The Financial Aspects Of Escaping To The Country

Table of Contents

Property Costs: More Than Just the House Price

The cost of escaping to the country significantly surpasses the initial property purchase price. Many underestimate the hidden expenses involved in rural living. Let's break down the costs:

Purchase Price Variations

Property prices vary dramatically between urban and rural areas. A charming cottage in a quaint village will differ vastly in price from a sprawling farmhouse with acreage. Location is paramount. Proximity to desirable amenities like schools, hospitals, and employment opportunities significantly impacts value. Property type also plays a crucial role; a renovated farmhouse commands a higher price than a dilapidated cottage requiring extensive refurbishment.

- Factors affecting rural property prices:

- Acreage: The amount of land included drastically affects the price.

- Property Condition: Renovation needs greatly influence the purchase price.

- Proximity to Amenities: Closer proximity to services commands a higher price.

- Views and Scenery: Stunning views add considerable value.

- Hidden Costs:

- Surveys: Essential for assessing property condition and potential issues.

- Legal Fees: Conveyancing and other legal costs add to the overall expenditure.

- Stamp Duty (or equivalent): Government taxes on property transactions.

Hidden Costs of Rural Living

Beyond the initial purchase, significant hidden costs are unique to rural properties. These often catch new rural residents off guard.

- Higher Utility Costs: Heating older, less-insulated properties, especially during harsh winters, significantly increases energy bills. Water costs can also be higher, depending on the source.

- Extensive Property Maintenance: Rural properties often require more upkeep. Older buildings demand regular maintenance, from roof repairs to plumbing issues. Expect higher maintenance bills than in urban areas.

- Rural Broadband Costs: Access to reliable high-speed internet can be a challenge and often more expensive in rural locations.

- Commuting Costs: If you work outside your rural community, commuting will involve higher fuel costs and potentially increased vehicle maintenance.

Lifestyle Changes and Associated Costs

Relocating to the country necessitates a lifestyle shift, impacting your budget in several key ways:

Transportation Costs

Rural living typically means increased reliance on personal vehicles. This leads to higher transportation expenses:

- Higher Fuel Consumption: Longer distances to amenities necessitate increased fuel usage.

- Car Maintenance: More frequent driving increases the wear and tear on your vehicle.

- Increased Insurance Premiums: Some insurers charge higher premiums for those living in rural areas with longer commutes.

Everyday Expenses

The cost of everyday goods and services can differ significantly between rural and urban settings.

- Grocery Shopping Habits: Access to large supermarkets is often limited, leading to smaller, more frequent shopping trips or reliance on online deliveries, both of which can be more expensive.

- Access to Local Markets: While farmer's markets and local shops offer unique advantages, they may not always be cheaper than larger supermarkets.

- Higher Delivery Costs: Delivery charges for groceries and other goods tend to be higher in rural areas due to increased transportation costs for delivery services.

Financing Your Country Escape

Securing suitable financing is crucial for a smooth transition to rural living. Options include:

Mortgage Options

Obtaining a mortgage for a rural property can pose unique challenges:

- Higher Interest Rates: Some lenders may charge higher interest rates for rural properties due to perceived higher risk.

- Stricter Lending Criteria: Lenders often have stricter criteria for rural properties, especially older ones.

- Difficulties with Older Properties: Securing financing for older properties requiring significant renovation may prove difficult.

Alternative Financing Methods

Beyond mortgages, explore these financing options:

- Substantial Savings: A significant deposit is usually essential to secure a mortgage or finance a purchase outright.

- Leveraging Existing Assets: Selling existing properties or other assets can provide funds for your country escape.

- Bridging Loans: Bridging loans can offer temporary financing, but involve potential risks and higher interest rates; use with caution and professional advice.

Long-Term Financial Planning for Rural Living

Careful financial planning extends beyond the initial purchase and ongoing expenses:

Unexpected Expenses

Older rural properties are prone to unexpected repairs. Building a financial buffer is crucial.

- Plumbing Issues: Older plumbing systems are susceptible to leaks and failures.

- Heating System Failures: Heating systems in older properties are more likely to require repairs or replacement.

- Roof Repairs: Roof damage from weather is a common occurrence in rural areas.

- Other Unpredictable Events: Numerous other unexpected repairs can arise in older properties.

Future Resale Value

Consider the long-term implications of your investment. Factors influencing resale value include:

- Market Trends: Stay informed about property market trends in your chosen area.

- Property Condition: Maintaining your property's condition is crucial for maximizing its resale value.

- Location: The desirability of the location significantly impacts resale value.

- Overall Attractiveness of the Area: The appeal of the surrounding area influences potential buyers.

Conclusion

Escaping to the country offers a compelling lifestyle change, but meticulous financial planning is crucial. From understanding the initial property purchase costs and ongoing maintenance expenses to securing appropriate financing and factoring in lifestyle changes, careful consideration of the financial aspects is key to a successful and stress-free transition. By thoroughly assessing these factors, you can make an informed decision and enjoy the rewards of your countryside retreat. Remember to thoroughly research your chosen area and consult with financial advisors to help you navigate the financial aspects of escaping to the country. Start planning your dream escape today!

Featured Posts

-

Dog Walker Confrontation Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Confrontation Kyle And Teddis Fiery Exchange

May 24, 2025 -

M62 Westbound Roadworks Resurfacing Project Between Manchester And Warrington

May 24, 2025

M62 Westbound Roadworks Resurfacing Project Between Manchester And Warrington

May 24, 2025 -

Mengungkap Sejarah Porsche 356 Perjalanan Dari Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Perjalanan Dari Zuffenhausen Jerman

May 24, 2025 -

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025 -

Planning Your Escape To The Country A Practical Guide

May 24, 2025

Planning Your Escape To The Country A Practical Guide

May 24, 2025

Latest Posts

-

Kerings September Surprise Sales Down Demnas Gucci Collection Launches

May 24, 2025

Kerings September Surprise Sales Down Demnas Gucci Collection Launches

May 24, 2025 -

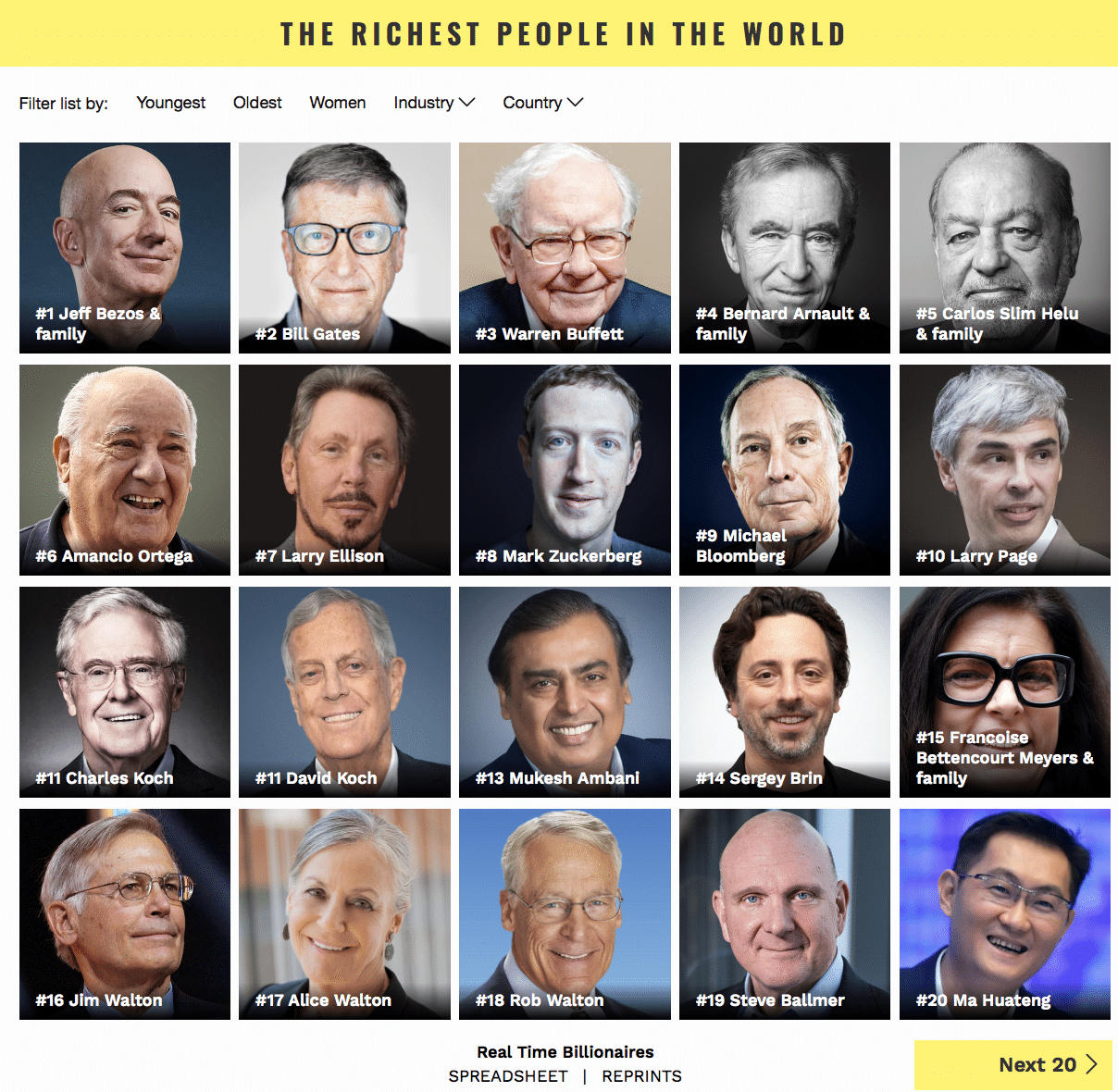

Musk Batte Zuckerberg E Bezos La Nuova Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

Musk Batte Zuckerberg E Bezos La Nuova Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025 -

Registratsiya Braka Na Kharkovschine Statistika I Osobennosti

May 24, 2025

Registratsiya Braka Na Kharkovschine Statistika I Osobennosti

May 24, 2025 -

Demnas Gucci Designs September Reveal Amidst Kering Sales Report

May 24, 2025

Demnas Gucci Designs September Reveal Amidst Kering Sales Report

May 24, 2025 -

I Piu Ricchi Del Mondo Nel 2025 La Classifica Forbes Aggiornata

May 24, 2025

I Piu Ricchi Del Mondo Nel 2025 La Classifica Forbes Aggiornata

May 24, 2025