The Bitcoin Market's Volatility And Trump's Crypto Expert's View

Table of Contents

Factors Contributing to Bitcoin's Volatility

Bitcoin's price fluctuations are rarely predictable, a characteristic driven by a complex interplay of factors. Understanding these factors is crucial for anyone considering Bitcoin investment or trading.

Market Sentiment and Speculation

The cryptocurrency market is highly susceptible to shifts in market sentiment. Fear of Missing Out (FOMO) can drive rapid price increases as investors rush to buy, while Fear, Uncertainty, and Doubt (FUD) can trigger equally swift sell-offs. Social media plays a significant role, with viral news and influencer opinions directly impacting Bitcoin price prediction and cryptocurrency investment decisions. The actions of "whales," or large investors, can also dramatically influence price movements, creating significant volatility.

- FOMO and FUD: These powerful emotions often dictate short-term price swings.

- Social Media Impact: Tweets from influential figures can trigger massive buy or sell orders.

- Whale Activity: Large transactions from institutional investors can create significant price volatility.

- Market Sentiment Analysis: Tools and techniques are emerging to better predict shifts in market sentiment.

Regulatory Uncertainty

The lack of a unified global regulatory framework for cryptocurrencies is a major contributor to Bitcoin's volatility. Different countries have vastly different approaches to Bitcoin regulation, creating uncertainty for investors. Government policies, statements from regulatory bodies like the SEC, and even proposed regulations can significantly affect Bitcoin’s price. The potential for new regulations or crackdowns in any major market creates a high degree of uncertainty.

- Varying Regulatory Frameworks: Different countries' approaches to Bitcoin create a complex and unpredictable environment.

- Government Policies and Statements: Announcements from governments can trigger immediate price reactions.

- Impact of Proposed Regulations: The ongoing discussion and potential implementation of new regulations greatly impacts investor confidence.

- Legal Frameworks: The evolution of legal frameworks surrounding cryptocurrencies is a crucial factor in price stability.

Technological Factors

Technological advancements and events within the Bitcoin network itself also impact price volatility. Bitcoin halving events, which reduce the rate of new Bitcoin creation, historically have led to price increases due to decreased supply. Technological upgrades or forks, creating alternative cryptocurrencies, can also significantly affect the Bitcoin price and market share. Furthermore, increased adoption and network effects contribute to price stability in the long run, though short-term volatility remains.

- Bitcoin Halving Events: These predictable events significantly affect the supply of Bitcoin.

- Technological Upgrades and Forks: These can lead to positive or negative price movements depending on market reception.

- Bitcoin Mining: The energy consumption and computational power required for mining influence the security and stability of the network.

- Blockchain Technology: Advancements in blockchain technology can drive wider adoption and influence price.

Trump's Crypto Expert's Perspective (or Political Influence on Bitcoin)

While no single individual can be definitively labeled as the "Trump's crypto expert," several individuals within the Trump administration held views that influenced the cryptocurrency market. Understanding their perspectives on regulation and adoption is key to understanding the political influence on Bitcoin's price volatility. [Insert name of relevant figure and brief background if known]. Their public statements regarding cryptocurrency regulation and adoption played a significant role in shaping market sentiment. For example, [mention specific statements and their market impact].

Analyzing their Views on Bitcoin Volatility

[This section needs to be fleshed out based on the specific figure(s) selected. Analyze their public statements regarding the factors influencing Bitcoin volatility (market sentiment, regulation, technology). Discuss whether their views were bullish or bearish, and how they compared to mainstream market sentiment. Include direct quotes if available].

Navigating the Volatility: Strategies for Investors

The inherent volatility of Bitcoin presents both risks and opportunities. Successful Bitcoin investors employ strategies to mitigate risk and capitalize on market fluctuations.

Risk Management Strategies

Managing risk is paramount in the volatile cryptocurrency market. Diversifying your cryptocurrency portfolio across different assets reduces the impact of any single asset's price drop. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of price, helps mitigate the risk of investing a large sum at a market peak. Remember, highly volatile assets are inherently risky, and losses are possible.

- Diversification: Spreading investments across various cryptocurrencies and other asset classes reduces overall portfolio risk.

- Dollar-Cost Averaging (DCA): Investing consistently over time reduces the impact of price fluctuations.

- Risk Tolerance: Understanding your personal risk tolerance is crucial before investing in any volatile asset.

- Stop-Loss Orders: These orders automatically sell your Bitcoin if the price falls below a predetermined level, limiting potential losses.

Long-Term vs. Short-Term Investing

The choice between long-term and short-term Bitcoin investing strategies depends on your individual risk tolerance and financial goals. Long-term investors typically ride out market fluctuations, believing in the long-term value of Bitcoin. Short-term traders, on the other hand, aim to profit from short-term price swings, often employing leverage and complex trading strategies.

- Bitcoin Long-Term Investment: This strategy requires patience and a belief in Bitcoin's future value.

- Bitcoin Short-Term Trading: This strategy involves actively buying and selling Bitcoin to capitalize on short-term price movements.

- Investment Horizon: Your investment timeline plays a critical role in your choice of strategy.

- Trading Strategies: Various strategies, including technical analysis and arbitrage, are employed by short-term traders.

Conclusion: Understanding and Managing Bitcoin Market Volatility

The Bitcoin market's volatility is driven by a complex interplay of market sentiment, regulatory uncertainty, technological developments, and political influence. Understanding these factors, and the perspectives of key political figures and market analysts, is crucial for informed decision-making. While the inherent risks are significant, effective risk management strategies like diversification and dollar-cost averaging can help investors navigate the turbulent waters. Continue researching "Bitcoin Market Volatility" and related topics to develop informed strategies for managing your Bitcoin investments. Stay updated on regulatory developments and the views of leading market experts to make informed choices in this dynamic market.

Featured Posts

-

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

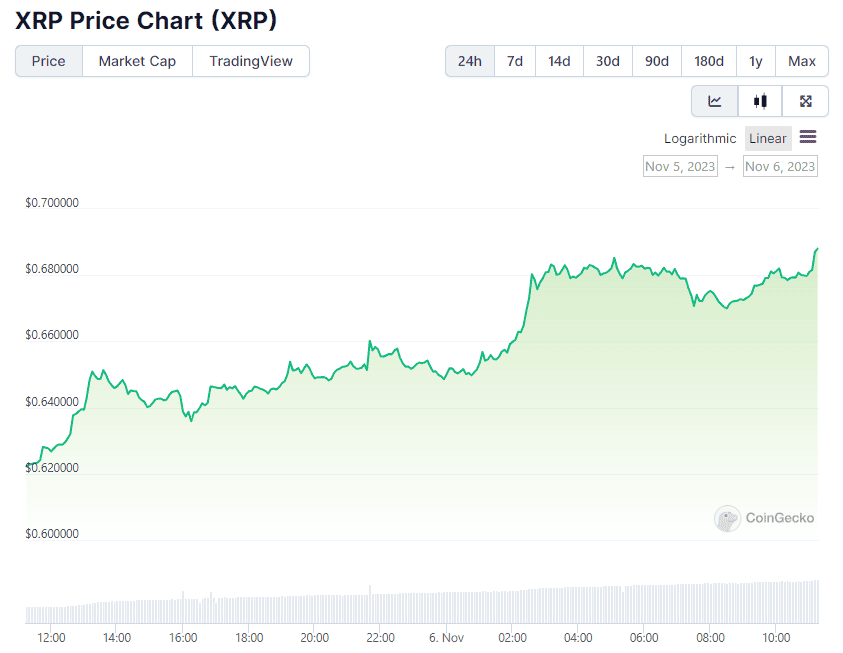

Xrp Price Up 400 Predicting Future Growth Potential

May 08, 2025

Xrp Price Up 400 Predicting Future Growth Potential

May 08, 2025 -

Kripto Piyasalari Icin Spk Dan Kritik Aciklama Yeni Bir Cag

May 08, 2025

Kripto Piyasalari Icin Spk Dan Kritik Aciklama Yeni Bir Cag

May 08, 2025 -

Ultimate Nba Playoffs Triple Doubles Quiz How Well Do You Know The Stats

May 08, 2025

Ultimate Nba Playoffs Triple Doubles Quiz How Well Do You Know The Stats

May 08, 2025 -

Andor Season 2 How It Differs From Rogue One And Redefines Star Wars

May 08, 2025

Andor Season 2 How It Differs From Rogue One And Redefines Star Wars

May 08, 2025