The Country's New Business Hot Spots: Investment Opportunities And Trends

Table of Contents

Top Emerging Cities for Startups and Small Businesses

Several cities across the country are experiencing unprecedented growth, attracting entrepreneurs and investors alike. These emerging hubs offer a compelling blend of lower costs, skilled talent, and supportive government initiatives.

[City A]: The Tech Hub Beyond the Coast

[City A], traditionally known for its [mention a past industry], is experiencing a remarkable tech renaissance. Its lower cost of living compared to coastal tech hubs attracts talented individuals seeking a better work-life balance without sacrificing career prospects. The city boasts a growing ecosystem of tech startups, particularly in renewable energy, biotech, and software development.

- Successful Startups: [Example 1], [Example 2], and [Example 3] are prime examples of companies flourishing in [City A], showcasing its potential for innovation.

- Projected Growth: Industry analysts predict a [percentage]% growth in the tech sector within the next five years.

- Funding Options: [City A] benefits from several angel investor networks, venture capital firms, and government-backed grants, providing ample funding opportunities for startups.

[City B]: A Manufacturing Renaissance

[City B] is experiencing a resurgence in manufacturing, driven by automation, advanced materials, and a renewed focus on domestic production. The city's skilled workforce, coupled with improved infrastructure and government incentives, has attracted significant investment in manufacturing facilities.

- Key Manufacturing Sectors: The city is particularly strong in [Sector 1], [Sector 2], and [Sector 3], offering diverse investment opportunities.

- Supply Chain Opportunities: Investment in related supply chains, such as logistics and component manufacturing, also presents significant potential.

- Government Initiatives: Local and national government initiatives are actively promoting manufacturing growth through tax breaks, grants, and workforce development programs.

[City C]: The Agricultural Innovation Center

[City C], strategically located in a fertile agricultural region, is becoming a leading center for agritech and sustainable farming practices. Its focus on innovation in food production and distribution is attracting investment and creating new job opportunities.

- Successful Agritech Companies: [Example 1] and [Example 2] are prominent examples of companies leveraging technology to enhance agricultural practices in [City C].

- Sustainable Agriculture Investment: Growing interest in sustainable and ethical farming practices is attracting investors seeking environmentally friendly opportunities.

- Export Market Potential: [City C]'s strategic location provides access to significant export markets, further boosting investment potential.

Investment Trends in Emerging Business Hot Spots

Understanding the prevailing investment trends in these emerging markets is crucial for successful investment.

The Rise of Impact Investing

Impact investing, which focuses on generating positive social and environmental impact alongside financial returns, is gaining significant traction in these new business hotspots. Investors are increasingly drawn to businesses that address social and environmental challenges while providing financial returns.

- Impact Investment Examples: [Example 1] focuses on sustainable energy solutions, while [Example 2] promotes fair trade practices.

- Key Performance Indicators (KPIs): Impact investors often focus on KPIs beyond traditional financial metrics, including environmental, social, and governance (ESG) factors.

- Government Support: Governments are increasingly supporting impact investing through tax incentives and dedicated funding programs.

Real Estate Opportunities in Growing Markets

Real estate investment in these emerging cities presents significant potential. Population growth, increased demand for commercial and residential space, and infrastructural improvements are driving property value increases.

- Real Estate Investment Types: Opportunities exist in both commercial (office, retail, industrial) and residential real estate.

- Projected Rental Yields: Analysts predict strong rental yields in these growing markets due to high demand and limited supply.

- Risks and Rewards: While potential rewards are high, careful due diligence is essential to mitigate risks associated with emerging markets.

Venture Capital and Private Equity Activity

Venture capital (VC) and private equity (PE) firms are increasingly focusing on these new business hotspots, injecting significant capital into promising startups and expanding businesses.

- Recent Major Investment Deals: [Example 1] and [Example 2] represent recent significant investment deals in the region.

- Key Venture Capital Firms: Several prominent VC firms are actively investing in these emerging markets, providing access to funding for startups.

- Access to Funding: The influx of VC and PE capital makes funding more accessible for startups and entrepreneurs.

Understanding the Risks and Rewards of Investing in Emerging Markets

While the potential returns in these emerging markets are attractive, it's crucial to understand the inherent risks. Investing in less-established markets requires thorough due diligence and a robust risk management strategy.

- Due Diligence Considerations: Thorough market research, detailed financial analysis, and assessment of regulatory environments are critical.

- Market Analysis Tools: Utilizing market research reports, industry analyses, and economic forecasts can help mitigate risks.

- Mitigating Investment Risks: Diversification, thorough due diligence, and a long-term investment horizon can help manage risks.

Conclusion

The country's new business hot spots offer a wealth of investment opportunities across diverse sectors. From the burgeoning tech scene in [City A] to the revitalized manufacturing sector in [City B] and the innovative agricultural landscape of [City C], these emerging markets present a compelling case for investors. While understanding the risks associated with emerging markets is crucial, the potential returns make these hotspots an exciting frontier for savvy investors. Don't miss out on the next big thing. Dive deeper into the exciting world of the country's new business hotspots and discover the investment opportunities waiting for you. Explore further resources and connect with experts in these burgeoning markets to make informed investment decisions.

Featured Posts

-

Analyzing Tim Cooks Difficult Year At Apple

May 25, 2025

Analyzing Tim Cooks Difficult Year At Apple

May 25, 2025 -

11 Injured 1 Killed In Myrtle Beach Police Shooting State Law Enforcement Investigating

May 25, 2025

11 Injured 1 Killed In Myrtle Beach Police Shooting State Law Enforcement Investigating

May 25, 2025 -

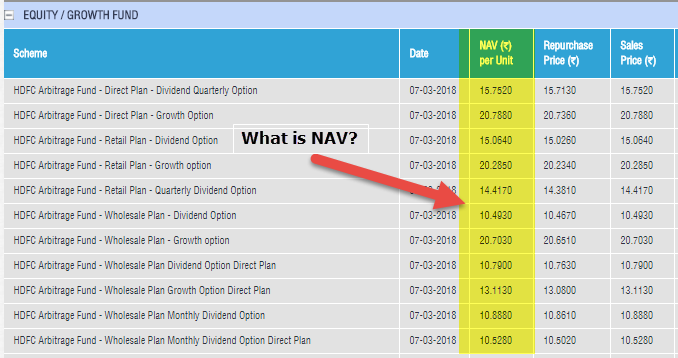

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 25, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 25, 2025 -

Verstappen Vs Mercedes I Nea Dynamiki Stin Formula 1

May 25, 2025

Verstappen Vs Mercedes I Nea Dynamiki Stin Formula 1

May 25, 2025 -

The Cost Of Power Presidential Seals 100 000 Watches And The Question Of Accountability

May 25, 2025

The Cost Of Power Presidential Seals 100 000 Watches And The Question Of Accountability

May 25, 2025

Latest Posts

-

Naomi Kempbell Provokatsionnye Obrazy V Novoy Fotosessii Dlya Glyantsa

May 25, 2025

Naomi Kempbell Provokatsionnye Obrazy V Novoy Fotosessii Dlya Glyantsa

May 25, 2025 -

Naomi Kempbell V Biliy Tunitsi Z Virizom Na Zakhodi V Londoni

May 25, 2025

Naomi Kempbell V Biliy Tunitsi Z Virizom Na Zakhodi V Londoni

May 25, 2025 -

Naomi Kempbell V Derzkoy Fotosessii Dlya Modnogo Zhurnala

May 25, 2025

Naomi Kempbell V Derzkoy Fotosessii Dlya Modnogo Zhurnala

May 25, 2025 -

Zivotni Stil Penzionera Izuzetno Bogatstvo I Luksuzne Vile

May 25, 2025

Zivotni Stil Penzionera Izuzetno Bogatstvo I Luksuzne Vile

May 25, 2025 -

Naomi Kempbell U Biliy Tunitsi Z Yavilasya Na Londonskomu Zakhodi

May 25, 2025

Naomi Kempbell U Biliy Tunitsi Z Yavilasya Na Londonskomu Zakhodi

May 25, 2025