The American Battleground: Taking On The World's Richest

Table of Contents

The United States, a nation built on ideals of opportunity and equality, faces a stark reality: a widening chasm of American wealth inequality. This "American Battleground" pits the aspirations of the majority against the immense power and influence of the world's wealthiest individuals and corporations. This article explores the key facets of this struggle, examining its causes, consequences, and potential solutions to address this critical issue of income inequality.

<h2>The Roots of American Wealth Inequality</h2>

The vast disparity in wealth distribution in the US didn't emerge overnight. It's the culmination of centuries of historical trends and deliberate policy choices.

<h3>Historical Context</h3>

The foundation of American wealth inequality was laid long ago. Historical factors significantly contributed to the concentration of wealth in the hands of a few.

- The Gilded Age (late 19th century): This era saw unprecedented industrial growth, but also immense wealth accumulation by a select few, leaving many workers in poverty. Robber barons and monopolies controlled vast sectors of the economy.

- The Legacy of Jim Crow: Systemic racism and discriminatory practices, including slavery and Jim Crow laws, systematically excluded Black Americans from wealth-building opportunities, creating a lasting wealth gap that persists to this day. This historical injustice continues to fuel wealth inequality.

- Land Ownership Patterns: Unequal access to land historically, particularly during westward expansion, created significant disparities in wealth accumulation. Those who had access to land prospered while many were left with nothing.

- Deregulation's Impact: Periods of deregulation have often led to increased corporate profits and executive compensation, widening the gap between the rich and the poor.

Statistics paint a clear picture. For example, the top 1% of Americans held approximately 30% of the nation's wealth in the late 20th century, a figure that has only grown since. This stark reality demonstrates the long-term effects of these historical trends on the current state of American wealth inequality.

<h3>Economic Policies and Tax Laws</h3>

Economic policies and tax laws have played a significant role in exacerbating wealth inequality.

- Impact of Tax Cuts on the Wealthy: Repeated tax cuts benefiting the wealthy, particularly those focused on capital gains and inheritance taxes, have concentrated wealth at the top. These policies disproportionately benefit those who already possess significant assets.

- Loopholes in Tax Codes: Complex tax codes with numerous loopholes allow the wealthy to legally minimize their tax burdens, further widening the wealth gap. This creates an uneven playing field, where the wealthy can afford sophisticated tax planning strategies unavailable to most Americans.

- Effect of Globalization on Income Disparity: Globalization, while offering certain benefits, has also contributed to income inequality by shifting jobs overseas and depressing wages for many American workers. This has resulted in a shrinking middle class and a growing gap between the rich and the poor.

Numerous studies by organizations like the Congressional Budget Office and the Institute on Taxation and Economic Policy highlight the regressive nature of many current tax policies and their impact on the distribution of wealth.

<h2>The Consequences of Extreme Wealth Disparity</h2>

The consequences of extreme wealth disparity are far-reaching, impacting nearly every aspect of American society.

<h3>Social Impact</h3>

The high levels of wealth inequality have devastating social consequences.

- Effects on Healthcare Access: Lack of access to affordable healthcare is a direct consequence of wealth inequality, leaving many without the necessary medical care. This leads to poorer health outcomes and increased mortality rates for those lacking financial resources.

- Education Opportunities: Wealth inequality creates significant disparities in educational opportunities. Children from wealthier families have access to better schools, resources, and opportunities, while children from low-income families often lack the necessary resources to succeed. This perpetuates cycles of poverty and inequality.

- Crime Rates: Research suggests a correlation between wealth inequality and higher crime rates. Increased desperation and lack of opportunity in marginalized communities can lead to higher levels of crime.

Data consistently shows a strong correlation between wealth inequality and poor social outcomes, including lower life expectancy, higher rates of infant mortality, and increased social unrest.

<h3>Political Influence</h3>

Concentrated wealth translates directly into political influence, distorting democratic processes.

- Super PACs: Super PACs, fueled by massive donations from wealthy individuals and corporations, wield significant influence over elections and political discourse. This undermines the principles of democratic representation.

- Lobbying Groups: Powerful lobbying groups, representing the interests of wealthy corporations and individuals, exert considerable pressure on policymakers, shaping legislation to benefit their agendas. This often leads to policies that exacerbate wealth inequality.

- Influence on Policy Decisions: The wealthy have disproportionate access to politicians and policymakers, influencing policy decisions in ways that benefit their interests. This creates a system where the voices of ordinary citizens are often drowned out.

Numerous examples illustrate how wealthy individuals and corporations actively shape legislation, often to their own benefit and at the expense of the broader population.

<h2>Strategies for Addressing American Wealth Inequality</h2>

Addressing American wealth inequality requires a multi-pronged approach focusing on policy changes and social investments.

<h3>Progressive Taxation</h3>

A fairer tax system is crucial for reducing wealth inequality.

- Increased Taxes on High Earners: Implementing a more progressive tax system, with higher tax rates for high-income earners and corporations, would generate revenue that could be used to fund social programs and reduce the budget deficit.

- Closing Loopholes That Benefit the Wealthy: Closing tax loopholes that disproportionately benefit the wealthy would increase tax revenue and create a more level playing field. This would ensure that everyone pays their fair share.

- Potential Revenue Generation: Progressive taxation has the potential to significantly increase government revenue, allowing for investments in crucial social programs and infrastructure.

While some argue that higher taxes stifle economic growth, research suggests that progressive taxation can be implemented without significantly harming economic activity.

<h3>Strengthening Labor Unions and Minimum Wage</h3>

Empowering workers is essential for reducing income inequality.

- Improved Worker Bargaining Power: Strong labor unions give workers greater bargaining power, allowing them to negotiate for fair wages, benefits, and working conditions. This directly impacts income distribution.

- Reduced Income Inequality: Higher minimum wages, coupled with stronger unions, can significantly reduce income inequality by ensuring that low-wage workers earn a living wage.

- Potential Effects on Job Creation: Contrary to some arguments, studies have shown that increasing minimum wages does not necessarily lead to significant job losses and can even stimulate economic activity.

<h3>Investment in Education and Social Programs</h3>

Investing in human capital and social safety nets is vital for promoting social mobility and reducing inequality.

- Affordable College: Making college more affordable through tuition reduction or increased financial aid would improve social mobility and increase opportunities for individuals from lower-income backgrounds.

- Improved Public Schools: Investing in quality public education for all children, regardless of their socioeconomic background, would create a more equitable playing field and reduce achievement gaps.

- Expansion of Social Security and Affordable Healthcare: Expanding social security and ensuring access to affordable healthcare are crucial for providing a safety net for vulnerable populations and reducing economic insecurity. Other countries have successfully implemented such measures, improving overall equity.

<h2>Conclusion</h2>

The "American Battleground" over wealth inequality is a critical issue demanding urgent action. This article has explored the historical factors contributing to American wealth inequality, its significant social and political consequences, and potential solutions through progressive taxation, stronger labor protections, and increased investment in education and social programs. Addressing income inequality is not just a matter of economic fairness; it is essential for a healthy and functioning democracy. Understanding the roots of this disparity and advocating for policies that promote fairness and opportunity are critical steps towards building a more equitable future. Join the fight against American wealth inequality and demand change today. Learn more about [link to relevant resource, e.g., the Economic Policy Institute or Oxfam America].

Featured Posts

-

Shedeur Sanders Nfl Future Cam Newtons Prediction And Team Analysis

Apr 26, 2025

Shedeur Sanders Nfl Future Cam Newtons Prediction And Team Analysis

Apr 26, 2025 -

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

Apr 26, 2025

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

Apr 26, 2025 -

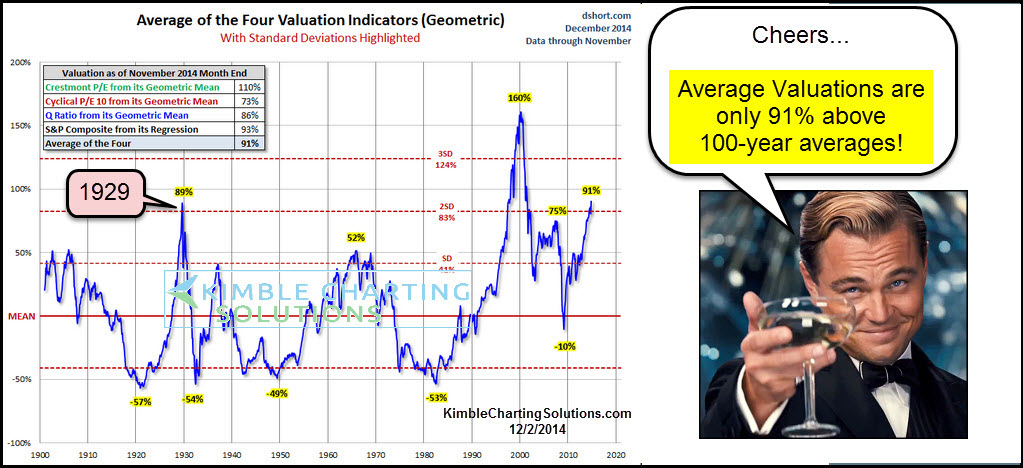

Understanding Stock Market Valuations Bof As Perspective For Investors

Apr 26, 2025

Understanding Stock Market Valuations Bof As Perspective For Investors

Apr 26, 2025 -

Are Food Dyes Being Banned Dr Sanjay Gupta Explains

Apr 26, 2025

Are Food Dyes Being Banned Dr Sanjay Gupta Explains

Apr 26, 2025 -

Peiling Wijst Uit Groeiend Draagvlak Voor Koningshuis 59

Apr 26, 2025

Peiling Wijst Uit Groeiend Draagvlak Voor Koningshuis 59

Apr 26, 2025