The Financial Landscape Of Celebrity Couples: When One Star Earns Significantly Less

Table of Contents

Legal and Contractual Considerations

Navigating the legal aspects of a relationship with significantly different earning capacities is crucial for protecting assets and ensuring a fair financial arrangement. This is especially true for high-profile individuals.

Prenuptial Agreements

Prenuptial agreements are essential tools for high-net-worth individuals entering a marriage where significant income disparity exists. They act as a legally binding contract outlining how assets will be divided in case of separation or divorce.

- Importance of independent legal counsel: Each partner should have their own legal representation to ensure their interests are fully protected.

- Common clauses: These typically include provisions for separate property, spousal support (alimony), and the division of assets acquired during the marriage. Specific clauses should address the unique financial situation of the couple, accounting for the high earner’s pre-marital assets and income streams.

- Renegotiating prenups: Circumstances can change, and prenups can be renegotiated throughout the marriage if both parties agree. However, this requires mutual consent and legal counsel.

Prenuptial agreements, while often associated with suspicion, offer vital protection for both parties, particularly the higher-earning spouse. They provide clarity and avoid potential future disputes, even within celebrity relationships characterized by complex financial structures and considerable assets. However, it’s important to understand that poorly drafted prenups can be challenged in court, so seeking expert legal advice is paramount.

Postnuptial Agreements

For couples who married without a prenuptial agreement but later desire to clarify their financial arrangements, postnuptial agreements offer a solution.

- Reasons for creating a postnup: Changes in circumstances, such as a significant increase in one spouse's income or the acquisition of substantial assets, can necessitate a postnuptial agreement.

- Common clauses: Similar to prenups, postnups address the division of assets, spousal support, and other financial matters.

- Legal considerations: Postnups require full disclosure and mutual consent to be legally binding. They should be carefully drafted by legal professionals experienced in high-net-worth divorce cases.

Postnuptial agreements differ from prenups in their timing, but serve a similar function: to clarify financial responsibilities and asset division in a marriage marked by significant income inequality.

Managing Joint Finances with Unequal Incomes

Even with legal agreements in place, managing joint finances effectively requires careful planning and open communication. This is especially true for high-earning couples where one partner’s income significantly outweighs the other's.

Budgeting and Financial Transparency

Creating a shared budget requires both partners to be transparent about their income and expenses.

- Importance of open communication: Honest discussions about financial goals, spending habits, and concerns are essential for establishing trust and preventing resentment.

- Fair contribution models: Several models can work, including percentage-based contributions (proportionate to income) or needs-based contributions (allocating funds based on individual and household needs).

- Tracking expenses: Using budgeting apps or spreadsheets can help track expenses and ensure accountability.

For high-earning couples, a percentage-based model often works well, acknowledging the significant income disparity while ensuring fairness. Careful budgeting is critical for managing substantial household expenses often associated with high-income lifestyles.

Investment Strategies and Asset Allocation

Diversifying investments is crucial, taking into account the individual financial goals and risk tolerance of each partner.

- Considering individual financial goals: Both partners should have input into investment decisions, aligning strategies with both short-term and long-term goals.

- Risk tolerance: Investment strategies should reflect the risk tolerance of each partner. The higher earner may be comfortable with higher-risk investments, while the lower earner might prefer a more conservative approach.

- Long-term investment planning: A comprehensive financial plan should address retirement planning, education savings, and other long-term financial goals.

- Seeking professional financial advice: A qualified financial advisor can provide personalized guidance on investment strategies suitable for high-net-worth couples.

Professional financial advisors experienced in high-net-worth wealth management can prove invaluable in developing a robust and tailored investment strategy.

Tax Implications

Understanding the tax implications of joint versus separate filing is crucial for minimizing tax burdens.

- Joint vs. separate filing: The tax implications differ based on income levels and deductions available. Expert tax advice is necessary to determine the most advantageous filing status.

- Tax deductions: High earners may be able to utilize various deductions and credits to minimize their overall tax liability.

- Capital gains taxes: Capital gains taxes must be considered when investing.

- Estate planning: Comprehensive estate planning is essential for protecting assets and minimizing estate taxes.

High-income earners often benefit from sophisticated tax planning strategies to mitigate tax burdens. Seeking advice from experienced tax professionals is highly recommended.

Emotional and Psychological Aspects

Beyond the legal and financial aspects, the income disparity in a relationship can have significant emotional and psychological implications.

Power Dynamics and Financial Dependence

Significant income differences can create power imbalances, potentially affecting the relationship dynamics.

- Maintaining independence: Even within a shared financial arrangement, it’s vital for each partner to maintain a sense of financial independence. This could involve having separate accounts for personal spending.

- Avoiding resentment: Open communication and a shared understanding of financial contributions are critical to preventing resentment and fostering equality.

- Promoting equality: Active efforts to promote equality within the relationship, beyond just finances, are essential for maintaining a healthy partnership.

Open communication is crucial for addressing any power imbalances and preventing resentment.

Maintaining Individual Identity

Preserving personal financial independence and goals strengthens the individual and the relationship.

- Separate accounts: Maintaining separate accounts for personal spending can help maintain a sense of autonomy and prevent disputes over smaller expenses.

- Individual savings goals: Each partner should have the ability to pursue their individual financial goals, even if these goals differ from the shared financial objectives.

- Maintaining personal financial autonomy: Encouraging financial literacy and decision-making power for both partners supports a healthy, equitable relationship.

Prioritizing individual financial goals, while maintaining a shared financial vision, fosters independence and respect within the partnership.

Conclusion

The financial landscape of celebrity couples with unequal incomes presents unique challenges. Careful planning, open communication, and professional financial guidance are essential for navigating the legal, financial, and emotional complexities. From robust prenuptial agreements to transparent budgeting strategies and thoughtful investment approaches, proactive planning is key. By understanding the potential pitfalls and employing sound financial strategies, these couples can build a strong financial foundation that supports both their individual and shared goals. Don't navigate these waters alone; seek professional advice on managing the financial landscape of your relationship or one with significant income disparity. Effective financial planning is critical for the long-term success and happiness of any couple, especially those with significantly different earning capacities.

Featured Posts

-

Analyse Passagiersaantallen Maastricht Airport Begin 2025

May 19, 2025

Analyse Passagiersaantallen Maastricht Airport Begin 2025

May 19, 2025 -

Chateau Diy Decor Stylish Projects To Elevate Your Space

May 19, 2025

Chateau Diy Decor Stylish Projects To Elevate Your Space

May 19, 2025 -

Updated Abba Voyage Setlist Whats Changed

May 19, 2025

Updated Abba Voyage Setlist Whats Changed

May 19, 2025 -

Justyna Steczkowska Recznik Eurowizja I Taniec Ktorego Nikt Sie Nie Spodziewal

May 19, 2025

Justyna Steczkowska Recznik Eurowizja I Taniec Ktorego Nikt Sie Nie Spodziewal

May 19, 2025 -

Espionage Case Understanding The Arrest Of You Tuber Jyoti Malhotra In Haryana

May 19, 2025

Espionage Case Understanding The Arrest Of You Tuber Jyoti Malhotra In Haryana

May 19, 2025

Latest Posts

-

London Culture Faces Devastating Blow Court Case Cancels Wide Awake Mighty Hoopla And More

May 19, 2025

London Culture Faces Devastating Blow Court Case Cancels Wide Awake Mighty Hoopla And More

May 19, 2025 -

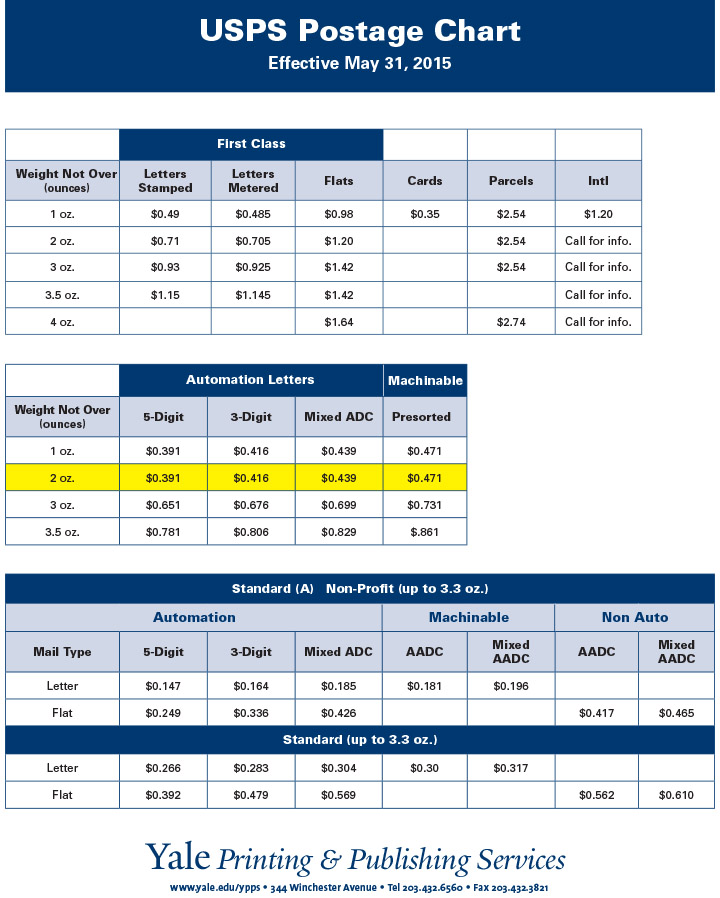

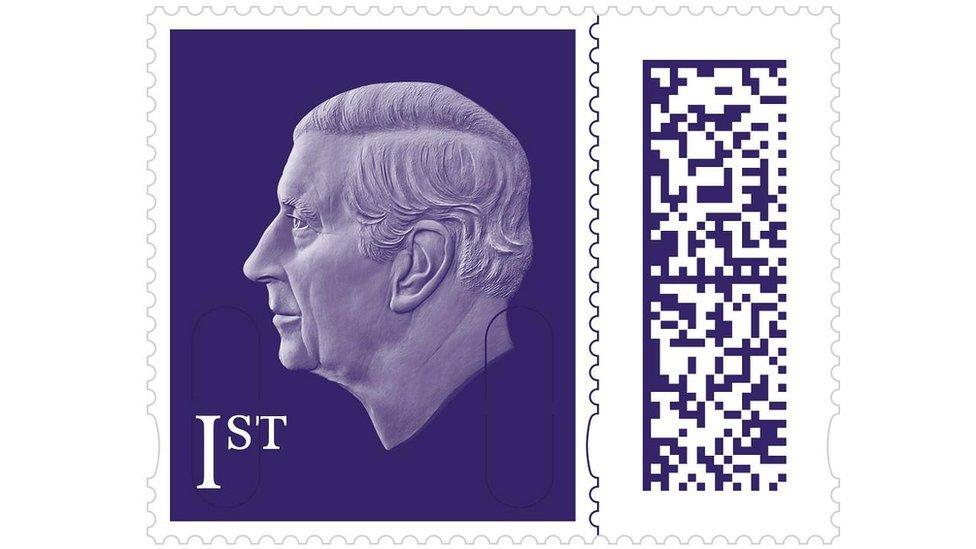

First Class Stamps Price Increase To 1 70 Impacts Senders

May 19, 2025

First Class Stamps Price Increase To 1 70 Impacts Senders

May 19, 2025 -

1 70 The New Price Of A First Class Stamp In The Uk

May 19, 2025

1 70 The New Price Of A First Class Stamp In The Uk

May 19, 2025 -

Understanding The Latest Royal Mail Stamp Price Increase In The Uk

May 19, 2025

Understanding The Latest Royal Mail Stamp Price Increase In The Uk

May 19, 2025 -

Uk Stamp Prices Soar Royal Mail Announces Further Increase

May 19, 2025

Uk Stamp Prices Soar Royal Mail Announces Further Increase

May 19, 2025