The Financial Impact Of Trump's Presidency On Musk, Bezos, And Zuckerberg's Net Worth

Table of Contents

Tax Cuts and Their Impact on Tech Billionaires' Wealth

The 2017 Tax Cuts and Jobs Act significantly altered the American tax landscape, potentially benefiting high-net-worth individuals like Musk, Bezos, and Zuckerberg.

The 2017 Tax Cuts and Jobs Act

This act's key provision was a dramatic reduction in the corporate tax rate, from 35% to 21%. This lower rate directly impacted company profitability and, consequently, stock prices.

- Reduction in Corporate Tax Rate: The decrease from 35% to 21% boosted corporate profits, leading to increased stock valuations for companies like Tesla, Amazon, and Facebook. This directly translated into a surge in the net worth of their respective CEOs.

- Impact on Net Worth: While precise figures attributing wealth increase solely to the tax cuts are difficult to isolate, the period following the act saw substantial growth in the net worth of Musk, Bezos, and Zuckerberg. Their fortunes significantly increased, reflecting the improved financial performance of their companies.

- Statistical Evidence: Analyzing financial data from 2017 onward reveals a positive correlation between the implementation of the tax cuts and the increase in the market capitalization of Tesla, Amazon, and Facebook, benefiting their CEOs substantially.

Implications for Stock Options and Capital Gains

Lower tax rates also affected the value of stock options held by these executives. Lower capital gains taxes meant a larger portion of any realized gains could be retained.

- Increased Realized Gains: The lower tax rates incentivized these executives to exercise stock options, resulting in larger realized capital gains.

- Tax Planning Strategies: Sophisticated tax planning strategies, likely employed by these individuals and their companies, further minimized their tax liabilities, maximizing the impact of the tax cuts on their personal wealth.

Regulatory Changes and Their Effects

The Trump administration's approach to regulation, characterized by deregulation in certain sectors, also had potential impacts on the tech industry.

Impact of Deregulation

While sweeping deregulation across the tech sector wasn't a defining characteristic of the Trump presidency, the administration's approach to antitrust enforcement, for instance, could have indirectly influenced the valuation of these companies.

- Antitrust Enforcement: A less aggressive stance on antitrust actions might have benefited larger tech companies by reducing the risk of significant fines or structural changes. However, this effect is complex and difficult to quantify directly.

- Impact on Company Growth: The overall regulatory environment, even without major deregulation, likely influenced investor confidence and the growth trajectory of these companies. A stable or supportive regulatory climate tends to encourage investment and expansion.

Trade Wars and Global Market Volatility

Trump's trade policies, particularly the trade war with China, created global market volatility that affected the valuations of Tesla, Amazon, and Facebook.

- Global Market Uncertainty: The trade disputes introduced significant uncertainty into the global economy, affecting investor sentiment and stock prices. Supply chains were disrupted, impacting production and profits for many businesses.

- Geographical Diversification: The geographical diversification of these companies played a crucial role in mitigating the risks associated with trade wars. Companies with substantial international operations were generally better positioned to weather the storm.

Public Perception and Brand Influence

Trump's public pronouncements about the tech industry and his relationship with tech leaders significantly impacted public perception and, indirectly, their net worth.

Trump's Relationship with Tech Leaders

Trump's public statements about the tech industry were often critical. These statements could have influenced investor confidence and consequently, the stock prices of their respective companies.

- Negative Impacts of Public Criticism: Negative comments or controversies involving these companies or their CEOs could have resulted in temporary declines in stock prices, impacting their net worth.

- Investor Confidence: A positive or negative relationship with the administration likely influenced investor confidence. Positive interactions could boost stock prices, while negative interactions could lead to dips.

Social Media and Political Discourse

Facebook, under Zuckerberg's leadership, played a central role in shaping political discourse during the Trump presidency. This had significant ramifications for the platform's image and its financial performance.

- Misinformation and Censorship Controversies: Controversies surrounding misinformation and censorship on Facebook generated significant public debate and scrutiny, impacting the company's image and user trust.

- Influence on Stock Valuation: These controversies negatively affected Facebook's stock valuation and public perception. Investor confidence suffered, leading to fluctuations in the company's stock price.

Conclusion

The Trump presidency's impact on the net worth of Musk, Bezos, and Zuckerberg was complex and multifaceted. While tax cuts likely provided a boost, trade wars and public perception created countervailing forces. A thorough analysis reveals the intricate connections between economic policies, regulatory changes, and public sentiment in shaping their financial trajectories. To further explore the specific financial ramifications, deeper dives into financial statements and economic analyses are recommended. Understanding the financial impact of presidential administrations on the world's wealthiest individuals provides crucial insight into the complex relationship between politics, economics, and the business world. Continue exploring the effects of political leadership on major businesses with further research on the financial impact of future presidential administrations on Musk, Bezos, and Zuckerberg’s net worth.

Featured Posts

-

How Palantirs Nato Partnership Will Reshape Public Sector Ai

May 10, 2025

How Palantirs Nato Partnership Will Reshape Public Sector Ai

May 10, 2025 -

Pakistans 1 3 Billion Imf Package Under Review Amidst India Tensions

May 10, 2025

Pakistans 1 3 Billion Imf Package Under Review Amidst India Tensions

May 10, 2025 -

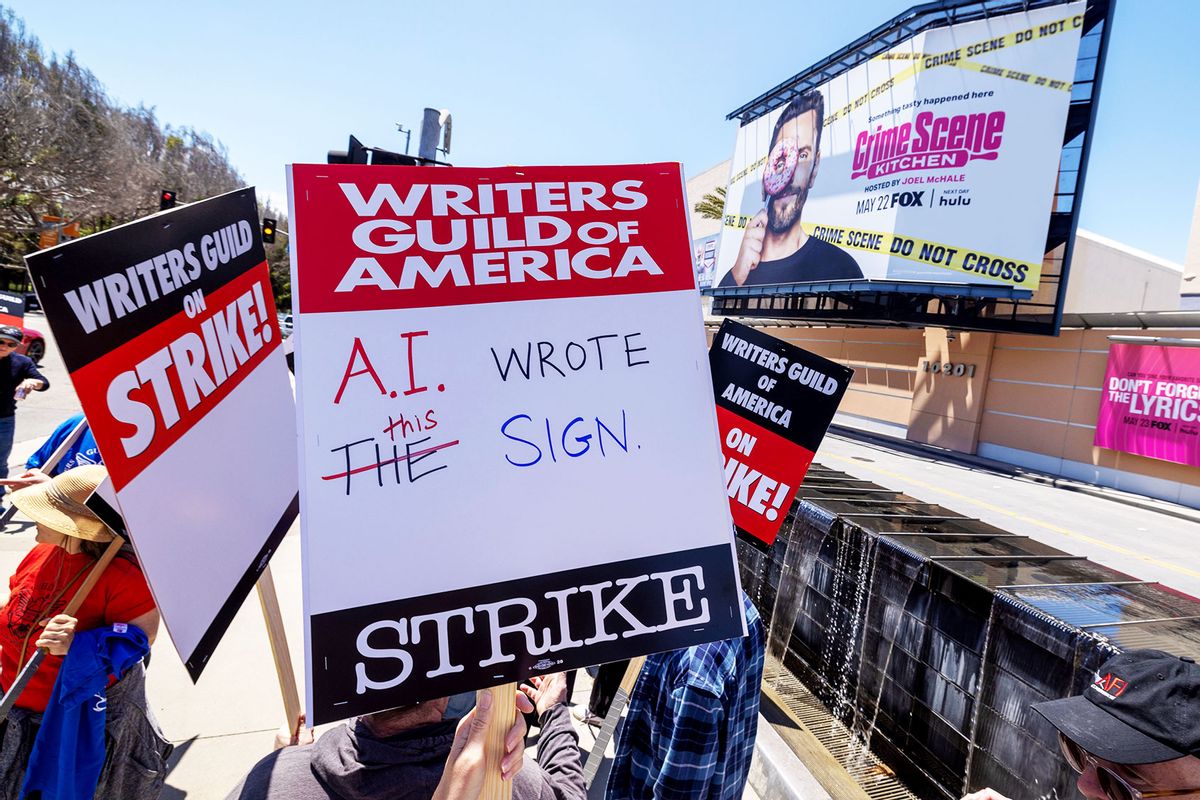

Actors And Writers Strike The Impact On Hollywood

May 10, 2025

Actors And Writers Strike The Impact On Hollywood

May 10, 2025 -

Nyt Strands Game 354 Solutions Thursday February 20 Hints And Answers

May 10, 2025

Nyt Strands Game 354 Solutions Thursday February 20 Hints And Answers

May 10, 2025 -

Strictly Come Dancing Wynne Evans Addresses Speculation Over Return

May 10, 2025

Strictly Come Dancing Wynne Evans Addresses Speculation Over Return

May 10, 2025