The Bank Of Canada And Rate Relief: An Analysis Of Recent Labour Market Data By David Rosenberg

Table of Contents

David Rosenberg's Perspective on the Canadian Economy

David Rosenberg, a highly respected economist and strategist, consistently offers insightful commentary on global and Canadian economic trends. His analysis often focuses on identifying potential risks and opportunities within the market. Currently, Rosenberg's perspective on the Canadian economy is nuanced, acknowledging both positive and negative indicators. He frequently highlights concerns about persistent inflationary pressures, even as the Bank of Canada attempts to manage them through interest rate adjustments.

- Key Concerns: Rosenberg often expresses concern about the resilience of inflation, suggesting that the Bank of Canada's rate hikes haven't fully dampened price increases. He closely monitors core inflation measures to assess the true underlying inflationary pressures.

- Predictions: While he acknowledges positive aspects like strong employment numbers, he cautions about the potential for a slowdown in economic growth due to high interest rates. He often highlights the impact of higher borrowing costs on consumer spending and business investment.

- Economic Indicators: Rosenberg's analysis frequently references key economic indicators such as the Consumer Price Index (CPI), the unemployment rate, and various measures of economic growth (GDP). He pays close attention to leading indicators that might signal future economic trends. You can find many of his insights on his blog and through his various media appearances. [Link to Rosenberg's website/relevant articles].

Analysis of Recent Canadian Labour Market Data

Recent Canadian labour market data presents a mixed picture. While unemployment remains relatively low, certain trends raise questions about the overall health of the economy. The most recent data reveals:

- Unemployment Rate: The unemployment rate has remained relatively low compared to historical averages, indicating a strong labour market overall. However, this does not necessarily reflect the full picture of labour market health.

- Job Creation/Loss: While job creation has been positive in certain sectors, others have experienced job losses, particularly those sensitive to interest rate changes. This divergence highlights the uneven impact of economic policies across different industries.

- Participation Rate: The labour force participation rate has shown [Insert trend - increase/decrease/stagnation] which may suggest [Insert implication, e.g., increased workforce participation or discouragement].

- Regional Variations: Provincial variations exist. Some provinces experience stronger job growth than others, reflecting regional economic differences and the impact of sector-specific trends. [Insert data/chart showing regional differences].

These statistics need to be interpreted carefully. While low unemployment suggests a healthy labour market, it does not necessarily mean that inflationary pressures are easing, especially if wage growth remains elevated.

The Bank of Canada's Response to Labour Market Trends

The Bank of Canada's monetary policy is currently focused on [State the current policy stance: e.g., fighting inflation, managing growth]. Their decisions are influenced by a multitude of factors, including:

- Inflation: The Bank of Canada’s primary mandate is price stability. They closely monitor inflation to determine the appropriate level of interest rates.

- Economic Growth: They aim to balance inflation control with sustainable economic growth, avoiding a sharp economic downturn.

- Labour Market Conditions: Employment data provides valuable insights into the health of the economy and informs their policy decisions.

The potential for future rate cuts or increases depends on the evolution of these factors. If inflation remains stubbornly high, further interest rate increases may be necessary. Conversely, if inflation cools and economic growth slows, the Bank may consider rate cuts to stimulate the economy.

- Recent Policy Actions: The Bank of Canada has [summarize recent actions: e.g., recently increased the policy interest rate to X% citing concerns about persistent inflation]. [Link to relevant Bank of Canada press release].

- Future Scenarios: Depending on incoming economic data, the Bank may choose to [state potential future actions: e.g., maintain the current interest rate, increase rates further, or initiate a rate-cutting cycle].

Connecting Rosenberg's Analysis with the Bank of Canada's Actions

Comparing Rosenberg's predictions with the Bank of Canada's actions reveals both areas of agreement and divergence.

- Areas of Agreement: Rosenberg’s emphasis on persistent inflationary pressures aligns with the Bank of Canada's focus on containing inflation. Both acknowledge the challenges posed by stubbornly high inflation rates.

- Areas of Divergence: Rosenberg may have a more pessimistic outlook on the pace of economic deceleration or the resilience of inflation, leading to differences in predicted policy responses. He might predict a more aggressive rate-cutting cycle than what the Bank of Canada currently anticipates.

- Implications: The discrepancies between Rosenberg's predictions and the Bank of Canada's actions highlight the uncertainty inherent in economic forecasting. Investors and businesses should carefully consider various perspectives when making investment decisions.

Conclusion: The Future of Bank of Canada Rate Relief – Insights from David Rosenberg

In conclusion, understanding the Bank of Canada's potential for rate relief requires a thorough analysis of recent labour market data and the broader economic landscape. David Rosenberg's insights offer a valuable perspective, highlighting the challenges of managing inflation while maintaining sustainable economic growth. While the Bank of Canada's actions are guided by its mandate and its assessment of economic data, it's crucial to monitor economic indicators and various expert opinions. The future direction of interest rates will depend heavily on the evolution of inflation and the broader economic climate. Continue following the economic news, analyze the Bank of Canada’s future announcements, and consider seeking professional financial advice related to Bank of Canada rate relief and its implications. [Link to Bank of Canada website and other relevant financial news sources].

Featured Posts

-

Middle Managers Investing In Their Development For Optimal Business Results

May 31, 2025

Middle Managers Investing In Their Development For Optimal Business Results

May 31, 2025 -

Carnaval D Ouistreham Ouverture De La Saison Estivale

May 31, 2025

Carnaval D Ouistreham Ouverture De La Saison Estivale

May 31, 2025 -

Ne Ohio Weather Alert Showers And Thunderstorms Expected

May 31, 2025

Ne Ohio Weather Alert Showers And Thunderstorms Expected

May 31, 2025 -

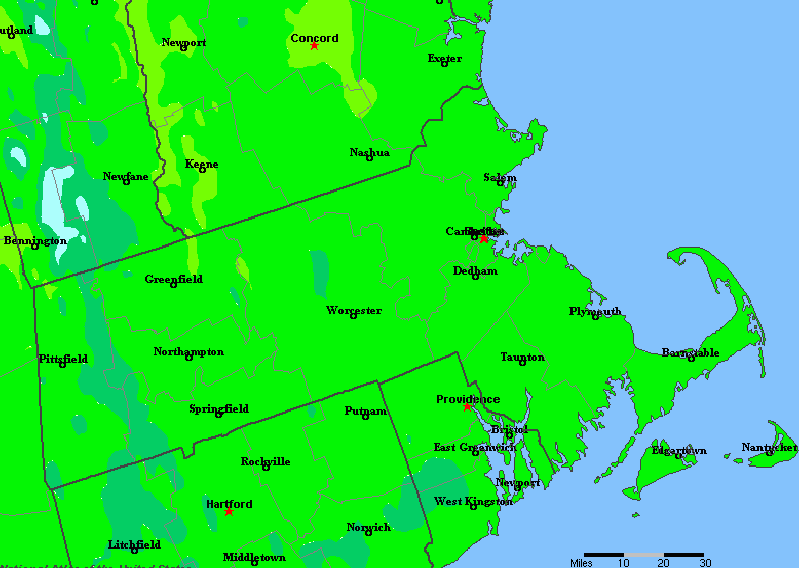

Western Massachusetts How Climate Change Impacts Rainfall

May 31, 2025

Western Massachusetts How Climate Change Impacts Rainfall

May 31, 2025 -

Updated Covid 19 Variant Concerns Who Report

May 31, 2025

Updated Covid 19 Variant Concerns Who Report

May 31, 2025