The Bond Crisis: A Growing Threat To Investors

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The Inverse Relationship Between Interest Rates and Bond Prices

The fundamental principle governing bond pricing is the inverse relationship between interest rates and bond prices. Higher interest rates mean lower bond prices, and vice versa. This is because when interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This drives down the price of those existing bonds to bring their yield in line with the market.

- Impact on Existing Bond Yields: Rising interest rates immediately reduce the value of existing bonds, especially those with longer maturities. This is because the fixed coupon payments on these bonds become less attractive compared to the higher yields available on newly issued bonds.

- Attractiveness of New Bonds: Conversely, rising interest rates make new bonds more attractive, as they offer higher yields to compensate for the increased risk. This increased demand for new bonds further pushes down the prices of existing bonds.

- Impact on Bond Portfolios: For investors holding large bond portfolios, rising interest rates can lead to significant capital losses. The longer the duration of the bonds in the portfolio, the greater the impact. For example, a portfolio heavily weighted in long-term government bonds will experience a more substantial decline in value than one invested primarily in short-term corporate bonds.

The Federal Reserve's Role in the Bond Crisis

The Federal Reserve (Fed), through its monetary policy actions, plays a crucial role in shaping interest rates and, consequently, the bond market. The Fed's recent aggressive interest rate hikes, aimed at combating inflation, have significantly impacted bond prices.

- Quantitative Tightening (QT): The Fed's implementation of quantitative tightening (QT), which involves reducing its holdings of government bonds and mortgage-backed securities, further contributes to upward pressure on interest rates. By reducing the demand for bonds, QT pushes bond yields higher.

- Future Actions and Projected Effects: The future path of the Fed's monetary policy remains uncertain. Further interest rate hikes or a prolonged period of high rates could exacerbate the bond crisis, leading to further declines in bond prices. Conversely, a quicker-than-expected pivot towards easing monetary policy could offer some relief to bond markets.

- Alternative Scenarios: A potential scenario includes the Fed pausing rate hikes prematurely, which could lead to a resurgence of inflation, potentially necessitating even more aggressive action later. This uncertainty adds complexity and risk to bond market investments.

Inflation and its Devastating Effect on Bond Returns

Eroding Purchasing Power

Inflation erodes the real return of bond investments. While bonds may provide a nominal yield, inflation eats away at the purchasing power of those returns. This means that the actual return, adjusted for inflation (real yield), might be significantly lower or even negative.

- Historical Examples: Periods of high inflation have historically demonstrated the devastating impact on bond returns. For example, during the 1970s, high inflation in the US significantly reduced the real returns of many bond investments, leaving investors with lower purchasing power.

- Nominal vs. Real Yields: It is crucial to distinguish between nominal yield (the stated interest rate) and real yield (the nominal yield adjusted for inflation). Investors should focus on real yield to accurately assess the true return on their bond investments.

The Struggle for Yield in an Inflationary Environment

In an inflationary environment, investors face the challenge of finding attractive yields while combating the eroding effects of inflation. The low yields offered by many traditional bonds become even less appealing when inflation is high.

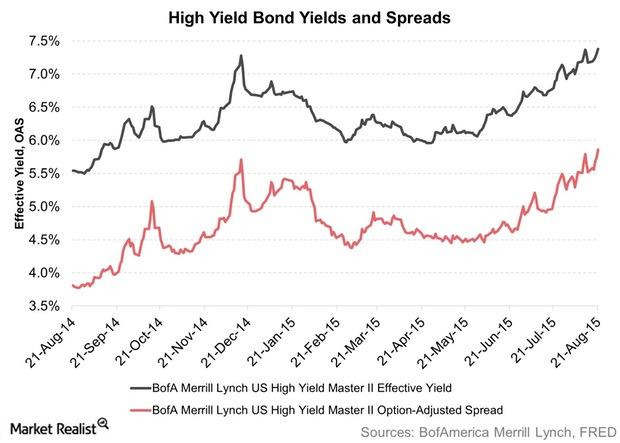

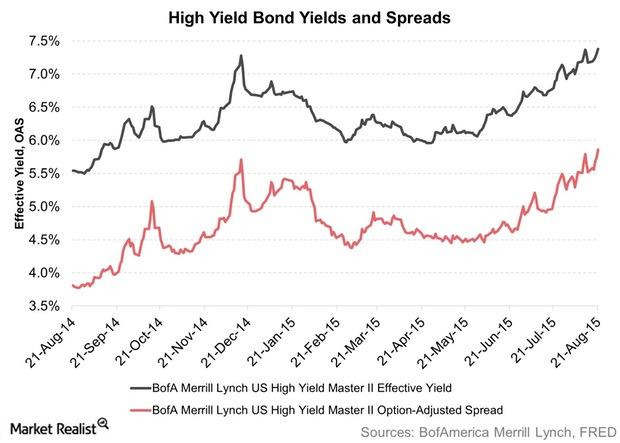

- Shift in Investor Strategies: This has led to a shift in investor strategies, with some seeking higher-yielding assets such as high-yield corporate bonds, emerging market debt, or even alternative investments. However, these alternative investments often carry higher risks.

- Portfolio Adjustments: Investors need to strategically adjust their portfolios to navigate this challenging environment. This may involve shortening the duration of their bond holdings, diversifying into assets that better hedge against inflation (such as inflation-protected securities or TIPS), or considering alternative investment strategies with higher potential yields but also higher risks.

Geopolitical Instability and its Influence on the Bond Market

Global Uncertainty and Risk Aversion

Geopolitical events significantly impact investor sentiment and bond prices. Uncertainty and risk aversion often lead to a flight to safety, pushing investors towards safer assets like government bonds. However, this can be a double-edged sword, as high demand for safe-haven assets can push their yields lower.

- Examples of Geopolitical Impacts: The ongoing war in Ukraine, trade tensions between major economies, and political instability in various regions have all contributed to increased uncertainty in the global bond markets.

- Investor Reactions and Market Effects: Investors tend to become more risk-averse during times of geopolitical uncertainty. This often translates into higher demand for government bonds, which pushes their prices up and yields down. This can also reduce the demand for riskier bonds, like corporate bonds, further impacting their prices.

The Impact of Sovereign Debt Crises

Sovereign debt crises in various countries can trigger wider bond market instability through contagion effects. A crisis in one country can shake investor confidence in other countries with similar economic vulnerabilities, leading to sell-offs across the bond market.

- Vulnerable Countries: Countries with high debt levels, weak economies, and political instability are particularly vulnerable to sovereign debt crises. These crises can cause significant disruptions in global bond markets and impact investors worldwide.

- Contagion Effects and Repercussions: The potential for contagion is significant, meaning that a crisis in one country can quickly spread to others, affecting even countries with seemingly strong economies. The repercussions for investors can range from capital losses to reduced liquidity.

Conclusion

The looming bond crisis presents significant challenges for investors. Rising interest rates, persistent inflation, and geopolitical instability create a complex and uncertain environment. Understanding the interplay of these factors is crucial for mitigating risk. By carefully analyzing your portfolio, diversifying your holdings, and staying informed about market trends, you can navigate this challenging landscape and protect your investments. Don't ignore the signs; actively manage your exposure to the bond crisis to safeguard your financial future. Consider consulting a financial advisor to develop a strategy tailored to your specific circumstances and risk tolerance to better manage your bond portfolio during this period of uncertainty. Proactive management of your bond investments is crucial in today's volatile market.

Featured Posts

-

Stranger Things Star Films In Cardiff New Tv Project Details

May 29, 2025

Stranger Things Star Films In Cardiff New Tv Project Details

May 29, 2025 -

Grupo Frontera Desatendiendo Las Criticas Por Supuesto Apoyo A Donald Trump

May 29, 2025

Grupo Frontera Desatendiendo Las Criticas Por Supuesto Apoyo A Donald Trump

May 29, 2025 -

Mein Schiff Relax Inaugural Season Kicks Off Cruise Line News

May 29, 2025

Mein Schiff Relax Inaugural Season Kicks Off Cruise Line News

May 29, 2025 -

Hujan Guyur Jawa Tengah Prakiraan Cuaca Besok 23 April

May 29, 2025

Hujan Guyur Jawa Tengah Prakiraan Cuaca Besok 23 April

May 29, 2025 -

Talk To Me Directors New Horror Film Bring Her Back Receives Overwhelmingly Positive Early Reviews

May 29, 2025

Talk To Me Directors New Horror Film Bring Her Back Receives Overwhelmingly Positive Early Reviews

May 29, 2025

Latest Posts

-

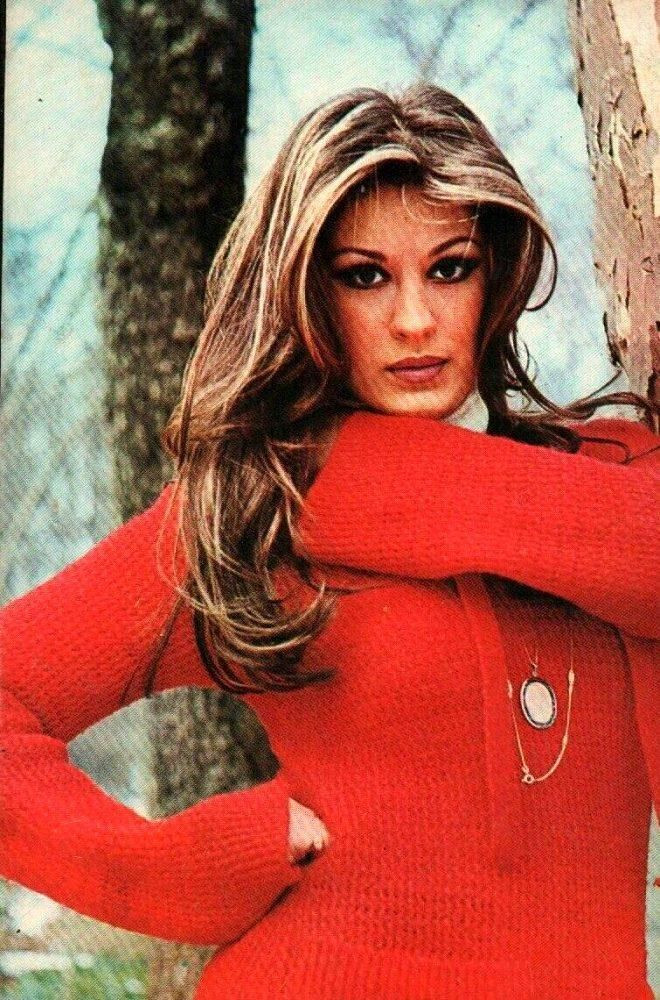

Guelsen Bubikoglu Ve Mine Tugay Yesilcam In Iki Guezeli Bir Arada Son Durumlari

May 31, 2025

Guelsen Bubikoglu Ve Mine Tugay Yesilcam In Iki Guezeli Bir Arada Son Durumlari

May 31, 2025 -

Miley Cyrus Dan Busana Sebuah Studi Tentang Ekspresi Diri

May 31, 2025

Miley Cyrus Dan Busana Sebuah Studi Tentang Ekspresi Diri

May 31, 2025 -

Yesilcam In Zarif Yildizi Guelsen Bubikoglu Nun Son Paylasimi Mine Tugay In Yorumu Dikkat Cekti

May 31, 2025

Yesilcam In Zarif Yildizi Guelsen Bubikoglu Nun Son Paylasimi Mine Tugay In Yorumu Dikkat Cekti

May 31, 2025 -

Busana Miley Cyrus Ekspresi Berbagai Cerita

May 31, 2025

Busana Miley Cyrus Ekspresi Berbagai Cerita

May 31, 2025 -

The Miley Cyrus Billy Ray Cyrus Rift Social Media Weighs In

May 31, 2025

The Miley Cyrus Billy Ray Cyrus Rift Social Media Weighs In

May 31, 2025