The Extreme Cost Implications Of Broadcom's VMware Acquisition For AT&T

Table of Contents

Keywords: Broadcom, VMware acquisition, AT&T, cost implications, financial burden, price increases, competitive disadvantage, strategic impact, enterprise software, virtualization, network infrastructure.

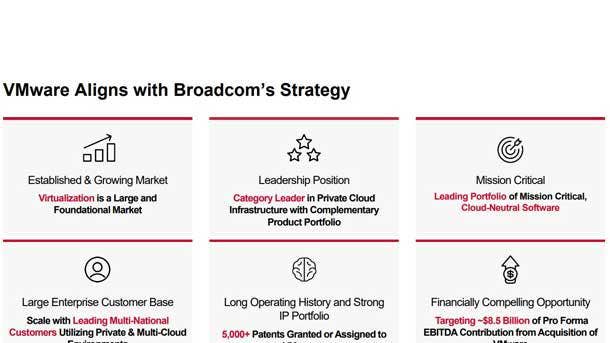

Broadcom's acquisition of VMware sent shockwaves through the tech industry, but the ramifications extend far beyond the headlines. For AT&T, a major VMware user, the deal presents extreme cost implications with potentially significant consequences for its operations, competitiveness, and bottom line. This article delves into the potential financial burdens AT&T now faces, examining the increased licensing costs, reduced competition, strategic network infrastructure impacts, and the overall long-term financial burden.

Increased Licensing and Maintenance Costs for AT&T

The most immediate impact of the Broadcom-VMware merger for AT&T is the likely increase in licensing and maintenance costs for its VMware-based infrastructure. Broadcom, known for its aggressive business strategies, has a history of consolidating acquired companies and optimizing for profitability. This often translates to higher prices for customers.

- Higher per-unit costs for existing VMware licenses: AT&T, relying heavily on VMware's virtualization technologies for its extensive network infrastructure, can expect to see a substantial increase in the cost per license.

- Potential removal of discounts or favorable pricing arrangements: Existing volume discounts or other favorable pricing arrangements negotiated with VMware may be renegotiated or eliminated entirely under Broadcom's ownership.

- Increased maintenance fees and support costs: Maintenance contracts and support services are also likely to become more expensive, adding to AT&T's overall IT expenditure.

- Mandatory upgrades and associated costs: Broadcom may enforce mandatory upgrades to newer VMware versions, leading to additional implementation and integration costs for AT&T.

These increased costs will significantly impact AT&T's IT budget, potentially diverting resources from other crucial initiatives and impacting overall profitability. The scale of AT&T's VMware deployment means even a seemingly small percentage increase in licensing costs translates to millions of dollars in extra expenditure annually.

Potential for Reduced Competition and Innovation in the Enterprise Software Market

Broadcom's acquisition of VMware raises concerns about reduced competition and stifled innovation within the enterprise software market. Broadcom's track record of acquisitions suggests a focus on integrating acquired companies into its existing ecosystem, rather than fostering independent innovation.

- Reduced choice for AT&T in virtualization solutions: With VMware largely under Broadcom's control, AT&T's options for virtualization solutions will be significantly reduced. The lack of viable alternatives could limit AT&T’s negotiating power.

- Potential stifle of innovation due to lack of competition: Less competition can lead to slower innovation, as the dominant player (now Broadcom) may be less incentivized to invest in cutting-edge technologies.

- Increased dependence on Broadcom's ecosystem: AT&T will become increasingly reliant on Broadcom's ecosystem, potentially creating vendor lock-in and reducing its flexibility in future IT decisions.

This reduced competition could force AT&T to seek alternative virtualization solutions, potentially incurring even greater costs associated with migration, retraining, and integration with existing systems. The long-term cost of reduced innovation may be even harder to quantify but equally significant.

Strategic Implications for AT&T's Network Infrastructure

VMware plays a crucial role in AT&T's network infrastructure, supporting various critical services. The Broadcom acquisition could significantly impact AT&T's network operations and overall strategy.

- Potential for integration challenges with AT&T’s existing systems: Integrating Broadcom's approach to VMware into AT&T's complex existing network infrastructure could be challenging and costly.

- Impact on network performance and stability: Any integration issues could negatively impact the performance and stability of AT&T's network, potentially leading to service disruptions and customer dissatisfaction.

- Potential need for significant investments in new infrastructure or migration: AT&T may be forced to invest in significant upgrades or even a complete migration to alternative technologies to mitigate the risks associated with the acquisition.

The risk of vendor lock-in is substantial. AT&T’s heavy reliance on VMware could leave it vulnerable to price increases and potentially less responsive service from Broadcom.

The Long-Term Financial Burden on AT&T

The cumulative effect of increased licensing costs, reduced competition, and potential network infrastructure challenges will place a substantial long-term financial burden on AT&T.

- Overall impact on profitability: The increased costs could significantly reduce AT&T's profitability, potentially affecting its ability to invest in future growth opportunities.

- Potential for increased prices for AT&T's services: To offset these increased costs, AT&T might be forced to increase prices for its services, potentially impacting customer satisfaction and market share.

- The effect on AT&T’s investors: The overall financial impact will undoubtedly concern investors, potentially affecting the company's valuation and stock price.

The long-term financial implications could be substantial, requiring AT&T to make difficult strategic decisions to mitigate the risks and navigate the changing landscape of enterprise software and network infrastructure.

Conclusion

Broadcom's acquisition of VMware poses a significant financial challenge for AT&T. From rising licensing costs and reduced competition to potential disruptions in its network infrastructure, the implications are far-reaching and demand careful consideration. The long-term financial burden on AT&T may be substantial, potentially impacting profitability and requiring strategic adaptation.

Call to Action: Understanding the extreme cost implications of Broadcom's VMware acquisition for AT&T is crucial for investors and industry professionals. Stay informed about this evolving situation to navigate the changing landscape of enterprise software and network infrastructure. Further research into the impact on other major VMware users will provide a more complete picture of the ramifications of this significant merger.

Featured Posts

-

Employee Replaceability A Look At The Changing Employer Employee Relationship

May 13, 2025

Employee Replaceability A Look At The Changing Employer Employee Relationship

May 13, 2025 -

Pretstavuvanje Na Prvata Kniga So Romski Ba Ki

May 13, 2025

Pretstavuvanje Na Prvata Kniga So Romski Ba Ki

May 13, 2025 -

The Allure Of Nba Tankathon For Miami Heat Fans During The Off Season

May 13, 2025

The Allure Of Nba Tankathon For Miami Heat Fans During The Off Season

May 13, 2025 -

Urgent Search For Missing Elderly Hiker In Peninsula Hill Region

May 13, 2025

Urgent Search For Missing Elderly Hiker In Peninsula Hill Region

May 13, 2025 -

Doom Soundtrack Curated Playlist For Dark Ages Waiting Rooms

May 13, 2025

Doom Soundtrack Curated Playlist For Dark Ages Waiting Rooms

May 13, 2025