The ECB On Inflation: How Post-Pandemic Fiscal Measures Contribute

Table of Contents

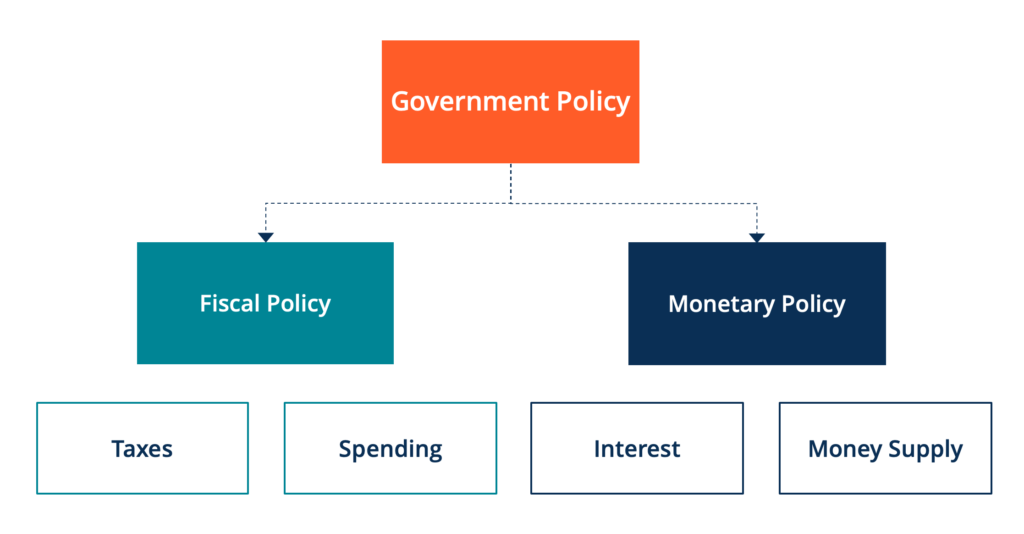

The Role of Fiscal Stimulus in Post-Pandemic Recovery

The substantial fiscal interventions undertaken by Eurozone governments following the pandemic aimed to prevent a deeper economic recession. These measures, driven by the need for rapid pandemic recovery, involved significant government spending and investment. The rationale was clear: to support businesses, protect jobs, and maintain household income to prevent a sharp contraction in aggregate demand. These policies, while successful in preventing a collapse, have also contributed to inflationary pressures.

- Increased consumer spending due to direct payments: Government initiatives like direct cash transfers to citizens boosted disposable income, leading to increased consumer spending on goods and services. This surge in demand, particularly in sectors already facing supply chain constraints, fueled inflation.

- Stimulated business investment through loan guarantees and grants: Government support programs, including loan guarantees and grants, helped businesses navigate the economic downturn and invest in their operations. This increased investment, while positive for long-term growth, also contributed to increased demand and inflationary pressures.

- Expansionary fiscal policy leading to increased aggregate demand: The overall effect of these policies was a significant expansion in aggregate demand. This increased demand, combined with the supply-side constraints discussed below, created a classic demand-pull inflationary environment.

- Potential for demand-pull inflation as demand outpaces supply: The rapid increase in demand outstripped the capacity of many industries to meet it, leading to shortages, higher prices, and significant demand-pull inflation.

Supply Chain Disruptions and Inflationary Pressures

The COVID-19 pandemic severely disrupted global supply chains, exacerbating existing inflationary pressures. Lockdowns, port congestion, and labor shortages created significant bottlenecks in the production and distribution of goods. This had a direct impact on both production costs and consumer prices, adding to the inflationary challenges faced by the ECB.

- Increased transportation costs due to shipping delays: Significant delays in shipping and transportation significantly increased costs for businesses, which were then passed on to consumers in the form of higher prices.

- Shortages of key components impacting manufacturing: The lack of essential components hindered manufacturing processes, leading to production slowdowns and shortages of many goods. This scarcity further contributed to upward pressure on prices.

- Rising energy prices increasing production costs: The surge in energy prices, particularly natural gas, significantly increased production costs across various sectors, adding to cost-push inflation. This cost-push inflation is particularly concerning for its persistence.

- Cost-push inflation resulting from increased production costs: The combined effect of supply chain disruptions and rising energy prices resulted in substantial cost-push inflation, adding another layer to the inflationary challenges facing the Eurozone.

The ECB's Response to Inflationary Pressures

Faced with rising inflation, the ECB has implemented a range of monetary policy adjustments aimed at curbing inflationary pressures while supporting economic recovery. This delicate balancing act requires careful consideration of the potential impacts on both price stability and economic growth.

- Interest rate hikes to curb inflation: The ECB has undertaken a series of interest rate hikes to make borrowing more expensive, thus reducing aggregate demand and curbing inflationary pressures. This is a standard monetary policy tool to combat inflation.

- Potential reduction of asset purchases (quantitative easing): The ECB is gradually reducing its asset purchase programs (quantitative easing), a policy implemented during the pandemic to increase liquidity in the financial markets. This reduction is intended to further curb inflation.

- Communication strategies to manage inflation expectations: The ECB actively communicates its monetary policy intentions to manage inflation expectations. Clear communication is essential to anchor inflation expectations and prevent them from becoming self-fulfilling.

- Balancing economic growth with price stability: The ECB's primary mandate is to maintain price stability while supporting economic growth. Balancing these two competing objectives requires a carefully calibrated approach to monetary policy.

Long-Term Implications of Post-Pandemic Fiscal Measures on the Eurozone Economy

The post-pandemic fiscal policies, while crucial for mitigating the immediate economic impact of the crisis, have significant long-term implications for the Eurozone economy. These implications extend to public debt levels, the sustainability of economic growth, and the potential for entrenched inflation.

- Increased public debt levels requiring fiscal consolidation: The significant government spending during the pandemic has resulted in increased public debt levels across the Eurozone. Fiscal consolidation measures will be necessary to manage this debt and ensure long-term fiscal sustainability.

- Potential for higher inflation becoming entrenched: If inflation becomes entrenched in expectations, it could become more difficult to control, leading to a wage-price spiral and long-term economic instability. The ECB is closely monitoring this risk.

- Impact on long-term economic growth prospects: While the fiscal stimulus supported short-term economic growth, the long-term impact depends on the effectiveness of subsequent fiscal consolidation and structural reforms. Sustainable growth requires carefully managed public finances and investment in productive capacity.

- Need for sustainable fiscal policies: The Eurozone needs to transition to sustainable fiscal policies to ensure long-term economic stability and avoid the risks of high inflation and unsustainable debt levels.

Conclusion:

Post-pandemic fiscal measures have played a significant role in contributing to the current inflationary pressures within the Eurozone. The ECB's response, balancing the need for economic recovery with price stability, involves a complex interplay of monetary policy tools and careful communication. Understanding the interplay between fiscal policy and inflation is crucial for navigating the current economic climate. Stay informed on the ECB's decisions and their impact on the Eurozone economy by following further updates on their response to post-pandemic inflation and related fiscal measures. Continued monitoring of the ECB's actions and their effect on inflation within the Eurozone is essential for businesses and individuals alike.

Featured Posts

-

Arne Slot The Architect Of Liverpools Near Title Win

Apr 29, 2025

Arne Slot The Architect Of Liverpools Near Title Win

Apr 29, 2025 -

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025 -

La Metodologia De Alberto Ardila Olivares Para La Garantia De Gol

Apr 29, 2025

La Metodologia De Alberto Ardila Olivares Para La Garantia De Gol

Apr 29, 2025 -

U S Businesses Respond To Tariff Uncertainty With Aggressive Cost Cutting

Apr 29, 2025

U S Businesses Respond To Tariff Uncertainty With Aggressive Cost Cutting

Apr 29, 2025 -

Chinas Automotive Market A Deeper Look At The Struggles Faced By Bmw And Porsche

Apr 29, 2025

Chinas Automotive Market A Deeper Look At The Struggles Faced By Bmw And Porsche

Apr 29, 2025

Latest Posts

-

La Metodologia De Alberto Ardila Olivares Para La Garantia De Gol

Apr 29, 2025

La Metodologia De Alberto Ardila Olivares Para La Garantia De Gol

Apr 29, 2025 -

Alberto Ardila Olivares Tu Garantia Para Aumentar Tus Goles

Apr 29, 2025

Alberto Ardila Olivares Tu Garantia Para Aumentar Tus Goles

Apr 29, 2025 -

Formacion Con Alberto Ardila Olivares Garantia De Mejorar Tu Juego Y Marcar Goles

Apr 29, 2025

Formacion Con Alberto Ardila Olivares Garantia De Mejorar Tu Juego Y Marcar Goles

Apr 29, 2025 -

El Secreto Del Exito En El Futbol La Garantia De Gol De Alberto Ardila Olivares Note While This Uses Secreto It Avoids The Negative Connotation By Framing It Within A Context Of Success Strategy

Apr 29, 2025

El Secreto Del Exito En El Futbol La Garantia De Gol De Alberto Ardila Olivares Note While This Uses Secreto It Avoids The Negative Connotation By Framing It Within A Context Of Success Strategy

Apr 29, 2025 -

Con Alberto Ardila Olivares La Garantia Del Gol Esta Asegurada

Apr 29, 2025

Con Alberto Ardila Olivares La Garantia Del Gol Esta Asegurada

Apr 29, 2025