markets without Sufficient Resources or Expertise: BBAI ventured into new markets without adequately assessing its capabilities or resources, leading to costly mistakes and failed projects. For example, a hypothetical expansion into the cybersecurity market without sufficient expertise resulted in significant losses.

- Integration Challenges and Difficulties in Managing a Rapidly Growing Business: The rapid expansion strained BBAI's internal infrastructure and management capabilities. Integrating newly acquired companies and projects proved challenging, impacting efficiency and profitability.

- Strain on Internal Infrastructure and Resources: The company's internal systems struggled to keep up with the rapid growth, leading to inefficiencies, communication breakdowns, and ultimately, decreased productivity.

- Increased Operational Costs and Decreased Efficiency: The costs associated with rapid expansion outpaced revenue growth, leading to a decline in profitability and ultimately, financial distress.

H2: Failure to Adapt to Evolving Market Dynamics

BBAI's failure to adapt to the rapidly changing technological landscape and market dynamics further contributed to its decline.

- Lack of Innovation and Investment in R&D: Insufficient investment in research and development meant BBAI lagged behind competitors in terms of technological advancements, hindering its ability to offer cutting-edge solutions.

- Slow Adoption of New Technologies: The company’s reluctance to adopt emerging technologies left it ill-equipped to meet the evolving demands of its clients.

- Inability to Compete Effectively with Agile Competitors: More nimble and innovative competitors quickly gained market share, leaving BBAI struggling to maintain its position.

- Missed Opportunities in Emerging Markets: BBAI failed to capitalize on opportunities in emerging markets, further limiting its growth potential. Hypothetically, the rise of AI-driven solutions in the financial sector was largely ignored.

H2: Poor Financial Management and Internal Issues

Internal challenges and poor financial management exacerbated BBAI's woes.

- High Debt Levels and Cash Flow Problems: Aggressive expansion fueled high debt levels, putting significant strain on BBAI's cash flow and increasing its vulnerability to economic downturns.

- Inefficient Cost Structures: High operational costs, combined with declining revenue, created a significant financial burden.

- Lack of Transparency and Accountability: Lack of transparency and internal conflicts hindered effective decision-making and created an environment of distrust.

- Leadership Changes and Internal Conflicts: Frequent leadership changes and internal conflicts further destabilized the company, disrupting operations and damaging morale.

3. Conclusion

The hypothetical fall of BigBear.ai (BBAI) in 2025 highlights the dangers of overreliance on government contracts, unsustainable growth, a failure to adapt to market dynamics, and poor internal management. Each of these factors played a crucial role in its decline. The most significant lesson learned is the critical need for diversification, strategic planning, and sound financial management for long-term sustainability. Understanding the factors that contributed to this hypothetical fall of BigBear.ai (BBAI) is crucial for investors considering similar companies. Further research into BigBear.ai stock and its future prospects, as well as exploring the risks associated with BBAI investment, is highly recommended.

Featured Posts

-

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025 -

Wwe Segment With Tony Hinchcliffe A Critical Analysis

May 21, 2025

Wwe Segment With Tony Hinchcliffe A Critical Analysis

May 21, 2025 -

The Enduring Appeal Of Little Britain To Gen Z

May 21, 2025

The Enduring Appeal Of Little Britain To Gen Z

May 21, 2025 -

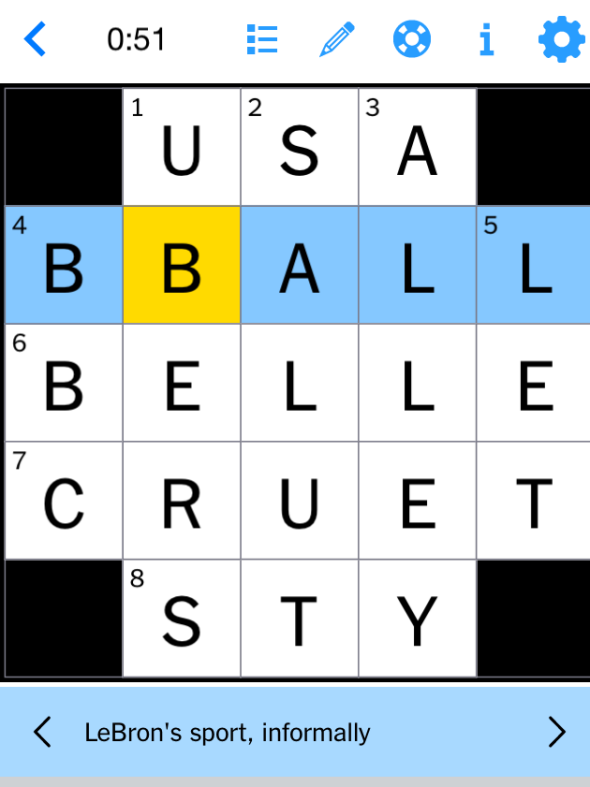

Complete Guide Nyt Mini Crossword Answers For March 26 2025

May 21, 2025

Complete Guide Nyt Mini Crossword Answers For March 26 2025

May 21, 2025 -

Work From Home

May 21, 2025

Work From Home

May 21, 2025

Latest Posts

-

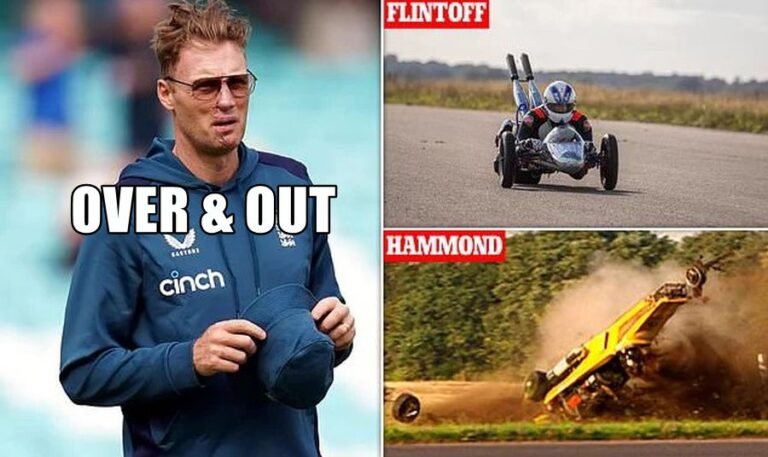

Flintoffs Honest Reflection The Horror Car Crash And His Near Death Experience

May 23, 2025

Flintoffs Honest Reflection The Horror Car Crash And His Near Death Experience

May 23, 2025 -

Freddie Flintoffs Car Crash I Wish I D Died He Admits

May 23, 2025

Freddie Flintoffs Car Crash I Wish I D Died He Admits

May 23, 2025 -

Freddie Flintoffs Accident A Disney Documentary Tells The Story

May 23, 2025

Freddie Flintoffs Accident A Disney Documentary Tells The Story

May 23, 2025 -

Tribute To Andy Peebles Andy Bayes Reflects On Bbc Lancashire Career

May 23, 2025

Tribute To Andy Peebles Andy Bayes Reflects On Bbc Lancashire Career

May 23, 2025 -

Andrew Flintoffs Career Explored In New Disney Film

May 23, 2025

Andrew Flintoffs Career Explored In New Disney Film

May 23, 2025