The Financial Challenges Of Offshore Wind Energy Projects

Table of Contents

High Capital Expenditures (CAPEX) and Financing Risks

The sheer scale of offshore wind farm development necessitates massive upfront investment. Developing these projects requires a substantial commitment of capital, far exceeding that of onshore wind projects. This high initial investment encompasses several key areas:

-

Turbine Costs: Offshore wind turbines are significantly larger and more complex than their onshore counterparts, resulting in considerably higher manufacturing and installation costs. These costs are further amplified by the need for specialized vessels and equipment capable of operating in challenging marine environments.

-

Foundation Installation: Installing foundations for offshore wind turbines in deep water requires advanced engineering and specialized equipment, significantly increasing the project's CAPEX. The type of foundation (e.g., monopiles, jackets, floating platforms) significantly impacts the overall cost.

-

Grid Connection: Connecting offshore wind farms to the onshore electricity grid involves substantial investment in subsea cables and onshore grid infrastructure upgrades. This can represent a considerable portion of the total project cost.

-

Permitting and Regulatory Costs: The extensive permitting process required for offshore wind projects can lead to significant delays and associated costs. Navigating environmental regulations, obtaining necessary approvals, and managing stakeholder consultations add layers of complexity.

-

High initial investment compared to onshore wind. The capital expenditure for offshore wind is several times higher per megawatt than for onshore projects. This difference is primarily due to the increased difficulty and cost of construction and maintenance in offshore environments.

-

Long lead times and potential for cost overruns. Offshore wind projects often experience extended lead times, increasing the risk of cost overruns due to inflation, material price fluctuations, and unforeseen technical challenges.

-

Difficulty securing financing from traditional lenders due to high risk profile. The high capital expenditure and inherent risks associated with offshore wind projects make securing financing from traditional lenders challenging. The long-term nature of these projects also presents a significant hurdle for investors.

-

The role of government subsidies and tax incentives in mitigating risk. Government subsidies and tax incentives play a vital role in reducing the financial risks associated with offshore wind projects, making them more attractive to investors.

-

Exploration of alternative financing models, such as project bonds and equity partnerships. Innovative financing models, such as project bonds and equity partnerships, are increasingly being employed to diversify funding sources and reduce reliance on traditional lenders.

Operational Expenditure (OPEX) and Long-Term Maintenance Costs

Beyond the initial capital investment, offshore wind farms require ongoing operational expenditure (OPEX) to maintain their operational efficiency and ensure the longevity of the assets. These ongoing costs can be substantial and include:

-

Regular turbine inspections and repairs (specialized vessels & skilled labor). Maintaining offshore wind turbines requires specialized vessels and highly skilled technicians, leading to high labor and transportation costs. Regular inspections are crucial for early detection and prevention of potential failures.

-

Underwater cable maintenance and repairs. Subsea cables are vulnerable to damage from marine life, fishing activities, and environmental factors. Repairing these cables is a complex and costly undertaking, requiring specialized equipment and expertise.

-

Environmental monitoring and mitigation. Ongoing environmental monitoring is necessary to assess the impact of the wind farm on marine ecosystems and implement mitigation strategies to minimize environmental effects.

-

Insurance costs and potential liabilities. Offshore wind farms require comprehensive insurance coverage to protect against potential risks, such as damage from storms, equipment failures, and liability claims. Insurance costs can represent a significant portion of the overall OPEX.

-

Impact of inflation and currency fluctuations on OPEX. Inflation and currency fluctuations can significantly impact the OPEX of offshore wind farms, particularly for projects with long operational lifetimes. Effective risk management strategies are crucial to mitigate these effects.

Grid Integration Challenges and Transmission Costs

Connecting offshore wind farms to the onshore electricity grid presents significant technical and financial challenges. The distance between the wind farm and the grid connection point often necessitates long subsea cable runs:

-

Subsea cable installation: high costs and technical complexities. Installing and maintaining subsea cables is a costly and technically demanding process. The cables need to withstand harsh marine environments and potential damage from fishing gear or other marine activities.

-

Upgrades to onshore grid infrastructure. Connecting offshore wind farms often necessitates upgrades to the onshore electricity grid infrastructure to accommodate the influx of renewable energy. This can involve significant investment in new substations, transmission lines, and other grid components.

-

Transmission losses and the need for efficient power management systems. Energy losses during transmission from the offshore wind farm to the onshore grid are inevitable. Implementing efficient power management systems can help to minimize these losses, but represents an additional cost.

-

The role of grid operators and regulatory approvals. Grid operators play a vital role in facilitating the grid connection process, and securing necessary regulatory approvals can be a time-consuming and costly undertaking.

-

Potential for stranded assets due to insufficient grid capacity. If insufficient grid capacity is available to accommodate the output of the offshore wind farm, the project may face difficulties in integrating its generated power into the grid, leading to stranded assets and financial losses.

Environmental and Permitting Uncertainties and Costs

Offshore wind projects face significant environmental and regulatory hurdles, leading to uncertainties and cost implications. The process involves:

-

Marine life impact assessments and mitigation strategies. Comprehensive environmental impact assessments are required to evaluate the potential impact on marine life, including birds, marine mammals, and fish. Mitigation strategies must be developed and implemented to minimize these impacts.

-

Navigational safety and regulations. Ensuring navigational safety around offshore wind farms requires careful planning and adherence to strict regulations. These regulations can add complexity and cost to the project.

-

Permitting delays and legal challenges. The permitting process for offshore wind projects can be lengthy and complex, involving numerous regulatory bodies and stakeholders. Delays and legal challenges can significantly increase project costs and timelines.

-

Contingency planning for unforeseen environmental issues. Unforeseen environmental issues, such as unusual weather patterns or unexpected ecological impacts, can necessitate contingency planning and additional costs.

-

The impact of changing regulations on project costs and timelines. Changes in environmental regulations and policies can impact project costs and timelines, requiring adjustments to project plans and budgets.

Supply Chain Vulnerabilities and Inflationary Pressures

The global supply chain for offshore wind components is complex and subject to various vulnerabilities:

-

Dependence on specific manufacturers and suppliers. Offshore wind projects often rely on a limited number of manufacturers and suppliers for specialized components, creating vulnerabilities to supply chain disruptions.

-

Increased material costs due to global inflation. Global inflation can significantly increase the cost of materials used in offshore wind farm construction, impacting the overall project budget.

-

Potential for delays in project delivery due to supply chain bottlenecks. Supply chain bottlenecks can lead to delays in project delivery, resulting in increased costs and potential penalties for missed deadlines.

-

Strategies for mitigating supply chain risks. Strategies such as diversification of suppliers, long-term contracts, and robust inventory management can help to mitigate supply chain risks.

-

Impact of geopolitical events on the cost of materials and labor. Geopolitical events can disrupt supply chains and impact the cost of materials and labor, adding to the financial uncertainties associated with offshore wind projects.

Conclusion

The financial challenges offshore wind projects face are multifaceted and significant, encompassing high CAPEX, substantial OPEX, grid integration hurdles, environmental uncertainties, and supply chain vulnerabilities. Overcoming these challenges requires careful planning, innovative financing strategies, and collaboration among stakeholders. Addressing these financial challenges is vital for accelerating the transition to clean energy and achieving climate goals. Further research and development, along with supportive government policies, are crucial to unlocking the full potential of offshore wind energy and reducing its financial challenges. Learn more about mitigating the financial challenges offshore wind faces by exploring further resources available online.

Featured Posts

-

Wiegmans To Do List 3 Key Questions Before Euro 2025

May 03, 2025

Wiegmans To Do List 3 Key Questions Before Euro 2025

May 03, 2025 -

Fortnite Server Status How Long Will Chapter 6 Season 2 Maintenance Last

May 03, 2025

Fortnite Server Status How Long Will Chapter 6 Season 2 Maintenance Last

May 03, 2025 -

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025 -

Poppy Atkinson Manchester United And Bayern Munichs Moving Tribute

May 03, 2025

Poppy Atkinson Manchester United And Bayern Munichs Moving Tribute

May 03, 2025 -

Fortnite Servers Down Chapter 6 Season 2 Launch Delayed Indefinitely

May 03, 2025

Fortnite Servers Down Chapter 6 Season 2 Launch Delayed Indefinitely

May 03, 2025

Latest Posts

-

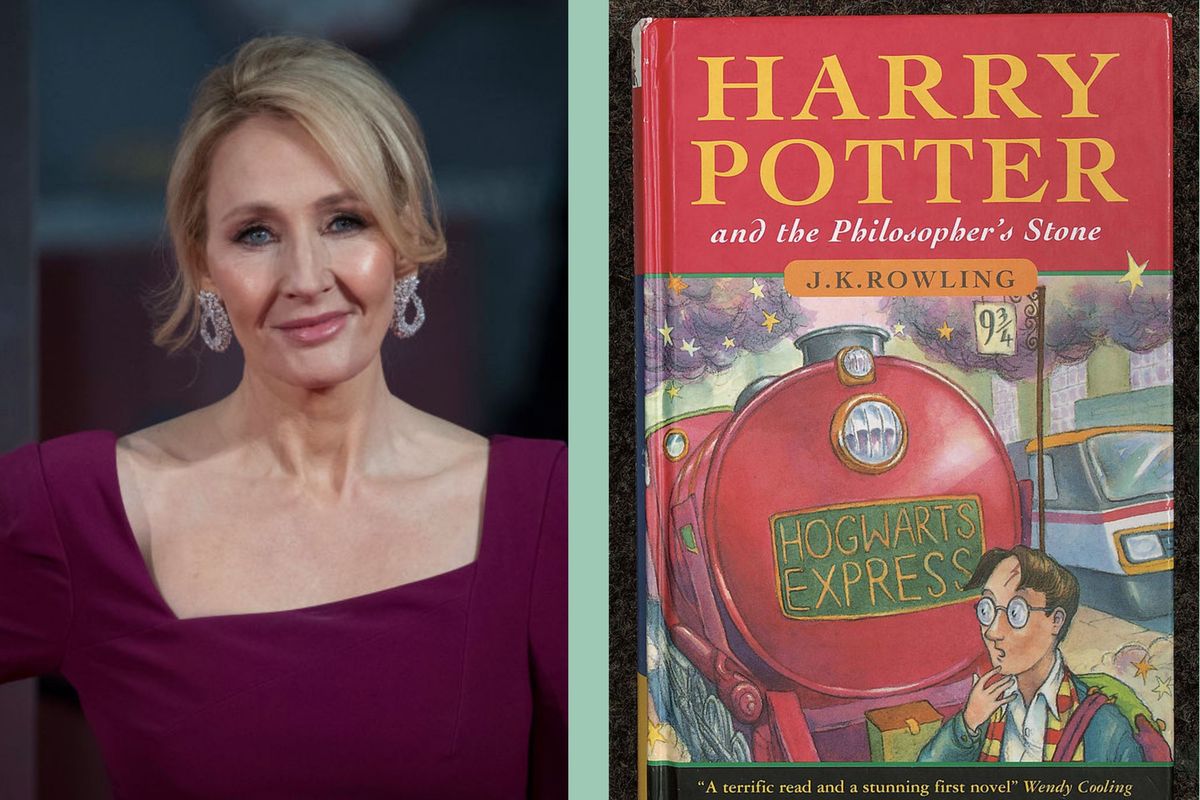

Sanchajuje 2027 M Duris Atvers Hario Poterio Parkas

May 03, 2025

Sanchajuje 2027 M Duris Atvers Hario Poterio Parkas

May 03, 2025 -

Can A Harry Potter Remake Succeed 6 Essential Elements

May 03, 2025

Can A Harry Potter Remake Succeed 6 Essential Elements

May 03, 2025 -

David Tennant And The Harry Potter Max Series A Return Ruled Out

May 03, 2025

David Tennant And The Harry Potter Max Series A Return Ruled Out

May 03, 2025 -

Heartbroken Family Pays Tribute To Tragically Lost Manchester United Supporter Poppy

May 03, 2025

Heartbroken Family Pays Tribute To Tragically Lost Manchester United Supporter Poppy

May 03, 2025 -

Harry Potter Remake Success Hinges On These 6 Factors

May 03, 2025

Harry Potter Remake Success Hinges On These 6 Factors

May 03, 2025