The Current State Of IPOs: How Tariffs Are Impacting Investment

Table of Contents

The Direct Impact of Tariffs on IPOs

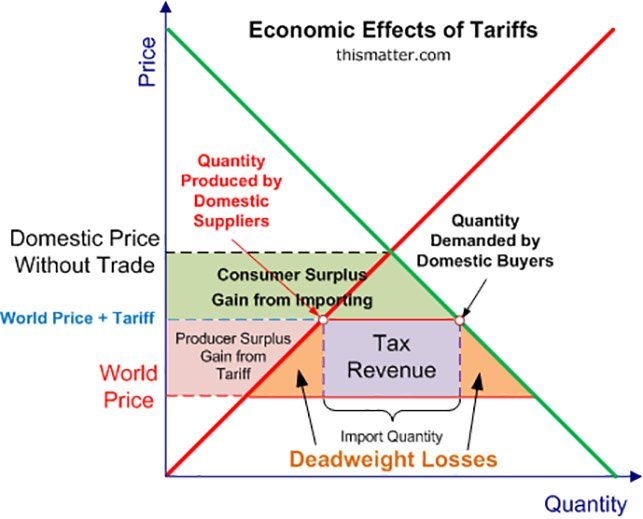

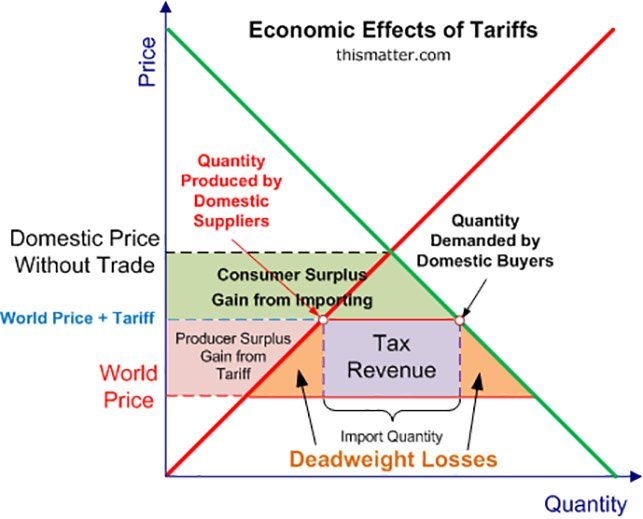

Tariffs, essentially taxes on imported goods, exert a direct and often significant influence on the IPO market. This impact manifests primarily through reduced corporate profitability and increased market uncertainty.

Reduced Corporate Profitability

Tariffs directly increase input costs for many companies. This leads to squeezed profit margins and can significantly impact the valuation of a company going public. The higher the tariff, the more pronounced the effect.

- Increased cost of goods sold (COGS): Higher import costs translate directly into higher production costs, eating into a company's profitability.

- Decreased competitiveness: Companies facing higher tariffs on their inputs may struggle to compete with rivals who source materials domestically or from countries with favorable trade agreements. This can negatively impact sales projections and overall valuation.

- Pressure on pricing strategies: Companies may be forced to absorb some of the increased costs, reducing their profit margin, or pass the increased costs onto consumers, potentially impacting sales volume.

For example, a manufacturing company reliant on imported steel, facing substantial tariffs on those imports, might see its projected profitability for the next fiscal year drastically reduced, making its IPO less attractive to investors who are focused on maximizing returns. This reduced attractiveness can lead to lower IPO pricing or even a postponement of the offering.

Increased Uncertainty and Volatility

The unpredictable nature of tariff policies creates significant uncertainty for companies planning an IPO. This unpredictability makes it difficult to accurately forecast future earnings, a key factor for investors assessing risk.

- Difficulty in long-term planning: Companies are unable to reliably project their costs and revenues over the long term, making it challenging to create a stable financial forecast for potential investors.

- Investor hesitancy due to risk: Uncertainty about future tariff policies increases the perceived risk associated with investing in an IPO, making investors more cautious and potentially demanding a higher return to compensate for the increased risk.

- Potential for delayed or canceled IPOs: Companies may delay or even cancel their IPO plans altogether until there is greater clarity regarding future tariff policies and their potential impact on profitability.

A company considering an IPO might postpone its plans indefinitely if significant tariff changes are anticipated, opting to wait for a more stable economic and political climate before seeking public investment. This delay can impact a company’s growth trajectory and access to capital.

Indirect Impacts of Tariffs on the IPO Market

Beyond the direct effects, tariffs create indirect ripples throughout the IPO market, influencing global supply chains and investor sentiment.

Impact on Global Supply Chains

Tariffs disrupt established global supply chains, forcing companies to rethink their manufacturing and sourcing strategies. This reshaping of supply chains has both short-term and long-term implications for IPOs.

- Reshoring and nearshoring: Companies may choose to bring manufacturing back to their home country (reshoring) or relocate it to nearby countries (nearshoring) to avoid tariffs, a process that requires significant investment and time.

- Increased logistical complexities: Reorganizing supply chains involves navigating complex logistical hurdles, leading to increased costs and delays.

- Higher transportation costs: Shifting production locations can lead to significantly higher transportation costs, impacting profitability and potentially affecting IPO valuations.

For example, a technology company relying on components manufactured in a country subject to high tariffs may opt to relocate some or all of its manufacturing to reduce its costs, a costly and lengthy process that could affect its IPO timing and financial projections.

Changes in Investor Sentiment

Negative news related to tariffs and trade wars can create a climate of fear and uncertainty among investors, dampening demand for IPOs and impacting the valuations of newly public companies.

- Decreased investor confidence: Negative news about trade wars and tariffs erodes investor confidence, leading to a more risk-averse investment environment.

- Flight to safety: Investors may favor established, less volatile companies over newer IPOs during periods of increased economic uncertainty, resulting in decreased demand for new offerings.

- Lower IPO valuations: Reduced investor confidence can lead to lower valuations for IPOs as investors demand a higher return to compensate for the increased perceived risk.

Investors seeking stable, predictable returns may turn to established, blue-chip stocks during times of trade uncertainty, reducing the pool of investors willing to take on the greater perceived risk associated with investing in IPOs.

Geopolitical Risks and Investment Strategies

The ongoing threat of escalating trade wars forces investors to reassess their investment strategies, considering geopolitical risks more carefully than in the past.

- Diversification strategies: Investors may adopt more diversified portfolios to reduce their exposure to specific regions or industries impacted by tariffs.

- Increased scrutiny of geopolitical risks: Investors are paying more attention to geopolitical risks and their potential impact on companies' profitability and valuations.

- Cautious investment approach: Overall, investors are adopting a more cautious approach, making them more selective about the IPOs they invest in.

Sophisticated investors will carefully analyze companies' supply chains, international exposure, and risk management strategies before investing in an IPO during times of high tariff uncertainty. Companies with robust contingency plans and diversified operations are more likely to attract investor interest.

Conclusion

Tariffs have a multifaceted impact on the IPO market, affecting corporate profitability, investor sentiment, and global supply chains. This creates a more challenging environment for companies seeking to go public and for investors seeking opportunities. Understanding these impacts is crucial for making informed investment decisions. To stay informed on the ever-evolving landscape of IPOs and how tariffs continue to shape the investment climate, regularly review market analysis and expert opinions on the current state of IPOs and tariff impacts. By understanding the dynamics of tariffs and their influence on IPOs, investors can make more strategic decisions and navigate the complexities of this crucial market sector.

Featured Posts

-

Important Safety Notice Walmart Recalls Tortilla Chips And Jewelry Kits

May 14, 2025

Important Safety Notice Walmart Recalls Tortilla Chips And Jewelry Kits

May 14, 2025 -

Wta Roundup No 3 Seed Stearns Unexpected Defeat In Austin

May 14, 2025

Wta Roundup No 3 Seed Stearns Unexpected Defeat In Austin

May 14, 2025 -

Dean Huijsen Chooses His Premier League Future

May 14, 2025

Dean Huijsen Chooses His Premier League Future

May 14, 2025 -

Jose Mujica Ex Presidente De Uruguay Muere A Los 89 Anos

May 14, 2025

Jose Mujica Ex Presidente De Uruguay Muere A Los 89 Anos

May 14, 2025 -

Coffee Creamer Recall Protecting Michigan Coffee Drinkers From Harm

May 14, 2025

Coffee Creamer Recall Protecting Michigan Coffee Drinkers From Harm

May 14, 2025