The Bank Of Canada And The Trump Tariffs: An April 2018 Interest Rate Analysis

Table of Contents

The Economic Climate of April 2018

April 2018 saw the Canadian economy exhibiting moderate growth, but with underlying uncertainties. While GDP growth remained positive, several indicators pointed towards a less robust outlook than in previous years. The Bank of Canada interest rate setting would need to account for these factors.

- Inflation levels and their trajectory: Inflation was hovering around the Bank of Canada's target range of 1-3%, but there were concerns about potential upward pressure due to rising global oil prices and the looming impact of the Trump tariffs.

- Canadian dollar exchange rate against the US dollar: The Canadian dollar (CAD) experienced volatility against the US dollar (USD), influenced by global market sentiment and anxieties about the trade conflict. Fluctuations in the CAD/USD exchange rate directly impacted Canadian exports and imports.

- Housing market conditions: The Canadian housing market, particularly in major urban centers, showed signs of cooling after several years of rapid growth. This softening could affect overall economic activity and consumer confidence.

- Consumer confidence index: Consumer confidence indices indicated a degree of caution among Canadian consumers, reflecting concerns about the uncertain economic outlook, particularly in the context of escalating trade tensions.

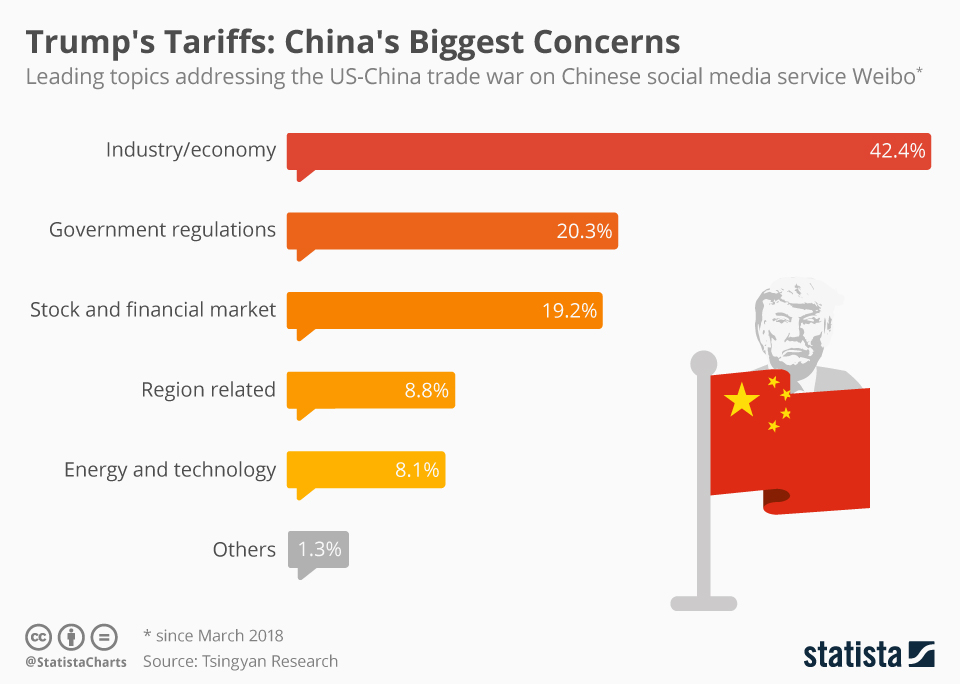

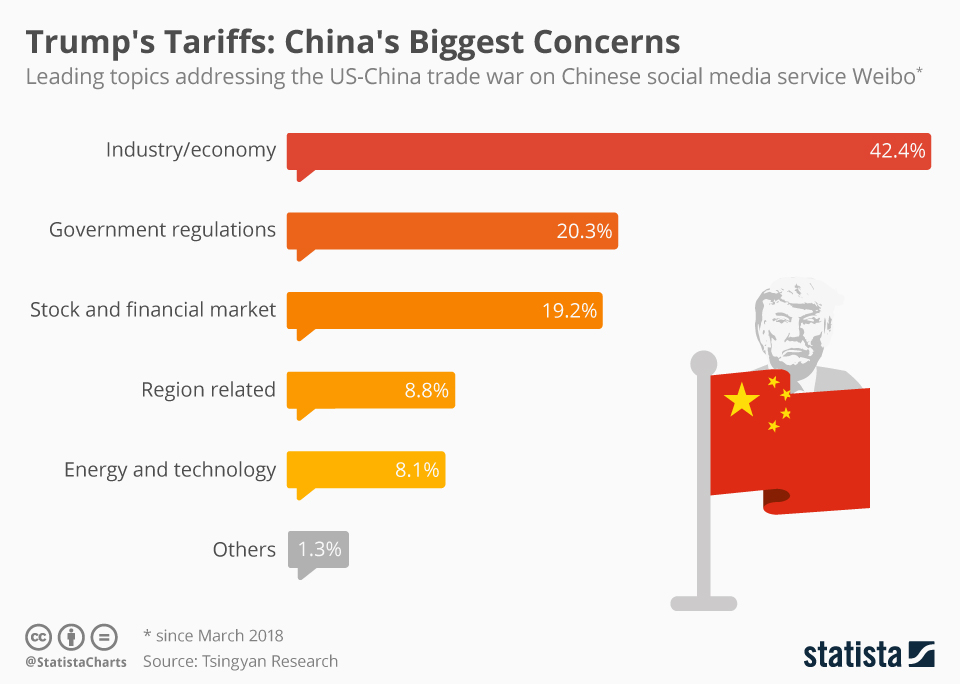

The Impact of Trump Tariffs on the Canadian Economy

The newly implemented Trump tariffs, specifically targeting Canadian lumber and aluminum, created significant ripple effects throughout the Canadian economy. These tariffs directly challenged the Bank of Canada interest rate strategy.

- Impact on specific Canadian industries: The lumber and aluminum sectors were immediately and severely affected, experiencing reduced demand from the US market, impacting employment and investment in these industries. Other sectors faced indirect consequences through supply chain disruptions and reduced consumer spending.

- Potential for trade disputes and retaliatory measures: The tariffs ignited trade tensions, raising the prospect of retaliatory measures from Canada, which further complicated the economic forecast and added pressure on the Bank of Canada's interest rate decisions.

- Uncertainty created by the tariff announcements: The unpredictable nature of the tariff announcements generated considerable uncertainty among businesses, discouraging investment and hindering long-term planning. This uncertainty compounded the challenges faced by policymakers at the Bank of Canada.

- Shifting trade relationships and their effect on Canadian exports: The tariffs forced Canadian businesses to seek alternative export markets, a process that was both time-consuming and costly, further dampening economic growth and impacting the overall economy and considerations for the Bank of Canada interest rate.

Analyzing the Uncertainty: Inflationary and Deflationary Pressures

The Trump tariffs created conflicting pressures on the Canadian economy, simultaneously pushing towards both inflation and deflation.

- Explanation of inflationary pressures from tariff-increased import costs: Tariffs increased the cost of imported goods, leading to higher prices for consumers and businesses, potentially fueling inflationary pressures.

- Explanation of deflationary pressures from decreased export demand: Reduced demand for Canadian exports, particularly lumber and aluminum, put downward pressure on prices and economic activity, creating deflationary risks.

- Discussion of the Bank of Canada's challenge in balancing these opposing forces: The Bank of Canada faced the difficult task of navigating these opposing forces. Raising interest rates to combat inflation could further dampen economic activity already weakened by reduced exports, while leaving rates unchanged risked allowing inflation to spiral.

The Bank of Canada's Response: Interest Rate Decisions in April 2018

In April 2018, the Bank of Canada maintained its key interest rate at 1.25%. This decision reflected a cautious approach in response to the conflicting economic signals.

- The actual interest rate set by the Bank of Canada: The decision to hold the rate steady, neither raising nor lowering it, signaled a wait-and-see approach.

- The Bank of Canada's official statement explaining their rationale: The Bank's statement acknowledged the uncertainty created by the tariffs and emphasized its commitment to monitoring the situation closely. The statement balanced concerns about inflation with the need to support economic growth.

- Analysis of whether the decision was hawkish (raising rates) or dovish (lowering rates) and why: The decision was considered neutral or slightly dovish, prioritizing economic growth in the face of increased uncertainty. Raising rates would have risked exacerbating the negative impacts of the tariffs.

- Mention of any forward guidance provided by the Bank of Canada: The Bank likely provided forward guidance emphasizing its data-dependent approach and its willingness to adjust rates as economic conditions evolved.

Alternative Scenarios and Counterfactual Analysis

It's crucial to consider what might have happened without the imposition of the Trump tariffs.

- Speculation on the Bank of Canada's likely response without the tariff impact: In the absence of tariffs, the Bank of Canada might have considered a slightly more hawkish stance, potentially raising interest rates to address inflationary pressures more aggressively.

- Analysis of potential economic outcomes under different scenarios: Without tariffs, Canadian economic growth would likely have been stronger, potentially leading to higher inflation and a greater likelihood of interest rate hikes.

- Discussion of the significance of the tariffs' influence on the Bank of Canada's actions: The Trump tariffs significantly altered the Bank of Canada's policy trajectory, forcing a more cautious and data-dependent approach than might have otherwise been the case.

Conclusion

In April 2018, the Canadian economy faced a complex situation marked by moderate growth, uncertainty stemming from the Trump tariffs, and conflicting inflationary and deflationary pressures. The Bank of Canada's decision to maintain its key interest rate reflected a cautious approach, balancing the need to support economic growth with concerns about inflation and trade uncertainties. The Trump tariffs significantly influenced the Bank of Canada's decision-making process, highlighting the challenges of managing economic policy amidst significant external shocks. Further research into the impact of the Trump tariffs on the Canadian economy and the Bank of Canada's subsequent interest rate decisions is encouraged. Understanding the intricacies of Bank of Canada interest rate policy in relation to global trade disputes is crucial for navigating future economic uncertainties. For deeper analysis of Bank of Canada interest rate decisions and their impact on the Canadian economy, continue exploring related resources and stay informed about ongoing developments affecting the Bank of Canada interest rate.

Featured Posts

-

Gaza Flotilla Under Attack Latest Updates From Malta

May 03, 2025

Gaza Flotilla Under Attack Latest Updates From Malta

May 03, 2025 -

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi

May 03, 2025

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi

May 03, 2025 -

Loblaws Commitment To Canadian Products A Temporary Trend

May 03, 2025

Loblaws Commitment To Canadian Products A Temporary Trend

May 03, 2025 -

Wednesday Lottery Results April 30th 2025

May 03, 2025

Wednesday Lottery Results April 30th 2025

May 03, 2025 -

5 6 9

May 03, 2025

5 6 9

May 03, 2025

Latest Posts

-

Nigel Farage In Shrewsbury Reform Party Leaders Visit Flat Cap And Tory Criticism

May 04, 2025

Nigel Farage In Shrewsbury Reform Party Leaders Visit Flat Cap And Tory Criticism

May 04, 2025 -

Farages Reform Party Under Fire For Jimmy Savile Slogan

May 04, 2025

Farages Reform Party Under Fire For Jimmy Savile Slogan

May 04, 2025 -

Nigel Farages Whats Apps Spark Integrity Debate In Reform Party

May 04, 2025

Nigel Farages Whats Apps Spark Integrity Debate In Reform Party

May 04, 2025 -

Nigel Farages Savile Slogan Reform Party Sparks Online Outrage

May 04, 2025

Nigel Farages Savile Slogan Reform Party Sparks Online Outrage

May 04, 2025 -

Leaked Messages Reveal Deep Divisions Within Reform Party

May 04, 2025

Leaked Messages Reveal Deep Divisions Within Reform Party

May 04, 2025