The Cooling Canadian Condo Market: Buyer Beware?

Table of Contents

Declining Condo Prices in Key Canadian Cities

The Canadian condo market, once a seemingly unstoppable force, is experiencing a notable cooling effect in several key cities. This translates to declining prices and increased opportunities for savvy buyers, but also potential risks.

Toronto Condo Market Trends

Toronto, a traditionally hotbed for condo investment, is witnessing price drops in various neighbourhoods. Average sale prices are softening, and months of inventory are increasing, indicating a shift in market dynamics.

- Data Point: Compared to Q2 2022, average condo prices in downtown Toronto have dropped by approximately 5-7%, according to the Toronto Real Estate Board (TREB). [Link to TREB data].

- Specific Examples: Condos in areas like the King West and Liberty Village neighbourhoods have seen more significant price corrections than others. Specific buildings experiencing price reductions should be researched further using resources like [Link to a reputable real estate website].

- Months of Inventory: The number of months it takes to sell all current condo listings in Toronto has increased, signaling a slower market.

Vancouver Condo Market Slowdown

Vancouver, another major Canadian city with a strong condo market, is also experiencing a slowdown. While not mirroring Toronto's exact trends, the Vancouver condo market shows similar signs of cooling.

- Price Comparisons: Although price drops in Vancouver may be less dramatic than in Toronto, the overall trend is still towards a slowdown. [Link to Vancouver real estate data source].

- Absorption Rates: Absorption rates (the speed at which new listings are sold) are declining in many Vancouver neighbourhoods, further signifying a cooling market.

- Regional Differences: Micro-markets within Vancouver are showing varied results, highlighting the need for localized research.

Other Major Cities

Other major Canadian cities are exhibiting cooling trends, albeit to varying degrees. Calgary, Montreal, and Ottawa, for example, are all seeing reduced buyer activity and increased inventory.

- Calgary: The Calgary condo market, historically influenced by the energy sector, reflects a more moderate slowdown.

- Montreal and Ottawa: These markets, though showing cooling signs, remain relatively resilient compared to Toronto and Vancouver. [Link to national real estate market summary].

Increased Condo Inventory and Market Saturation

One of the most significant factors contributing to the cooling Canadian condo market is the substantial increase in condo inventory. More unsold units mean increased competition among sellers and enhanced negotiation power for buyers.

Rising Number of Listings

The number of condos listed for sale in major Canadian cities has risen considerably over the past year. This surge in supply is a key driver of the market slowdown.

- Statistic: The number of active condo listings in Toronto is up by [Insert Percentage]% compared to last year. [Link to Supporting Data]

- Buyer Negotiation Power: This increased inventory gives buyers considerable leverage to negotiate lower prices and potentially secure better terms.

Impact on Selling Times

The higher inventory directly impacts the time it takes to sell a condo. Days on Market (DOM) are increasing significantly.

- Data Point: The average DOM for condos in Toronto has increased by [Insert Number] days compared to the same period last year. [Link to Supporting Data]

- Market Implications: Longer DOM suggests a less aggressive seller's market and more time for buyers to make informed decisions.

The Influence of Rising Interest Rates

Rising interest rates are playing a significant role in the cooling Canadian condo market. Higher borrowing costs directly impact affordability and investor activity.

Mortgage Rates and Affordability

Increased mortgage rates have made condos less affordable for many potential buyers. This reduced purchasing power has dampened demand.

- Impact on Payments: A small increase in interest rates can lead to a substantial rise in monthly mortgage payments, making condo ownership less accessible.

- Affordability Index: [Link to a relevant affordability index report]

Impact on Investor Activity

Rising interest rates also negatively impact condo investors. Higher borrowing costs reduce potential rental yields, making investment less attractive.

- Rental Yields: Increased mortgage costs can squeeze rental yields, making it harder for investors to achieve profitability.

- Decreased Demand: The combination of reduced yields and higher financing costs leads to decreased investor demand, further contributing to market cooling.

Risks and Opportunities for Canadian Condo Buyers

The cooling Canadian condo market presents both risks and opportunities for buyers. Understanding both is crucial for making informed decisions.

Potential Risks

Buying in a cooling market carries inherent risks. Potential for further price drops and challenges in reselling are significant considerations.

- Further Price Drops: Prices could continue to decline in certain areas, leading to potential losses for buyers who purchase at the wrong time.

- Reselling Difficulty: Selling a condo in a slow market can be challenging, and buyers should factor in potential extended selling times.

- Due Diligence: Thorough due diligence, including property inspections and legal reviews, is critical to avoid unforeseen issues.

Potential Opportunities

Despite the risks, the cooling Canadian condo market also offers opportunities. Negotiating lower prices and finding better deals are possible.

- Negotiating Power: Buyers have increased leverage to negotiate lower purchase prices and potentially secure favorable terms.

- Better Deals: In a buyer's market, finding attractive deals on undervalued properties becomes more likely.

- Expert Advice: Working with a knowledgeable real estate agent can provide valuable insights and guidance.

Conclusion: Navigating the Cooling Canadian Condo Market

In summary, the Canadian condo market is experiencing a significant cooling period characterized by declining prices, increased inventory, and the impact of rising interest rates. This presents both risks and opportunities. While the potential for further price drops exists, savvy buyers can leverage increased negotiation power to secure favorable deals.

Key takeaways: Careful consideration, thorough research, and seeking professional advice are essential before investing in the Canadian condo market. Don't rush into a decision.

Call to action: Before making a move in the cooling Canadian condo market, remember to thoroughly research your options and consult with a trusted real estate agent. Don't let the cooling Canadian condo market catch you off guard! Take your time, gather information, and make informed decisions regarding Canadian condos and the current market conditions.

Featured Posts

-

The Dnieper River A Path Towards Peace And Regional Stability

Apr 25, 2025

The Dnieper River A Path Towards Peace And Regional Stability

Apr 25, 2025 -

Cara Desain Meja Rias Modern And Sederhana 2025 Tren Terbaru Untuk Rumah Anda

Apr 25, 2025

Cara Desain Meja Rias Modern And Sederhana 2025 Tren Terbaru Untuk Rumah Anda

Apr 25, 2025 -

Hul Q Quarter Number Results Profit Meets Estimates Amid Weakening Consumer Demand

Apr 25, 2025

Hul Q Quarter Number Results Profit Meets Estimates Amid Weakening Consumer Demand

Apr 25, 2025 -

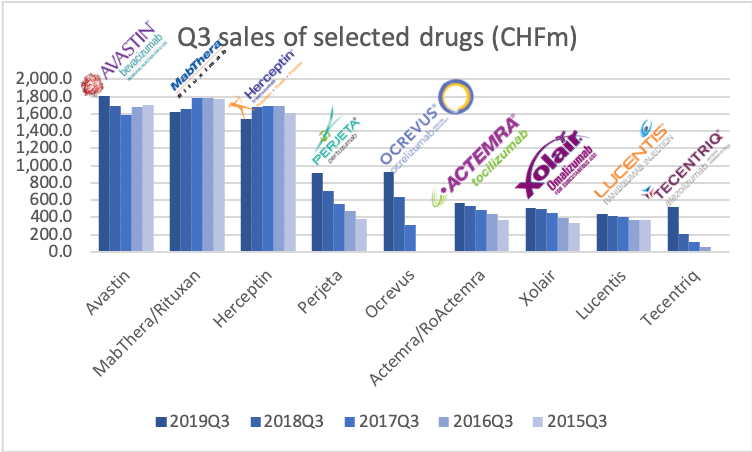

Roche First Quarter Sales Strong Growth And Pipeline Potential

Apr 25, 2025

Roche First Quarter Sales Strong Growth And Pipeline Potential

Apr 25, 2025 -

Analysis Trumps Uncommon Reprimand Of Putin Over Kyiv

Apr 25, 2025

Analysis Trumps Uncommon Reprimand Of Putin Over Kyiv

Apr 25, 2025

Latest Posts

-

King Announces Advance Birthday Party Plans

Apr 26, 2025

King Announces Advance Birthday Party Plans

Apr 26, 2025 -

Early Birthday Celebrations Announced By The King

Apr 26, 2025

Early Birthday Celebrations Announced By The King

Apr 26, 2025 -

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025 -

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025 -

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025