The Fate Of Trump's Tax Bill: A Divided Republican Party

Table of Contents

The Initial Impact and Long-Term Projections of the Trump Tax Cuts

Trump's Tax Cuts and Jobs Act of 2017, a cornerstone of the Trump administration's economic policy, significantly lowered corporate and individual income tax rates. Initial reports suggested a boost in GDP growth and job creation. However, the long-term effects remain a subject of intense debate. Some economists predicted sustained economic expansion fueled by increased business investment. Others voiced concerns about the ballooning national debt and potential inflationary pressures.

The Tax Policy Center, for example, projected a significant increase in the national debt due to the reduced tax revenue. Meanwhile, the Congressional Budget Office offered varying forecasts, highlighting the uncertainty inherent in long-term economic modeling. Analyzing the impact requires a nuanced understanding of its effects on various income brackets.

- Increased national debt: The tax cuts significantly increased the national debt, a point of contention among fiscal conservatives.

- Impact on different income brackets: While proponents argued it benefited all income groups, critics highlighted disproportionate benefits for high-income earners and corporations.

- Effect on corporate investment and innovation: While some corporations increased investment, others used the savings for stock buybacks, raising questions about the stimulus to innovation.

- Predictions for future tax revenues: Lower tax rates led to lower tax revenues, creating a long-term challenge for government spending and budget deficits.

Internal Republican Divisions on Tax Policy

The Republican Party, far from presenting a united front on tax policy, is fractured along ideological lines. Fiscal conservatives, prioritizing balanced budgets and debt reduction, clash with pro-growth conservatives who champion lower taxes as a catalyst for economic growth, regardless of the deficit implications. This internal struggle directly impacts the future of Trump's tax bill.

The debate within the party is far from settled. The disagreements are not just about numbers; they represent fundamental philosophical differences on the role of government in the economy.

- Differing opinions on tax cuts for corporations vs. individuals: Some argue for prioritizing cuts for businesses to stimulate investment, while others advocate for greater benefits for individuals and families.

- Concerns about the national debt and deficit: Fiscal conservatives express deep concern about the long-term consequences of increased national debt caused by the tax cuts.

- Debate over potential tax reforms: Even within the Republican Party, there is ongoing debate about potential future tax reforms, ranging from minor adjustments to more comprehensive overhauls.

- Influence of lobbyists and special interest groups: Powerful lobbying groups representing various sectors continue to exert influence on tax policy debates, adding another layer of complexity.

The Role of the Democratic Party in Shaping the Future of Trump's Tax Bill

The Democratic Party, largely opposed to Trump's tax bill from its inception, views it as a regressive policy that disproportionately benefits the wealthy. Under a Democratic administration, significant changes to the tax code are highly probable. This includes potential tax increases, particularly for high-income earners and corporations, to fund social programs and reduce the national debt.

The Democrats have proposed alternative tax reform plans focusing on closing tax loopholes, increasing taxes on the wealthy, and expanding tax credits for low- and middle-income families. The likelihood of these proposals becoming reality depends heavily on the political landscape and the composition of Congress.

- Democratic proposals for tax reform: Democratic proposals generally aim to increase taxes on corporations and high-income earners, while expanding tax credits for low and middle-income families.

- Potential challenges to repealing or altering the tax bill: Overturning the entire tax bill would be a politically challenging undertaking, requiring significant bipartisan support.

- Political strategies and implications: The political strategies employed by both parties will significantly shape the future trajectory of tax policy in the US.

Public Opinion and the Future of Tax Policy

Public opinion on Trump's tax cuts is divided, reflecting the partisan polarization that characterizes much of American politics. Polling data shows varied levels of support depending on factors like income level and political affiliation. While some polls indicated initial positive sentiment, concerns about the national debt and the perceived unfairness of the tax benefits have influenced public opinion.

The influence of public perception on future tax policy decisions is undeniable, though the precise nature of this influence is subject to debate. Public pressure can force politicians to reconsider their positions and lead to compromises.

- Public perception of the effectiveness of the tax cuts: Public perception is influenced by factors such as personal financial situation, media coverage, and political affiliation.

- Support for tax increases to fund social programs: Support for increased taxes to fund social programs tends to be higher among Democrats and lower-income individuals.

- Influence of media coverage and public discourse: Media narratives and public discourse play a crucial role in shaping public opinion on tax policy.

Conclusion: The Ongoing Debate Surrounding Trump's Tax Legacy and the Path Forward

The fate of Trump's tax bill remains uncertain, largely due to the deep divisions within the Republican Party and the contrasting agendas of the Democratic Party. While the initial impact saw some short-term economic benefits, the long-term consequences, including the increased national debt, remain a major source of concern. Public opinion is fragmented, reflecting the political polarization surrounding this critical issue. The debate over Trump tax reform, the future of Trump's tax policies, and the fate of the Trump tax cuts continues to shape the political and economic landscape. Stay informed about this ongoing discussion and actively participate in shaping the future of tax policy in the United States.

Featured Posts

-

Understanding Cassis Blackcurrant From Berry To Bottle

May 22, 2025

Understanding Cassis Blackcurrant From Berry To Bottle

May 22, 2025 -

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable Y La Prevencion De Enfermedades Cronicas

May 22, 2025

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable Y La Prevencion De Enfermedades Cronicas

May 22, 2025 -

Alles Over Tikkie Betalen In Nederland

May 22, 2025

Alles Over Tikkie Betalen In Nederland

May 22, 2025 -

Blake Livelys Alleged Blackmail Of Taylor Swift Examining The Baldoni Connection And Leaked Information

May 22, 2025

Blake Livelys Alleged Blackmail Of Taylor Swift Examining The Baldoni Connection And Leaked Information

May 22, 2025 -

Barry Ward Interview The Irish Actor On Roles And Type Casting

May 22, 2025

Barry Ward Interview The Irish Actor On Roles And Type Casting

May 22, 2025

Latest Posts

-

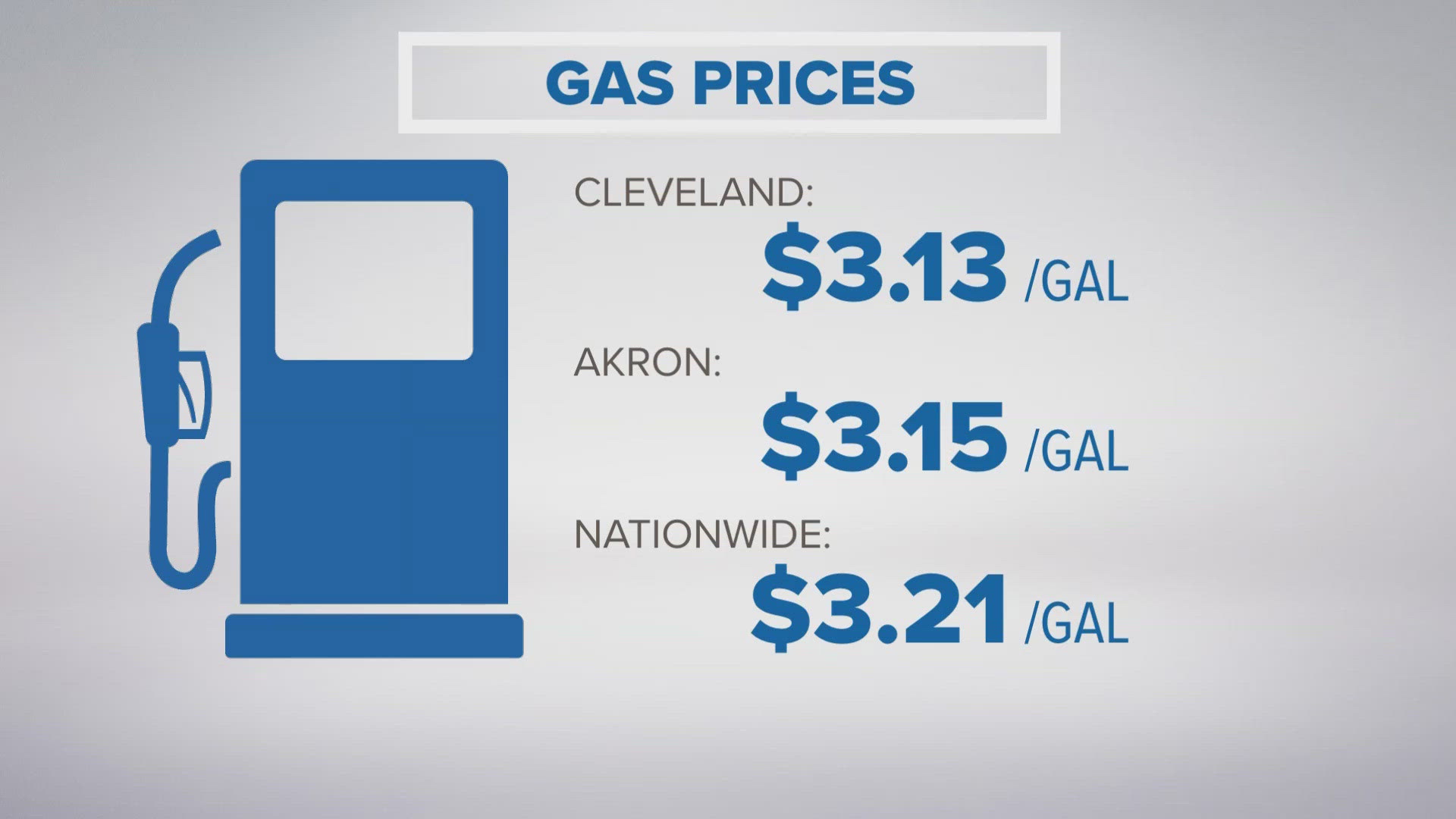

Akron And Cleveland Gas Prices Why The Recent Spike Ohio Gas Buddy Updates

May 22, 2025

Akron And Cleveland Gas Prices Why The Recent Spike Ohio Gas Buddy Updates

May 22, 2025 -

Recent Lancaster City Stabbing Prompts Increased Police Patrols

May 22, 2025

Recent Lancaster City Stabbing Prompts Increased Police Patrols

May 22, 2025 -

Why Are Gas Prices So High In Southeast Wisconsin

May 22, 2025

Why Are Gas Prices So High In Southeast Wisconsin

May 22, 2025 -

Lancaster City Stabbing Incident Victim Information And Police Appeal

May 22, 2025

Lancaster City Stabbing Incident Victim Information And Police Appeal

May 22, 2025 -

Recent Increase In Gas Prices Southeast Wisconsin

May 22, 2025

Recent Increase In Gas Prices Southeast Wisconsin

May 22, 2025